USDC has been one of the stablecoins, (a dollar pegged tokens), that has tried to grow and build a reputation as the safest and the most legit out there. It wants to be a legitimate competitor to Tether USDT, but it is US based and in compliance with all the regulations, unlike Tether that is an offshore company and not subject to US regulations.

But even with all its regulation and compliance USDC had a real market test back in March 2023, when due to a bank failure it lost its peg for one weekend. Before this event, USDC was considered by most the safest stabelcoin to park your dollars. In 2024 there seems to be some positive numbers again.

Let’s take a look at the growth of USDC through some data.

USDC is issued by Circle. It is a US-based company that is regulated and has regular audits on its holdings.

Here we will be looking at:

- Daily USDC printed

- Monthly USDC printed

- USDC supply

- Number of daily users

- USDC chain allocation

- USDC VS USDT

The data is collected from tools like Coingecko and Dune analytics.

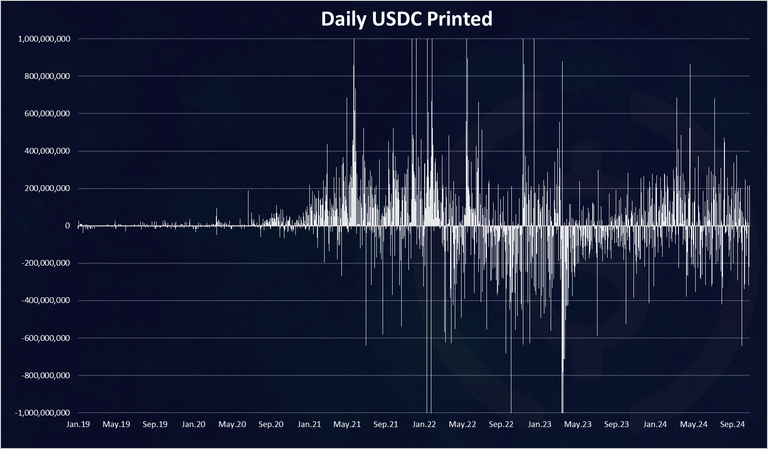

Daily USDC Printed

USDC started at the end of 2018, but here we have data from 2019, for simplicity, and because there is not much movement in 2018.

Here is the chart for the USDC printed per day.

As we can see in the first years there was not a lot of printing for USDC. The larger amounts started to come in 2020 and increased significantly in 2021.

At times there were more than one billion USDC issued per day.

We can notice the sharp burns that happened in March – April 2023 when the deppeging event happened.

2024 seems to be a mixed bag with a higher numbers in the first half and some lows in the second half.

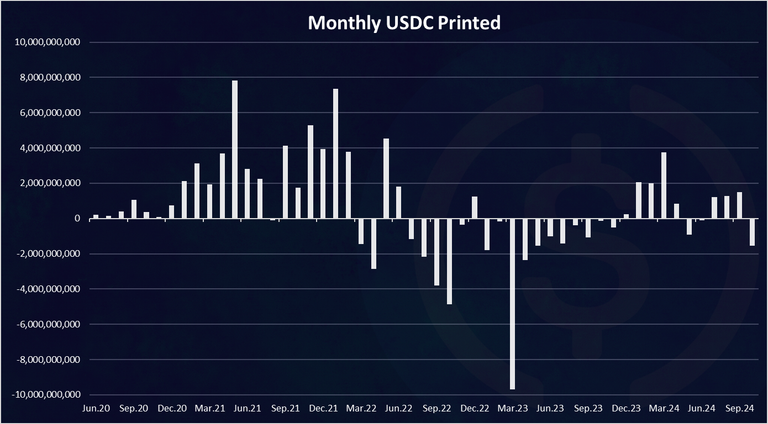

Monthly USDC Printed

Here is the monthly chart for better visibility.

We can see that up to 2022, there was in general more USDC monthly printed, and then in 2022 the trend shifted with almost every month being in the negative.

A massive negative bar in March 2023, when almost 10B USDC was taken out of circulation. This was during the deppeging event.

