NEW NOTICE OF CASH IN VENEZUELA:

The puppets that are in the Venezuelan monetary cone seem to be the most hated, but at the same time "they are the most desired". Although in some businesses they simply refuse to accept cash, as in the case of the Bs. 100 bill, there are others that demand buyers only cash. Well this will be used for business "redonditos".

The puppets that are in the Venezuelan monetary cone seem to be the most hated, but at the same time "they are the most desired". Although in some businesses they simply refuse to accept cash, as in the case of the Bs. 100 bill, there are others that demand buyers only cash. Well this will be used for business "redonditos".

Venezuela Daily Update

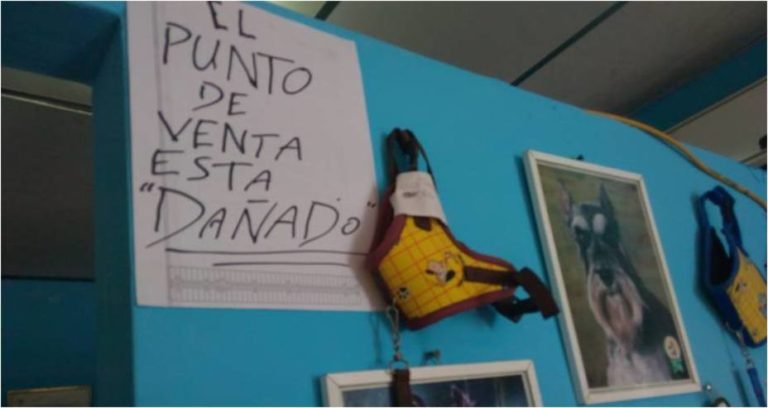

In Maracaibo, specifically in the market of Las Pulgas, merchants begin to let out that there are no points of sale and demand only cash "because they even allow transfers". It turns out that these, like those who dominate the public transport routes, maintain a fairly large cash business.

Ticket they receive, a ticket that passes into the hands of wholesale intermediaries and currency traders, buyers of pesos and dollars.

Carriers, specifically those that have collective units with 34 positions, generate over the week and with an average of 900 users per day, more than Bs. 5,000,000. That later an indeterminate percentage goes to the clandestine sale of money.

Carriers, specifically those that have collective units with 34 positions, generate over the week and with an average of 900 users per day, more than Bs. 5,000,000. That later an indeterminate percentage goes to the clandestine sale of money.

¿How does it work?

At the tables and tarantines located in Las Pulgas, the cash is counted in dispensing machines. "Only cash, it has to be that way because the wholesalers who bring Maicao products ask us to pay in bills. No cards or transfers, "criticized a merchant.

"THE WORST HAS NOT BEEN SEEN"! The hyperinflation in Venezuela, by @vnzla-libre

“To talk about inflation, an analogy with hepatitis can be useful, which is a disease that develops into four types A, B, C, and D. There is a type of low inflation that we can call type A, another moderate and chronic that we can denominate type B, in high levels and acceleration would be type C, and hyperinflation that we can well call D. In medicine, hepatitis A is usually combated by a rule or by the automatic reaction of the same immune system. The same happens in countries where annual inflation is less than one digit. In a way, central banks have a reaction function that makes them move the interest rate and the level of demand for goods and services automatically. When you get hepatitis D, the strongest drugs do not work and doctors can recommend a liver transplant, which in economic terms I associate with a coin transplant. That is why it is common to find in monetary hyperinflation events monetary reforms that in the end lead to the adoption of a new currency like the dollar. "

“To talk about inflation, an analogy with hepatitis can be useful, which is a disease that develops into four types A, B, C, and D. There is a type of low inflation that we can call type A, another moderate and chronic that we can denominate type B, in high levels and acceleration would be type C, and hyperinflation that we can well call D. In medicine, hepatitis A is usually combated by a rule or by the automatic reaction of the same immune system. The same happens in countries where annual inflation is less than one digit. In a way, central banks have a reaction function that makes them move the interest rate and the level of demand for goods and services automatically. When you get hepatitis D, the strongest drugs do not work and doctors can recommend a liver transplant, which in economic terms I associate with a coin transplant. That is why it is common to find in monetary hyperinflation events monetary reforms that in the end lead to the adoption of a new currency like the dollar. "

I believe that Venezuela is entering a hyperinflation process and the worst has not yet been seen. "The most popular metric is that of Phillip Cagan, who points out that the process starts when the rate is 50% per month. Since the Second World War, several episodes of hyperinflation have occurred especially in Latin America, in countries such as Bolivia, Peru, Argentina, Brazil, Uruguay and Nicaragua. The last big case of hyperinflation is Zimbabwe that started in March 2007 and ended in early 2009. "

Beyond the metric: what is the symptomatology of hyperinflation?

