I wish I was a witness...

But that's hard to do when I'm not even running a node and have no dapplications to offer the network. Perhaps I'll get my act together one of these days.

:D

In any case, witnesses on Hive can be viewed as our politicians. We are the great nation of Hive, and they secure out great nation and make it a better place to live.

All politicians need a platform...

A set of standards and principals that they stand by that are indicative of the population they represent. Make no mistake, DPOS is a crypto republic. The witnesses represent our interests. We vote them in; we vote them out.

Representation

The problem I'm seeing is that we are so new that witnesses don't even have platforms yet. Steemit Inc was pretty much controlling everything development-wise, so there was no need to actually form political parties. All that changes with Hive. There will be many arguments going forward about what direction we should head in, and we no longer have any centralized leadership to bear the burden of that responsibility.

It all falls on the witnesses.

And that's fine;

that's the way it's supposed to be;

that's how republics work.

If I were a witness

Below I will describe the direction I'd like to see the platform go it. If I was a witness, this is the platform I would stand on. I suggest the other witnesses start thinking carefully about the political issues this platform has, and figure out what direction they want this platform to go in. Not having a political platform underneath your feet as a witness makes you look unprepared... although it seems like none of the witnesses do so from a relative perspective they are all currently on even ground.

Issue #1: Destroy the ninjamine.

This became issue #1 just yesterday, when @justineh created a worker proposal granting 500 HBD per day for 60 days ($30000). This would be for executive services rendered for getting us listed on exchanges and the like.

@justineh's proposal

You know, if that $30000 was spread out over a year instead of two months I would of had no problem with it. When people see that number ($30000) that looks like a yearly salary, not something you would get after 2 months. Even $40000 or $50000 for a year would be much more justifiable. Already we are seeing the backlash to this proposal. Judging by the massive support the proposal has, it will be approved and create even more backlash.

Wasn't this supposed to be about the ninjamine?

Precisely!

This is why I wrote this post immediately after Hive was forked into existence:

FUCK: Never Send Humans to do a Hobbit's job!

You see, now that the ninjamine has been funneled into the proposal system, it looks like we stole it. Now that proposals like this are going to get approved, it looks like the Hive elite is funneling the ninjamine into their own pocket without really having done enough work to earn it.

@justineh is asking for more money than pretty much all of the devs are asking at the moment. Who should make more money? Devs or public relations? Or perhaps I'm downplaying the work and it should be considered more of an executive function?

I have to be honest, I'm extremely biased here, as some of the cliques I've been involved with here do not like @justineh, and that's putting it lightly. I don't know her and I've had no interaction with her.

On the other hand, there seems to be a bias in the opposite direction when we look at the core elite group of Hive; they all seem to support her. It stands to reason the proposal will get approved no matter what.

If I thought this problem wasn't going to get worse, I wouldn't even mention it, but it's obvious to me that this problem is going to escalate x100 over time, or at least has the potential to.

Solution: destroy the ninjamine!

Obviously obviously obviously. We need to destroy the ninjamine 100%. Even from a development standpoint, this makes the most sense. Why would we go through the trouble of figuring out how to turn that Hive into HBD when we can just destroy it and create more HBD later with inflation?

I'm not sure how many people know this, but our inflation is not set in stone. We are not Bitcoin. We can do whatever the witnesses agree to do, as should be obvious by now. We could just as easily destroy the ninjamine and bump our inflation rate back up from 8% to 10% and pump that extra 2% into the proposal system. Sorted.

Doing it this way would give us the advantage of making it appear as though we didn't steal anyone's money. We destroyed it (or rather they simply weren't airdropped the coins, and as a temporary measure they were stored in @steem.dao to be dealt with during the next HF). That's the end of that.

Issue #2: one to one witness voting.

Looks like I'm going to order these issues as most contentious to least. Currently we can all vote for 30 witnesses with full power. All of our tokens count for all 30 votes. The second I got to this platform in 2017 I felt that this was wrong and foolish.

I still stand by 1:1 witness voting, no matter how much largely theoretical math that's thrown at me. This is the policy that makes the most logical sense. 1 coin can vote for one witness (not 30). Which coins go to which witnesses is up to the user. End of story.

Not end of story (witness downvotes)

The push/pull of this issue should be made known. The more witnesses that a single coin can vote for, the more likely it is that there are zero bad actors in the top 20. It becomes a polarizing issue. Either they are all solid or they are all sockpuppets, which JSun showed us very clearly.

1:1 witness voting makes is so a very rich person could probably pay for themselves to be a witness (which is why we should probably consider witness downvoting).

However, that same rich person would not be able to elect multiple witnesses, which is clearly the biggest threat. 1:1 witness voting is more secure against complete security failure, while multiple votes defends against a few bad actors ascending the ranks.

Again, I think a policy of 1:1 voting with a 25% downvote pool would be the best of both worlds, and it would mimic how upvoting and downvoting already work when it comes to reward pool distribution, lowering the bar for understanding the platform and improving the UX. In my mind, this is the obvious logical conclusion to the adversity we recently faced.

Issue #3: Stabilizing HBD with DeFi CDP loans.

Now begins my push to show which development paths for the Hive blockchain have the most value. I have many many posts on this issue.

Stabilizing HBD

More on Stabilizing HBD

SBD is Broken

SBD is killing Steem

My biggest fear with bringing DeFi to Hive is that the developers of such a thing would get greedy and implement interest rates to funnel money into the platform (or even their own pockets). This would be a huge mistake.

It's very obvious that if a user is collateralizing their own debt by more than 100% they should not be charged an exploitative interest rate. Charging 0% interest secures Hive's race to the bottom and allows us to leech the Maker community into our own. It will also undermine Tron, which is making a similar technology.

