This post is a follow up to my entry in the VIVA whitepaper design contest, a part 2 if you will. In last week's post, @williambanks left a long comment with additional details about how mint interest is used. I've taken that comment and fleshed it out a bit, making it the seed for this post.

But before we get to that, let's take a little detour to introduce another important and relevant part of the VIVA ecosystem:

Getting rid of price volatility with vX

You already know about VIVA Crowns & coins, but there is another type of digital token in the VIVA economic system as well: vX. vX is a currency that is always worth 1 X amount of VIVA coins, where X can be anything capable of being reliably priced. For example, vUSD for units of US dollars, vMXN for units of Mexican pesos, or even vXAU for mg of gold.

1 vUSD will always be redeemable for $1 worth of VIVA coins, regardless of the current price of VIVA. This makes it easier to spend your money. You don't have to worry that the price of VIVA tomorrow might not be what it is today. You always know that you've got $1 worth of purchasing power, no matter what.

Steemit users are already familiar with this concept, because it's just like how SBD (Steem-backed Dollars) works. In fact, it's fair to say that 1 SBD = 1 vUSD = $1.

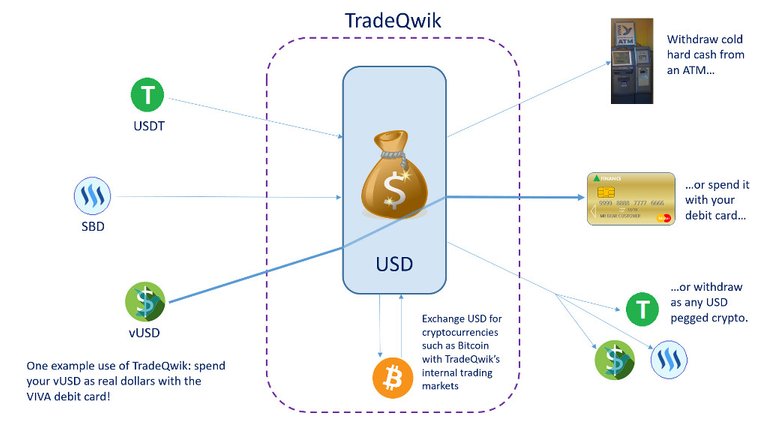

The TradeQwik exchange takes this concept a step further, allowing fiat currency to mix freely (be completely fungible) with its pegged digital asset equivalents. For example, when you deposit vUSD or SBD on TradeQwik, it's just counted as USD, which you can withdraw as cold hard cash at an ATM or spend with the debit card linked to your account.

Thus the use of vX allows people to seamlessly spend their VIVA earnings outside the digital world.

Figure 9: TradeQwik is a melting pot where fiat pegged digital currencies can be mixed & matched to your heart's content.

Giving away money through votes

Now that we know about vX, we are in a position to revisit the concept of mint interest that was discussed last week. As mentioned previously, crownholders collectively set an interest rate that determines the fee mints are required to pay for the privilege of minting new VIVA coins. 50% of this fee is distributed to liquidity pool stakeholders in the form of dividends. But what happens to the rest of it?

Well, the simple answer is: 25% gets allocated to the awards pool (more on that a bit later), and the remaining 25% gets allocated according to user voting, with any unused votes also contributing to the awards pool.

Voting is similar in concept to the way you vote for posts on Steemit to award post authors a chunk of the daily Steem rewards allotment. But there are some key differences. Let's do a comparison:

| Steemit | VIVA |

|---|---|

| Vote on posts | Vote on user accounts (not actual content per se) |

| Get rewards in Steem / Steem Power / SBD | Get rewards in liquidity pool stake |

| Users can vote as often as they like (with diminishing effect for voting too frequently) | Users have a fixed number of votes per day, which is determined by how much stake they have in the liquidity pool |

| Votes have a variable value depending on your Steem Power and how other people vote | All votes have the same dollar value (set by crownholders) |

| Has curation rewards | No curation rewards |

Voting is a mechanism by which you can reward VIVA community members for any actions that you deem worthwhile. And since you are voting on accounts, not specific content, applicability of votes is much more general than Steemit. Do you know someone who produces wonderful videos on YouTube, runs a particularly reliable worker node for a business, or helps provide liquidity to thin markets on TradeQwik? Then toss a vote their way and show them their efforts are appreciated!

