Last month I posted about using BitShares and bitUSD to essentially short the USD. See the videos and links there for detailed instructions on how this all works.

Here is a simple example of shorting the USD over the last five days to gain an extra 2,383 BitShares and $11.59 in bitUSD for a total of around $45 in value essentially out of nothing. Obviously, this only works if the price of BitShares is going up and/or the demand for USD (bitUSD) is going down. This is a simple, short example, but I could also hold longer or invest in something else besides BitShares with by bitUSD before selling and unlocking my collateral.

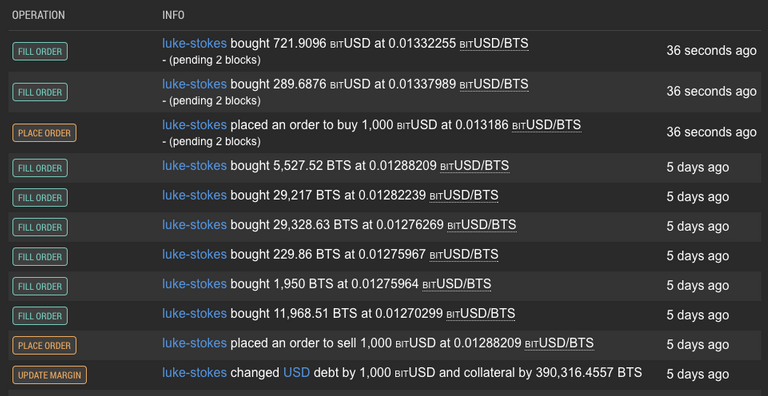

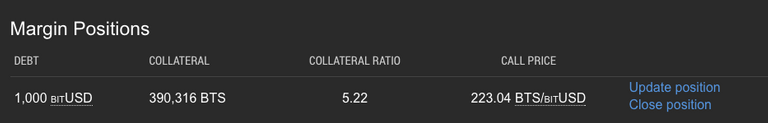

It starts by locking up some BitShares in a smart contract which is used as collateral to borrow bitUSD into existence. In this example, I burrowed $1,000 at a 5 to 1 ratio. I like not having to worry about it, so I went with a really high ratio. You're probably fine with 4 to 1 or 3 to 1. You won't be automatically called until much less than that (I think 1.5 to 1).

Once I borrowed the bitUSD, I bought BitShares with it. Five days later, the value of BitShares went up so my collateral was above 5.0 meaning anything sold at this point is a profit.

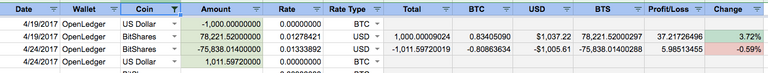

You can see from my Cryptocurrency Bank Spreadsheet all the trades involved here:

I didn't have to time the market perfectly for this to work, I just had to sell the BitShares back for bitUSD at a higher price than I started.

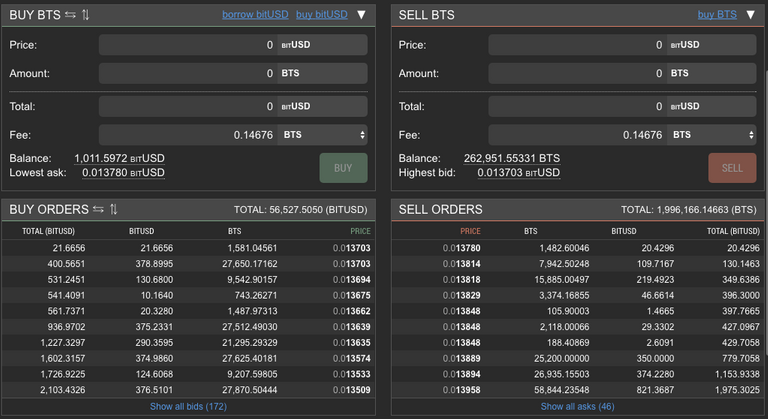

This gave me an extra 2,383.5060 BitShares and 11.5972 bitUSD. It's really pretty simple. The trickiest part involves getting familiar with the order book and how to use the Buy Orders and Sell Orders screen. If I was going to buy some BitShares right now, as an example, I could click on any of the sell prices and my order would be filled up to the amount I specify. Same thing goes for selling BitShares and clicking on a price somewhere in the Buy Orders order book.

You can also just add an order to one side of the book if you think the market price will meet you there with the price either going up or going down. One thing I've found is that often it's best just to pull the trigger right away at the current prices if you've already made a decision to buy or sell. If the liquidity is low, you'll have to worry about slippage depending on the size of your order, but most of the time it won't matter too much. You might be able to squeeze an extra penny here or there if you wait for the market to meet you, but I've missed out quite a bit when I end up planning in the wrong direction.

I hope you find this useful. You can use the BitShares wallet (pictured here) at https://bitshares.org/wallet/ or you can use Open Ledger at https://bitshares.openledger.info. Nothing here should be taken as investment advice, it's just for entertainment/education only. If enough people started playing around with BitShares to increase the liquidity there, we'd have a nice, secure, decentralized exchange with keys we control directly in our own backed up wallets.

That's pretty cool.

