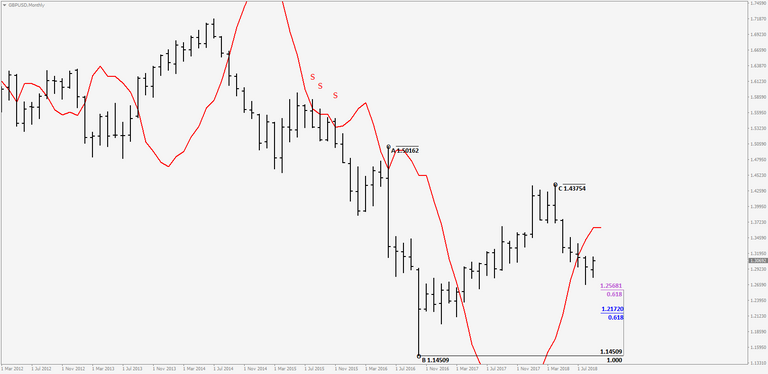

in cable we've got the quarterly in a buy. It is the third bar after trend change and we dont see strong dynamic pressure recently. We have two more weeks to the close of the quarterly bar. On the other side a new ABC developing and if the market can move higher there is massive resistance ( OP agreement + confluence zone) up at around the 1.50 area

The monthly is in a sell and the 0.618 support holding for now.

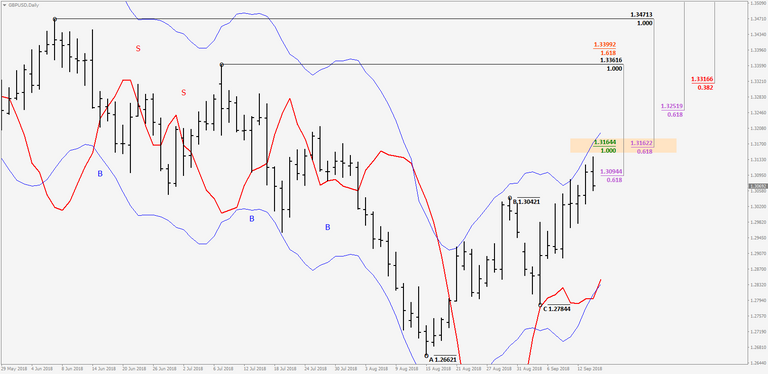

Looking at your weekly; trend turned into a buy with very good initial follow through on this buy signal. First good resistance stands at 1.3160-65ish which is agreement of 0.618 fib resistance + 1.00 fib expansion and more resistance higher up 1.3317 and 1.34 respectively.

On the daily as you see market couldnt reach the 1.3165 level yet so it is probably gonna be buying opportunity on the lower timeframes for a move up to that level.

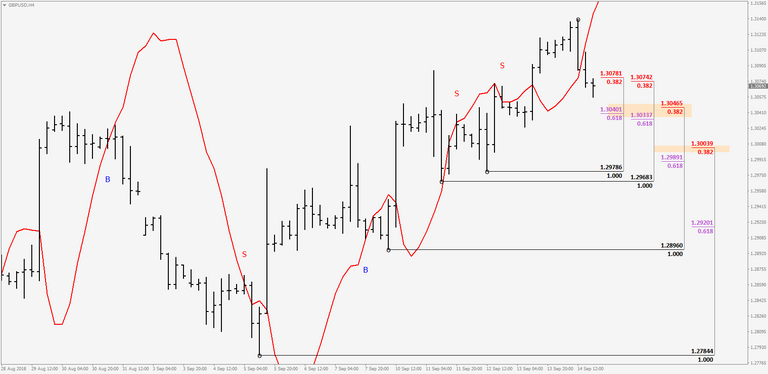

You can see the perfect 0.618+ 0.382 confluence support levels on the 4hour to long the market for short term..

So cable looks strong on the short term but it s bearish on the long term. We have weak dynamic pressure on quarterly buy; monthly trend is in a sell and weekly buy signal can be faded by monthly traders at strong fibonacci resistance levels.