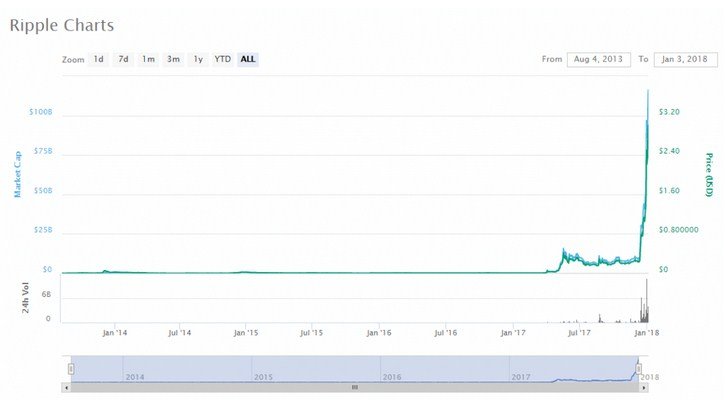

In the course of recent hours, the cost of XRP, Ripple's local token, has expanded by more than 24 percent, to over $3. The market valuation of Ripple expanded from beneath $95 billion to $116 billion, additionally separating itself from the third most important digital money in the worldwide market, Ethereum.

Of course, the every day exchanging volume of XRP is intensely gathered in the South Korean market. Korbit and Bithumb are handling 40 percent of worldwide Ripple exchanges, representing more than $2.2 billion of Ripple's day by day exchanging volume.

On Bithumb, the second biggest cryptographic money exchanging stage on the planet situated in Seoul, South Korea, Ripple stays as the most exchanged digital currency, recording an every day exchanging volume that is three times bigger than that of bitcoin.

In spite of being the biggest and most fluid Ripple trade advertise, XRP is being exchanged with a high premium inside South Korean digital money showcase. On Bithumb and Korbit, Ripple is being exchanged at $3.5, with a with a 12 percent premium.

Swell has likewise begun to increase some prevailing press scope, with news productions exhibiting their perusers how to buy, store, and send Ripple easily. Such increment in scope of Ripple by the media and dread of passing up a major opportunity (FOMO)- driven South Market's push has enabled Ripple to accomplish new unequaled highs and maintain solid force.

Brad Garlinghouse, the CEO at Ripple, which is in charge of the improvement of the Ripple blockchain organize, expressed that the "genuine utilize case" separates Ripple from other computerized resources.

"Made up for lost time with Joel Comm and Travis Wright on Bad Crypto about Ripple and how its genuine utilize case separates it from other advanced resources, why Ripple is the most productive answer for cross fringe installments," said Garlinghouse.

Be that as it may, as with some other cryptographic money, Ripple was met with some feedback. Prior today, on January 3, P4man expressed that the vision of Ripple to develop into Swift 2.0 isn't sensible, on the grounds that all together for the Ripple system to end up noticeably a Swift-like system, banks should pick up control over it.

"With respect to the moonshot of supplanting Swift; most importantly, I exceedingly question a worldwide agreement convention is the correct approach and could even scale to that level. Yet in addition, banks as of now control Swift. How likely is it they would give up control to a little startup and enable themselves to end up plainly indebted to its private cash, that they have no requirement for?," P4man wrote in a blog entry distributed on Coindesk.

Swift 2.0

It isn't conceivable to put a market valuation on the Swift system, given that banks have responsibility for and it is the foundation of the whole worldwide keeping money framework. Yet, similar to the New York Stock Exchange, on the off chance that it was esteemed as an organization or a venture, its market valuation would be in the trillions.

Basically, the present market valuation of Ripple originates from the aggregate addressable market, given the preface that Ripple will some time or another have the capacity to overwhelm Swift and advance into a multi-trillion dollar showcase.

Similar Articles:

Add up to Crypto Market Cap Hits New All-Time High Over $700 Bln https://steemit.com/cryptocurrency/@ultraspace/add-up-to-crypto-market-cap-hits-new-all-time-high-over-usd700-bln

XRP (Ripple) - What You Need To Know [Review] https://steemit.com/xrp/@ultraspace/xrp-ripple-what-you-need-to-know-review

Russian bishop condemns cryptocurrencies [Opinion] https://steemit.com/bitcoin/@ultraspace/russian-bishop-condemns-cryptocurrencies-opinion

Ripple to the MOOOON!!!!!

yes is right :)

This blew my mind when I saw the uptick in XRP this morning! This is great to see the cryptos causing such an increase in prosperity with investors.

One thing I feel that Ripple has over Swift is the simple fact that Swift still relies on wires, paper, and humans. Transactions are painfully time consuming, and in today's day & age, the advent of the blockchain is going to save billions (or even trillions) of dollars each year in human error, labor hours, and kick cronyism to the curb. Thanks for posting, @ultraspace!

yes i agree with you and thanks for reply