It has been nearly three weeks since my last analysis of the @steemit account power down. There have now been four releases of 5.5m Steem Power(SP) out of the total of thirteen potential payments, reducing the @steemit account holding from 71.5m SP to 49.5m SP. However it was not until 7 February that we had the next set of significant movements of the released SP allowing further insight into how the power down is to progress.

In this study:

- I examine the 2nd and 3rd instalments of the @steemit account power down through analysis of the related transfers, power ups, and delegations with the aim of illustrating where the money released has flowed to;

- I compare the recent movements of capital to those of the 1st instalment analysed in my previous study on 22 January 2018; and

- I then draw interpretations to determine whether this recent power down is likely to be a positive or a negative event for the Steem blockchain.

0 Summary of Findings

I start by presenting a high level summary of findings for readers who have limited available time. The full details of the analysis are included in the later sections of this article.

0.1 2nd and 3rd Power Down Installments

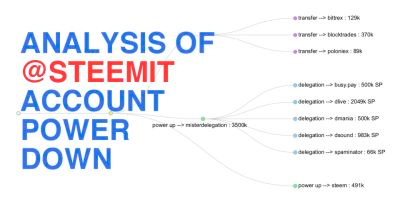

This first diagram charts the flow of money from the @steemit account from 22 January 2018 to 9 February 2018 (i.e. the period from my last study until yesterday):

- All amounts shown are in thousands of Steem (so 3000k is 3 million Steem).

- Internal transfers are yellow, power-ups green, delegations blue and transfers to exchanges purple.

The @steemit account is powering down a 71.5m holding of Steem Power. The first instalment of 5.5m was released on 16 January and three further releases have been made on a weekly basis, with the latest made on 9 February.

The @steemit account SP holding has thus been reduced by 22.0m SP to 49.5m SP. The latest release of 5.5m SP is currently held as Liquid Steem in the @steemit account, presumably awaiting distribution. The flows in the above diagram broadly relate to the second and third instalments of the power down, a total of 11.0m SP.

We can see four main flows from the @steemit account.

(doubling their delegation to 2m SP)(1m SP)(an increase of 0.5m SP to 1.5m SP).6.0m of the 11.0m was powered up into Steem Power for the @misterdelegation account. This account has then made some very significant delegations to two of the teams developing applications on the Steem blockchain: An additional 1m of delegation to @dtube and a first delegation of 0.5m SP to @zappl. Significant delegations have also been made to @spaminator and @steemcleaners These two accounts lead the fight against spam and plagiarism on the blockchain. Approximately 3m SP remains undelegated in the @misterdelegation account.

2m of the 11m was powered up into Steem Power for the account @steem which provides the delegation necessary to give new accounts power and bandwidth.

(via account @steemit2)600k of the 11m was passed to account @alpha . The Steem passed to @alpha appears to be slowly finding its way to the exchanges @bittrex, @poloniex and @blocktrades.

(the remainder was passed to @alpha).Out of 3m originally transferred to the @steemit2 account, 2.4m was retained in Liquid Steem holdings Small amounts of this Steem have been transferred to what look like development accounts, as well as 50k to the @steem account.

(It should be noted that the above analysis only shows the direction and amounts of flows on money. Since the @steemit2 account and @misterdelegation accounts already possessed smaller, yet significant, holding of Steem, it is not possible to conclude exactly which Steem were passed and which were retained by the accounts).

0.2 1st Power Down Installment

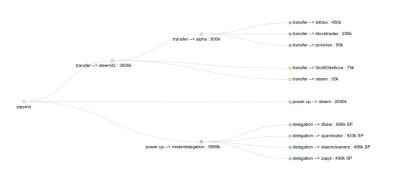

(i.e. the period for my first investigation) corresponding to the fund movements from the first power down instalment.This second diagram charts the flow of money from the @steemit account from 9 January 2018 to 21 January 2018

The overall pattern of capital flows is very similar:

- Delegation to platform operators and blockchain cleaners through @misterdelegation: 3.5m from Installment 1 vs 6.0m from Installments 2 and 3

- Powering up to the @steem account for new accounts: 0.5m from Installment 1 vs 2.0m from Installments 2 and 3

- Transfer out to exchanges through @alpha: 1.0m from Installment 1 vs 0.6m from Installments 2 and 3

0.3 Conclusions

Delegations: 60% of power down funds

The delegations made as part of the first instalment release, from @misterdelegation to dlive, dmania, and dsound, have seen a surge of growth in these platforms over January 2018. Previous delegations made to Utopian at the start of November and to DTube at the start of December have also been useful in helping to promote these platforms, both of which are now becoming very significant assets for the steem blockchain. The new delegation to zappl and the increase in the DTube delegation should bring additional growth to these two platforms and further enhance the overall Steem content creation and social network offering.

