I love traveling — everything about it excites me from planning to being out there looking for life transforming experiences. Also, I’m a budget traveler, always on the lookout for the cheapest tickets that led me to this awesome combination of cashback programs, co-branded frequent flyer credit cards for the best value tickets.

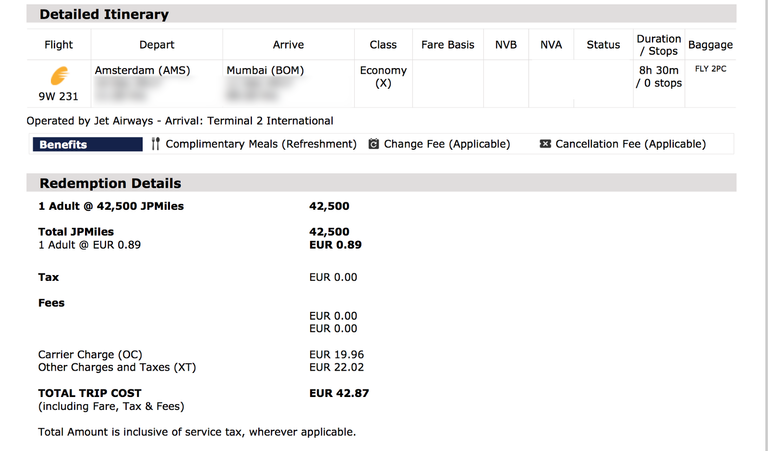

🔥Result — Almost a free ticket from Amsterdam to Mumbai. If I had paid with cash instead of miles, that ticket would’ve cost around $850. Ended up just paying $46 for Taxes and Surcharge.

The trick — Booking during the sale, Cashback from Ticketing companies, Co-branded Frequent Flyer Credit Cards.

Big Bet— Co-branded Frequent Flyer Credit Cards and a bit of time

What are these Co-branded FF Credit Cards? A simple loyalty program that gives you flyer miles for every transaction on the card as little as $2.

How it works?

- Sign up for some bonus miles and get the credit card.

- Spend the minimum money to get the sign up free miles and bonuses.

- Use miles to book free flights.

A short list of Co-branded Frequent Flyer programs in India

JetPrivilege Miles works with all Jet Airways and its long list of partner flights — with AMEX, ICICI, HDFC, and IndusInd.

Citibank offers PremierMiles that can be redeemed for any flight operating from India.

SBI has a tie-up with Air India — really? 😆

The Credit Card companies let you fly for free? Nah! Credit Card companies make money every time you swipe or purchase with their cards. If you leave unpaid balance, they make more money with the interest. So you sign up for their card, meet the minimum spends to get the major chunk of the miles. Spend, earn miles, repeat and fly.

How I won the miles?

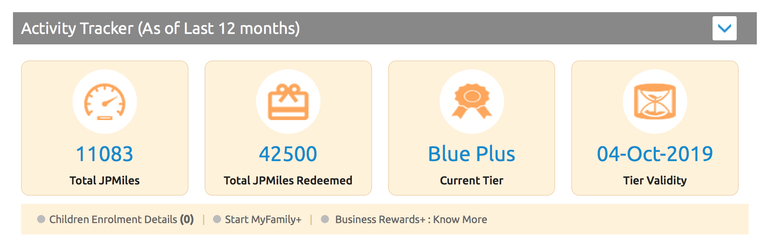

I planned a trip to London this year and wanted one way to be a free ticket. I applied for 2 Cards, Citi Premier Miles and Jet Privilege that gave me around 10k miles each. Within a month, I met the minimum spends and received the miles in my JetPrivilege account. I was still short of a lot of miles and the breakdown of How I earned my 42500 points over the last 7 months below

- 10000 JPMiles Sign up points from JP Amex

- 7000 JP Miles when I converted my the sign-up bonus from PremierMiles Citi Card. They have a conversion ratio of 2:1.

