1. sell 70% positions.

All diagrams went bad, keep away and see what will happen.

News Today

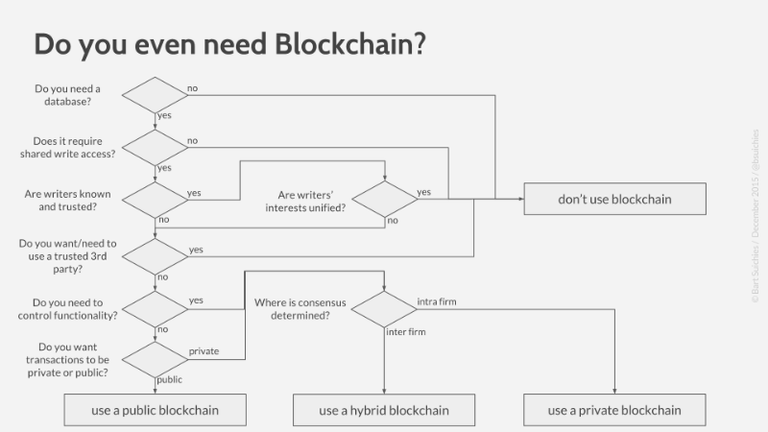

Opinion: Do We Really Need Cryptcurrency?

Interesting article here:

link

How Ripple (XRP) Will Surely Respond To The Launch of SBI Virtual Currencies Exchange

Ripple (XRP) and the SBI Holdings Group have enjoyed a fruitful partnership for over 2 years now. What has resulted in the partnership is the formation of SBI Ripple Asia that has spearheaded the adoption of Ripple technologies in the region as well as innovation in the industry of fintech. So far, Ripple has access to over 61 banks in the consortium that makes up SBI Holdings.

It is, therefore, no surprise that the SBI Group wants to release a cryptocurrency exchange that plans to utilize XRP as the centerpiece for trading on the platform. The exchange, known as SBI Virtual Currencies, has updated its website and is now live for trading for users who had pre-registered back in October 2017. One thing to note is that XRP is the only cryptocurrency on the site that has been described in terms of what it is and its capabilities. The exchange will alter add Bitcoin Cash (BCH) as the second traded digital asset on the platform.

This means that the CEO and President of SBI Holdings, Yoshitaka Kitao, was serious when he said that once the exchange is ready, it will feature primarily XRP and the exchange will eventually be number one. The exchange had been scheduled for launch this summer and the XRP HODLers and the entire crypto-verse is applauding and excited with the launch today, June 4th.

One thing to remember is that the country of Japan is home to over 3.5 Million crypto traders and HODLers. These traders are between the ages of 20 and 40. This will be the target demographic of the new crypto exchange by the SBI Holdings Group.

With respect to the cryptocurrency markets, they are still showing some upward mobility in terms of gains since the entire market came to its knees on Tuesday, the 29th of May. On this date, the total market capitalization of the crypto markets came to a recent low of $303 Billion and Bitcoin (BTC) was trading at $7,100 levels. The crypto markets have since regained $40 Billion at the moment of writing this and the total market capitalization stands at $345 Billion.

Will Ethereum (ETH) Survive the TRON and EOS MainNet Onslaught?

How will Ethereum (ETH) still thrive amongst the competition?

To begin with, Ethereum (ETH) is time-tested and has weathered the storm that was security vulnerabilities discovered earlier on in the year as well as the constant FUD with respect to low transactions per second. Yes, the ETH network does get congested due to DApps about animals and kitties, but there is no other stable platform out there that have been tested such as Ethereum. Also to note is the current conversation of introducing sharding on the ETH network. When this concept materializes, ETH will obliterate any competition.

EOS on the other hand recently had a very serious security issue right before the MainNet launch that left many speculating if the MainNet would launch. What was found on the EOS platform, was a vulnerability where a malicious hacker would create and execute a smart contract that would technically hijack the nodes to cause a full-blown cyber attack on other crypto networks. This issue has since been resolved but questions still linger.

When we analyze the current Tron project, the foundation has implemented a $10 Million Bug Bounty program to any developer or team of developers that can find any security vulnerabilities before the 24th of June this year. Also to note is the presence of a Tron hackathon in the Tron Project Genesis calendar to further test the Odyssey MainNet for vulnerabilities. This means the MainNet still has a long way to go in terms of gaining trust from DApp developers and showing network stability.

With respect to market dominance, Ethereum (ETH) is firmly in the number 2 position behind Bitcoin (BTC) and according to market capitalization. As a matter of fact, many Crypto analysts have predicted that ETH will flippen Bitcoin before the end of the year. This means that even crypto-traders still find favor with ETH when it comes to the crypto-markets.

In summary, both TRON and EOS MainNet platforms are a welcome addition to the crypto-verse platform arena. However, they have a long way to go for them to be considered as potential Ethereum Killers with respect to being platforms of choice and general popularity. ETH is also eons ahead when you consider its market presence with respect to both TRX and EOS.