I've outlined very clearly that there are only 2 levers that need to be implemented in order to make this thing work:

required_collateral_percentliquidation_percent

required_collateral_percent is much more important than liquidation_percent. It determines how much collateral a CDP can dip down to before it is no longer allowed to create more HBD. I personally would start it out at something very high like 300%-500%.

Debt cap.

Hive's debt cap is extremely conservative due to how poorly HBD functions as a stable-coin. MakerDAO has a required_collateral_percent/liquidation_percent of 150%. This means technically loans must only be over-collateralized by an extra 50% of their face value.

Meanwhile, HBD has a debt cap of 10% of Hive, which means that HBD is collateralized by a MINIMUM of 1000%. This is ridiculous, because even at 1000% collateralization we see that HBD can't maintain the peg. Nobody trusts in its ability to remain stable, and rightfully so.

By implementing CDP DeFi we could greatly raise our debt cap, or better yet eliminate the debt cap completely and let it be determined by the free market (baby steps on this front to make sure we don't wreck the system). Instead of having a hard-capped debt cap (currently 10%) we could employ a dynamic debt cap using governence voting.

Governance voting dynamic debt-cap.

Imagine we remove the 10% hard-cap from Hive. This removes the HBD haircut, which in turn puts our platform at risk if we print too much HBD and it ends up getting burned for Hive.

However, with CDP loans we ensure that too much HBD doesn't get printed in the first place. We'd never be in a situation where HBD is trading for $13, in fact the MakerDAO system shows us that the most extreme ranges fluctuate from $1.05 to $0.95, while the more normal range is around $1.02 to $0.98.

The key to solving this problem lies in the required_collateral_percent. Imagine our HBD debt percent skyrockets up to something scary like 30% due to free-market demand. We can lower that number simply by voting to increase the required_collateral_percent. If more Hive is required to generate HBD out of thin air, then less HBD will be generated, thus lowering the supply of HBD and increasing it's value. Locking more coins also increase the core value of Hive, again lowering the debt percent.

HOWEVER

We may find that 30% debt is not scary at all, and the free market has dictated that this level is completely stable and healthy for the platform based on the demand for a stable asset. If there are dozens of legitimate businesses on Hive, this could very well be the case.

How would we know if a high debt % is acceptable?

Quite simply, it all comes down to supply and demand. If our debt percentage is high that is risky, but this is only the case when HBD is trading UNDER $1. If our debt percent was 50% but HBD was still trading at $1.05, this would imply that we could allow our debt percent to ascend even higher.

A high debt percent is a good thing.

Having a lot of HBD is an amazing thing for the platform if the demand we've garnered at that level is in fact stable. For one, it increases liquidity.

The more value we keep in our debt (HBD) the less supply Hive has and the more valuable it becomes. With CDP loans, that value becomes magnified because if we have a required_collateral_percent of something like 300% that means a lot of the HBD out there is being collateralized by triple that value in Hive coins that are frozen into the smart contract.

liquidation_percent

Like I said before, this is the secondary variable that matters a lot less and is much less prone to argument, as it has much less effect on the network. However, it is still a very important variable.

A high liquidation_percent (say 125%) puts the burden of risk on the CDP makers of HBD and keeps the price of HBD stable even in the event of a Black Swan event. They are risking getting low bid during such an event for 100% of the collateral, and thereby losing 25% of their funds to the "vulture capitalist" that made the bid and took the risk to buy the bad debt.

A low liquidation percent (say 105%) puts the burden of risk on the stable-coin holders (those who hold HBD). If the liquidation percent is low and a Black Swan event occurs, the price and liquidity of Hive might fall and cause all the remaining bad debt up for auction to become unprofitable. This would leave bad debt on the platform, and the peg to HBD could fall well below $1 until we made a recovery.

As a witness I would be in favor of a low liquidation_percent because we've already had plenty of experience with the peg dropping (sometimes even as far down as 50 cents). As we've seen time and time again, Black Swan events in crypto are usually met with a strong recovery, so I don't think it would be a big deal to let the price dip once and a while and give users the opportunity to buy back debt cheap and pay off their loans at a discount. It would at least be worth testing out and raising this percent after the fact if it didn't work out via governance voting.

Dichotomy of the system.

Unlike MakerDAO, Hive already has a system of stabilizing HBD. CDP loans would be added on to this system, making it x100 times more stable. However, it's important to note that the combination of the two system will create emergent economic effects that are impossible to occur on other systems that are only collateralized in a single manner.

For example

Imagine HBD dips to 80 cents a coin. Now Hive users have incentive to lock Hive and use CPD loans to create HBD and either hold it or burn it immediately for more Hive. They also have incentive to buy HBD straight up and pay off their current outstanding loans for cheap (but this is also true for other platforms).

What I'm getting at here is that the system becomes immensely more robust.

There is a synergy at play here that can't even be predicted.

The whole is greater than the sum of its parts.

Modifying the peg

Here's something that no one is talking about. What if we were to modify the peg of our stable coin to account for inflation? This would make it even more stable than USD itself. Nothing is stopping us from re-pegging the value of HBD to $1.05-$1.10 and beyond over time. The logistics and economics of this idea are enough to write a complete dissertation on, so I'll table this topic for now.

Why do I personally need DeFi on Hive?

My primary objective is to create games on the Hive blockchain. I believe that burning assets and sending them to @null will be a great way to guarantee in-game assets have value.