- 2500 JP Miles I had an account with ICICI and they gave a free upgrade to Coral JP Miles Card. I don’t use this card unless looking for free BookMyShow tickets.

- This leaves me short of around 23000 points to get my free ticket (3285 miles per month for 7 months) That meant I spent a total of 40k-50k on my card every month. Every little transaction happened with this Card. Thanks to all the friends and family who let me pay first and transferred the money later. I booked all the flights for my friends, family and the inner circle that traveled during the period swiped for all big purchases like electronics and rings.

Picking the right flight — Now I had 42500+ points and started looking at the flights from London, Paris, and Amsterdam to Mumbai.

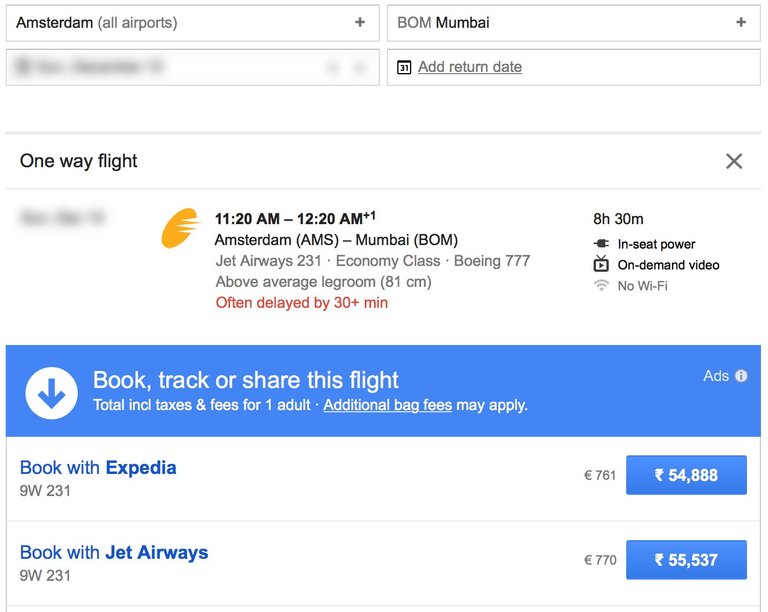

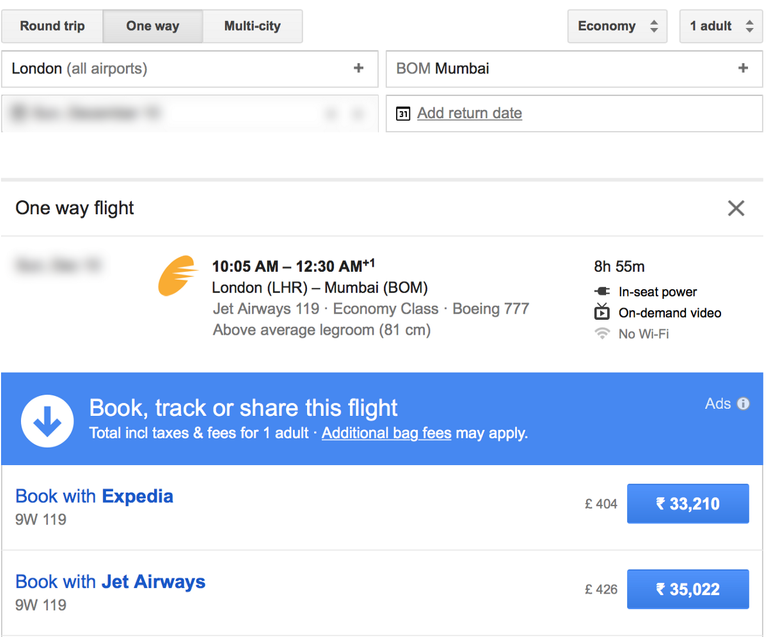

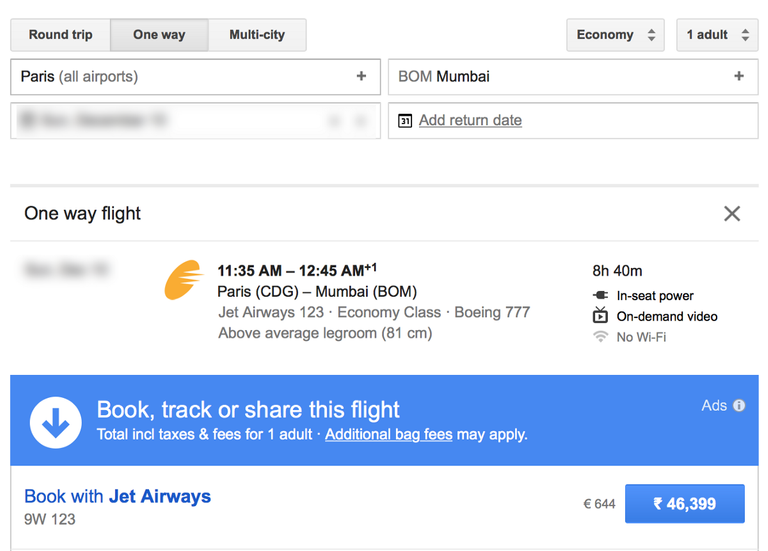

One thing that caught my attention was that all 3 places needed the same amount of miles but the actual cost of flying from Amsterdam was much higher compared to London and Paris. With the same amount of miles redeemed, you are getting better ROM (Return on Miles 😎) flying from Amsterdam (Rs. 55k — $853) vs Paris (Rs. 46k-$713) and London (Rs. 35k-$542).

So I decide to fly back from Amsterdam and upgrade my London trip to the UK + Iceland + Eurotrip (covering Paris, Berlin, and Amsterdam). Not exploiting but just picking the right city is letting me explore 3 extra cities and save an extra Rs. 20k.

The price breakdown of Jet Airways flights from Amsterdam, London and Paris below.

How to get this right?

- Get the right credit card. Go for the cards that have waivers on yearly spends or talk your way through the waiver with the Credit Card executive.

- When buying for Friends and Family, spend on high return rewards like flight tickets, electronics, and expensive stuff.

