During my daily twitter scroll in the evening I´ve stumbled upon an article from Joseph Young about a study that reveals that about a fifth of all cryptocurrency investors borrowed money for trading diverse coins. To me that´s shocking news as I personally consider such a move as damn stupid!

(Source - Cointelegraph.com)

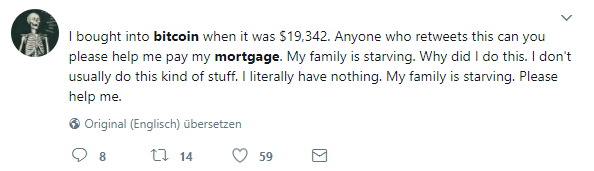

(Source - Cointelegraph.com)

Yes there are big profits to be made in the cryptocurrency market these days and yes it might actually even look damn simply to newcomers as you don´t have to do anything else than to buy a cheap coin and wait for it to rise. Well sure I won´t deny that it can work out that way as long as we´re in a massive bull market but you should never forget that it could turn out the opposite way within a few hours only.

That being said you should always remember to only invest what you are willing to loose. Yes you´ve heard correctly as your investment could as well be completely gone in a single day in the cryptosphere! Putting money at such a high risk that you don´t even own and are not able to loose is therefore simply a very stupid idea...

The below Excerpt from Twitter, whether it might be true or not, shows how you could eventually end up investing borrowed money into cryptocurrencies or basically anything else. So please do yourself this favor and never start trading with borrowed money, it´s not worth the risks!

A Worldwide Crypto Society! | Awesome Steem Witnesses! |

|---|---|

|  @TheCryptoDrive, @Ausbitbank & @Adsactly-Witness |

(I Upvote Quality Comments - Support Me Doing So 😉)

"Invest what you can afford to lose". Well I can say it's for case-to-case basis. Some might say borrowing money is not a good idea for investments, but rich people do it most of the time. What someone needs is proper risk management. You can borrow money and set a stop-loss on what you can afford to pay when you lose it. It's for making your trades higher on volume somewhat like leverage trading.

Well I don´t see it as a case-to-case basis. You simply shouldn´t invest with any borrowed money whenever you can´t afford to loose it. Rich people might do so but they probably could pay it off easily with another investment though, normal people mostly can´t do that...

Example, Person A can afford to lose $100. He could apply for a loan worth $1000, and put $500 in btc and $100 each in coin A to D. The ratio may vary but for simplicity, let's factor out the fees. Worst case, all coins go down, he sells all when his total losses become $100. He would actually have unwanted losses on the interest of the loan. But if BTC goes down, but his alts go up, he could break even or profit from it. I guess it would be better than investing all $100 into 1 coin and screaming moon. But the key phrase would be "Invest with any borrowed money whenever you can't afford to loose it." Like people blindly pulling out their 401k to buy btc without any plans when things go south.

That could be a possible scenario but take a look on the market just now. It´s down 20% easily in an hour so you could get stopped out right away loosing your 100$ in a minute. It´s just too risky to invest with borrowed money and I guess no one will be able to convince me otherwise.

You're right. But there were coins in the top 100 which could've offset your losses in the top 10 coins. Some were 30-60% up. Spreading is important. I'm not suggesting that everyone should get a loan to invest in this market. My point is, I believe it's possible and doable. But not everyone has the talent to do so, including me. Thanks for giving time replying to my opinion man. I appreciate it.

I've read a few horror stories about borrowed money and trading. I think borrow to trade is a deathtrap to most. People should trade forex and indices first for 3+ years and prove to themselves they can make money or at least breakeven in the world of manipulations and hard decisions. If they manage to do that, go for it. But borrowed and bigger amounts of money put unnecessary pressure on one's trading, which only thrives if one is in a "zen" environment.

Trading on margin is even too risky for most people let alone pulling out bank loans or credit cards to trade.

You would think after the dot.com era, people would learn. There were many who got cooked going into debt to finance their trading activities.

