Hello!

My name is Anton Dzyatkovskiy. I am the co-founder of Platinum, the world’s number one ICO and STO promotion company. If you plan an ICO campaign ou should definetely visit our site:

In fact, we want not only to make companies successful, but also to share our knowledge on crypto-economics with them. That’s why we created The University of Blockchain and Investing where you can get the most relevant knowledge on the market. Today The UBAI has already launched a unique ICO, which is going to solve the problem of student’s and employee’s data verification. Why people invest in cryptocurrencies? Test the UBAI courses and get the answer:

Objectives

By the end of this lesson, you will understand the following:

- The reasons why people invest in cryptocurrencies. The benefits, including diversification, negative correlation to other asset classes, etc.

- The demographics of cryptocurrency investors, their mindset, and particular characteristics.

- Some of the biggest individual and institutional investors in cryptocurrency.

- Better ways to successfully invest in cryptocurrencies, and pitfalls to avoid.

We will answer the following questions: Who are cryptocurrency investors? What drives people to invest in cryptocurrency? What are some distinct characteristics and specific analytical tendencies a cryptocurrency investor should have in order to thrive in this space?

Terminology

Over-Exposed: The state of taking on too much risk. For example, a cryptocurrency portfolio weighted too much towards low cap “moon shots” would be over exposed.

Chase Pump: The act of attempting to make profits by jumping on an asset that is currently enjoying a spike in price. An inadvisable investment decision that will often result in huge losses.

Day Trader: Someone making trades, taking profits and losses on a daily basis. The opposite of a long-term holder.

Swing Trader: Like a day trader, but trades are spaced out over multiple days or weeks

Scalping: The act of dipping in and out of a trade very quickly to realize extremely short-term gains. You make profits from very small and very short-term fluctuations and price movements.

HODL: “Hold on for Dear Life” A crypto investment technique (derived from and named by BTC investors) that parallels traditional long-term holding to let the value of your assets appreciate. This technique requires you to ignore monthly or quarterly dips in price.

Liquidity: Liquidity is the volume of the asset traded on the market in a specific period of time. Liquidity gives an investor the ability to buy or sell specific stakes without disadvantageously influencing the price.

Trading Pair: Most exchanges do not offer fiat-to-crypto trading pair trades; therefore, you will most often make crypto-to-crypto trades. The trading pair is what you use to buy your desired asset, e.g. BTC/ETH pair means you are paying BTC to purchase ETH.

Due Diligence: The process of doing your own research for an investment decision, to uncover and ascertain all relevant factors including, legal compliance, business plan, financial condition etc. and the potential gain or loss from this investment.

Flipping: The act of selling anything fast for a profit. E.g. A pre-sale ICO can be flipped and sold for twice the purchase price.

Exchange Traded Funds: A fund that tracks an underlying asset, has a lower expense ratio than managed mutual funds, and trades on an exchange like a stock. This fund may contain stocks, bonds, gold, other commodities or futures contracts. It will also hold the asset it tracks.

Exchange Traded Note: An unsecured debt note that is traded on exchanges and can be bought or sold at will.

Opportunity Cost: Represents the benefits an individual or business loses out on when choosing one option over another.

“Newbie” Investor: A novice investor who lacks the fundamental understanding of the underlying technology or the market.

“Gambler” or “Get Rich Quick” Investor: An investor who speculates without any research, trying to make as much money as possible as fast as possible.

High Yield Investment Plans (HYIP): A strategy or something similar that offers a tremendous rate of return without a clear explanation as to how this is achieved.

Introduction to the Investors

Notable Success Stories

Before we begin, let’s look back at some interesting items that once made headlines in the cryptocurrency investment space.

Remember the Winklevoss twins? How much did they make? How long did it take? Was it luck or strategy that made them bitcoin billionaires?

Have you heard of Erik Finmann? He is the Idaho teenager who turned a $1000 gift into $1,000,000 by investing in Bitcoin.

What about Zhao Changpeng? He is the mastermind behind Binance, the famous and immensely profitable cryptocurrency exchange.

