As normal, there are close triggers and collateral factors in a market shock. Obviously, a global spread of coronavirus infections and the dramas of measures to stop them have stopped the Chinese economy. They have boosted prevailing hopes for the forthcoming increase of global growth and have fanned the prospects of corporate income. But the market is still in turmoil condition in china. As the Chinese economy dealing with coronavirus and it’s after effect. The world is not yet ready for it.

China extracted itself from the world for the better good. The health organisation published several notifications for travelling abroad especially effect countries. Now global outbreak of coronavirus affected the world economy including wall street, financial market etc.

This financial crash may cause a recession again. You remember when in 2008 the USA became the key centre for the global recession to begin. Now the factors are building the base one after one. Is the recession coming? If it comes then will crypto ecosystem help the economy to revive?

The is one basic indicator to recognise whether a recession is near or far. If security stock dropped 20% from the current high then anyone can predict that bearish market is coming with the fall. The bearish market could lead to a recession.

Bank of America listed some indicators to identify the bear or bull market through historical research. Somehow the 80% of the causes match the circumstances of the market then the bear market is ready to give a headache.

Here are 19 researched factor to recognise the bear market.

Interest rate increment one of the significant catalysts to understanding the market is at risk. If Federal Reserve increases the interest rate then the bear condition may not away.

For credit, the term and condition become tougher.

In the last 12 months, the minimum return on the bull market has been 11%

In the last 24 months, the minimum return on the bull market has been 30%

If the last 6 months data displayed low-quality stocks run faster than high-quality ones then bear market may occur.

If growth stock reflects the same nature as momentum stock for the same period.

Last year’s 5% stock pullback.

If stock outperforms on the low cost.

The level of consumer confidence of the Conference Board did not reach 100 within 24 months.

The number of the Conference Board expected to exceed in the stock market.

Decreased the reward earning amount and make it difficult.

Indicator of selling hand, a counter indicator of confidence in sell-side equity.

Manger Survey of the Bank of America Fund shows high cash rates.

Inverted return curve Increase in preferences

For long-term growth, the transformations are being observed.

Regulations 20, additional price/earnings trailing ratio of CPI is greater than 20

Volatility level rises above 20 at some point over the past three-month period.

Here revision rule applies to estimate earning from stock.

Momentum stocks out sailing for more than 6 months to 12 months.

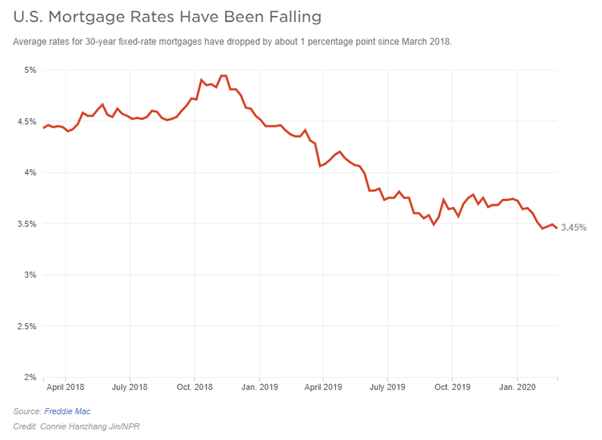

Among 19 factors if 80% matches then the recession may knocking at the door and we have to be prepared. Last time when US stock market figures declared recession, all blamed the US mortgage. Here, it broke down a 1% interest rate after 2018.

A dramatic drop in mortgage costs will enable future homebuyers to purchase their houses–or can reduce monthly refinancing payments.

The most drastic stock market sell-off since the financial crisis of 2008 was caused by concerns over the potential economic effect of the older coronavirus epidemic. Monday’s markets surged to expect the Federal Reserve to lower interest rates to boost the economy.

But there is a silver coating for homeowners and homebuyers in this market chaos: mortgage rates have fallen to almost constant lows.

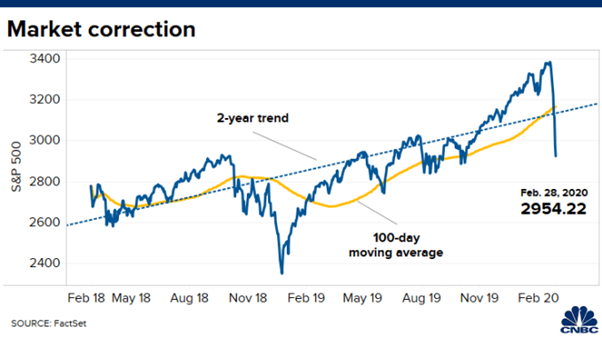

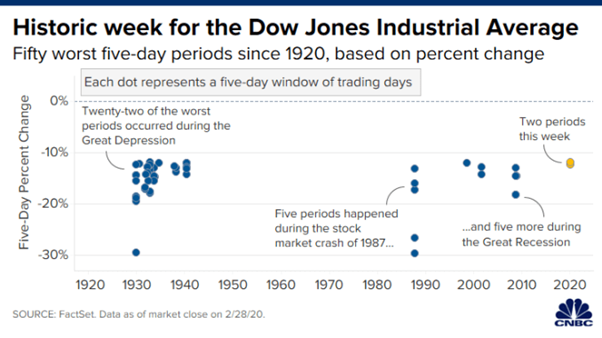

Like the mortgage interest rates, the several stocks fell due to the fear of coronavirus. The Dow Jones and S&P 500 fell from their high about 16.3% and 14.6% respectively, reported by Nasdaq. These reports from US stock markets are quite scary and indicating the bearish market.

The image of S&P 500 correction:

The image of the Dow Jones Industrial Average’s worst 50 days since 1920. It indicates that this is the first time after the global recession in the era 2010 when it faces the worst days. However, this week, it dealt with two consecutive crash indicating the worst week of history.

At an unprecedented pace, the stock market has entered an extreme position. This implies that, among many other factors, the tape is stressed out and extended in the course of a rapid, strong and potentially untrustworthy form of a reflex rally. The 12% collapse loss in seven trading days is a litany of rare occurrences.

The coronavirus impact is currently being struggled with in the world. Sooner or later, I could be prepared to see a significant downturn in the economy. And it’s just started. But the recession? Maybe it can. Nonetheless, a crisis cannot be allowed to enter the global economy if the sector can quickly recover.

https://www.coinbreze.com/

Telegram: https://t.me/coinbreze

Twitter: https://twitter.com/coinbreze

Facebook: https://www.facebook.com/Coinbreze

The Steem blockchain is currently being attacked by a central authority in order to take control of the witnesses. If you are not managing your witness votes, please consider setting @berniesanders as your witness voting proxy by clicking here to help restore the decentralization of Steem.