Prices begin to rise vertiginously because an expectation is enthroned in everyone who has the ability to set a price that the adjustments will become stronger and more frequent. The fuel comes from the disorderly printing of money and / or the depreciation of the exchange rate. In Venezuela both things are activated. The drought of dollars in the official exchange market is absolute in the midst of a flood of bolivars that nobody wants. When these two things are combined, pressure is immediately generated in the parallel currency market, where most of the foreign exchange transactions are going through.

Why do you consider that the parallel market of dollars has so much weight?

The account is very simple. During the time that Dicom was active, it sold 100 million dollars a month, that pointed to 1,200 million in the year in a country that will end up with imports in the order of 14 billion dollars. Where are the other 11 thousand or 12 thousand million? They would have to be transacted through the Dipro, whose registry we do not know, or through the parallel market. Surely, the Dipro system is trading much less than this amount of dollars.

He pointed out that there is a flood of bolivars, that is, the Central Bank creates more money to finance the Government. Why is the situation getting worse?

In real terms, the income collected by the State is falling dramatically. The income tax is charged with a one-year lag and the increase in the tax unit is not adequately compensating for the erosion caused by inflation. At the same time, the recession impacts imports and the collection of customs taxes and impacts sales and VAT collection in real terms. On the other hand, for no one is it a secret that Venezuela is financially isolated.

It is evident that the income from non-oil taxes is falling in real terms. What is happening with the tankers?

Oil tax revenues have also collapsed. The royalty falls linearly with the production of crude oil and the taxable income of the business is minimal. To add insult to injury, from that income in dollars, a minimum part is transferred to the treasury in bolivars at a fixed rate of 10 bolivars per dollar. Among colleagues we did not reach a consensus but we are all clear that Pdvsa is practically not declaring transfers for income tax and we do not know what is happening with the royalty. Oil taxation seems to be falling dramatically, some of my colleagues are inclined to estimate a figure that ranges between 0 and 10% of ordinary income. And that's a dramatic change in a country that was used to this relationship being between 40% and 50%.

In view of the decline in tax revenues, oil and non-oil revenues, the Government resorts to Central Bank financing.

Since the government has very little access to the international financial market, it is appealing more and more to the issue of money and that is why monetary aggregates are growing at a rate that we had never seen before of 1000% year-on-year.

To the flood of bolivars and to the pressure in the parallel currency market are added other factors such as the rate of salary increase, which also accelerate inflation?

My fear is that other things can also inject fuel into this fire and one of them are the most recurrent wage increases. In 2012, the minimum wage increases were semi-annual, in 2013 they became every four months and in that dynamic it seems that we have already reached increases every two months. The greater frequency in salary adjustments is a typical symptom of a process of inflationary acceleration, but also a source of power for the process because costs begin to change at a faster rate. Companies finance payroll increases by raising prices and requesting increases in their lines of credit to banks. The government does it by printing money.

There is also a growing desire among the population to get rid of bolivars quickly.

Of course, people seek to protect their assets by trying to get out of the bolivars turning them into anything else like physical assets, durable food or dollars, because there are no financial instruments and interest rates are frozen. We are already seeing transactions in dollars as a mechanism used by certain service agents to protect themselves. But what I want to highlight is that this process of mistrust in the currency has been combined with distrust of the financial system, because banks have been forced to put limits on withdrawals since the catastrophic change in the monetary cone was made. All this is very dangerous.

Is it possible that people get to completely repudiate the currency?

Yes, and that is what this attempt to introduce so chaotically the new monetary cone, which incidentally is one of the things that begins to happen in a hyperinflation with a frequency that we do not even imagine, has contributed. In the processes of hyperinflation, the monetary authority has to continually change the monetary cone because the bills that circulate no longer work.

Let's talk about how to face the disease. Is it enough to change the Central Bank's directory and cut the money issue?

It is a problem that must be attacked because of its complexity from several aspects. Therefore, it is not as simple as changing the Central Bank's board of directors with an express executive order to cut the amount of money. Of course, we must put order in monetary policy, but that is not enough. That monetarist vision is not entirely suitable for Venezuela. You have to work with a much more integral approach, do several things at the same time. Remove the currency distortion and the price system, promote the recovery of economic activity, close the fiscal difficulties, and move quickly towards a monetary reform.