1.1 Introduction to the Investors

1.1 Introduction to the Investors

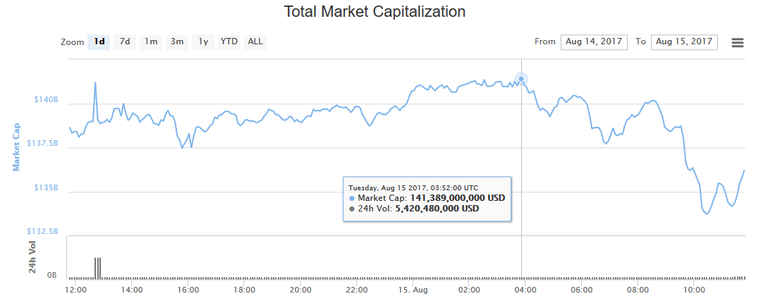

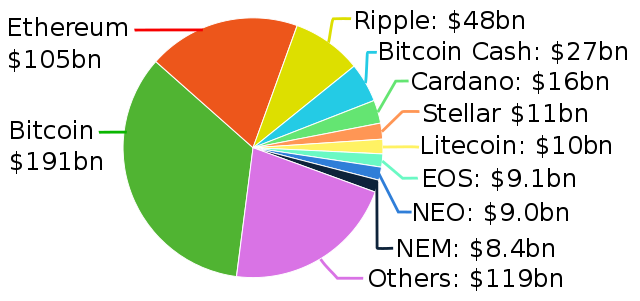

In 2017, the total cryptocurrency market capitalization was approaching $850B which begs the question:

Why are investors turning to cryptocurrencies?

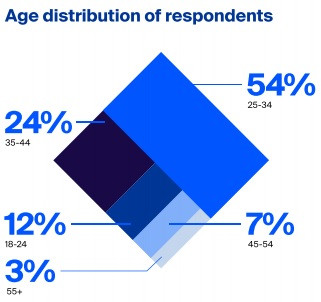

A survey by Blockchain Capital indicated that at least 30% of millennials would rather invest in bitcoin than invest in traditional stocks. Cryptocurrency investors, like traditional investors, expect a return at least proportionate to the risk they take. Due to the fundamental lack of regulation, incredible volatility and astronomical relative risk, many cryptocurrency investors expect to earn meteoric returns.

1.1 Introduction to the Investors

Returns in the ranges of multiples from 200% to 1000%.

Let us first begin by examining the kinds of people who invest in cryptocurrency, and then let’s see the reasons why each of them is investing in this relatively new market.

1.2 Types of Investors

The “Newbie” Cryptocurrency Investor

This investor is just starting out. They probably have not had any significant experience in any form of investing before and bitcoin is their first experience. They have heard about people making incredible returns from cryptocurrency investing, or some aspect of the entire blockchain and crypto revolution attracts them, and they decide they want to invest too.

Unfortunately, most of the newbie investors will end up losing their money, primarily because of one specific misconception; they think cryptocurrency investing is an easy way to make huge profits.

1.2 Types of Investors

This is the notion that all you need to do is buy some BTC today, and soon enough, there will be a tomorrow when you will be a millionaire! So, after a few losses, especially during a down market, like for much of 2018, these investors will cash out, discouraged and disillusioned.

Newbie investors are often ignorant of how cryptocurrencies and the blockchain actually work. Then, because they lack sufficient information, they can be easily discouraged, and will lack the perseverance they need to succeed. Many people come into the market with an immature or arrogant attitude, and a poor work ethic too. The best thing that can happen is the newbie discovers as quickly as possible that without learning the fundamentals of trading and studying the business of investing seriously, they are not likely to make reliable profits in the market.

“Gambler” or “Get Rich Quick” Investor

This is the second class of cryptocurrency investor, and is actually not really an investor at all.

This type of person is out to make a fortune as fast as possible. They will fall for whatever sweet-sounding scheme they hear. They love ideas that promise to double or triple their investment quickly. Like the Newbie, they do not understand how cryptocurrencies work, and they don’t care. The difference between this kind of investor and the successful individual or professional investor is that

the gambler does not care about the management of risk, or about the timing of trades.

They place their money on the table, and they hope it will make a good return. They are gambling rather than creating an investment thesis and executing a well-thought out strategy. They might even have an infectious positive attitude, but unfortunately it is not backed by knowledge or the due diligence required to be a successful investor.

A good example of this style of thinking, outside of cryptocurrency, is high yield investment plans (HYIPs) that promise to multiply an investors capital by a certain factor. This is not to say that all HYIP programs are scams, but a good number of them are. Most importantly, the investors who flock into such plans have similar characteristics to that of the Get Rich Quick investor in that they will not take the time to learn about the field in which they are investing. They are just looking for fast money and an overnight success.

You can find many of the Get Rich Quick investors, like their counterparts the Newbies, in many unauthenticated cryptocurrency groups on Facebook, Telegram, Discord etc.

Gambler or Get Rich Quick investors typically hope to make astronomical returns without a clear understanding of the risks involved. They will grow increasingly impatient and attempt to chase pumps or invest in dubious schemes. They are easily taken advantage of because they are not actually investors, but rather just gamblers or speculators.