If I were to have a game that burned Hive this would not be an ideal situation. What if the value of one Hive coin was $1000 in ten or twenty years? The games I create that require you turn burn 0.001-0.01 coins to generate in-game assets would no longer be viable. There are many many reasons why this network requires a stable asset. I require a stable asset to do these things, and burning the debt of the platform itself makes the most sense.

If we do not enable DeFi CDP loans and I were to make a popular game that burned HBD, guess what would happen? The supply of HBD would run out because our liquidity is razor thin (collateralized 1000%). The value of HBD would spike and the network would have no recourse to print enough to meet demand. We'd see the return of what we saw in 2017; millions of HBD getting printed that aren't going to get liquidated for Hive until the price of Hive has crashed into the dirt and the ratio of HBD to Hive is at a vastly incorrect level.

Just as a reminder

If HBD is $20 a coin and Hive is $10 a coin, millions of HBD are going to get printed out on blog posts because the value of Hive is so high. However, as HBD and Hive crash together, HBD should be getting liquidated for Hive, but isn't because the value is vastly inflated. HBD does not get liquidated until it trades under $1.

So a monster post might pay out 100 Hive and 1000 HBD. The Hive in this case is worth $1000 and the HBD is worth $20,000. If you were to trade the HBD for Hive you'd get $1000, so no one's going to do it. By the time HBD crashes to 99 cents, Hive has also crashed to 99 cents or less, meaning that 1000 HBD that got printed is AUTOMATICALLY going to generate 1000 Hive eventually even though it was only supposed to create 100 Hive. HBD instability tricks the network into printing way way more inflation than it should during the big pumps.

With CDP loans this never happens, as the price of HBD will never go higher than $1.20, and if it does the crash will be swift instead of taking a year. Demand can be instantly met with supply provided by the community.

Well, I've talked about this topic entirely too much.

Onto the next.

Issue #4: Reallocate interest rates to bank accounts.

This one is a no-brainer to anyone who understands the issue. Unfortunately, even the top 20 witnesses apparently do not understand the issue. I find this concerning.

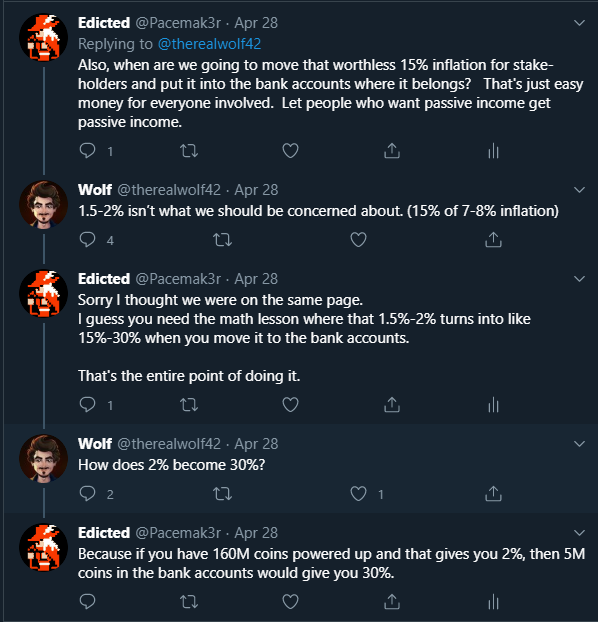

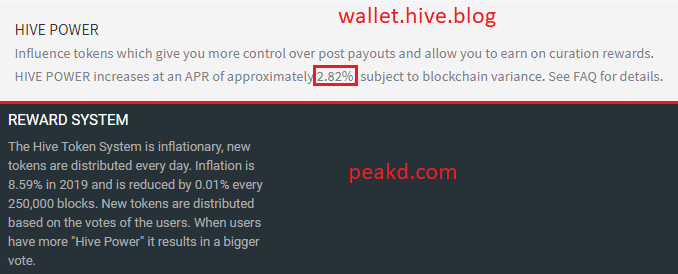

I got into it with @therealwolf the other day on Twitter, which really shows exactly what I'm talking about. I was pretty rude, and I regret that. However, when I'm talking to someone who's greatest contribution to the platform was a bid-bot, I lose a bit of respect.

I explained this issue in detail in November:

Vault Dividends: Clarification and Conclusion

Summary:

We are currently foolishly allocating 15% of our inflation to stake holders. This is absolutely unacceptable. We have bank accounts that are going fully unused because there is no incentive to use them. We have inflation already built in to the network to provide this incentive, yet we are allocating that inflation to the wrong place.

Indisputable math

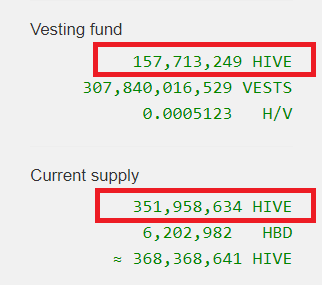

Here's how it works: Hive has a certain amount of yearly inflation (APR). Well, not really. Every certain number of blocks at lower that inflation by 0.1% or whatnot. I'm looking for our current inflation rate on getDynamicGlobalProperties() but it doesn't appear to be listed there. Seems like it should be but whatever. For the sake of simplicity say the current inflation rate is 7.5%. 15% of that inflation currently goes to stakeholders (huge mistake).

Why is it a huge mistake?

Because 0.15 * 0.075 = 0.01125.

No one cares about the 1% interest rate we are giving to stakeholders. It is meaningless to them and doesn't sway the actions of our users into any kind of meaningful direction. Nobody powers up more Hive because they're going to get an extra 1% APR; They do it for the increased upvotes. That's where the irony kicks in!

Everyone forgets about the multiplier!