I'm not one to margin trade with debt by borrowing from others, but when it's my own collateral being used, it makes a lot more sense to me, as long as I'm patient for the market to trend in the direction I need in order to make a profit. If you have any questions, feel free to ask in the comments.

Luke Stokes is a father, husband, business owner, programmer, voluntaryist, and blockchain enthusiast. He wants to help create a world we all want to live in.

Well done @lukestokes!

Love it!!

I'm not sure I understand. You short the dollar by going against it via buying another currency with dollars.

Sounds like you did something completely different here.

It sounds like you just went long bitshares and you're saying this means you shorted the dollar. Which is wrong.

Please explain :)

You're correct in that you buy another currency (in this example BitShares, a cryptocurrency) using a pegged asset to the US Dollar (bitUSD). Since bitUSD trades consistently for $1 USD worth of value, it's essentially the same thing as $1 USD. The difference here is you create the bitUSD from a smart contract loan using your BitShares as collateral. When BitShares goes up in value, you sell some of it back to get your original bitUSD (in this example, I got a little bit more than I put an order for). I didn't show this in the example, but you can then close out your margin position by returning the $1,000 you borrowed while keeping the left over bitUSD and BitShares obtained via the difference in price from when you bought to when you sold again. As long as bitUSD is going down in value against whatever currency you buy, you're essentially betting against the USD and thus shorting it. You're also doing it without ever actually purchasing real USD, you're just benefitting from the movement against it. Make sense?

So you used bitshares as collateral to buy bitshares with a tokenised version of the USD.

I guess you could twist that to be shorting the USD, but really shorting the USD is very different prospect. You'd need a basket of assets against it as it's a currency. Other currencies are the best approximation at this. A basket of currencies such as the dollar index is probably closer .. along with a highly traded commodity traded in dollars like oil.

Regardless, I'm sure it was fun to think outside the box :)

Maybe I am over-simplifying the process, but if I bet against USD by borrowing some amount of USD value and use that value to buy other currencies then later sell those currencies for USD value to pay back my loan, is that still a short? I'm essentially betting the value of USD will go down against whatever other thing I buy with that USD value.

The BitShares DEX (distributed exchange) certainly doesn't have high volume (yet) and anything done there isn't going to impact the real USD in any real way, but if there was massive volume there, along with massive volume in the cryptocurrencies which we're trading against the USD value, then would it be similar to betting on a commodity traded in dollars like you described?

To your point, yes, this is a fun way to think outside the box and bet for cryptocurrencies against the value of the dollar. As far as I understand, if the volume was higher, moves like this could have a bigger impact as more people move out of fiat USD and into cryptocurrencies.

I see what you mean. Let's simplify it further though.

If I use USD to buy some cigarettes cheaply and then sell them for a higher price, am I shorting the USD?

I would answer yes. You decided to hold an asset (cigarettes) that you felt would appreciate relative to USD.

No, but the USD wouldn't be on loan, right? If so, then... yes, maybe that would be a short?

Here's how I understand what a short is:

bitUSD's in my example are created via borrowing.

I think the whole borrowing angle comes from stocks. As unlike futures markets you need to borrow stocks from long term holders in order to short.

Taking a currency on margin, is different to borrowing a stock.

In my head there's something very different to a security and a currency.

If you buy something with dollars, even margined, borrowed dollars .. I don't think it's shorting dollars unless what you're buying is another currency or something 'big' rather than just a small asset.

Can you see that perspective?

Nice job Luke, I've been doing the same! The BTS uptrend is real.

Btw my middle name is Luke. Were name brothers in a sense, haha!

Haha! Nice. Luke's of the world, unite!

Great tip, Luke! I'm not a finance guy, so I appreciate the detailed explanation!

You can read this post in Russian as well thanks to the efforts of @blockchained.

The coming day, let him bring with him

Success, luck, joy and love!

Deep will be filled with meaning,

And the positive only visit the thoughts.

All that in the plans for today was

So that by noon by the evening it was done.

The code will fall off the sheet from the calendar,

To make it clear - the day is not wasted!

What's the pair with the most volume on openledger ?

Seems like a no man's land every-time I go there, I have coins there to play but I haven't found the patience to place order or found any liquid market to trade.

Yeah, the lack of liquidity can certainly be frustrating. It's such an amazing platform with minescule fees, I don't know why more people don't use it. Maybe it's a chicken/egg problem or maybe just a marketing one.

The BitShares/bitUSD is fairly active, but still nothing like you see on other exchanges. I've thought about setting up a market making bot to increase liquidity, but I'd probably just lose a bunch trying to figure it out.

I still have a hard time wrapping my head about where are the BTC and other crypto held.

Yeah, I get a bit confused by that also. Googling around a bit, I found this Steemit post helpful. From what I understand (which isn't much), it's similar to any other exchange in that you're trusting whoever runs that asset to play fair. If they go belly up, you may be out of luck, but the smart contracts of bitUSD and bitBTC can provide some security as long as the value of BitShares doesn't go through the floor.

@lukestokes, you have out done yourself. Great idea for a tutorial. Loving it.

I know this is an old post Luke, but with the continued huge run up, are you continuing this method. I have many BTS in my Bitshares platform... Thanks

For sure! See my latest post on it: 9 Day bitUSD Loan Result: 19,821 BitShares and 199 ZAPPL for Free