EUR is a currency of the european nation while USD is a currency of USA country . These currencies are used by local of each nation to conduct their daily transactions as well as by foreign to determine the pricing of different product which are then converted to their local pricing. On Monday the 20th of July, one EUR started trading at around 1.1400. The price was able to rise as high as 1.1460 the same day but slightly dropped to around 1.1440. The price again further rises to around 1.1580 on Wednesday the same week.The market has started to move downwards which can further continue dropping further . This can be explained as from below;

Traders behaviour.

EUR/USD currency is a stable paired currency and is thus being well tradeable by different traders from all over the world. Both buyers as well as sellers can easily profit from its upward and downwards movement. When the market is moving upwards, that is an indication that those traders holding their long positions are fewer in numbers than those holding their short positions . On the other hand, when the market is trending downward, that is an indication that those traders holding their short positions are fewer in numbers than those holding their long positions. Therefore, we can say that the market moves in direction where few traders are so that it profits with them and makes many traders make some losses. Since there is possibility of the market to be in bearish condition the whole of the week, it can therefore be explained as from below;

- EUR/USD price analysis based on traders behaviour.

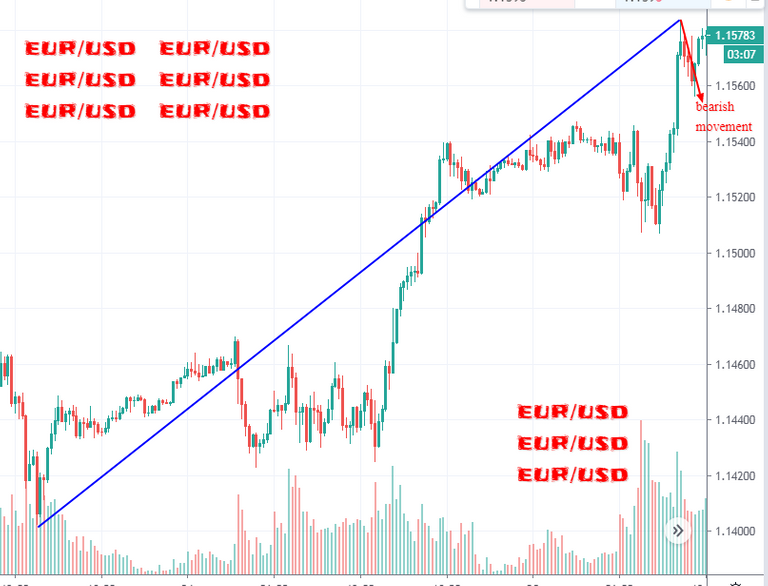

In a bearish market,the EUR/USD market will be moving in a downwards direction. On Monday the 20th of July, one EUR started trading at around $1.1400. On the same day, the price managed to rise as high as 1.1460 but later slightly dropped to around $1.1440 on Tuesday the same week.On wednesday the same week,the price further rises to around 1.1580. This market movement is being indicated as from the candle sticks chart below;

The above is the market for EUR/USD. The market can be seen to be trending in an upwards direction all the way to around 1.1580 from its previous low of around 1.1400 on Monday. This upward market movement has been as a result of the number of traders holding their long positions being fewer in number than those holding their short positions. This causes the market to experience an upward market pressure where it moves from its lower price on Monday of 1.1400 all the way to around 1.1580 on Wednesday. Currently, the number of traders who were previously holding their short positions have started to close their positions in the fear that the market will continue moving upwards thus causing their losses to continue increasing. They have started to open some long positions in the hope that the market will continue moving upwards. This is causing the market to resist to continue moving upwards and has instead reversed and is starting a bearish movement. You can place a short position since there is possibility of buyers to continue exceeding the sellers thus the market can continue moving downwards until Monday next week. The market can move as low as 1.1430. Make sure to place a sell order of around 1.1580 by applying risk management well since the market punishes greedy traders.

Warning! This user is on our black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

our discord. If you believe this is an error, please chat with us in the #appeals channel in