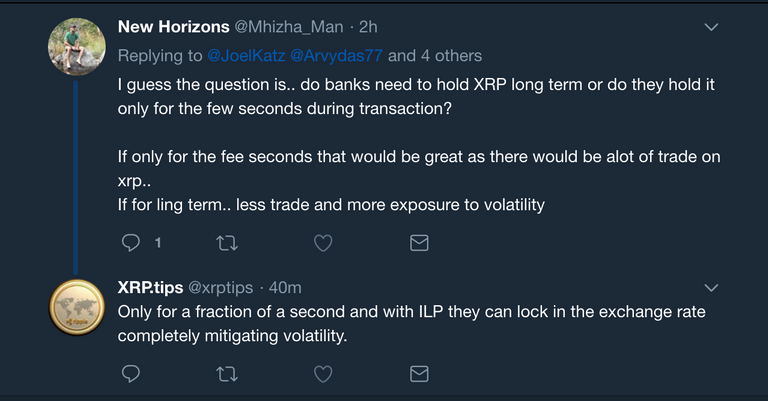

Think of XRP “like the oil you put in [a car] engine”, says Greg Kidd, Ripple’s former chief risk officer who runs Synthetic Liquidity, a liquidity provider that is trialling XRP by moving small amounts. Banks “really shouldn’t need that much”, he adds.

Kansas-based CBW Bank was one of the first partner banks announced by Ripple in 2014. But Suresh Ramamurthi, CBW’s chairman, says it has shelved plans to use Ripple’s systems until regulatory guidance is clearer.

western union to announce ripple partnership.

February is going to be a big month for @Ripple and $XRP. pic.twitter.com/T27CL14zrq

January 20, 2018— XRP.tips (@xrptips)

Earthport's network gives businesses unparalleled transparency into costs and settlement time for making international transactions. The Earthport Distributed Ledger Gateway transports the funds through the Ripple protocol to record the transaction and leverage its prefunded accounts to provide instant liquidity and the best FX rate. The beneficiary then receives the amount in near real-time.

In addition, Earthport allows banks to connect to the Ripple network without having to establish their own infrastructure. This solution brings best-in-class AML monitoring, sanction screening, transaction monitoring and KYC tools to enable compliance control. Banks that still use legacy formats will be able to send and receive over the distributed ledger, with Earthport managing format transformation.

link