That's right! Stake holders get significantly more than APR than what I have outlined. This is due to the fact that not all of the coins on the network are powered up, while all coins on the platform do indeed create inflation.

Yes, I am right (for once).

The multiplier is calculated from the ratio of coins that the interest rate is applied to divided by the total amount of coins.

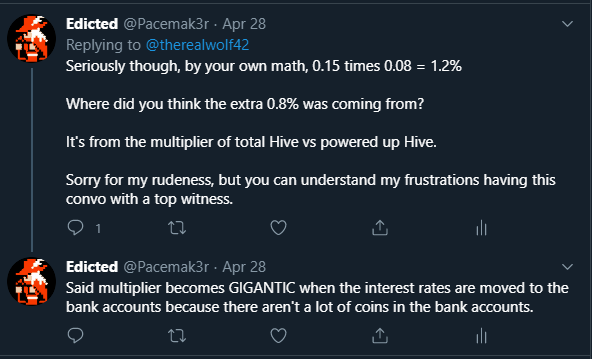

The current multiplier of stakeholders to total coins is x2.23

351,958,634 / 157,713,249 = 2.23163644...

Using "reverse engineering" we can calculate current inflation

AKA basic algebra.

0.15 * x * 2.23 = 0.0282

x = 0.08430

Therefore our total APR inflation rate sits at 8.43%.

How big does that multiplier get when you allocate it to the bank accounts?

One word: gigantic.

Because we know that when we transfer inflation to the bank accounts, most users will want to keep their coins powered up so they have strong upvotes. With 10% of our inflation going to witnesses, another 10% going to HPS and 15% going to interest rates, that still leaves 65% that is allocated via upvotes (50/50 author/curation).

So what's the multiplier of the bank accounts?

It's variable dependent on how much money is in the bank accounts. If there were 5M coins in the bank accounts, they would have a multiplier of 352M/5M (x70.4!!!). This would give an interest rate of 89% APR! (70.4 * 0.012645)

WOW!

But we have to assume that an 89% APR on the bank accounts would be way way too much incentive to deposit more coins. So we know for a fact that more than 5M coins are GUARANTEED to stay locked in the bank accounts FOREVER.

How much more?

| Millions of Hive | APR |

|---|---|

| 5M | 89.0% |

| 10M | 44.5% |

| 15M | 29.7% |

| 20M | 22.3% |

| 25M | 17.8% |

| 30M | 14.8% |

| 35M | 12.7% |

| 40M | 11.1% |

| 45M | 9.9% |

| 50M | 8.9% |

| 55M | 8.1% |

| 60M | 7.4% |

| 65M | 6.8% |

| 70M | 6.3% |

| 75M | 5.9% |

| 80M | 5.6% |

| 90M | 4.9% |

| 100M | 4.5% |

Maybe you're thinking these numbers aren't accurate because our inflation is going down over time. Remember that the total number of coins is also going up over time, increasing the multiplier. I'm not going to do that math, but you get the idea. We are leaving free money on the table for absolutely no reason.

WOW!

Wow wow wow wow wow!!!!!11

Look at those numbers!

It stands to reason that anywhere between 30M and 40M Hive would be GUARANTEED to enter the bank accounts if we implemented this minor change. Where does this Hive come from?

If it comes from the exchanges, our liquidity and supply are lowered and the price goes up. If it comes from the powered up supply, the value of upvotes goes up; this is where the irony comes in.

Irony!

We are allocating interest rates to the stakeholders to incentivize powering up, but that exact action is causing upvotes to be worth less money, imposing the opposite effect.

If we were to allocate the interest rates to the bank accounts, it's quite possible that our upvote value would increase MORE than the amount of money we lost from the interest rates. Think about that for a second.

More then Possible: Probable.

How much are we making from interest rates again? PeakD says 2.82%. I can believe that. That means only 2.82% of the powered up stake has to exit to the bank accounts for us to break even on the deal as stake holders (assuming the move has no other value to the network; which is obviously false).

2.82% of current powered up stake is 4.44M coins. How many coins did we think were going to enter the bank accounts if we implemented this thing? 40M at least for a passive income of 11%? Is it reasonable to assume that at least 4.44M of those coins would come from powerdowns? Obviously yes.

This is how you seal the deal:

Combining bank account APR with CPD smart contracts.

The problem here is that if 40M coins were to enter the bank accounts and start generating 11% interest, some turd in the punch bowl would come around and do the math and show why that wasn't worth it.

Instead it would be more worth it for one to power up those coins and simply self-upvote themselves with it. However, this leaves one open to being downvoted, and it also locks the coins up for 13 weeks instead of 3 days.

Streamlining the UX:

The way to fix this "problem" is to combine witness issues #3 and #4. Any Hive in the bank accounts receives the interest rate bonus, however, any Hive in the bank accounts also functions as an AUTOMATIC collaterallized CDP.

That's right!

So the smart contract that creates CPD collateral would simply be combined into the bank accounts. For example, if you had 1000 Hive in the bank accounts (locked for 3 days) that bank account would automatically count as a CPD with collateral inside it and it would also earn interest at the same time. This would streamline the UX and take the complexity of all these new features out of the platform.

Do not reinvent the wheel.

No need to create a separate CPD smart-contract system when we already have bank accounts right there that lock up coins as part of the smart contract anyway. The only thing we would need to change are the rules for unlocking Hive from the bank accounts. If you have outstanding HBD loans and you are trying to withdraw too much Hive (pushing your collateral percentage below required_collateral_percent) the transaction would be denied by the network and you'd have to buy/destroy HBD to free up some collateral.

Please contact your favorite witnesses.