Coinbase Announces Japanese Expansion Plans

Will Coinbase List Ripple (XRP)?

By entering the Japanese market, Coinbase has once again stoked the flames of the Ripple (XRP) listing debacle. There has been a long-running debate on whether coin base would add Ripple to its catalog of supported cryptos. XRP is reportedly the most popular digital token in Japan. Thus, the company might see itself coming under increased pressure to list Ripple tokens.

Japan has emerged as a crypto-friendly nation especially after the negative policies of countries like China and South Korea in 2017. The country is considered to be the center of cryptocurrency commerce in the Asian theater with numerous licensed exchange platforms. However, in the aftermath of the $550 million Coincheck hack in January, the FSA has taken a more hands-on approach to cryptocurrency monitoring and regulations.

Crypto Point-of-Sale Devices Begin Roll-Out in Indonesia Despite Ban

A network of cryptocurrency enabled Point-of-Sale (POS) payment devices has begun to spread in Indonesia, despite the ban by the central bank. Pundi X is laying the groundwork for Indonesian merchants to accept cryptocurrencies immediately after the rules are changed.

The Ripple (XRP) Powered Santander App Is Amazingly FAST

Youtube Video

The team at Ripple (XRP) have provided a video demonstration of a live transaction on the Santander OnePayFX app. In the video shown by the Ripple team, we see the user having an easy time navigating through the payment options between the USD and the Euro. The user then proceeds to select the recipient of the payment who happens to be in the United States. The sender is in the U.K who then proceeds in selecting ApplePay’s platform to complete the payment. He selects his Santander Debit card and the transaction is then complete at the touch of a button and in a few seconds.

HitBTC Temporarily Suspends Services in Japan During Licensing Process

Ripple announces initiative partnering with universities called UBRI

Analyse: Nowadays we have so many ripples news.

IOTA Releases The Long-Anticipated Trinity Wallet Mobile Beta

Now even your crack smoking grandmother can enjoy the benefits of zero fees for her purchases.

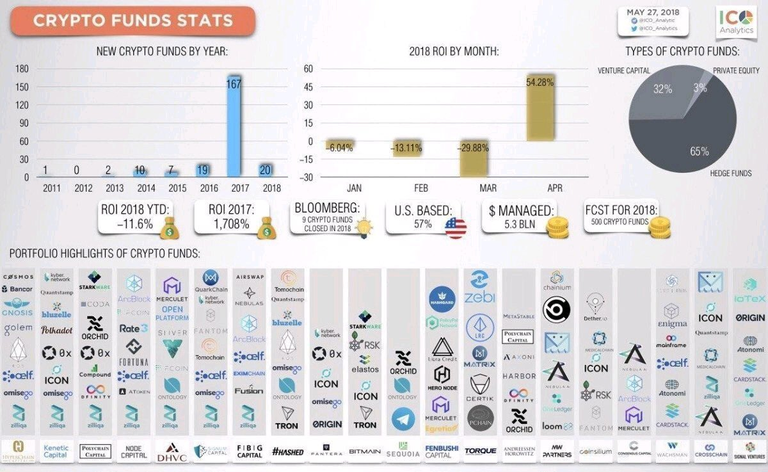

Cryptocurrency Hedge Funds Invest in Zilliqa, Aelf, ICON, and 0x

Whenever a new cryptocurrency hedge fund emerges, it seems to garner a lot of attention fairly quickly. There is a good reason for that, as cryptocurrencies are still extremely appealing to consumers. Investors prefer to be exposed to volatility through hedge funds, rather than buy their own coins from exchanges or ATMs.

At the same time, one has to wonder what these cryptocurrency hedge funds are really investing in. Unlike what most people might expect, there aren’t too many companies which actually hold Bitcoin or Ethereum at this stage. That is according to an infographic shared with us via email. Instead, we see some other interesting projects listed, even though there are not many actual cryptocurrencies on this list.

Google’s Crypto Advertising Ban is Self-serving and Unethical

Ed Cooper, head of mobile at digital banking startup Revolut, told The Independent,

“Unfortunately, the fact that this ban is a blanket ban will mean that legitimate cryptocurrency businesses which provide valuable services to users will be unfairly caught in the crossfire,”

Others go beyond questioning the outcome of the ban to look at the possible self-serving reasons behind the ban as each of the tech companies has announced plans of their own cryptocurrency and blockchain ambitions. Phillip Nunn, CEO of Manchester-based investment firm Blackmore Group, told The Independent that despite the pressure from users, both Google and Facebook continue to run ads from gambling and other potentially unethical sites. He continued,

“I suspect the ban has been implemented to fit in with potential plans to introduce their own cryptocurrency to the market in the near future and therefore removing other crypto adverts allows them to do it on their own terms.”