How to approach the exchange issue?

We must put an end to the exchange distortion. Venezuela does not even have a foreign exchange market at this precise moment. The parallel market is illegal. We must build an exchange market, liquid, free access, with a single quote, not overvalued and credible, that does not generate expectations of devaluation, that is, that the public feels that it is a type of change that even in the face of any eventuality the Bank Central can defend. Maybe you should float at the beginning, looking for the market to mark the initial quote. The parallel market could be legalized for certain other portfolio transactions.

Does not this require a significant increase in international reserves?

Certainly, for that it is necessary to rebuild a fund of international reserves. This quickly brings us to the issue of international financing, multilateral aid, the re-profiling of public debt, the need to change the way in which PDVSA brings together dollars and sells them to the Central Bank, and to revise agreements such as those that exist with China and China. Petrocaribe.

Another edge of the problem is the fiscal flank.

A second task is to work the fiscal. It seems a lie, but the most serious fiscal problem that Venezuela has is not in the Government, it is in PDVSA. PDVSA accounts in bolivars have a huge hole because the few dollars they have, they sell them at the Dipro rate (10 bolivars per dollar) and their expenses grow with inflation. Then a company whose expenses are rising with inflation and its income in bolivars are stagnating to sell each dollar at a ridiculously low rate, obviously has to have a gap increasingly large.

Would the unification of the exchange rate end the artificially low rate of the Dipro and help reduce the imbalance in the PDVSA accounts?

Obviously the exchange unification will benefit PDVSA and the Treasury and to that extent it helps to cut the monetary financing. The fiscal deficit of the public sector can be at 20% of GDP and about 12 points correspond to PDVSA. But that is not the only thing that needs to be done. It is necessary to restore the purchase and sale of dollars between PDVSA and the Central Bank. I have suggested returning to the mechanism in which PDVSA sells all the dollars to the Central Bank and if it needs foreign currency to buy them in the market like any other institutional agent. This mechanism worked efficiently for decades in Venezuela and is the way in which the Central Bank can create an international reserves fund. PDVSA stole from the Central Bank the power to set up international reserves, therefore, it stole monetary policy and exchange policy, and it has stolen fiscal policy from the treasury because it has become a parafiscal agency.

And would not deep tax reform still be pending?

The fiscal problem has to be solved, but more than cutting the governorships, the mayor's offices and the Central Government, I think we have to reform the public administration and that does not happen overnight, nor does a tax reform, which Of course it will be very necessary. The fiscal reform must be signaled from the beginning, even if it materializes later. That helps generate a change in expectations. What I think can help a lot in the short term is the reduction of public spending in dollars and the process of unification of the exchange rate to reduce the fiscal gap that PDVSA has. The economic recovery that should come with the construction of a foreign exchange market that serves the country and not power groups, would also improve tax revenues.

What to do with standards such as the Fair Prices Act?

It must be eliminated, it became a propagating mechanism of inflation. It is absurd to try to fight a high inflation process with price controls. It's like putting out a fire with a handkerchief. When the products disappear, the prices end up being mega-adjusted, but in a desynchronized way; one day the price of corn flour, another day wheat flour and every now and then there are price adjustments desynchronized. That becomes a propagating mechanism of inflation. Also, if you do not have controlled prices you must work with a profit margin that does not exceed 30%.

And does the 30% profit margin act as an incentive for a steady increase in uncontrolled products?

The fixed margin of 30% is a mechanism that also spreads inflation. Companies and traders have adjusted to that margin and every time there is an increase in costs they modify the price to protect the margin. Notice that companies receive cost impacts every day, therefore, they have incentives to adjust the prices every day. That mechanism is a contradiction.

One of its approaches has been a monetary reform. What would it be?

The Venezuelan lost confidence in the bolivar, he uses it because it is the obligatory means of payment, but he has no other reason to do so, he lost his property of reserve of value. A monetary reform consists of bringing a new currency that generates confidence. Some have talked about switching to the dollar, but the problem that Venezuela has to switch to the dollar is that dollars do not abound, we do not have dollars to go for a dollarization.

And what is the proposal?