There´ll be many more that get cooked on the crypto era. People don´t learn from others mistakes and some unfortunately not even from their own.

I was margin trading before as well but ended doing it with a big loss. Lesson learned!!!

I think that borrowed money especially leads to irrational decisions whenever you made a bad trade as you´re about to loose money you don´t even have. Risks are just multiplying that way.

There have been a lot of these stories lately. The thing is, there is an entire segment of the population that are gamblers who always jump on the hype-train and will risk everything for a shot at redemption. Many of these people lost before... many times, but have grown accustomed to the excitement & stress of "investing" with blind optimism (aka, gambling).

Fomo is the worst that can happen to you whenever you´re looking out to make more money!

It is really sad that an article like this has to be written but it is obvious it does. The stats you provided exemplify how moronic it is.

You would think that people learned after the dot.com bust when people were using credit cards to buy stocks only to realize they were worthless 6 months later.

The old adage, never invest more than you can lose.

It´s really sad to see that people are always making the same mistakes again, especially whenever it´s a dumb one like gambling with borrowed money. Investing in crypto isn´t anything else than that!

I talk to almost everyone about cryptos....amazing times! I am hearing more and more people thinking of putting a few grand on a credit card at an exchange to not miss out. Absolute bonkers. I tell them...go on Steemit. I will upvote good content and so will others!

Fantastic article.

Thank you very much :) Hope you can get a lot of people into steem along the road ;)

to me it's a bit like gambling - just like penny stocks. Never put in more than you're willing to lose - otherwise walk away. Better to invest in yourself - take a class, learn a skill etc.

Couldn´t have made a better comparison. Penny stocks just describes it perfectly...

22% of people are about to lose their asses! Lol 😂

Great post, the biggest falls come when investors leverage up and pile in.

lol yeah that´s unfortunately quite possible whenever we´re talking about inexperienced newcomers who can´t stand a drop of 20% like it happens in crypto.

Completely agree there - I have met with people who have been cashing in ridiculous amounts from pensions and savings funds too, as well as borrowing. Investing more than you can afford to lose is a bad idea, but with the current bull market a lot of people have the 'can't lose' feeling. You're right though, the market could turn around in hours.

The quick money is calling and while some few might succeed with that a lot of people will loose a lot I guess. Crypto trading is pretty much similar to gambling these days!

Yes there will be a lot of losses unfortunately.

It is, unless you're researching extensively!

Ya, this is a bold strategy, I would not go there

Please never do! Don´t even consider it!

NOT WORTH THE RISK! I get people asking me all the time if they should put some bitcoin on their credit card. I say no. That is even worse than a bank loan.

Buying Bitcoin on a credit card. That would be the sign of a bubble for me in case the crypto market wouldn´t be as small as it is today.

borrow to trade to be is just plain stupid, one should only trade with their excess money, not by borrowing. i understand that some would think its a calculated risk and gamble .. i guess its just not for me. . interesting topic though, something that i would like to discuss further with my friends and see their opinion too. cheers

I just hope none of your friends will ever consider to borrow money for trading either. It´s just the dumbest thing you could do!

great statistic! i've been wondering how much leverage is in this market

honestly i'm kind of surprised that the % isnt higher

to keep it in perspective tho, NYSE margin debt is $580 billion dollars, thats just one stock market which has a much debt as the combined market cap of the top 5 coins!

Thank you

A wise warning for investors. Way too many people are jumping in as well without researching what they are investing in. To do so with borrowed money is bad bad bad!

Thank you very much @steembusiness , i am pure man and from today going to be following you step by step to get a chance for life,got 120 usd to start ) Thank you very much man,you do make some difference for people !

Interesting!

Merah membara

That is a major example of a bad way of investing :)

Amazing post! I follow you :) https://seeninbg.wordpress.com/

Risk & emotions involve in that type activity is very high..

Good Analysis ,nice topic

Upvote & Resteemed