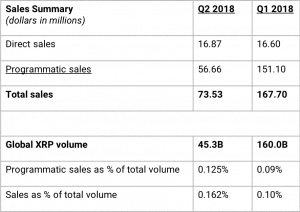

Ripple sells $73.53 million in XRP amidst low volatility in Q2 2018

$73.53 million XRP sold

Ripple sales volume accounted for 0.125 percent of global XRP volume

Three billion XRP released out of cryptographic escrow, 2.7 billion XRP returned to escrow

In Q2 2018, the company sold $56.66 million XRP programmatically. This represented 0.125 percent, or 12.5 basis points of the total XRP volume traded globally in the second quarter.

In addition, XRP II, LLC — a Ripple subsidiary that is a registered and licensed money service business (MSB) — sold $16.87 million XRP in direct sales. In total, the company sold $73.53 million in Q2.

XRP was notably less volatile in Q2 and XRP’s 9.0 percent price decline was in line with bitcoin’s 8.2 percent decline. Despite the tepid environment, the company’s XRP sales proved to be a drop in the bucket of an XRP market that traded $45.35 billion.

Q2 Escrow Activity

In Q4 2017, Ripple locked up 55 billion XRP in a cryptographically-secured escrow account. Due to the lockup, Ripple has access to only 13 percent of the total XRP in circulation.

In Q2 2018, XRP was again released out of escrow. 3 billion XRP was released out of escrow (1 billion each month). 2.7 billion XRP was subsequently put into new escrow contracts.

The remaining 300 million XRP not returned to escrow is being used in a variety of ways to help support the XRP ecosystem.

New Entrants

Q2 brought several significant new entrants into the XRP ecosystem, such as Coil, a new venture led by Stefan Thomas that will use XRP for various micropayments applications, such as facilitating “bite-sized” purchases of media.

Additionally, Scooter Braun, entertainment talent manager, entrepreneur and founder of SB Projects, is pursuing several endeavors that will use XRP to improve artists’ ability to monetize and manage their content.

Both of these new entrants have support from Xpring, a new initiative by Ripple that will work with companies and projects run by proven entrepreneurs that are building out the XRP ecosystem.

Market Commentary

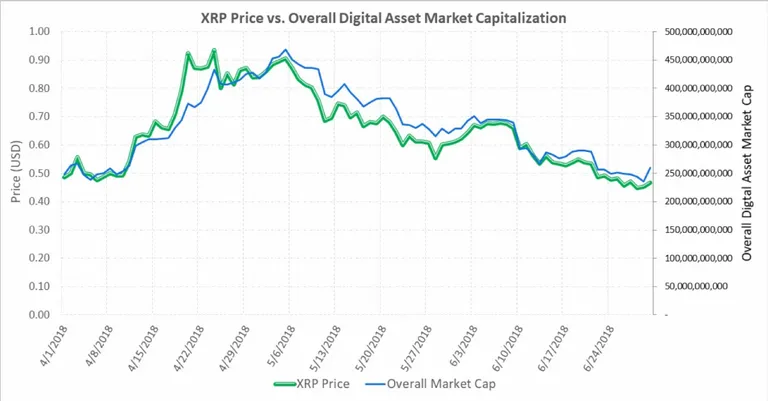

The total market capitalization of all digital assets started the year at $603.7 billion but by mid-year — despite the issuance of hundreds of new ICO “coins” — had declined to $254.7 billion.

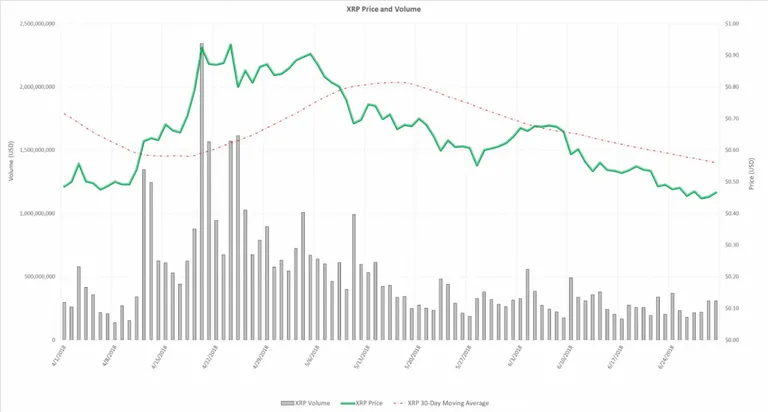

During Q2, the XRP market also slowed considerably, compared to the prices and volumes we saw in Q4 2017 and Q1 2018.

This slowing could be attributed to the ongoing concern around regulation, both in the U.S. and around the globe. Despite the SEC announcing in June that they don’t consider ether a security, there wasn’t a meaningful and sustained bump in volume or price of any digital asset, including XRP.

