I've gotten sick of this phrase "Don't invest more than what you can afford to loose". I followed the breadcrumbs of this ridiculous statement to Dr. Phil and here is what I consider an appalling video to look at: http://www.oprah.com/oprahs-lifeclass/dr-phil-never-invest-more-than-you-can-afford-to-lose-video

It's actually given as a life advise and I don't know what kind of -excuse my french- cucks and pussies they have in their target audience. But I'm seeing this advise popping up all over the cryptocurrency/blockchain investment scene. I'm seeing many financial newsletter writers from groups like Palm Beach Group, Stansberry-Churchhouse and James Altucher who had lost it all multiple times and one of his much promoted investing techniques (1000% Backdoor) was simply piggybacking on other successful investors using his "Network" he has built up. All these people who have multiple newsletter worth tens of thousands of dollars per year per person promotes Cryptocurrencies and always mentions how you shouldn't invest more than what you can afford to loose.

But they ask you to buy the $3000 newsletter which would save you about 300 hours on steemit and few other sites.

I'll let that sink in and invite you to read my last week's article You are the Elites: Financial Newsletter review and how you are secretly smarter than veterans + My outrageous prediction and Why Bitcoin will never be P2P Electronic Cash

Now let me show you that the title wasn't click bait by convincing you that unless you buy Berkshire Hathaway or something similar, you are better off letting a monkey pick your investments for you. Before jumping right into the monkey, allow me to show you how people never learn by traveling to 1998 and picking up the Wall Street Journal which non-savvy investors read to make them look like they know a thing or two about investing.

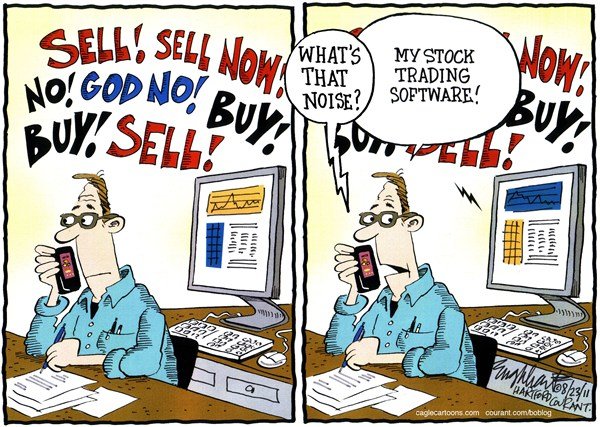

Economist Burton Malkiel said “a blindfolded monkey throwing darts at a newspaper’s financial pages could select a portfolio that would do just as well as one carefully selected by experts.” Since real investors don't bother with WSJ anyways and for the sake of selling more copies to the mainstream they ran an experiment.

On October 7, 1998 the Journal presented the results of the 100th dartboard contest. So who won the most contests and by how much? The pros won 61 of the 100 contests versus the darts. That’s better than the 50% that would be expected in an efficient market. On the other hand, the pros losing 39% of the time to a bunch of darts certainly could be viewed as somewhat of an embarrassment for the pros. Additionally, the performance of the pros versus the Dow Jones Industrial Average was less impressive. The pros barely edged the DJIA by a margin of 51 to 49 contests. In other words, simply investing passively in the Dow, an investor would have beaten the picks of the pros in roughly half the contests (that is, without even considering transactions costs or taxes for taxable investors).

Despite all the revelations by WSJ, people still count on hedge fund managers to make them money. These banksters and wall street guys can't produce the gains of a 10min bull run of a crypto in an entire year. Being in the market isn't just about being in it for the year. You've got to think long term and use the market to invest to build yourself a better life. So..... here goes some additional age old info about the well educated Keynesian schmucks.

- The Announcement Effect: by announcing the stocks to the entire audience of the WSJ, it will artificially inflate the returns (in fact, abnormal gains for the first 2 days after publication scaled back between 15 and 25 days later).

- Pros picked riskier stocks: Case Western Reserve University professor Bing Liang says that, adjusted for risk, the pros’ would have lost 3.8% on the market over the six-month period.

- The Dartboard stocks continued to do well: After the contest ended, the dart stocks continued to perform, while the pros’ picks fell from their initial highs after publication.

Too bad I was quick to do the standing ovation. I started my trading life on August 1st with a bold contrarian investment that tripled my portfolio. After going through many crashes and drama and massive volatility I really cringe when the mainstream investors talk about risk and balancing portfolios. Lots of people who talk in favor of hedge funds claims that those funds are “managing risk”. The facts say that their "management" is as good as a managed economy of communists who make the land go barren like a grim reaper for all thing good on this Earth.

