Supply Side Economics is a failure

I currently despise the Republican Party, think the Democrats are pandering idiots and just roll my eyes at the pie in the sky Libertarians. I am a fiscal conservative but I am socially liberal. What that means for me is there is no politician that holds my views in the government and can represent me, So every election I am forced to hold my nose and vote for the least offensive candidate.

The reason why I posting this now is that President Trump just hit on a hot button issue for me, proposing a Tax Break. Every time I hear those words, especially from a Republican my blood boils in anger. You see, most tax breaks follow the failed and stupid policy of Trickle-Down Economics which also can be called supply side economics. Republicans are especially prone to this because they revere Ronald Reagan and his flagship economic policy of Reaganomics which was nothing more than a rebadged Trickle-Down policy.

Trickle-Down Economics is a complete and utter failure! It will always be a failure no matter how many times it is tried and while I doubt most politicians understand why that is, you better believe the people that lobby for this policy knows exactly why it is a failure. The reason why is literally capitalism itself!!

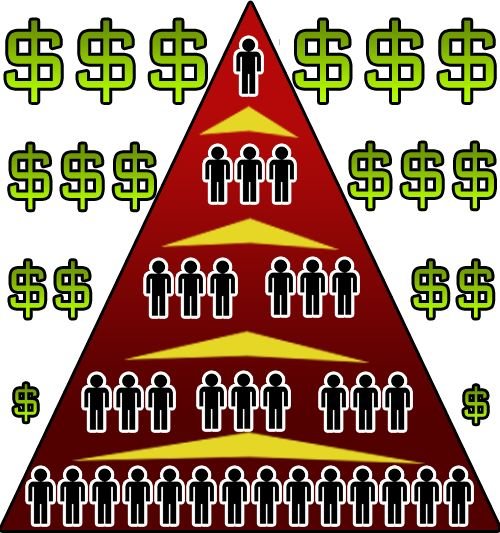

Do you know what shape a regulation free capitalistic market forms? Here is a picture of it:

Capitalism forms a Pyramid

That's right, it will resemble a pyramid. Capitalism is the most powerful and efficient economy ever created by man but that doesn't mean that it doesn't have serious flaws, it has 2 significant flaws in my eyes:

- In this case the main flaw that makes Trickle-Down a failure is this: Money Flows Upwards

Ideally, the flow of money should form a perfect cycle, the money flows up towards the wealthy and the same amount flows down towards the blue-collar/white-collar workers. That doesn't happen though, the money flows upwards just fine but a smaller amount will flow down. The reason for this is the wealthy are able to keep more of it, the same amount of money is generated each time but the wealthy are able to keep more of it and use it to increase their wealth.

Who will save more? The person who makes $1000 but $900 is spent on living expenses or the one who makes $10,000 but $9,000 is spent on living expenses.

Of course, this flaw of is also part of its greatest strength, that every person has the potential to reach the top and become one of the wealthy. Good governments regulate capitalism to prevent excess abuse while allowing enough liquidity to allow upward movement.

Trickle-Down Economics assumes that somehow giving tax breaks to the wealthy and the money the wealthy saves will then trickle down to the blue-collar worker and thus creating an impetus for increased economic activity. In other words, most of the money will stick to the top with very little of it reaching the middle or bottom.

1929 and 2008 Common Denominators.

*Do you know what the most popular economic theory leading up to the 1929 Great Depression was? Trickle-Down Theory.

*Do you know what was used by Reagan and used by Bush II leading up to 2008? Trickle-Down Theory.

*Did you know that the first mention of Trickle-Down Theory was in 1896, 33 years later after years of using this theory, the Great Depression happened.

*1981 is when Reaganomics started being used and 27 years later the 2008 Financial Crisis happened.

Very interesting, right? Do you also think it's a coincidence that the wealth income gap was and still is the greatest it's been since the Great Depression?

This is the reason why I hate tax breaks, they are mostly aimed at the ones who have the most wealth and who don't need the tax break. Don't even get me started on the havoc it causes the government budget. Btw, for those wondering what I think the 2nd flaw of capitalism is won't have long to wait, my next story on steemit will be covering that flaw in detail and it is a very serious flaw.

The Agony Index(A measure of how long it took me to write this story) = 190 Minutes

I will certainly agree with you on the fact one needs to hold their nose while entering the voting booth. One fact, that you need to consider is that higher tax rates can slow down the growth of GDP. Obviously, we all like the economy to grow. The relationship between tax rates and GDP growth is very complicated. (It is not easy to estimate and it also depends on marginal rates.) (like everything else there are about 10 factors you need to consider before you get to one simple answer.) The thing is there is a long term effect and a short term effect. People are impatient and don't wait for the long term effect. I once did some modeling in a spreadsheet with what I felt were the best guesses based on a good set of data. The problem the politician had with supply side economics is it took 8 years to see the positive effect, and he was up for election in 4 years. Like saving for retirement, compounding takes time. The effect changes with the tax rates. (The reason it does not work as good now is that tax rates are lower than they were back in the 1980's) (1980 70-90% marginal tax rates; now 30-40%). Certainly, trying to sell long term growth in a short term instant gratification world is a harder sell.