In the first months of 2024 USDC experienced growth with March being close to 4B more USDC added to the supply. Then a few months with negative numbers, positive again, and October is down again.

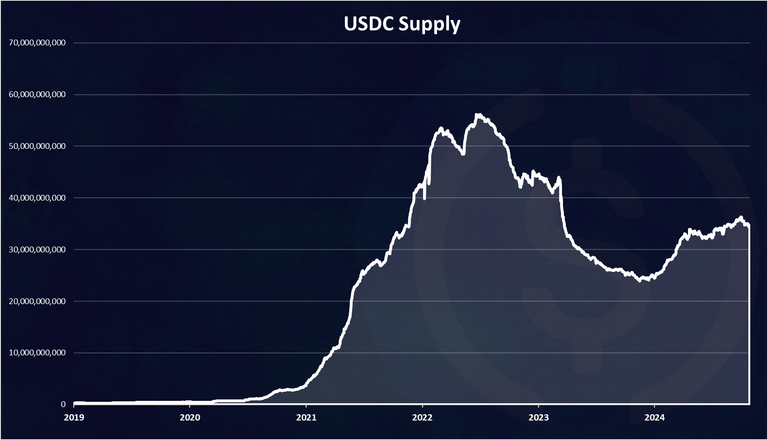

USDC Supply

The chart for the USDC supply looks like this.

We can see that prior to 2020, the marketcap of USDC was negligible, with under 1B in supply. Then a huge increase in 2021 when there almost 40B USDC added to the supply.

The peak for the USDC market cap was in June 2022, with around 55B in market cap. At this time Tether was experiencing FUD, and a lot of the stablecoins were transferred to USDC.

Since the summer of 2022, the supply of USDC has went down, with a massive drop in March 2023 . In 2024 it increased again and has been somewhat sidewise in the last months. Still less then its ATH back in 2022.

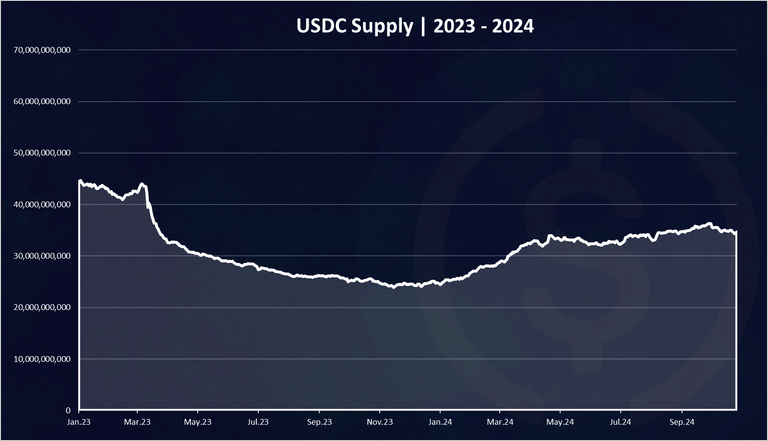

If we zoom in, we have this.

Here again we can see the overall downtrend for USDC in 2023 and a reversal at the end of the year. In 20224 the supply kept growing in the first half and then slowed a bit. At the moment the market cap for USDC is at 35 billions.

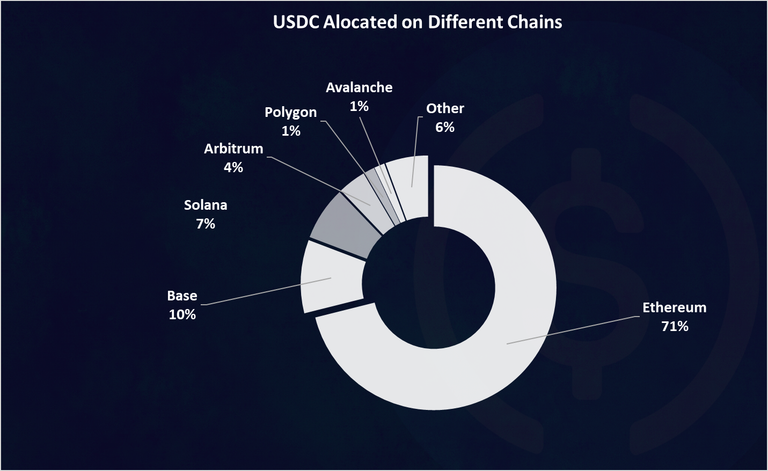

USDC Allocation on Different Chains

USDC is centrally issued but can live on multiple chains. Here is the chart.