In terms of monetary reform, something very similar to what Brazil did with the Real Plan. Something a little more complex than changing currency, but society understood it very well. First they created a unit of account very similar, for example, to the tax unit, and promoted the marking of transactions to this unit that was called URV, so that prices were not marked in cruzeiros, but in URV. The URV had a 1 to 1 parity with the dollar, but its value in cruzeiros was adjusted daily according to a pro-rate of the monthly inflation rate calculated by the Central Bank. The cruceiro lost value every day against the URV, but the URV 1 to 1 with the dollar. Soon people started making transactions in URV and as it had fixed parity with the dollar at a rate of 1 to 1, it worked as an anchor.

What does the introduction of this unit of account look for?

The idea was to achieve a perfect indexing system in a first stage and the synchronization in the adjustment of all prices because once the prices are adjusted synchronously-at the same time-, and people use a unit of account anchored to the dollar, there is no need for further adjustments and inflation drops sharply. At first, not all of them folded to the mechanism, but little by little they realized that it was advantageous because the unit of account was equal to one dollar, parity one by one. Therefore, with respect to the dollar, it always maintained the same parity while the cruzeiro lost value every day.

And achieved the perfect synchronization and the decline of inflation is introduced a new currency?

So is. After three months of the introduction of the URV, inflation fell to one digit and it was when Fernando Henrique Cardoso, who was in charge of the Ministry of Finance, introduced the new currency, the real one, with one-to-one parity with the dollar and with the parity regarding the cruzeiro at which the last day of the conversion had arrived. The economy was dollarized because the unit of account was anchored to the dollar, without using dollars, so I say that the scheme serves as an indirect dollarization. Since that year 1994, Brazil has not suffered double-digit inflation.

If the possibility of devaluing is maintained if necessary, is not it assumed a straitjacket like the one Ecuador has with dolarization?

Exactly. In fact, what happened in Brazil is that they began to appreciate the currency. An error that they paid years later. But the Real Plan was so successful that Cardoso resigned from the Ministry of Finance and won the presidential elections of 1994. The Real was constituted in a credible, reliable currency.

The situation in Brazil was not simpler than the Venezuelan one?

I do not know of a worse catastrophe in as few years in Latin America as the Venezuelan one. Of course, our case is more complex than the Brazilian one. That is why I pointed out that we have to work in several flanks: to set up a liquid international reserves fund, to resolve the exchange distortion and the adjustments caused by the law of fair prices, to close the fiscal gap, all these things condition the implementation of the monetary reform. But I think that Venezuela has to walk through a set of measures of this type. Inflation can be defeated quickly and it is a priority to do so. In Brazil it was defeated in three or four months and it was a country with three-digit inflation and went to annual one-digit inflation, a resounding success.

You can not cut monetary financing abruptly without creating a liquidity crisis, so some think that graduality will be needed and therefore, in case of a reform, inflation will gradually fall.

It's true, I was the first to notice it. The abrupt cut of monetary financing without anything else on the menu is almost impossible and may even be counterproductive. If you do it gradually, I admit that you can go down to a monthly inflation of 200%, then to 80% and in three or four years maybe reach a digit. That is more or less the approach if you go in that way. If you are in a political transition I do not see how a government can gain support with turtle-step plans. Only in a strong hegemony could the population withstand such a litany. The approach I make is that we have to kill inflation very quickly, but we need aggressive treatment. If we do not do this already, hyperinflation will generate a landslide that we will regret for generations.

And that strategy could be compatible with a plan that promotes the growth of the economy and allows the population to recover consumption capacity?

Undoubtedly, the recovery of consumption and investment, hurt by the acceleration of inflation, is very important. What we are proposing is part of an economy that is committed to expansion. We have talked about creating a reserve fund and a functional exchange market to put an end to currency restrictions. The companies will produce more at the moment in which the control of changes is eliminated and they can increase the imports, and have more inputs and raw materials. But certainly we must take measures to help increase consumption, especially in the lower strata, whose purchasing power has been wiped out.

How would this be achieved?

In the expansion the salary improves, because the benefits grow and the productivity is pro-cyclical. But Venezuela would also need an emergency fund to implement good programs of conditional transfers or not to the population in extreme poverty. These types of programs already exist in all Latin American countries and are endorsed by organizations such as the World Bank and the Inter-American Development Bank. My idea is that a National Development Agency would be responsible for the design, monitoring, and supervision of social plans, while the execution would be in the hands of the ministries. The recovery program of the economy with low inflation does not have to be recessive or restriction of consumption.

@hien-tran @anyx @glitterfart