I didn't even get a response back from @therealwolf on Twitter. I assume it's because I was a dick about it, but this is a serious issue that the witnesses seem to not even understand. I find it very frustrating. We are leaving free money on the table for absolutely no reason. We are hamstringing the value of bank accounts for absolutely no reason. We are lessening the value of upvotes for absolutely no reason.

Let's get this fixed in the next hardhark!

I have to assume that the code to get this done would be extremely trivial compared to other developments (like CPD smart contracts or SMT).

Issue #5: Enable Reset Accounts

I spoke to this issue very recently. I didn't even know what reset accounts were until a few days ago. If an account goes inactive after 60 days the reset account can change the Owner key of that account to any one they see fit.

This adds a slight attack vector to the network, allowing reset accounts to steal accounts that go inactive. However, there is no reason to not enable this 100% optional feature that is opt-in by design (all reset accounts are @null by default).

By enabling this feature, we could set up services whereby reset accounts are alt accounts that have their owner key posted to the cloud or some other place. The idea here is that security of the alt account goes down, while the accessibility of the alt account goes sky high (can't be destroyed / accessed all around the globe).

If a user was ever to lose the keys to their main account, the alt reset account would be the only means to recover it. This feature would set Hive security above every other network out there, even ones based on Condenser and Graphene.

However, I think we should consider taking this feature even once step further, and allow the users to determine how much time must pass before their account becomes "inactive". For security reasons, there would obviously have to be a minimum (likely 30 days). However, I could see situations where users wouldn't want to be considered inactive for as long as a year or even two. There's no reason Hive can not or should not provide this completely optional opt-in functionality.

Issue #6: Clean up loose ends (SMT/RC pools)

This is a no-brainer and obviously has the support of the vast majority of the network already. We need to finish SMTs, but arguably more so we need to finish RC pools. If another crypto boom happens and we have millions of accounts trying to transact, without RC pools we will be quite lost on that front. I'd like to stop playing this reactionary game of needing to develop these things in the moment and get in front of this one.

Issue #7: Permanent Vesting

This is an issue I have talked about previously. I believe we should add a simple smart contract that allows users to transfer liquid coins to other users, and those coins become powered up PERMANENTLY.

This ensures that coins transferred in this way will never again appear as liquidity on the exchanges. It allows users to host contests and giveaways with the knowledge that the reward will not be dumped. It allows coins to be sold at a discount knowing that they will not be immediately sold at a profit.

I believe that reputation of accounts will be a big thing going forward. With the rise of DeFi and CDP smart contracts, credit scores will eventually be created for the platform. Other forms of reputation will arise as well.

These developments will make it difficult for users to part with their accounts, as the reputations they've amassed over the years may turn out to be more valuable than the coins they hold themselves. Also, locking ones own coins on purpose to their own account permanently would be seen as yet another way to show they support the network, and subsequently another way to gain reputation in said systems.

I've been met with resistance on this idea, and like reset accounts and bank account APR, I'm completely flabbergasted by said resistance I encounter. These are optional features that no one is being forced to use. Adding them to the network simply adds value no matter what. Someone will use them; that usage adds value.

Issue #8: Documentation

Originally this post was going to be another tirade about how poor our documentation is right now. I'm currently in a battle trying to figure out how to calculate ref_block_num and ref_block_prefix in order to sign transactions offline and broadcast them without exposing my keys to the Internet.

I need to find it again, but my last post about this issue even got the attention of Ned and he was commenting on my blog. He spent so much time pushing SMTs and other complex BS that he never got around to cleaning up the code and helping people like me help build here. This is a huge problem that we've had since day one.

We absolutely need to clean up this code, document it better, and have far more resources and tutorials. This is also a no-brainer.

Issue #9: Who's going to do the work?

It's very disappointing to see all the devs who used to work on this stuff start another project. I'm sure OpenSeed and the like will be worth it, but we are constantly spreading our resources here razor thin and not getting enough done.

I have no solutions to this problem, I only note that we clearly need more devs, which goes back to issue #8. Clean, well documented code with tutorials and solid explanations will go a long way.

Conclusion

These nine issues are the current foundation of my political positions on the Hive blockchain. It might not seems like traditional politics, and it isn't. These online governance structures are obviously quite new and fledgling. They will get much more complex when we begin to form physical communities in the real world. Imagine Hive providing things like healthcare or insurance. These issues could escalate quite quickly.

I wish I was a witness.

I wish I had proven myself much more than I have.

I await the day that Hive moons once again and I have the resources to kick my ideas into high gear.

*4 mths.

2 and a half past months of work plus 2 future months. Which included major exchange listings valued quite high and continued work to get more.

If someone can do it cheaper, great. It seems the first guy who everyone is praising (Birdinc) couldn’t. In fact he wanted to pay huobi $150k plus pay himself a salary to continue this work.. work in which he wanted to send an email.. and well, that’s it. You see he wanted to send an email and then have someone else do all the work.. as he “had no time for it”.. but he wanted a title and salary.. as apparently all those listings he got for STEEM .. oh wait. Perhaps I should be a bit more open about his role since he seems to be wanting to smear my name. Anywho, I digress. It’s a job I did and will do for 2 more months, so 4 total. The amount is based on the market for this type of work, not someone’s salary for some other type of work that has nothing to do with what my proposal is for.

As far as the rest, I’m over defending myself today. If people don’t want to approve the proposal, that’s totally cool. But the work I did is clear and the core people voting on it should probably tell the community something.. like I don’t know, that I actually did it.