There will even be a VIVA browser plug-in so that when you vote for a post on Steemit, you also vote for that user in VIVA if they happen to have a VIVA account named the same as their Steemit account. It's easy to imagine similar plug-ins being developed for other social sites such as YouTube, Reddit, etc.

A few important points:

All votes contribute to a user's liquidity pool account, meaning that votes increase a person's percentage ownership of the liquidity pool rather than being paid out directly in VIVA coins.

Votes are use-it-or-lose it. If I have 5 votes per day, and I only use 3 of them, then the 2 unused votes don't carry over to the next day. I just lose them.

Nothing in VIVA is wasted. If I have 2 unused votes leftover at the end of the day, they would get sent to the awards pool.

Figure 10: Minting fees are allocated to dividends, user votes, and the awards pool.

We can now go back and give a more complete picture of the 10% interest rate example shown last week:

Figure 11: Cash flows generated throughout the VIVA ecosystem by the minting process.

The 50-25-25 split shown above will be the initial ratio when VIVA launches, but as with other economic parameters, the crownholders are able to vote on changing these numbers according to the needs of the system at any given time. So it's important to realize this ratio is not set in stone.

Award Rights & the VIVA awards pool

Every 90 days, crownholders can perform these actions for each Crown they own:

Sell (rent out) a Treasury Right (TR) to a mint, or sink a TR into the liquidity pool (thereby purchasing additional ownership stake in the pool).

Give an Award Right (AR) to any VIVA user.

TRs and ARs can be used independently of each other, and mixed in whatever measure is desired depending on how many Crowns you have. For example, if I had 10 Crowns I could choose to rent out 3 TRs, sink 7 TRs in the liquidity pool, and issue 4 ARs to deserving users, all for the same 90 day period (not all ARs have to be used).

You are already familiar with TRs, but we haven't talked about Award Rights yet. Like TRs, an AR is good for a 90 day period and then it expires, allowing you to issue another one. The purpose of ARs is to allow crownholders to award people a potentially life changing amount of money, above and beyond what simple voting can accomplish.

Is there an aspiring musician you just know would take off, if she could just stop working 80 hours a week as a waitress? Is there an artist you believe has the potential to be the next Picasso? Then issue them an AR, and let other crownholders know so they can also issue ARs, with the aim of giving the beneficiary a jumpstart on escaping the daily grind in order to pursue his or her true passions.

Sounds great in theory. How does it work in practice?

This is where the awards pool comes in. As mentioned above, 25% of minting fees plus all unused daily votes go to the awards pool, which stores them as vUSD. This vUSD is allowed to accumulate over a 90 day period. At the end of the 90 days, the pool is drained: all the vUSD is converted back into an equivalent amount of VIVA coins and distributed in the form of liquidity pool stake to everyone who was granted an AR during that particular 90 day period. Then another 90 day period begins, with the awards pool balance reset back to 0. Note that at no time is the market being flooded with extra VIVA; all the coins in this process are destroyed in the liquidity pool and only pool ownership is affected accordingly.

The recipients of the ARs will then be able to claim dividends for life in the usual manner, based on their awarded liquidity pool stake.

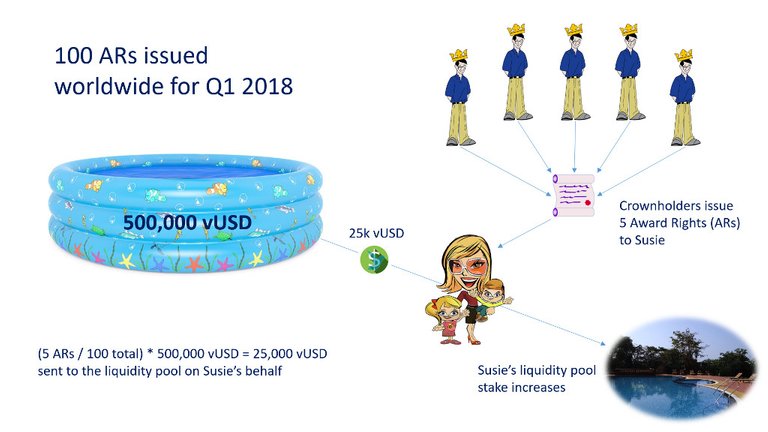

Awards for each 90 day period are granted in a proportional fashion depending on how many ARs an individual was granted during that period vs. the total number of ARs granted.