A few years back a study conducted on behalf of the endowment of Cambridge University’s Clare College found that, historically, the best risk-managed simple portfolio for a long-term investor had usually been a balance of 80% stocks and 20% cash (or equivalent, such as Treasury bills), rebalanced once a year.You can play around with simple portfolios but this will do as well as any. It’s about as simple as you can get.Someone who put 20% of their money in a federally insured bank savings account, and the other 80% in a random collection of stocks from around the world, picked by monkeys, would be up about 6.2% so far this year. (And that’s assuming for the sake of simplicity that you earned 0% interest on the savings. In reality, you could have done slightly better)

In other words, they would still have earned more than twice the returns of the average hedge fund.

I'm exclusively investing in cryptos. I have no first hand experience regarding these PhD ridden hedge funds. I've come to know that the norm is 2% of the assets as a basic fee and 20% of profits (If they managed to actually make a buck) I've heard about worse cases of charging 25% of profits. If the funds are doubling your money each year (which is possible in a week or even few hours with cryptos) I won't object to even a 30% fee.

But these guys are charging you 2% or more plus 20% or more from the profits to employ a bunch of College kids and Wannabe investment legends while 20% money in a bank and 80% invested in a randomly picked stocks will get you upto 4 times better returns.

You read that right. Sometimes monkeys beat the College Graduates by 3 or even almost 4 times when it comes to making money

So why should you go and preach about blockchain, how it's going to change the world as we know it and say Don't invest more than what you can afford to loose as if all cryptos were just BitConnect forks???

I sincerely ask my fellow investors to grow some sensibility and a functioning spinal cord and say things as they actually are. Take a look at the following fellow who got a 150 year sentence for running BitConnect Bernard L. Madoff Investment Securities LLC on top of being the former non-executive chairman of the NASDAQ stock market.

He is going to come out of jail November 14th, 2139 after commiting a $64.8 Billion fraud. General Motors went bankrupt in 2008 along with Lehman Brothers, Chrysler, Fannie Mae, Freddie Mac and Enron which these ono-monkeys had valued at ~65,000,000,000 USD at the time of chapter 11 bankruptcy.

I've tried some stock simulators and one things I've confirmed is that focusing on trends can give you excellent returns (like 50%+ in 6weeks trading stocks). You can pick a small but growing sector that is really important and make a lot of money investing. I see great potential in Miners (both precious metals and copper), solar energy and cyber security. I love cryptos so much and I don't plan to trade stocks. But I know good signs when I see them.

Multi-Billion Dollar Blue chip stocks that has been around for generations can and will go bankrupt. So why does everyone consider S&P 500 safe and go around putting warnings when they talk about or downright recommend a cryptocurrency on a premium newsletter or YouTube or even some Blockchain preaching website as if this is some gamble?

If you have a brain to think, the only gamble is how much % gains you are going to get. That's the uncertain part. You can check market histories over centuries and figure out that even the bad picks have great gains at the right time in the right sector. This is the time where blockchain is getting hot. I've seen 150% gains in 2 days with mining stocks. When yo see those returns and get out of the position, you'll be safe...... and rich.

A non-executive chairman of the NASDAQ turned out be be a scammer. But with transparency of blockchain, frauds mainly happen when investors make stupid decisions. Crytpos give the reruns as good as or even better that OTC stocks while having high liquidity and potential to become very important. You don't have to HODL. You can get out after a quick spike and move onto another thing.

In a world where monkeys can invest better than pros, you'd have to be dumber than a monkey to loose your investment in cryptos (unless it was stolen).

Always do your research and don't act like you are investing in a ponzi while the risk to reward ratio is sky high compared to Blue chip stocks or even OTC. The only way your account is going to zero is from a bad margin call or a theft.

Be proud about what you are engaged in. Be proud that you are a pioneer. Spread the word and tell people to act knowing that the good projects will take over the scam ridden NASDAQ and non-transparent Blue chips that are on bed with the 3 letter agencies. Don't repeat the words of people who can't beat a monkey at trading.

That was a fun read :D I did not know you had such talent in writing skills.

Yes constant investing, BTFD and buy and hold used to outperform any other strategy unles there was a big market crash.

If you can find such a good topic occasionally, you can earn this amount more often. You deserve it!

Thanks for the compliment. It's hard to find enough time to write and research with trading and a massive backlog of movies and anime on my shoulders. But I do make about a post per day and a few long ones each week.