As far as the rest. There will be no more proposals for me. This ain’t a “2mth salary” that then will be repeated, it’s a contract work, that’s it. I did a thing, I’m gonna do some more things; that’s my proposal for the things I’ve done and will do. I also have no intention to take any rewards from the pool going forward and most likely won’t be posting other than updates. I’d rather take a backseat role as I feel no need to be a visual face in the slightest. No conspiracy.. and Rome is not burning.

The rest of my thoughts can be seen in the countless comments I’ve made today to counter some of the absolute bs being said. Each person can make their own decision.

As far as the rest of your post.. agree with many things that need to be improved and many are already working on them. Perhaps it’s confusing as they aren’t posting daily to tell everyone and get those autovotes, but work is being done.

Edit:

Oh and one more thing since your focus is first.. people not liking me (weird focus) and second “who should make more? Devs or public relations?” ... my proposal is not for more than the devs proposals, it’s for a shorter time frame. A few months rather than a year or more. So mine is for a specific job and not a full time salary.. so I’m kind of confused by your assessment here due to.. well math. How is $100k+ less that $30k?

And no proposals are guaranteed to be funded the whole time period. Partial funding is common. Stake holders just unvote it.

Wow, sounds like you are getting a lot of flak today.

Sorry for adding fuel to the fire.

In the long run, I think squabbling about $30k is a waste of time.

This platform is worth so much more than that.

I big part of me wants you to get the funding.

I honestly have no idea how much work you've done.

But I did watch that hour+ long video you did about the hostile takeover.

Obviously you put a lot of hours into this platform.

Stay frosty and sidestep them haters.

No, all good. Sorry if my response was a bit rambling. I respect and encourage questioning all proposals.. just the insults and accusations seemed a bit unneeded. Anyways, thanks for listening to me ramble and keep on keeping on 👍🏼

Just like to reiterate that I'm much more in favor of destroying the ninjamine than I am of blocking your proposal. Your proposal just brings the issue back to center stage for me personally.

I think it's cool that the network can even afford to pay people this much with 10% inflation. Hopefully we'll all laugh about this in a few years as the HPS is bursting with funding.

Also, I haven't heard anyone trash talking you for over a year, so I shouldn't have even mentioned that nonsense.

No one cares what us nutball conspiracy theorists think anyway.

I have some same thoughts about the ninja mine and hope we have a discussion about it soon. Just important to note my proposal, if funded at all, doesn’t come from the ninja mine. As you mentioned, the ninja mine is essentially “stuck” there until it’s converted somehow.

As far as the rest, I will fully admit I can be a total asshole .. am too blunt, get pissed off and say stuff I shouldn’t etc.. so people not liking me is understandable and I would never blame someone for it. I do think my actions should show my commitment to this place though and that my history does not show a focus on money or posting for autos etc etc. Just saying.. no issue with anyone disliking me, but I hope they at least can see my actions have been pretty consistent.

I make jokes that I have "mutual hateful respect" for the lot of the people around here.

In the end, we're all on the same team.

they I`s have it!

Lol is this the first time you've commented on my blog?

What are you doing here?

Gloating about the impending proposal acceptance?

That's a baller move.

:D

Pretty solid platform, and the only substantial disagreement I have with it is you are not actually proposing to destroy the ninjamine. I don't even see a practical plan to destroy the founder's stake (although such practical plan could be as simple as simply sending it to @null, so that's not much of a criticism), which is what you are proposing to destroy. All Steem, and thus Hive, was mined into existence by ninjaminers, amongst whom were @ned and @dan. Not sure about the details of their stakes, but apparently @ned and Stinc had mined up ~70M Steem, which on Hive has been stuffed into the HPS system, and that is what you propose destroying rather than paying @justineh for getting listings on exchanges with it.

Not taking a position on your proposal at all here, just pointing out that destroying the ninjamine would actually eradicate the vast majority of Hive in existence, leaving only that which was not mined into existence but created via inflation and paid out as rewards. Since a lot of folks have purchased that mined stake with fiat, I reckon that would be pretty despicable to do, maybe even criminal.

The only mined stake you express a desire to eradicate is that formerly held by @ned and Stinc, now stuffed into the HPS system. @berniesanders stake is actually not the target of your destructive yen, even though they ninjamined with the best of them.

I could not more strongly support your recommendation regarding 1:1 witness voting. It would be quite simple to implement, with a mechanism that has been tested for ~four years already. All that would be necessary is to deplete witness vote VP 100% and recharge it at 0%. Easy peasy. I also like the idea for witness downvotes.

I'd have used that feature more than once had it been in place.

Not a finance guy, so I'm not going to reveal my ignorance by commenting on your discussion regarding collateralizing HBD, although from what you describe the consequences of your proposals to be, I would strongly support acting to produce those effects.

We clearly do need to get in front of RC pools, before we have a massive problem to deal with during an influx of users during a moon event.

Not particularly sold on permanent vesting. Seems like that would create a new class of tokens, which would have far lower value since they couldn't be sold.

Documentation is absolutely necessary, as you point out. I find this issue linked to the founder's stake issue, and the question you raise as to how to incentivize development. That's what the founder's stake is supposed to be for, which is why we're here on Hive today and Sun has proved to be a scumbag destroying Steem.

I think it's a little ironic that you propose destroying that stake and in the same post lament the lack of developers annotating and creating improvements to the blockchain. Just as a thought experiment I wonder if you personally might submit a proposal to set out to document the codebase properly for a nominal rate of pay to be disbursed from the founder's stake, which you could destroy or whatever at your preference once you own it.