For example, let's imagine that during a particular period, 500,000 vUSD accumulates in the awards pool, and crownholders issue 100 ARs. Susie Soccermom, a single mother with 2 kids, struggles to make ends meet and runs a worker node for a business to generate some extra income on the side. She's also a popular science blogger, but doesn't have enough time to write frequently. Some of her friends, who are also the crownholders that introduced her to VIVA in the first place, decide to help her out. Collectively they issue her 5 ARs.

Figure 12: Using Award Rights to be a good philanthropist.

As there are 100 ARs total for this period, each AR is worth 1% of the awards pool which is 5000 vUSD. So Susie's stake in the liquidity pool will increase by $25,000 worth of VIVA coins, giving her quite a boost in future dividends. With the extra money she doesn't have to work as much and can concentrate on her dream of being a professional writer.

There are a few more subtle details to take note of:

Awards issued via ARs are capped at a maximum of 1% ownership of the liquidity pool, to prevent ownership from becoming unbalanced.

If a 90 day period ends with no ARs being issued, the ending balance of vUSD in the awards pool gets rolled over to the next 90 day period (the awards continue to build up until there is at least one person to claim them).

The cutoff for issuing ARs is 7 days before the end of the awards period. This means people can't game the system by sneaking in ARs at the last minute.

If a Crown is currently in debt to the liquidity pool due to negative interest (see the "Negative stakes" section of last week's post if you need a refresher on this), then the Crown cannot issue any ARs. But a crownholder with negative stake can still be an awards recipient; in this case the award received will first be used to pay off the debt to the liquidity pool and boost the recipient's stake into positive territory again.

I love the idea of helping as many people as possible, but what if I'm too busy to find worthy AR candidates?

Never fear, you can designate any VIVA user as a proxy to hand out your ARs for you. It's easy to imagine a whole cottage industry springing up, centered around professional philanthropic scouts dedicated to searching out & vetting candidates for awards on behalf of the crownholders.

VIVA sounds awesome! How can I be a part of it?

Feel free to join the VIVA community at https://chat.vivaco.in/home . I've found the VIVA team is very friendly and always willing to discuss any questions you may have.

The system is not fully live yet, although parts of it are up and running in beta testing, notably the TradeQwik exchange. It's an exciting time and watching the day-to-day progress feels like witnessing history in the making! Now is a perfect time to get involved.

Looking forward to seeing you there. Until then, keep calm and Steem on!

Links for further study

Read about the whitepaper contest here (there is still time if you want to enter the contest yourself!): https://steemit.com/contest/@vivacoin/viva-contest-so-you-think-you-can-graphic-artz

The first part of my entry in the whitepaper contest: https://steemit.com/vivacoin/@cryptomancer/my-entry-in-the-viva-whitepaper-contest

A comprehensive introduction to VIVA by @sykochica : https://steemit.com/vivacoin/@sykochica/have-you-heard-about-vivacoin

VIVA essential references by @williambanks :

- Part 1 - Introduction to VIVA : A Price Stable Crypto Currency with Basic Income

- Part 2 - More than meets the eye

- Part 3 - How does it work?

- Part 4 - How do you bootstrap a new economy?

- Part 5 - VIVA CAN? You bet!

Join the TradeQwik beta: https://www.tradeqwik.com/

For more posts about cryptocurrency, finance, travels in Japan, and my journey to escape corporate slavery, please follow me: @cryptomancer

Image credits: VIVA logo used in the title image & diagrams is the original creation of the VIVA team. ATM picture also courtesy of the VIVA team. SBD coin image is modified from a screen shot of the Steemit logo taken from the Steemit web site. All other clip art comes from Pixabay and is used under Creative Commons CC0. The diagrams themselves are my own creation, built using Microsoft PowerPoint.

Check out his blog.Achievement badges courtesy of @elyaque . Want your own?

Excellent post! There has just been one update to this, after a discussion William and I had this weekend, and that is to give a Crownholder BOTH a TR and and a committee award right AR, the mechanisms for both to be at play are built in and we didn't think a Crownholder should have to choose between the two but have both rights. :-) Your graphics are badass, thank you so much for your time and energy into the VIVA project, so thankful you are involved!

I'm glad my diagrams get the badass stamp of approval. :-) And thanks for the heads up about the change; William gave more details in his comment as well. I will get the post updated accordingly.

Very nice graphics and text explanations! Thanks for your work on this!

