- Hewlett-Packard is worth 41 billion today.

- 63.4 billion in revenue for 2021.

- 6.5 billion in profit.

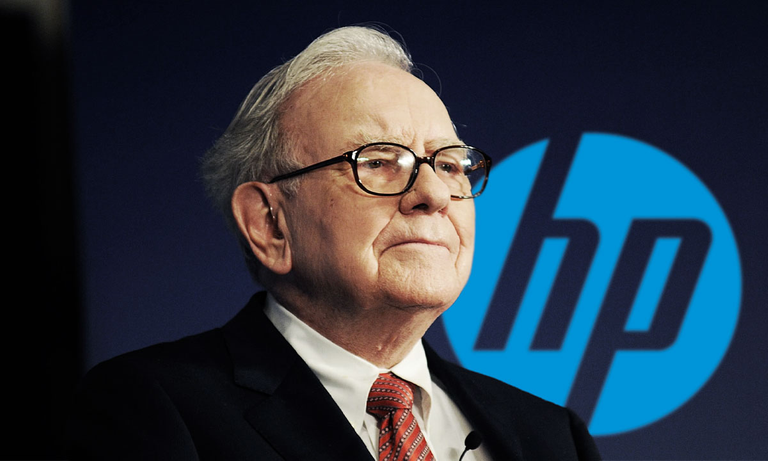

Warren Buffett recently purchased 121 million shares of HP, giving Berkshire an 11% stake in the company and many are wondering if HP is a good investment.

To figure this out, the first thing to look at is why the market cap on HP is at 41 billion, when revenue is about 50% higher.

Looking at HP’s financials, nothing seemed glaring, but the history of the company might throw a few people off.

HP in 2015, when Meg Whitman was CEO decided to split the company into two.

There is the classic HP which Warren Buffett bought into that sells printers, computers and many more products the company is known for.

The second is Hewlett-Packard Enterprises, which focuses on data services, storage and the cloud.

The rational behind the split was one company focusing separately as a stock could perform better, due to the belief the data business would hold better margins over the hardware business.

HPE had 27.8 billion in revenue for 2021 and 3.4 billion in profit, giving the company a 12.3% margin, versus HP’s margin of 10.3%.

Not a huge change and it doesn’t seem like HPE has been a huge success, where the market cap is currently 21 billion and has remained flat the last five years, only growing 14%, which has underperformed HP and also the S&P as a whole.

This split though is why I feel HP as a whole has suffered as a stock, where despite solid profit and revenue, it seems confusing to a lot of stock holders.

A similar company is Dell, which went private in 2013 and public again in 2018.

- Dell made 94 billion in revenue during 2021.

- It had a profit of 3.2 billion.

While the margin wasn’t strong, that’s mainly due to the cost of going public again as obligations on the company and also lower margins to handle the heavy growth, where revenue is up 30 billion in the last 5 years.

The market cap though is still a let down at 36 billion, which is lower than what it should be, while still being up over 50% from last year.

HP, I feel has a similar issue to Dell, where despite solid financials, the weird situation of the split and general confusion of two publicly traded companies with almost the same name bothers people.

That’s why I would believe HP is generally undervalued.

But the big question is did Warren Buffett make the right choice and should others?

The best thing to do would just be look at the stock price the last five years, where HP has actually gained 111% in value.

It has outperformed the Nasdaq, DOW and S&P 500, despite being a company where the market cap is only about 60% of revenue, while being a tech company.

That makes a case it can grow from here and why I believe Warren Buffett bought it.

The other reason is the company is old.

Warren Buffett was born in 1930, so HP started in Palo Alto in 1939, when Buffett was just nine years old.

Warren Buffett bought See’s Candy in 1972, because it was his favorite candy and he also joked that it started before he was born, which at the time wasn’t that long, but the company was still over 50 years old.

HP being over 80 years old likely impressed Warren Buffett, where it fits into the goal of having investments which aren’t trendy, but instead have longevity and the power to make some growth.

Should people invest in HP though?

Personally, I think Dell is a better long term investment, but I’m sure in a decade HP will be doing fine.