If you make a good case and suggest a reasonable rate of pay for your effort learning how the code works and spelling that out in the documentation you create, I'd be willing to vote for you to leave Amazon's employ entirely and become a full time autodidact. Hell, you could probably parlay that into a witness job before too long.

Thanks!

You really sound fucking whiny and pathetic.

You love drawing attention to yourself. Enjoy the consequences.

Project much?

I note you are capable only of making insults, and not rational, factual arguments regarding anything I've said. Until you have something worth listening to to say, Imma ignore your bitching.

You would get my vote as a witness.

I appreciate that.

Perhaps I'll bring enough value to justify it.

Damn, you cover so many things I'll need to keep coming back to sort through each point for the next week or so.

I would say that is a lot of my clique. I've never been a fan of hers, don't follow or upvote her. Despite that, and at the risk of losing some of my larger supporters I posted earlier advocating for her proposal. I won't rehash my post here, but I do think there is great value to what she accomplished, enough to risk losing some of my major support by acknowledging and advocating.

I will need to think some on your idea to shift stake inflation to savings inflation. It's a hard swallow as the purpose of that inflation is to ensure the under the hood holdings (vests) don't erode due to the inflation. While it's true that voting is higher than that loss, I'm not certain we would see such a transfer into those savings account to see an adjustment upwards of significance in voting power. An interesting idea and will require more consideration on my part (not that any position I hold will change shit, lol).

As usual, I appreciate your take on things. Just not used to so much to digest at once, lol. Hope you enjoyed your day off.

Honestly it doesn't matter if inflation erodes the value of vests a bit. We are building so much value here it makes up for inflation 1000%. Transferring the APR to the interest rates not only makes logical sense, but it also brings way more value to the network than it takes away.

Jeez ... you should of split this post :)

I have also made some calculations on the VESTS rewards and its around 2.9% with the current VESTS.

Its something I call hidden staking, that is absurd. If we offer staking rewards, then at least make them visible and attractive to people. Its so hard to calculate the staking rewards atm.

The VEST system is one more complication to this. Its totally different token/coin, with exchange ratio to HIVE.

The Hive Power actually doesn't exists .... its just readable VESTS.

Anyways, my point is if we offer staking reward, it doesn't need to be with a double token system, HIVE/VEST, hidden in the ratio of the two, that nobody is noticing or appreciating.

Make it daily rewards for staking with clearly visible transactions.

Yeah the TL:DR factor of this post is abysmal.

I should have done like 5 posts and then a summary post lol.

9

Posted Using LeoFinance

I vote to give her 30k even though I don't care to have Hive traded on huobi and Binance after what they did. I also vote to airdrop those who didn't get an airdrop. I also vote to burn the steemit stake.

I just don't think any NEW development or proposals I have seen are worth giving away all this HBD. I know it's only been 6 weeks, but that's probably long enough to write up some proposals. Most of the new proposals look like unnecessary backslapping to me. Highfive bros, we saved the Steemit funds for ourselves.

I'm worried about the future. Is this value?

I'll vote your witness.

At this point I'm more worried about 1:30 witness voting and feel like it will be very hard to get it changed to 1:1 because they want to be able to upvote each other to the top. There's a lot of stake voting that aren't witnesses or developers though so who knows.

Well there is that idea. Also, with 1:1 voting. A disgruntled group would only need to control 20% of the HP to have 4 witnesses in the top 20 and block any changes. I think voting for somewhere between 5 ~ 16 would make the most sense. It would require at least 25% to cause trouble and more than 51% to dominate Hive.

Your Witness has already started getting votes. Why not start a proxy to propagate your ideas? I'll vote for it too :)

Posted Using LeoFinance

Good idea. Although I don't know any witnesses who have actually come forward and share my ideals.

It was a long read, glad to see at least one person talking about the witness selection/retention process. Not real sure about what to do with all the ninjamine, I think a 25% reduction, (burn) to start with and see what happens. The HPS Proposals, well at least it is the community even if it is the top 1 or 3% that can control what gets approved, perhaps a slight correction to the vote process it has to make it more likely that it would take at least 23% of the voting population to vote a proposal in. Difficult times and choices to make in the future. It is good to see we are very close to cutting the strings to steem and will be able to move forward with out having steem issues trailing along in our wake.

I would definitely vote your witness.. you make a lot of valid points here that even a stoner like me can follow along for the most part

Defi is an idea I have thought about, not on this scale (didn't know it was called defi, to be honest). I just think there should be more investment options for investors while the social aspect of the blockchain develops( not directly linked to the financial aspect of the blockchain). There is so much this blockchain can be and it takes conversations like this and the willingness to implement new ideas. I will have to read more about defi. Most of the ideas I encountered in this post are new and it is quite difficult to digest in one sitting.

It's just short for decentralized finance.

DeFi.

You should break this down into several posts instead of putting it all into one. Hard to keep up with it all this way. Lot of good ideas on here. Some I agree with, some I don't. I do like burning the ninja mined stake though, that should be done ASAP.

As far as proposals, I think just about all of the approved (and going to be approved one) are being paid way too much at this point in the project's life cycle. While that work may be "worth" what they say it is somewhere else, this is essentially a startup and in startups people often defer taking salaries for years while they get the startup up and running. They don't take all the cash out of it immediately when it is available or it can kill the project. I think this should be treated the same way. Unless there is a proposal that can seriously pitch how it will create exponentially more value than it takes in, we need to be extremely judicious and conservative on how that money gets spent.

Yeah I knew it was too long but I just wanted to have it all in one place to start. I'll probably break it up and expand more on the issues... then I can create a summary post that links them all together.

