I can't think of a worse analogy than comparing crypto currency to gold.

People keep saying that crypto is 'virtual gold', and a 'wealth store'. But despite the effort to shoehorn gold related terminology into crypto, I don't think they can more different.

Gold has intrinsic value. It's been used as a currency for thousands of years. It's used as a base material for hundreds of industrial processes. It's used in everything from treating auto immune diseases like arthritis to covering the visor of spacesuit helmets. It has a useful purpose.

Gold is rare and takes some effort to obtain so it has scarcity value. If some new industrial process comes along, perhaps a new type of battery that uses predominantly gold then the price will go up as scarcity increases.

What if the world (at least the electronic world) ended tomorrow because of a mass coronal ejection or some other apocalyptic event ? We'd probably go back to gold as a basic barter system. The PC that you used to trade crypto would probably be broken down to recover the gold from the connectors.

No-one 'invests' in gold. Gold is a very temporary short term wealth store. When the going gets tough, an oil crisis or some world turmoil, people transfer their money to gold as a safe haven. As soon as things settle ? they take it back out again. I like to think of gold as being like a rechargeable battery for money.

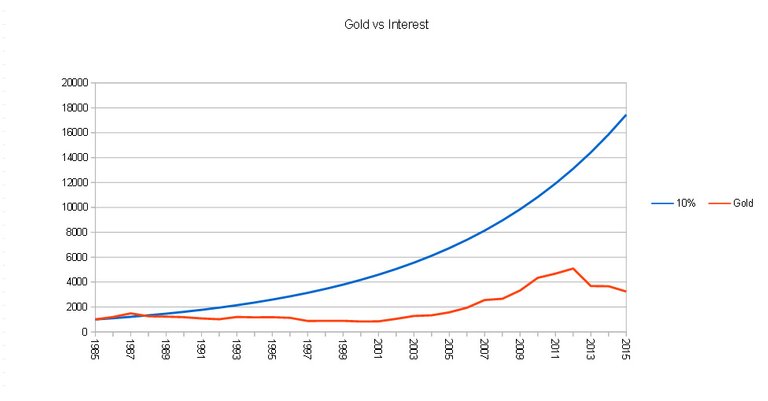

Anyone invested in gold over the long term would be making a bad investment. Sure, the price has a tendency to rise over time, but not nearly anything like equities or other commodities.

Say I sold my medium size car in 1960 and used the money to buy a bar of gold. If I then sold that gold today, what would it be worth ? Yep, about the price of a medium sized car. It hasn't appreciated at all. In all likelihood, the same car would be worth more money today if I'd just kept it !

To emphasise the point, here's what a $1000 investment in gold would look like today if I'd invested in 1985, compared to just having cash in an equity earning only 10% interest. I could have bought a house in 1985 and made more money just by renting it out.

And what about the crypto 'store of wealth' idea ?

So... how's that working out for you ?

What are you telling the people that bought at $18,000 about their 'long term wealth storage', as they watch their investment dwindle to nothing ?

The concept of 'wealth storage' is to put your money in a safe haven, like gold. And as soon as your wealth storage medium starts to tank, you take it out and put it in something else that will protect and increase your wealth. You don't sit an watch it decrease to less than half its value and pray that some time in the next 30 years you can break even.

Money management seems like a difficult concept for a lot of people to understand, but it's just common sense. Only invest in things that make you money, and drop things that lose you money. Is it really that difficult a concept ?

Header image credit : http://goldbullionhunt.com via Google image search, no affiliation.

About me -

I'm a full time financial trader, mostly in Forex and Commodities. I write for fun and try to help beginner traders get started, avoiding all the mistakes that I made. I'm always happy to chat or discuss ideas so please just give me a shout in the comments !

100% of anything I earn from this post will be donated to a Steemit charity or worthy user.

Earned a follower with that. ;)

lol, thanks, worked in the space industry most of my life and also a borderline prepper, so I know all the space borne possibilities... it's just a matter of time.

Followed back !

Isn't it so the people invest in gold cause it does keeps it value?

I do think that BTC could be compared the most to gold. This because it is also scarce but BTC has indeed no intrinsic value.

If I do understand enough what you are writing then maybe Tether would be a better comparison to gold, than BTC does!

If the market plummets, tether will stay around the same value. But tether isn't scarce and has an intrinsic value.

Does this make sense?

I wouldn't for sure call all cryptos besides the two I mentioned to be a safe haven, not could I compare it with gold. Investing into these is more like taking a gamble!

We all have do have high expectations, but within 1 year it could just vaporize!

I think you made a great point, gold will still be here in a years time, probably a hundreds years time. What about the 1500+ shitcoins that people can invest in today ?

It's not so much the fact that investing in gold is bad, it's just bad long term compared to just about everything else. The point is that gold is very safe, but it won't make you money over time.

Tether could also implode with little warning. It's value is entirely based on a sufficient number of people holding to the faith that it is backed by USD. In my opinion, USDT is a lot more likely to go to zero than Bitcoin

Anyone that bought BTC at 18k is a bumbling idiot and they deserve their wealth to dwindle. Probably sucked in to the hype after watching it double several times and the greed set in their eyes.