“a blindfolded monkey throwing darts at a newspaper’s financial pages could select a portfolio that would do just as well as one carefully selected by experts.”

haha excellent That's right, my only investment experience was the one I had when I was a teenager and participated in the virtual exchange, I did it to learn the basics of hold. Right now, the margins that are obtained when dealing with cryptocurrencies are so high, that really investing in anything else is silly.

If you do your research and keep a small focused portfolio and be careful with margins (Only time I had lost screwed up was when using X5 margins under high volatility) You'll do quite well. Fundamentals always catch up.

This. Is. Brilliant. For all of the reasons I have invested in cryptos. I became very tired of trying to find financial advice and being told that I didn't have enough money to be worth their while. Or that I would have to put that money into a CD for 5 years at 2.5%. I also love Cryptos and am proud to be a pioneer! Thanks for the empowering post!

Nothing is worth as much as your own personal understanding. steemit is actually a great place with great analysts providing free content. @haejin has put out a bunch of tutorials to help you and he is the most active poster on the site. I also check the content of @freeforever and @ew-and-patterns who are also very good and helpful. Visit those people and decide for yourself.

Good luck investing!

Cheers Vimikthi, I follow @haejin and @ew-and-patterns, but I will also check out @freeforever. Finding a place with like minded individuals has been wonderful. Thank you for your post and your insight!

The part about like minded individuals is the single greatest thing about steemit.

There aren't many cryptos that aren't higher now than they were 3-6 months ago. If you went all in and held since then you would have cleaned up. That being said there are people who buy a coin and expect overnight moonshots and cry incessantly when it doesn't come to pass, then panic sell at the low point. These are the folks who are always crying scam. Sometimes all you need is the will power to hold your position even when it looks bleak.

If you do enough research you can build up that confidence to HODL through all the dips. Year in stocks is barely a week in cryptos. Crypto trading will breed a generation of veterans in a very short time. Of course it'll also kill many more weak hands in the process. Crypto trading isn't that different. It's just plays 50 times faster.

When I say do not lose more than you can afford it means not beyond what you need to survive. Rent money and food do not lose that. It is easier to save more and invest when I am ready rather than become a homeless bum just because of my greed. I have no 401k but saving 529 for my kids. I just save and earn for the sake of supporting my family first. Thanks.

It's better to just say: "Don't invest your lunch money. Invest your saving."

That much is obvious. You don't know what might happen with your life. On the bright side, their is SALT which gives loans for your crypto holdings. If you pick a good HODL coin, the loan would pay for itself.

Really interesting topic. It is more likely to lose when you actions are not based on good foundation, and the risk of going down is as higher as your investments.

That's what is happening with bonds and negative interest rates. You really can't win with bonds. You will loose money when you hold money in your bank because there is inflation even if there isn't any negative interest rates.

True man , i appreciate that.

@originalworks

Some similarity seems to be present here:

This is an early BETA version. If you cited this source, then ignore this message! Reply if you feel this is an error.The @OriginalWorks bot has upvoted and checked this post! http://www.investorhome.com/darts.htm

Resteemed upvoted

I support you with my resteem service

Your post has been resteemed to my 3300 followers

Resteem a post for free here

Power Resteem Service - The powerhouse for free resteems, paid resteems, random resteems

I am not a bot. Upvote this comment if you like this service

@vimukthi upvoted 25$

Curious?

introduction post

Check out the great posts I already resteemed.Resteemed by @resteembot! Good Luck! The @resteembot's Get more from @resteembot with the #resteembotsentme initiative

Very good post :)

@mit downvote

Please don't SPAM... Take a look in this:

https://steemit.com/steemit/@miti/a-complete-guide-for-newcomers-and-minnows-to-avoid-a-possible-spam-and-to-write-good-comments

Nice fantastic post Happy 2018 Contribution comment#

@miti 9 spam within a single hour and already has a reputation of 44

I do not understand friend

Please don't SPAM... Take a look in this:

https://steemit.com/steemit/@miti/a-complete-guide-for-newcomers-and-minnows-to-avoid-a-possible-spam-and-to-write-good-comments

greeting our friendship, at the beginning of 2018, greeting success always

@miti https://steemit.com/@haikalbatat/comments

Please don't SPAM... Take a look in this:

https://steemit.com/steemit/@miti/a-complete-guide-for-newcomers-and-minnows-to-avoid-a-possible-spam-and-to-write-good-comments

I counted 15 spam comments posted within 12 minutes.@miti One of the worst offenders I've seen. Already has a reputation of 52

Please don't SPAM... Take a look in this:

https://steemit.com/steemit/@miti/a-complete-guide-for-newcomers-and-minnows-to-avoid-a-possible-spam-and-to-write-good-comments