I was actually thinking about this the other day. Imagine we pumped millions of HBD into a lottery fund for Hive. Lotteries can generate gobs of money so it would be totally worth it to spend huge overhead on the initial prize pool.

Sounds interesting... how would it work? I'm all for proposals that end up creating more demand for HIVE and thus help increase its price...

I'm more interested in gambling that is friction free and doesn't generate an income. Fair for everyone. Something like that would also bring massive generic value to the platform.

However, the way I am organizing logistics is to use the unhackable random numbers of Bitcoin as the seed that determines who wins the lottery.

In the case of a big prize pool anyone who won and got lucky would get a percentage of the lottery fund. Say if you win you get 25% of the fund. That way there is always a bunch of money in the fund no matter what.

There are some seriously amazing ideas (and math) in here!

Introducing a CDP system could be a game-changer and I love the idea of incorporating the savings/bank accounts that are sitting idle to help accomplish this goal. Having investors, invest a large portion in a banking account instead of voting power makes a lot of sense and could help to solve a lot of the issues we're constantly grappling with. Allowing investors to earn a higher return is something i definitely support and, theoretically, might curb a lot of the abuse.

It's a brilliant idea, and i've heard others put similar ideas forward but rarely are the mechanics so clearly laid out. Having the MakerDao/DEFI example as a functioning model of a CDP to bring greater stability to the HBD makes me believe that this could work to benefit the ecosystem in multiple ways including raising the value of the token by locking up HBD in the CDP.

I don't know how much work is involved and on what sort of time-frame from a technical standpoint but I hope more technically savvy people take a hard look at your ideas here.

I also think a priority should be to burn the ninja-mine or at least a large portion of it. I think the optics are bad, outsiders may perceive it as 'stolen', I'm sure there's a case for keeping it as it was the original intention but I think that maybe there are other more desirable solutions if we can come to a understanding as a community.

Overhauling witness voting is overdue.

Other chains are looking at what happened to Steem and are discussing ways to safeguard against future attack vectors.

We should be the first ones looking at this as we have first hand experience in a having our chain overthrown.

Voting 1:1 or 1-token-1-vote should be discussed in earnest, there maybe a few options out there but so far I would agree it appears to be the best solution.

There's really a lot here, thanks for putting these ideas out there.

I think you would make a great witness in the future!

*edit - One more thing I wanted to mention is that I think implementing a rotational backup witness reward, where not only the top 20 have a chance to produce blocks and earn rewards but perhaps adding another 20 backups (20top / 20backups) might be a function worth exploring that might help improve the calibre of witnesses and spread some rewards to additional contributors.

Yeah extra backups isn't something I've specifically thought of but it's very in line with where we need to go if Hive starts gaining traction and we can afford to spread the wealth around a bit more for extra network security.

As we see on Steem, the backup witness can really stick it to the network when they fuck up, because the backup witness is including blocks that contain frozen account transactions, this causes the chain to become unstable because the top 20 have to roll it back... this is exactly what they deserve to be honest.

There are many facets of the MakerDAO that we can skip or already have. For example, the biggest attack vector of CPD loans are the arbiters that provide the price feed. We already have these arbiters and a price feed.

MakerDAO has a nuclear option and they don't allow bad debt to exist (print more Maker to buy bad debt at auction). We don't have to do this. We can simply let the peg dip as we always have until the market bounces back.

We don't have custom smart contracts like Ethereum, but we do have smart contracts. This network already knows how to freeze/unfreeze stake (bank accounts). We already know how to create HBD (if the network will allow it).

I'd like to say it would be easy to implement but as you say we'd need someone with the technical knowledge of the platform and c++ experience to weigh in.

Holy crap dude I need to read this like 4 times. The 30k salary for 2 months work is insane.

Lol what can i say, is too late to absorb that insane amount of info, but you convinced me. I would vote for you as witness. I need to read more carefully all the post though. That idea for the inflation rate seems really intelligent to me. And I have to say that i was lmao with your comment about the realwolf in twitter.

Duh, almost forgot it, for me the recent proposal for the DAO is also exagerated. Burn the DAO why not?.

yeah it's a lot of info... ill be surprised if many ppl read the whole thing

But come to think of it, $30000 is quite much! Damn much for few months.

Well that is my opinion

You know what, I think you should get a witness. :)

Haha, its been a widely awesome ride with @hextech.

crazy stuff hasn't even started yet.

not even close.

Congratulations @edicted! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Vote for us as a witness to get one more badge and upvotes from us with more power!

You instantly would get my vote!

I only disagree with @Justineh, to be honest, I do not know how much work it was, but it only matters how much value it brought and I think this is much more than 30k, though I cannot number the amount exactly. Anyone who brings in significant value should get a proportion of it, don’t matter if it took one day, one week or six month.

"And saying, The time is fulfilled, and the kingdom of God is at hand: repent ye, and believe the gospel."(Mark 1:15)

Question from the Bible, Do you believe that the Bible is the complete and final word of God? [Part 1 of 4]

Watch the Video below to know the Answer...

(Sorry for sending this comment. We are not looking for our self profit, our intentions is to preach the words of God in any means possible.)

Thank you, our beloved friend.

Check our Discord Chat

Comment what you understand of our Youtube Video to receive our full votes. We have 30,000 #HivePower, It's our little way to Join our Official Community: https://peakd.com/c/hive-182074/created

Why do you hate God so much that you drive people away from Him by spamming this constantly, turning that love letter into an annoyance and bother to folks not looking to invest in reading it in the places or at the the times you spam it?

You should know there will be consequences to you for driving His children from Him. You must be some Luciferian or Satanist.

I rebuke you by the power God grants his righteous children! Go, and sin no more.