I am a believer in the VIVA project and an investor; I am a crown holder. I trade on tradeqwik. I invite everyone who reads this to consider joining us!

Thanks, glad you liked it. Full Steem ahead for VIVA!

Yet again you knock it out of the park!

Also, this isn't your fault but it's the result of having some in depth discussions and crunching numbers. The CR system is being replaced with AR or Award Rights. It's more than a branding change. It's a change to the way we think about the award system.

I think @badassbarbie put it best when she said that "altruism should be a choice we make based on love not our pocket book. most people will never issue a CR if it's going to be a choice between a TR and a CR".

So the primary difference here is that each Crown can generate 1 TR AND 1 AR every 90 days now. Previously it was 1 TR OR 1 AR.

Also if no ARs are awarded at all during a 90 day period then it rolls over to the next 90 day period.

Another change is that the AR cutoff period is 7 days before the end of the award cycle. This prevents someone from sneaking in an AR at the last minute.

Finally, crowns which are in a "debt state", cannot issue ARs but crown holders who have debt are just as eligible to receive an AR as any other VIVA participant. In that case, any Award they might receive would first be used to be pay off their crown debt. This is important because indebted crowns automatically sink their TRs into the liquidity pool until any debts are settled and indebted crowns cannot be transferred.

These are new changes just based on user feedback and your explanation was correct up until a day or so ago and you did an awesome job of explaining it!

Upvoted and Resteemed!

Another question if I may:

Can you give more details of the rationale behind this? I don't think it would really make a difference; instead of people sneaking in ARs at the last minute, they could just sneak them in right at the 7 day cutoff limit.

I think to make it fair and prevent people from gaming the system, you could make it so that ARs are "hidden" until the end of the 90 day period, and only then it is revealed how many were granted during that period and to whom.

Hiding public things on a blockchain is complex. The 7 days is there so folks know who got what. 7 days isn't arbitrary, it's the block proceeding the block that pays the AR.

This is the same as saying it takes 1 confirm from the AR close until AR payment.

Okay, sure. I thought maybe the data could be encrypted or something, but not really a big concern. This sounds fine.

I like this explanation better @williambanks, rather than it sounding like someone is 'gaming the system' (although it may be accurate). @cryptomancer, perhaps the explanation can read:

"ARs must be submitted on or before the 83rd day (7 days before the end of the 90-day period). At the end of the 83rd day, the AR awards are closed and recorded on the blockchain; on the 90th day, the AR awards are distributed and recorded on the next block on the blockchain. In this way, the AR awards can be recorded on a block-chain block preceding the one which includes the actual AR distribution. In other words, awards are recorded on one block (day 83), and the awards distribution are recorded on the next block (day 90). This gives everyone involved a chance to see to whom each award is given."

Of course, @cryptomancer, you may have a better explanation, or something - umm - less wordy :-)

Does this mean that if a crownholder does not issue an AR for a particular Crown during a 90 day period, then that Crown can issue 2 ARs in the next 90 day period? Or does it mean that if no ARs are issued at all from anybody, then the awards pool balance rolls over to the next 90 day period, instead of being reset to zero?

So ARs can be used completely independently of TRs? Does this mean you can choose to rent your TR to a mint, or sink it in the liquidity pool, but either way you still get to give out an AR as well?

It's just a reference to the pool itself as for ARs, they are use it or lose it.

Yes your AR is completely independent of your TR, unless your crown is indebt. Indebted crowns sink their TR into the liquidity pool to cool off and cannot issue ARs during the debt cycle.

Okay, makes sense, thanks.

Thanks for the additional details and appreciate the resteem! I'll get the post updated to reflect the changes. It's great that people won't be forced to make the hard choice between a TR and an AR.

Interesting... and thank you for sharing this. Still trying to learn about-- and understand-- the VIVA project; articles like this are quite helpful.

You're welcome, glad you found it helpful! There is a lot to learn about VIVA; it's a big system, and one of the most exciting projects I've come across in a long time. I'm happy to have the chance to help spread knowledge about it.

Very well explained and I especially love the graphics you've made. It really helps to get a better idea of how things fit together.

Great post!

Thanks! A picture is worth a thousand words, as they say, so I tried to make mine speak volumes. Looks like over the weekend William has decided to use the term Award Right instead of Committee Right after all, so you should change it back in your post. I'll get mine updated shortly as well.

Exactly! And you do it very well, better than i could.

Yea, i did see that and already made the changes.