Delegating Steem Power to these alternative blockchain applications also results in significant payouts to the content creators operating on the platforms. In addition to attracting new users, this should also result in Steem Power being spread down to users at lower power levels and in particular to those users producing quality content.

(does not include comments) in November 2017 to 2% of all posts in January 2018. As the work of these accounts largely involves flagging (downvoting) these delegations should return rewards to the reward pool, increasing rewards for valid contributors.The delegations to @steemcleaners and @spaminator should have a positive effect in reducing network spam and plagiarism. Recent efforts have reduced the level of automated posts from nearly 20% of all posts

New users: 15% of power down funds

The use of funds to support the @steem account and the on-boarding of new accounts also seems a necessity and a positive impact for the growing blockchain.

Transfers to exchanges: 10% of power down funds

As noted in my previous study, the use to which these funds will be put is unclear. Without greater knowledge of the use of these funds any conclusion drawn here is in the realm of speculation.

Overall the pattern of use for the second and third power down instalments is similar to that of the first. It would (still) be interesting to understand how the other power down releases are to be used if the power down is to continue since I am still of the view that the above approach does not scale.

Outline

- 0 Summary of Findings and Conclusions (see above)

- 0.1 2nd and 3rd Power Down Installments

- 0.2 1st Power Down Installment

- 0.3 Conclusions

- 1 Scope of Analysis

- 2 Tools Used

- 3 Scripts

1 Scope of Analysis

The analysis is based on the data for the @steemit account and other accounts that have received a flow of money from the recent power down instalments. The data has been obtained through SQL queries of SteemSQL, a publicly available Microsoft SQL database built and maintained by @arcange, containing all the Steem blockchain data.

Data on transfers and power ups was taken from the TxTransfers table. Data on delegations was obtained from the TxDelegateVestingShares table.

The data has been separated from the overall Steem blockchain data by use of an iterative process through which each recipient of funds was added to a list of accounts to be queried. This process continued until the terminal point for each flow was reached.

The first part of the analysis includes data on transfers, power ups and delegations from 22 January 2018 to 9 February 2018. The second is from 9 January to 21 January 2018. The data has been filtered by date using the timestamps in the respective tables.

2 Tools Used

Valentina Studio, a free data management tool, was used to run the SQL queries. The raw data was then verified and analysed in the spreadsheet application of the LibreOffice office suite.

Graphs and charts were produced using RAWGraphs, an open source data visualisation framework, with colours added in GIMP.

SQL scripts are included at the end of this analysis.

3 Scripts

This was the script used to extract the transfers and power ups for the first two parts of the analysis.

The list of account names was determined by use of an iterative process through which each recipient of funds was added to a list of accounts to be queried. This process continued until the terminal point for each flow was reached. Not all of the accounts in the iterative list make it into the final summary.

SELECT

TxTransfers.id,

TxTransfers.type,

TxTransfers.[FROM],

TxTransfers.[TO],

max(Convert(decimal(20,3), TxTransfers.amount)) as [Amount],

TxTransfers.amount_symbol,

TxTransfers.memo,

TxTransfers.timestamp,

max(Convert(date, TxTransfers.timestamp)) as [Date],

max(Convert(date, TxTransfers.timestamp)) as [Time]

FROM

TxTransfers (NOLOCK)

WHERE

TxTransfers.[FROM] IN

( *iterative list of accounts*

) AND

Convert(date, TxTransfers.timestamp) >= '2017-11-01'

GROUP BY

TxTransfers.id,

TxTransfers.type,

TxTransfers.[FROM],

TxTransfers.[TO],

TxTransfers.amount_symbol,

TxTransfers.memo,

TxTransfers.timestamp

ORDER BY

TxTransfers.timestamp

A similar but simpler simpler script was used to obtain the delegations. The query used the same WHERE clause as the query above and referenced the TxDelegateVestingShares table rather than the TxTransfers table. No grouping or ordering was necessary in this second query.

That's all for today. Thanks for reading!

Posted on Utopian.io - Rewarding Open Source Contributors

.

Hey @crokkon, I just gave you a tip for your hard work on moderation. Upvote this comment to support the utopian moderators and increase your future rewards!

As a noob it’s not all clear but as I read more my knowledge is powering up to a level I feel more confident with.

It takes a little time but that's the right approach. Read everything you can then work out where you can best make a difference!

Hey @miniature-tiger I am @utopian-io. I have just upvoted you!

Achievements

Community-Driven Witness!

I am the first and only Steem Community-Driven Witness. Participate on Discord. Lets GROW TOGETHER!

Up-vote this comment to grow my power and help Open Source contributions like this one. Want to chat? Join me on Discord https://discord.gg/Pc8HG9x

Post very good