- Pay back in time and avoid the interest.

- And alway redeem your Miles for flight tickets and not the petty gifts they sell on the site. I avoid redeeming domestic tickets and use the cashback/sale instead.

Some general advice

Don’t stop at one free flight. With the 11k points bleeding, I’m already planning my next trip. Hoping this is helpful and if you’ve any questions on travel hacks in India, hit me up on my channel in Pepo — Wandermacha

Places I traveled in the last one year include Delhi, Kasol, Hampi, Lovedale, Coorg, Jodhpur, Jaipur, Chennai, Bangalore in India and Chiang Mai, Bangkok in Thailand, Bali, and Singapore. If you're in US and looking for the best travel credit cards, you've to check Cards for Travel and

have a great time brother

Thanks!

Thank you for the excellent and useful tips. I am a frequent traveler myself and I use several co-branded credit cards to pump up my Executive Club mileage. This has saved me lots of travel costs and also many many free upgrades (minus the tax and surcharge of course). Upvoted.

Really handy information for those frequent travelers!

That is a great deal. Will have a look into this as I love travel as well.

Brilliant post.

I do similar, then I cancel the credit cards. For most, if you wait 2 years, you can reapply for the card and get the bonus points again.

I usually have stayed away from canceling but may be something I can try. Have to make sure Credit score isn't impacted.

Thank you for sharing this with us. I love to travel too, so I am going to look for ways to reduce money spent for tickets. I am following you.

Thanks! feel free to check out my travel channel pepo.com/wandermacha for more tips and tricks :)

You could make a series of posts for cheapest travel ideas! It could get popular!

Sounds interesting and a nice idea. Will plan out something :)

This one deserve a vote

Thanks interpreter!

I appreciate