In the post of last week, we calculated the APR of the CTPSB token during the previous year. To do that, we simply took the value one year back and compared it with the value of today. The resulting APR for 2024 was 17.4%.

It becomes interesting when we look at this APR and compare it with what you could generate by curating with your own hive power. When you stake your hive power yourself you get staking rewards just for holding hive power and curation rewards from voting on content.

Staking rewards

The staking rewards is flexible but more or less around 3% APR. This is the rate with which your hive power will grow organically without you having to do anything at all. If you have 1000 hive power at the beginning of the year, you will have 1030 Hive Power at the end of it.

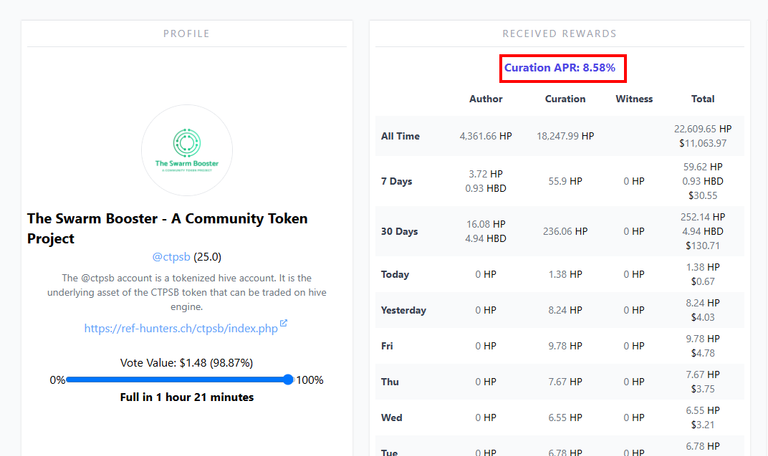

Curation rewards

It's not that easy to calculate curation rewards because they are quite dynamic, depending on what percentage of the overall stake is actually curating. Then there is also the natural inflation coded into the blockchain that will actually go down over time. In my opinion, the best place to find the current curation reward return is to go to https://hivestats.io/ and check the curation rewards for several accounts. I did that and the average curation rewards at the moment is between 8.3 and 8.6%. This percentage can fluctuate for several reasons (power ups, power downs, not used voting mana,...).

How much APR can you get on your Hive stake?

To calculate the return that you can get on your Hive power you need to take the sum of your staking rewards and your curation rewards:

3% + 8.5% = 11.5%

As of today, the return that you can expect of your hive power is 11.5%.

Comparing it with CTPSB

During the last year, holding the CTPSB token allowed you to earn 17.4%, which is about 6% higher than what you could get by holding Hive Power directly. It's probably not totally correct to compare these two numbers because they are differed time wise. I would say that the APR of CTPSB is around 16% at the moment, which is still about 4.5% higher than holding Hive Power.

The disadvantages of holding CTPSB

- Tokens on hive-engine always hold an additional risk linked to the platform and the issuer of the token. While Hive Power is native of the blockchain, CTPSB is not and there is a risk linked to that and it shouldn't be underestimated. It's the same risk than with all the other hive-engine tokens.

- When you hold CTPSB, you can't use the voting power on content that you appreciate.

The advantages of holding CTPSB

- The great thing with holding CTPSB is that you get a higher return than with hive power and also you can sell the token at any time without having to wait 13 weeks to power down your stake. There is of course a limited amount of buying order on the market but you can sell some of your tokens at any time.

- You don't need to think about curating yourself. CTPSB is using it's voting power on a proven curation trail that manually curates quality content.

How does CTPSB get a higher APR?

The CTPSB token is backed by the hive account @ctpsb and it's hive power. The account grows the same way as any other hive account with organic growth and curation rewards. In addition to that however, it has several other income sources that cumulate:

- 178 LENM tokens that generate daily mining rewards

- Author rewards

- Delegations to @ctpsb

- Burning mechanism that reduces the number of tokens in circulation

Thanks to the accumulation of these income sources, the account manages to grow at a faster pace than a normal hive account and thereby provides a higher APR.

Learn more about the CTP Swarm Booster:

Excellent !! Thanks for the information.

There is also another risk in having hive-engine tokens in general, is that if the token issuer goes dormant or decides to abandon/leave without compensating, the tokens value turns into pennies or useless. On the other hand, hive is integral part of the base blockchain.

No offence @achim03, on the darker side, What happens to CTPSB in your absense is also a question?

This is an important point. The keys were with a second person when it was linked with CTP. Since then, I run it alone and I'm working on a solution for to make sure that somebody else also has the keys in case something happens to me.

(Never invest a quantity of money into a project, where loosing that quantity, is a greater loss than the "absence" of the founder. In other words, factor in this possibility as a risk.)

Investing heavily on 2nd layer makes me a bit nervous. About 22% of my entire HIVE investment is 2nd layer. !BBH

There are some ways to protect against some part of the risk from the project side. One is to make sure that other people have access to the keys of the accounts in case. Another is to have diesel pools that actually manage the market by themselves.

It's great to see that CTPSB is doing well and that you are giving people all the information upfront. I agree that most HE tokens are risky.

I think people need to be aware that holding hive-engine tokens is much more dangerous than holding hive or HBD. There is a risk linked to the HE platform that could stop working and then there is a big risk linked to the person running the token, in many different ways.

Thanks for the info.

!WINE

!BBH

You are welcome!

@ctpsb! @ironshield likes your content! so I just sent 1 BBH to your account on behalf of @ironshield. (29/100)

(html comment removed: )

)

@ctpsb! @edgerik likes your content! so I just sent 1 BBH to your account on behalf of @edgerik. (9/50)

(html comment removed: )

)