Ripple has started to attract much interest from investors as well as pre-codec enthusiasts in the past few months. Since its launch in 2017, Ripple has consistently established many partnerships with the world's largest banks.

Currently, Ripple has cooperated with 120 banks. The list includes big names such as Santander, American Express, Westpac, Seb, UniCredit, transferGo, Yes Bank, BBVA, CIBC and Western Union.

The surprising thing for most pre-coders is that no bank uses XRP (the original token of the ripple). Out of all these partnerships, most of them still take advantage of the current ripple-based service called xCurrent.

xCurrent is a product that makes communication between users and banks as well as payment services much more effective. The task of the ripple is always to improve the overall speed of payments and cross-border transactions. With the release of the latest Ripple technology, xRapid, the company hopes to make the blockchain technology more reliable and enable cross-border transactions to be faster.

Sending money abroad through banks can often take several days and cost you a lot of money. xRapid was developed as the second stage of the ripple expansion, and it aims to make XRP a token for all banking partners of ripple.

What is xRapid?

xRapid is the latest product of Ripple, and it represents a big step forward in the development of the company. The main objective of xRapid is to improve the xCurrent system by making transactions cheaper and faster with XRP token as the central pill to solve the problem of money transfer.

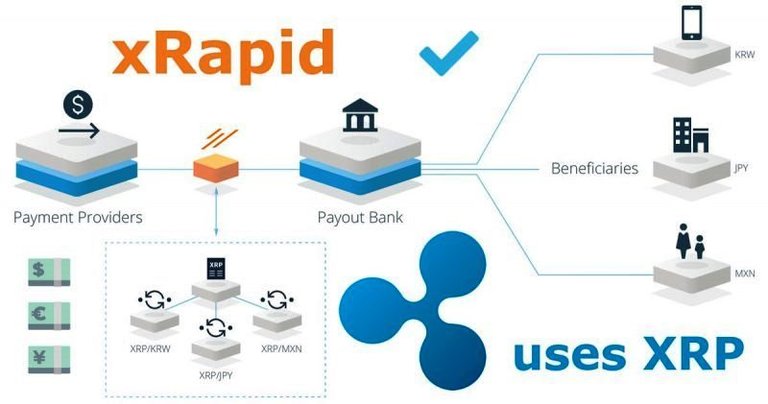

To streamline the process, Ripple plans to use XRP as a "bridging" currency. To explain exactly how xRapid works, we will use a real example. Let's say a person from any European country wants to send money to someone else in Asia. Through traditional banking system, the time and cost of transferring money will be great.

With xRapid, the remittance is almost instantaneous and at almost zero cost. The first person transfers money by converting it to XRP then it will be automatically converted to the currency that the recipient in the Asian country requires.

xRapid whether to represent the future without borders?

For a depositor through a regular banking system, from one country to another, a nostro account will be required (Bank A's account opened at another bank B). These nostro accounts are pre-funded with millions of local currency, to improve liquidity. Liquidity is one of the most important aspects of any successful forex trading platform. Banks also need a good level of liquidity to operate effectively.

By means of a regular money transfer, the amount deposited from the first person in Europe (ie above) is then exchanged from one currency to the next through the sponsored nostro accounts. before. Banks often have local nostro accounts for any currency to facilitate cross-border payments. As mentioned before, these types of nostro accounts are very inefficient.

Ripple is geared towards persuading banks to change or replace these nostro accounts with encryption, specifically with the XRP token. This eliminates the need for specific bank accounts for each type of foreign currency, thus making the system not only safer but also much more efficient.

Is it easy?

The simple answer is almost no, not easy at all. Currently, Ripple is trying to convince its partners to test this new technology, as most of them are still using xCurrent. According to reports, many partners have begun testing new products and early research shows that they have reported savings of about 40-70%.

The company intends to expand its reach and xRapid will participate in major banking systems by the end of 2019. Of course, easier said than done, mainly because not all banking institutions They are using blockchain technology. If this strategy succeeds, this would be a great thing for simple ripple because XRP tokens will be used more, XRP's daily trading volume will also likely increase dramatically. This will definitely make Ripple a "face" company in the field of coding encryption is competitive and exciting.

Conclude

xRapid is a big step forward for the ripple, as well as for the future of cross-border transactions. This system uses the XRP token to provide on-demand liquidity, minimize costs and improve transaction time.

xRapid has the ability to fully address the issue of payments in emerging markets, which require pre-approved local currency accounts. This can completely come true as long as cc banker's ripple is willing to give it a chance. So far, it looks like everything is going according to plan and the ripple is quite optimistic about expanding its service in the future.

Thank you for viewing this article of mine. If I see or upvote I have more motivation to share more