Hello there, specially to those interested in trading and quant trading/quant strategies.

I've been working in an idea during the last months that I want to show you.

I'll give more details if asked to but what I basically do here is filtering the returns of a time-series, disaggregating them with a rule within its cathegory of positive or negative, measuring the momentum of the price dynamic and taking a position.

Still on the way to be improved because I'm having some problems in getting to the idea that conceptually came to my mind but yet getting a shape.

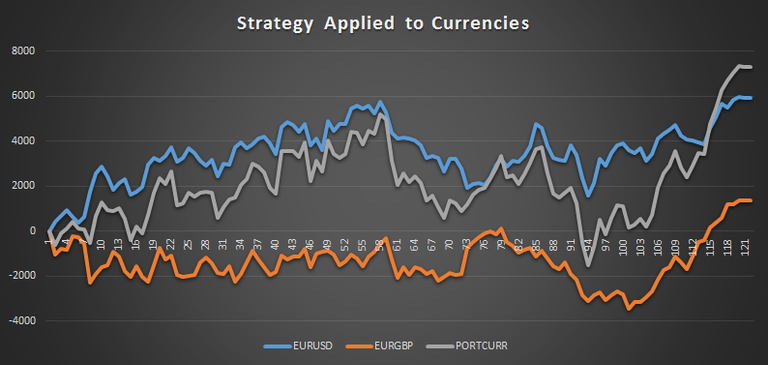

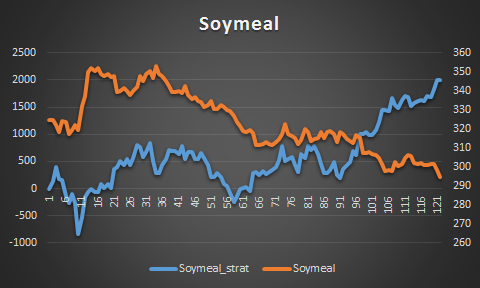

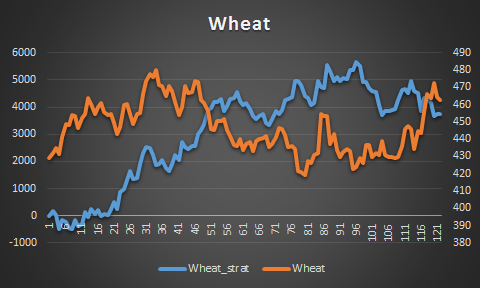

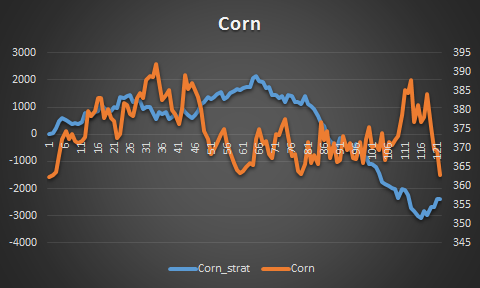

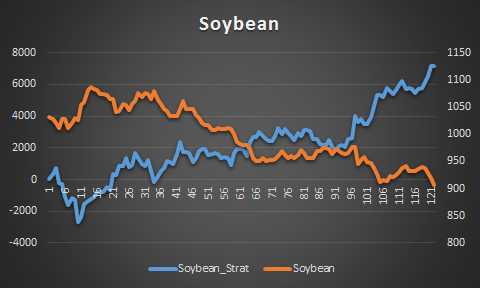

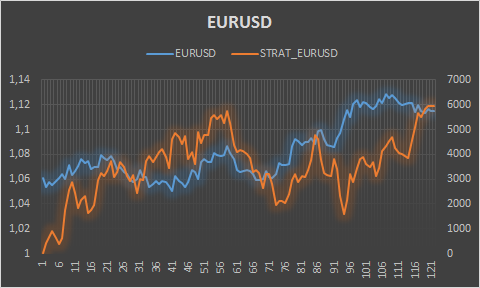

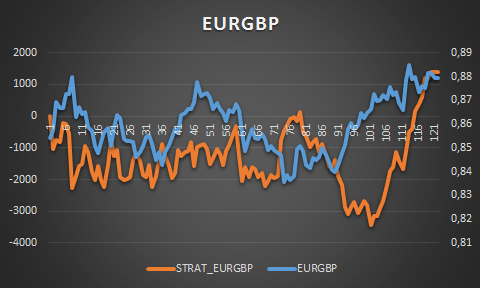

Summing up, I'm using here 3 months of data received from Interactive Brokers and passed to my strategy created on R.

Daily frequency and commisions included (commision charged by IB).

Seems like trend-persistent prices like soybean, wheat or soymeal are well recognized by still fail to avoid choppy markets and fail to get the right entry/exit point.

There is a saying in spanish that could be approximately translated as "Royal Palace stuff is slow" ("Las cosas de palacion van despacio"), meaning that the important stuff must be slow and well prepared, not just done superficially.

I let you some graphs from the strat.

I will update numbers and infor if anyone is interested, tho I wont show the entire process. Always happy to colaborate with others to develop new strategies.

STRATEGY RUN ON COMMODITIES.

Good post @wese, I'll wait to see the next steps in your strategy, good luck!!!!

Nice article friend for trading beginners. Regards @wese

Congratulations @wese! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!