Obviously, the big share of USDC remains on Ethereum with 71% share. Yet in the past it was even higher, meaning the other chains have increased USDC liquidity in the last months.

Base is surprisingly on the second spot with 10% share, followed by Solana with 7%.

In the past Arbitrum and Polygon were leading before Solana, but now they have dropped in the rankings, especially Polygon.

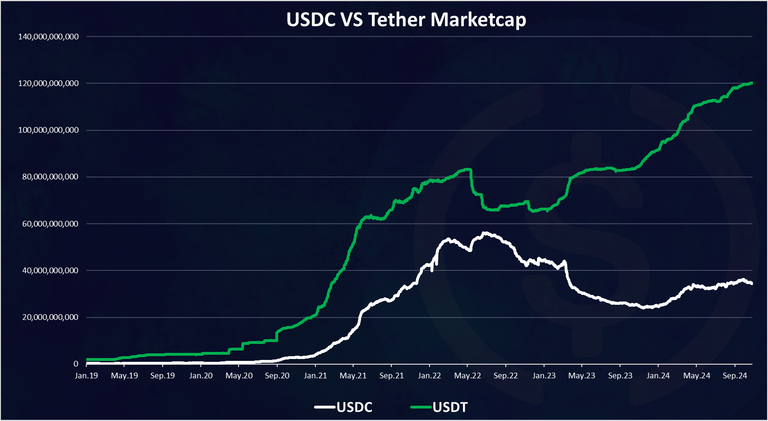

USDC VS USDT

How is USDC doing against the number one stablecoin Tether? Tether was founded three years before USDC, so it has some head start. Is USDC managing to catch up?

Here is the chart.

At first these two were both growing on a similar pace in the bull market of 2020 and 2021. The in 2022 when the bear market kicked in the correlation between the two became almost negative, when one was growing, the other was falling.

Tether came out as the stronger from the bear market can consolidated its number one position even further. In the last few months for the first time since years both of the tokens increased in market cap, with Tether growing even faster, reaching new ATH.

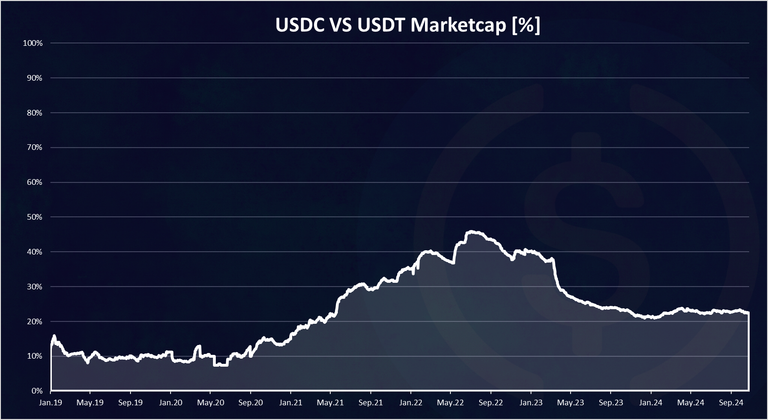

In relative terms % the chart looks like this:

The USDC market share against Tether has been growing up until the summer of 2022, when it reached a 45% of the USDT and USDC marketcap (56B to 66B), and it was looking that at some point USDC will flip Tether, but then it lost momentum and started losing market share. It dropped to 20% a few months back, and has slightly increased in the last months to 22% where it stands now. In the last year it has been in the range of 20% to 25%.

All the best

@dalz

Hmmm. Would be interesting to see stats about stablecoin PayPal USD.