Today marks the third anniversary of 2030 Agenda when all 193 UN member states adopted the 2030 Agenda setting up 17 Sustainable Development Goals (SDGs) aimed at transforming our world. On the occasion UN Secretary-General Antonio Guterres chaired a high-level meeting on financing the 2030 Agenda, and proposed urgent action to achieve three objectives::

- building momentum and political support at all levels;

- stepping up engagement with the private sector, and;

- making the most of innovative solutions to finance the SDGs.

In his tweet UN Secretary General clearly indicated an urgent need for “a surge in investment.”

With SDGs already facing a $2.5 Trillion annual funding gap, the 3-year cumulative funding deficit has already hit $7.5 Trillion.

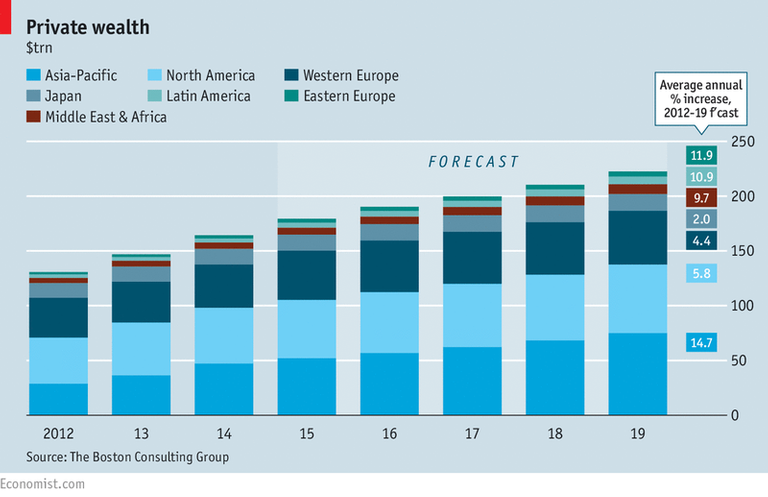

Each passing day is making the SDGs impossible to be achieved. The tragedy is, despite SDGs, in itself, being a $12 Trillion impact investment opportunity for private sector, much of it remains unexploited especially when global private wealth is projected to grow to $210 Trillion by next year.

The Secretary General announced “a Task Force on the Digital Financing of the Sustainable Development Goals.” Will that be enough, or we indeed need some radical thinking for mobilizing the trillions that SDGs need?

AGROW targets SDG1 and SDG2 goals

We support SDGs

At this rate the 2030 Agenda funding gap will keep on increasing making sustainable development goals impossible to achieve by 2030

The Sustainable Development Goals cannot be achieved unless massive and immediate impact investing happens from private sector. Thanks for bringing attention to the problems SDGs are facing.

We are fully committed to the SDGs and are offering new innovative approach to fund SDGs.

click here!

click here!This post received a 48% upvote from @krwhale thanks to @rahemanali! For more information, 이 글은 @rahemanali님의 소중한 스팀/스팀달러를 지원 받아 48% 보팅 후 작성한 글입니다. 이 글에 대한 자세한 정보를 원하시면,

We are setting up an initiative to bring together all those dealing with the SDGs on Steem. WOuld be great to have you with us.