Cryptocurrency like the Blockchain is here to stay, and of course there will be many casualties but after all this is a gorilla game. I remember when a typical cryptocurrency market cap was several millions of dollars and even then doomsayers predicted the worst. Now tens of billions of dollars later despite the fall, more regulation, an "ok" from CFTC, SEC, Governments, etc... it would be inconceivable to think a winner won't emerge.

Intrinsic value you ask for? One of the most innovative technology ever. The Blockchain is what you call a Platform tech. These cryptocurrencies is what you call pilot studies. There is a bigger payday for those that solve issues such as scalability.

@tradergurl I'm starting to suspect you traded crypto and got burned, and since then your mission is to give it hell =)

Dude, if I traded crypto I'd be able to solve world hunger with the profits lol :-) I actually really like the idea of crypto, and really want it to become mainstream. I just can't stand all the hype and bullshit and fantasists and dreamers who think they're all going to be millionaires on it... Bitcoin to $100,000 by the end of the 2017 ? lol.

I don't doubt some crypto will survive, probably not bitcoin but one of the useful ones. Until there is mass adoption it's just a highly speculative market for short term profits, nothing else.

Something to note... you see that other side of the curve after the big bitcoin peak ? As you already know, for every seller there has to be a buyer, so people were still buying into it, all the way down to where it is now... If find that sad but interesting :-(

The "mass adoption" needed is a delusion. The market caps should tell you that it'll go whenever, wherever it wants to. I also doubt VC's, Banks, and others whom is fueling the infrastructure race wants their positions to be diluted by the masses. Despite the rise and fall the majority of bitcoins biggest wallets did not decline, hence no dumping by biggest shareholders. Market manipulation is easy in this space, human sentiment is even easier to manipulate.

I do believe the forces at work are more sinister, and devious than previously imagined.

Awww you care about others potential loss... This is my face -_-

lol, I feel bad for the people that bought into that bubble. That wasn't a tiny minority of geeks on the internet who knew what they were doing, that was the 'ordinary folks' piling in because they were told that bitcoin was going to the moon and they could make it rich.

An awful lot of normies got stung, that would be pension money, college funds, life savings. Yes I know it's nobodies fault but their own, but they made bad choices based on bad information.

The problem I see for Bitcoin now, is where is the money going to come from ? All those people got stung, some probably still in pain, so they won't be investing any time soon. Virtually all the geeks are already long, so who else is left to buy ?

Not many institutional investors will touch it because a) it's a penny market to them and b) too risky for too little gain. All this "$100,000 by the summer !", where exactly is the 2 trillion dollars coming from that would make that happen ? I just don't see it, especially when investable dollars are now being spread over 1500+ currencies.

Gold is at the tail end of a multiyear correction from all time high right now - comparable to BTC in July of 2015. It has broken its downtrend on the weekly timeframe, and while there is a good chance it may retrace to the support zone around 1200 one last time, it is starting to look quite bullish. I expect we will see it above $2000 per troy ounce within 3-5 years. That ascending triangle on the weekly chart is anything but bearish, and the last two times it finished a consolidation pattern similar to the one it's completing now it was followed by a 300+ point run.

I couldn't even begin to predict what gold is going to do in the future. For all I know some shithole country could set off a nuclear weapon tomorrow and all the predictions will mean nothing.

My predictions are more like the weather, I can tell with high accuracy what the weather is going to be today, less so tomorrow and even less the day after. In 1 weeks time ? no idea.

I'm not disparaging your analysis, long term fundamentals is something I'd like to get in to so I can give up day trading, I just admit I don't have the skills to do it yet.

Imagine that you live in an unstable third world country and that your currency is highly volatile and generally devalues against USD. Imagine that most of your local potential financial assets aretied to your currency and suffer from the same issues.

Now imagine that you have the choice to invest in these fiat backed assets, or you can buy universally accepted "stores of value" like gold or Bitcoin.

Nice move with the crypto graph, but a "store of value" is typically held over years, not a few months, and crypto year on year has been a very good store of value so far!

I'm not arguing with your analysis in traditional first world markets. But there do exist places that put a lot more value onto things like universal acceptance, not linked to the national economy, relative stability etc. than just raw returns.

You can store your wealth in anything at all, but if it increases at lesser rate than inflation or cost of living, what's the point ? You might as well take in fiat currency and put it in a shoe box under your bed, it's not going to increase over time relative to the general economy.

The point of the article is that gold is a short term storage solution to get your wealth temporarily out of volatile markets, it's not an investment vehicle for long term profits. But it has been, and will be, around for a long long time.

How many of the 1500+ crypto are going be around in 5 years time ? surely you don't think all of them ? That's the point, even though gold is a crappy long term investment, it's more than likely still gonna be here long after all those coins are dead and forgotten. Not very good for long term storage in other words.

Maybe 50-250. They'll drop like flies.

I really hope they do, and just leave the ones worth buying, ones that serve a real purpose.

Unfortunately I'm sure that new ones will come along, equally unworthy. In fact, the more crypto goes mainstream, the worse this tide may become. It's this kind of thing that I hope regulation can help to mitigate. It's also for this reason that I strongly support NEO's much higher (than Ethereum's) token establishment fees. Seen a bad DApp on NEO yet?