Short Term Traders (Day/Swing Traders)

Short term traders must, without a doubt, be the most knowledgeable investors if they are going to succeed at their chosen profession. They have, or they should have, studied the art and science of trading more thoroughly than other people. This is the kind of investor who has taken the time to learn about cryptocurrencies and the markets on which they trade. Short term traders create deliberate and timed strategies in an attempt to profit from fast market movements. Maybe many of the short term traders started off as Newbies, but these are the individuals who took the time and effort to learn about the market. They wanted to know what they were doing. These are the people who survived and thrived to grow into the type of trader that they want to be.

Interestingly, the Day Trader does not attach emotion to any given coin.

They do not need to believe in the sustainability/whitepaper/vision/road map, etc. of the project they are buying into at any particular time. They just need to be confident about the direction and timing of the potential price movement of the coin.

Note that Day Traders make hourly or daily trades. Swing Traders make weekly or monthly trades. But they both operate on the same principle of benefiting from the extraordinary volatility of the cryptocurrency market. You will find that this kind of investor may have prior experience trading stocks on a traditional market, or perhaps a background in economics or finance.

Short term traders are calculated risk-takers who create, evaluate and execute specific timed strategies based upon underlying principles or third-party data sources. There are many types of strategies similar to those used in traditional investing too. If they are successful, short term traders will be patient, disciplined and have a keen understanding of the risk of their specific strategies and their position in a broader portfolio.

Long Term Investors/ Hodlers

A great majority of successful cryptocurrency investors can be most properly classified as Long Term Investors, or HODLers in true crypto terminology. These are investors who understand quite a bit about cryptocurrency and blockchain technology and believe in the sustainability of the coins in which they are investing.

Think of the first few investors who bought bitcoin in the early days and years, when it was still deep under the radar for most people. These are the people who believed in the blockchain and cryptocurrency revolution. They didn’t sell their bitcoin for fast profit, although they had many chances to do so. They knew what they were doing, holding for the long term. These early investors and HODLers enjoyed astronomical growth all the way up to 2016 and 2017. But to be a long-term holder despite all the bad news and negative factors surrounding this brand new asset class, they must have really believed that bitcoin and the blockchain were going to change the world. This belief can only be established through study and research about the blockchain industry and the specific currencies and tokens in which you are going to invest.

Long term Investors will take the time to critically analyze all aspects of a given cryptocurrency. Then, ideally, after they are convinced of the potential it has, they will buy at the appropriate price and time, and hodl until they reach their target price point. You will also find that a long-term investor in crypto typically has a broader portfolio with other assets and investment vehicles. A certain amount of capital is allocated for this kind of diversification into the crypto asset class.

Long term Investors can also be surprisingly knowledgeable about the specific token in which they are investing, as well as the broader blockchain industry. They are focused on business growth, and longer term movement of the market price, taken from a more holistic perspective. They must absolutely be disciplined, and also tend to be risk averse. This leads to a significant amount of risk management with a clear focus upon the longer term.

Sophisticated/Professional Investors

These are experts in cryptocurrency investing. They most likely have a background in other forms of trading and investing, such as in stocks, bonds or options etc. They may also be earning fees by investing or managing money for other people.

The Iconomi fund managers are a good example. Each Fund Manager manages an array of digital assets. Investors might choose Iconomi because it offers a platform for the investor to allocate funds to specific fund managers, with the ability to swap between managers instantly if the investor desires to do so.

Each fund manager selects a number of coins in which they wish to trade or invest, with specified time horizons, short or long term. Investors can buy into the array of mutually held coins. This allows investors to utilize the knowledge and experience of professional fund managers to trade an allocated pool of capital, hopefully generating returns greater than the individual investor would be able to produce on his own.

The fund managers are motivated by the fees and commissions they earn, and perhaps a performance-linked bonus. You can certainly be properly classified as a Sophisticated Investor without any need to be a fund manager for other peoples’ money. But a professional fund manager has the ability to trade with a larger pool of capital, manage complicated risk, and diversify trading strategy to generate various streams of income.

You can get the most comprehensive information on the topic after buying the full course! Contact me via Facebook, Telegram, and LinkedIn to know more about Platinum and UBAI services:

SKYPE: AntonD.Merlion

LINE: Anton.Dziatkovskii

WECHAT: antondz

TELEGRAM: @antondz

FB: m.me/AntonDziatkovskii

WHATSAPP: +79685331499

Congratulations @ubai! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!