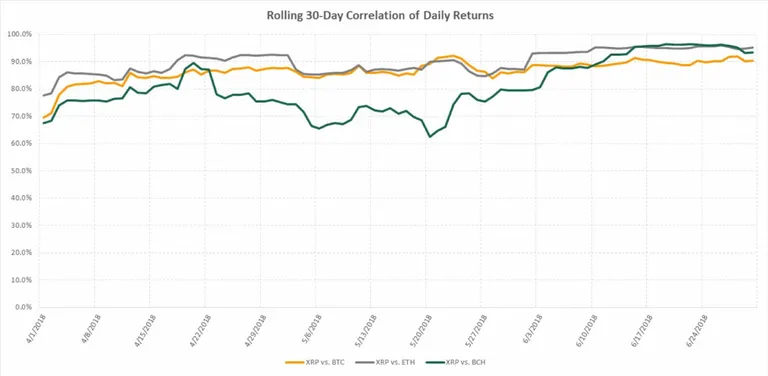

The decline in both volume and price was consistent across the majority of digital assets, as many moved with tight correlation.

The tight correlation is indicative of a market that is still in its infancy. Traders have yet to distinguish among the intrinsic values of the best known digital assets. As the industry matures and decides what it deems most useful and valuable, we should expect to see more separation.

When we drilled down further to specific assets, we saw some slight variation. XRP performed in line with bitcoin (-9.0 percent vs. -8.2 percent), while widely traded digital assets ether and bitcoin cash outperformed, up 14.8 percent and 9.3 percent.

It’s also important to note that despite Ripple having its best quarter ever in Q2 — in terms of customers signed — XRP’s price continued to decline with those of other digital assets, underscoring XRP’s independence from Ripple.

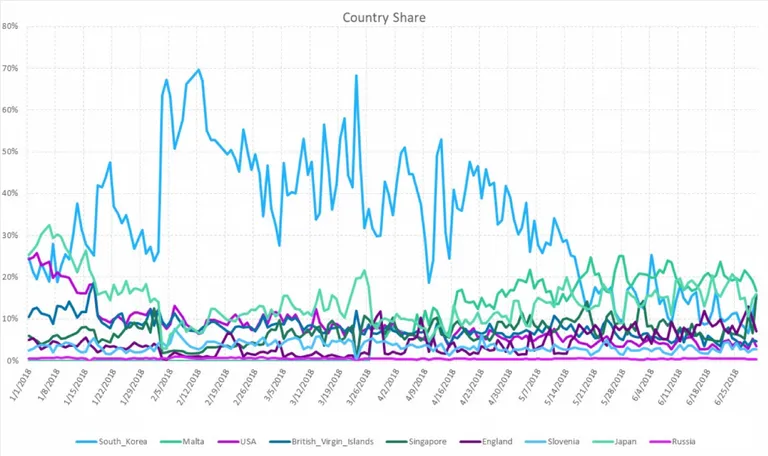

Also notable in the contraction of the market was the lessening influence of South Korean trading. South Korea had dominated digital asset trading, on some days accounting for nearly 70 percent of global volume. But by the end of the second quarter, South Korea’s trading had fallen to fourth in global share. Several prominent exchange hacks in South Korea, along with overall fatigue from traders, may have contributed to the recent fall.

Speculative traders drove volatility to 13.8 percent in Q4 2017, but as retail investing in digital assets subsided in Q2 2018, XRP volatility also abated — falling to 5.7 percent. It was the lowest volatility XRP has seen since Q4 2016. The highest XRP volatility, as it happens, was not Q4 2017, but Q2 2017 when XRP volatility hit 22.3 percent. The decline in volatility was accompanied, chicken and egg style, by a decline in volume.

That lower volume notwithstanding, a number of the largest firms in finance made a series of announcements about moving into the space:

Goldman Sachs announced plans to start a digital asset trading desk.

JP Morgan named a head of “crypto-asset strategy.”

Nasdaq’s CEO Adena Friedman said it would consider becoming a crypto exchange.

Fidelity said it was building a digital asset exchange.

Nomura became the first bank to offer custody services for digital assets.

These announcements are nascent efforts but seem to indicate widespread interest in digital assets from the largest names in finance. However, it’s important to note that these are announcements — they have yet to lead to meaningful institutional crypto trading. Nevertheless, it’s clear that financial institutions are beginning to build crypto divisions and establish technological solutions to take advantage of the opportunity at hand.

XRP II, LLC is licensed to engage in Virtual Currency Business Activity by the New York State Department of Financial Services.

Correction: An earlier version of the post stated that total sales of XRP was $75.53 million. This was not accurate. We have updated the post to reflect the correct number: $73.53 million.

Here are my previous blogs:

https://steemit.com/xrp/@blk007/xrp-first-pilot-results-for-xrapid

https://steemit.com/etf/@blk007/etf-coming

https://steemit.com/xrp/@blk007/xrp-first-pilot-results-for-xrapid

https://steemit.com/bitcoin/@blk007/where-is-bitcoin-heading

https://steemit.com/cryptocurrency/@blk007/ripple-effect-future-of-xrp

https://steemit.com/electroneum/@blk007/today-s-big-news

https://steemit.com/billionaire/@blk007/kylie-jenner-joins-billionaire-club

Disclaimer:

This article should not be taken as, and is not intended to provide investment advice. Please do your well informed research before taking any investment decision.