Via Charles Hugh-Smith:

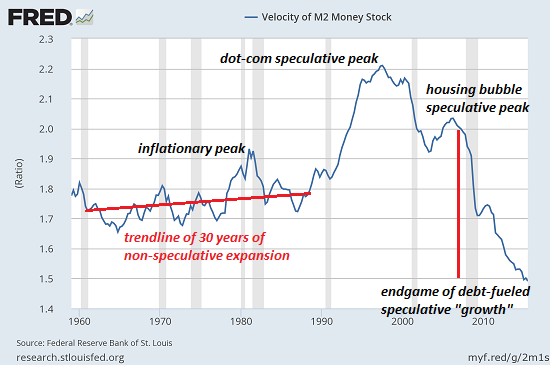

"Velocity is an indicator that buyers and sellers agree on a price, that the price is "right" and not an outlier. That's why you see a stock move on high volume "confirming" the move, because it means the prices wasn't "right" at the previous level, while more people agree the new price is fair.

If prices are allowed to go where they need to without pressure and manipulation, you will always have velocity, as the most buyers and sellers will always agree at some price. Because this is true, low velocity cannot happen in a free market. Which means the only reason for low velocity (in this or the previous Depressions) is that someone has somehow managed to get an edge that prevents them from selling, from liquidating, at the true price, i.e. the one the buyers will agree to.

This has another corollary, that the measure of velocity on the Fed's own chart is the measure of the level of unnatural price manipulation on the market. We can watch this aggregate indicator of their failure in real time, by the Fed's own hand, and we can know the manipulation is ending when it rises.

So yes, the Fed, the governments, the insiders can manipulate to their heart's content, as they've been doing, but that unnatural pressure goes somewhere. And the pressure diverts into velocity. As we saw in the Great Depression, or the Roman Empire, velocity can stagnate for 10, 20, or 1,000 years until the manipulation ends, property rights are restored, and we have a free market.

History has shown that may be a bargain they're willing to make, but it won't do the rest of us a lot of good."

More:

http://charleshughsmith.blogspot.de/2015/12/money-velocity-is-crashing-heres-why.html

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.washingtonsblog.com/2015/12/money-velocity-crashing-heres.html