Keep in mind, my previous warnings about the precarious and completely unstable condition of the global economy after a full decade of 'Extend & Pretend' combined with the extreme wizardry of central bank financial engineering - and then "all of a sudden" an obscure country like Latvia could just be the anticipated and long-awaited match to the full tank of gas!

Over the last week, a number of events has happened within the Latvian banking sector - and have very quickly escalated.

On February 13th, the U..S. Treasury’s Financial Crimes Enforcement Network identified ABLV bank as an

"institution of primary money laundering concern pursuant to Section 311 of the USA Patriot Act”

and immediately severed access to other banks, afraid of getting caught into a whipsaw themselves...

(who, BTW, had ALL STOPPED LENDING to one another as early as January 3 of THIS year - a cause of "concern" to all those paying attention...even though you likely haven't heard about it)

So the next day, Latvia began investigating US claims scrambling as its 3rd largest bank was cut off from any of its usual lending sources - and totally reliant on the ECB instead (the rhetoric is all about "North Korea" and money-laundering)

And, within a couple of days had discovered that Latvia Governor of the Central Bank Ilmars Rimsevics could shoulder the "blame" for corruption and money-laundering and they arrested him on Saturday.

Interestingly enough he is also an ECB Governing Council member - and, just TODAY ...

....the ECB has FROZEN ALL of ABLV's payments - as well!

(How about all those credit-swaps and derivatives?)

Here is an interesting link on an IMF whitepaper completed in 2009, with data from a full decade ago - but clearly it can show you how "shaky" everything was...even then "after" the global banking crisis (remember, it never really 'ended')

https://s3.amazonaws.com/academia.edu.documents/41170698/Regional_Financial_Interlinkages_and_Fin20160114-13233-1piqco8.pdf?AWSAccessKeyId=AKIAIWOWYYGZ2Y53UL3A&Expires=1519088794&Signature=vAKrQbtrzGja3TpDe363AUsGY3Y%3D&response-content-disposition=inline%3B%20filename%3DRegional_Financial_Interlinkages_and_Fin.pdf

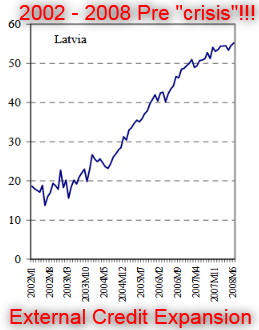

The above chart shows Latvia's great dependence on foreign banks - ie RISK OF CONTAGION

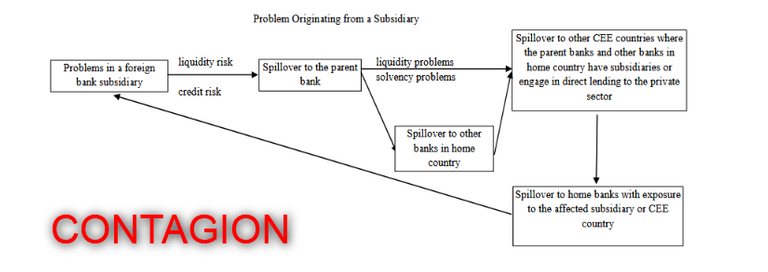

Here's how it could happen...

Latvians are not at all 'trusting' of their banks, and I suspect that there is already probably a RUN taking place over there - as demonstrated in an even less stressful occurrence in 2011 that was contained to just one bank.

The following year, the IMF produced a report about that;

https://www.imf.org/en/News/Articles/2015/09/28/04/53/soint020712a

(forget all those "statistical numbers" - they're all nonsense)

You can find more information regarding the whole situation here;

https://www.zerohedge.com/news/2018-02-19/latvia-bank-crisis-central-bank-chaos-ecb-blocks-payments-third-largest-bank

And, STAY TUNED @gloryb