"What are practical ways that the United States can be proactive in preventing future financial crises?" - @dylangrimes00

In my opinion, there are several steps that the US needs to take to stop financial crises. First of all, the US has to stop propping up businesses that are unable to sustain themselves. *No company is too big to fail and propping up these companies can only make the situation worse in the long run.* The economy is supposed to go up and down, not strictly up, and many in the government have decided to try and prevent downturns in the economy which is completely unnatual. Eventually, everything comes crashing down and does a lot more damage than if the economy had just been left to its own devices.

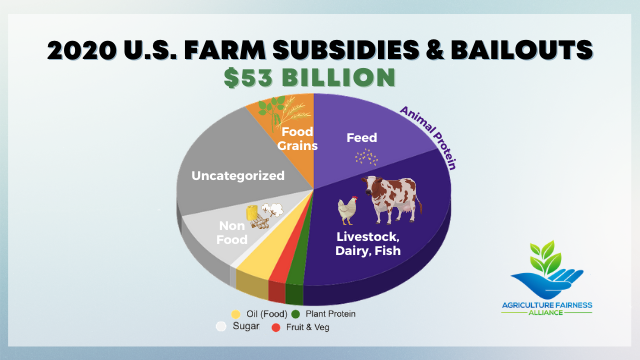

With this in mind, the very first step is to stop subsiding companies. The government essentially gives certain companies taxpayer money and expects them to allocate it as if they had produced that money themselves. It is largely a transfer of wealth from the average American to the richest among us and is simply immoral. Not to mention, subsidies stifle competition in the marketplace and always seem to give a monopoly to the company receiving the subsidy. It seems funny that monopolies are illegal in the US but the federal government has the audacity to create them. This creates the companies that are "too big to fail" because they drive all unsubsidized companies out of the market. This is particularly problematic in industries such as agriculture that Americans depend on for their food. I believe that subsidies stifle competition by giving monopolies to companies that essentially steal money from taxpayers and have no incentive to be efficient with the way that they allocate their resources.

In addition, corporate bailouts need to end immediately. An industry that cannot support itself deserves to die, because it is better for the consumer in the long run. If a company is not profitable, it is either mismanaged or consumers do not want the product or service that is being offered. Allowing bad businesses to fail creates opportunities for innovation and ensures the most efficient allocation of scarce resources. Overall, it is completely unacceptable for taxpayers to be expected to prop up businesses that cannot sustain themselves.

With that in mind, businesses that are destined to fail will almost always fail at some point. The problem is that the government can refuse to allow the economy to work naturally by using taxpayer dollars to keep the business doors open, usually in the name of "preserving jobs" or some other buzzword that gets workers to believe that it is for their own good. Failing businesses that are propped up almost always come crashing down and create much bigger problems than if they were left to die naturally. If the government wants to prevent a financial crisis, it needs to stop doing all of these things that seem to always result in a financial crisis and an inefficient allocation of resources that fail to benefit consumers in the long run.

Congratulations @haydenhirzel12! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 40 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

I'm not sure why the formatting is messed up on this post. I am pasting the original content below, to help others read it without difficulty: