Bitcoin and most cryptocurrencies are tanking today, possibly on news from China suggesting an even stricter crackdown on ALL centralized cryptocurrency trading, beyond the stances they've already taken against ICOs and exchanges. Furthermore, there are speculations over the Chinese New Year and typical January lulls contributing to the fall.

While I am skeptical over the idea that prices are seasonal, I do think this is a strong opportunity. For those of you who missed out on being able to buy Bitcoin back when it reached $10k back on December 22nd, this could be a good time to scale more cash into the market if you generally keep a cash position in your portfolio. Personally I won't be adding more as I already scaled my position comfortably back on December 22nd and don't plan on buying more Bitcoin til it goes to $10k or lower.

Generally speaking, I still prefer Bitcoin over altcoins. While it is unfortunate that it is currently looking like Bitcoin will retake its dominance on the downside rather than the upside, I still find it to be better exposure for the crypto market in either direction.

On the topic of whether or not the bubble is popping, I still suspect we have a while left and there are plenty of speculators (ahem, "investors") waiting on the sidelines for "cheap" Bitcoin. While I still think Bitcoin is a bubble, there is plenty of room for it to grow and both retail and institutional investors are waiting for better entry levels to ride the hype. Naturally it's always possible that the bubble is popping, but my thoughts (for now) are that we are still on board to see higher levels.

As such, if we see Bitcoin decline further from here, I will continue to shift more funds into it especially if we see it reach $8k (a level that many people are watching). In the event that this ends up being a more sustained downtrend, I would be ready to pick up more at lower price levels.

What are your thoughts on this current price movement? Do you think it will continue or it is shortlived? Thank you for watching as always.

There is no more room for emotional state of mind and cryptocurrency on the same bus. Cryptocurrency fluctuates and breathe like a set of lungs. When crypto inhale get ready for your investment to Skyrocket and when markets exhale , look out below because cryptocurrency is not for the faint at heart and it's obvious at this point, cryptocurrency is just experiencing exhaling and as the markets get ready to bounce back before the next round of shorts starts ,before ultimately traders who are trying to drive down the price back to five or six thousand USD are finally going to be happy before they can open up a new series of Long's, well what are you waiting for? lets go ;p

God bless crypto currency, God bless Steemit and Cryptovestor, keep up the good work, we love the blog and videos!

Well I get emotional when this stuff happens - it's just a different emotion from most: Excitement!

Hope you are well brother.

I felt both, excitement and terror. That's an improvement, during the Xmas correction I just felt terror!

although, even pro panis when graphs deeps hahahahaha

Bless you both!100% agree with you @jazminmillion Thanks for this wonderful insight @cryptovestor

This may just be a precursor. In all honesty we may see a slight recovery in the next few days with a lot of sideways action leading up to the Jan 24-25 date before another major dip occurs (possibly towards the ~$7800 BTC level). The good news however is that IF this happens I expect it to hit the floor quite hard and bounce back up settling around the 10k mark for about 2 weeks before starting to rise again to the ~$13,800 level, which if it passes would become a new support floor which would act to hold the BTC price above this level going forward where we could then continue our climb back up towards record highs in the weeks/months following that. With all that said I have a feeling that many of the alt-coins without a lot of substance (aka shitcoins) may not survive this one very well and may never recover back to their previous highs (BTC will, good alts will, shitcoins likely won't).

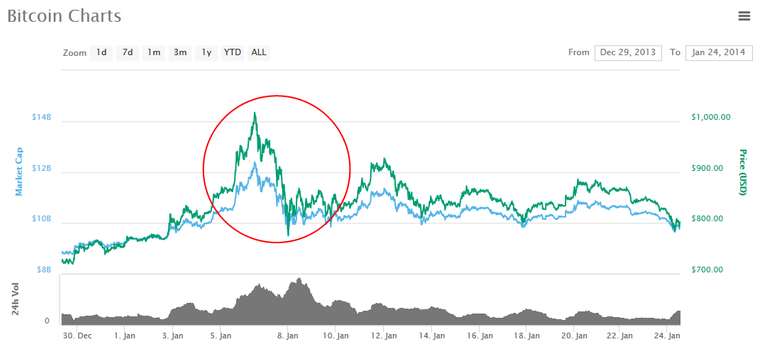

Starting Jan 7, 2014... BTC crashes -23.13% (24 days before Chinese New Year which was Jan 31, 2014)

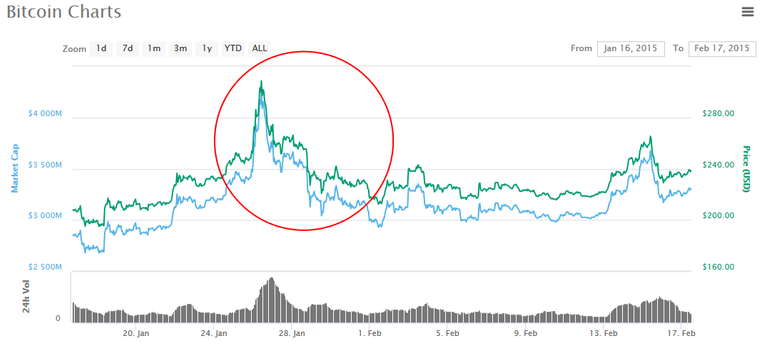

Starting Jan 26, 2015... BTC crashes -32.35% (24 days before Chinese New Year which was February 19, 2015)

Starting Jan 15, 2016... BTC crashes -24.19% (24 days before Chinese New Year which was February 8, 2016)

Starting Jan 5, 2017... BTC crashes -35.39% (23 days before Chinese New Year which was January 28, 2017)

Starting Jan 24-25, 2018... will BTC crash 25-35% to continue the trend??? (23-24 days before Chinese New Year which is February 16, 2018)

I would personally be quite hesitant to get into the market at the current time, as you may very well be better off waiting ~1-2 more weeks before making any new positions in the crypto space.

Just my 2 Satoshis...

I like astrology too, it fits so well within all the China FUD, Year of the Dragon wise...

Indeed, I think it is almost a rule that as soon as some pattern is observed, it disappears.

In general that's true, but for many years strategies like seasonality (e.g. Stock Traders' Almanac) were popular and even profitable. Eventually all that inefficiency disappeared.

The crypto space is much less efficient than the stock market so we're probably seeing the same pre-Chinese New Year dip again.

Good point, with less regulated markets like the crypto space these tend to happen. I just tend to be skeptical of these kinds of analisis is all.

It's good to compare past patterns as these are often co-generated by algos, and you can see their typical buying and selling patterns in the wave structures... we do have a completely different situation than last year now though.

It is definitely strange, but after a while such effects stop because they really don't make ANY sense at all. For example, do you think this would have happened if we got exceptionally good news on Bitcoin today instead? I think it's more correlation than causation, although it is acting a bit like a self-fulfilling prophecy.

What are your predictions for next week, month. I am about to get in, and I am very excited, I just dont know what is the best time, tomorrow or for week or two, or to do it in parts?

Any thoughts on why this patter occurs 23-24 days before Chinese New Year ? Do they usually pass regulations on the start of the New Year or it's just the psychology of the investors ?

That's worth at least 200 Satoshis, @budz82 ;)

Excellent... Thank you and god bless you...

History doesn’t repeat itself but it often rhymes.

Well played budz82, let's hope you're right.

I'll load up just to make sure it drops…

I like watching the order book for positions of intense concentrations of limit orders. The buy on the spike.

Be weary of comparing and "forcing" patterns with crypto charts.

The market is different every month, and the reasons for flash crashes are different every time. That's not to say the same types of events don't catalyze such crashes, just that the reasons behinds those events are different every time!

post your videos to dtube.

He will when YouTube no longer works, otherwise there doesn't seem to be enough incentive to mirror onto dtube. You'd have to make the case that he would benefit greatly from doing so.

I literally can't right now without a bit of hassle.

Similar fall last Jan. with some trend differences:

https://steemit.com/bitcoin/@ka82/comparison-of-bitcoin-price-trend-dec-to-jan-in-2016-2017-and-2018

Everybody's talking doom on the threads, so this is what we might call a "Warren Buffet Situation" - time to buy.

What fools! You'd think they learned by now. However, today's price compared to the price when the futures markets got in makes me giddy just thinking about what must be going through their minds.

That might be true if cryptoassets were fundamentally undervalued, but since that's not how they're priced, we have no idea whether to be fearful or greedy.

Totals ;p

What we are seeing is a short squeeze power move, weak hands need not apply!

Yep - how I tend to see these types of events.

I completely agree. Price of BTC is like rollercoaster, you only need to know if you are on top of the tracks or at the bottom. A lot of people got hyped when BTC was $19k+, and that was clearly the worst time to invest. That is why a lot of people are negative about Bitcoins and cryptovalutes in general.

Yes. resentment because they got caught on a bad FOMO run, and now they need to get back at SOMETHING to work off their auto-aggression - that something is Bitcoin, so Bitcoin is being punished right now, for non-deliverance ;)

Historically bitcoin has reached the 100 day moving average. Use that as a guideline!!!!!!

Can you explain a bit? Does that usually indicate a bounce?

In these bubbles you want to buy on the dips when it drops to the 100-day or 200-day moving average.

Trends tend to repeat themselves. Not to say that it is a guarantee but a very likely possibility that we will see price hit the 100 day MA and bounce back as shown in the above examples, ESPECIALLY since we haven't seen a dip to that yet ever since the "crash" from 19k USD.

I personally believe that the bubble will take a few years to pop. This is just dumb guessing, but I based that on the huge potential of this bubble.

Then internet bubble of 1999 reached 6 trillion dollars. This was United States ONLY bubble. Crypto are open to the world and some markets are getting crazy, especially in Asia. If coinbase and exchanges open the doors for the middle east, I believe it will get crazy too there. A worldwide bubble has at least 50x the potential of a US based bubble. Therefore 50 x 6 trillion = 300 trillion.

And it doesn't stop here. Internet bubble was still seen as 'stocks', not many people are familiar with stocks, some people didn't care about investing at the time. If I was in the US in 1999, I wouldn't have bought any internet stocks because I didn't look at markets or trading. However, cryptocurrencies brings a lot of people in, who would never have invested in traditional stocks. I am one of those people. I only invest now because I liked the idea of bitcoin a few years ago, and this is what brought me in. I see legions of 18-20 year olds who are rushing into cryptos. I don't think it would have been the same for internet stocks.

That said, the crypto bubble has even more potential. Will it go to 500 trillion? More? In any case, it's going to be huge gains if the coins we picked don't die.

I don't really think it's that fair of a comparison though - A lot more capital and liquidity in stock markets. Crypto is still too wild west for it to have such insane amounts of capital. We'll see though, should be interesting. I agree we're not at the end yet.

Thanks for the post!

I haven't been this excited for a long time. Ready to pick ore btc up somewhere under 10000.

It has been interesting to see all this activity during the last few weeks with alts, but it will be more interesting to see what comes of the new coins that have gained dominance now that the market has turned, it might tell us if they are truly going to be around for very long.

I think the communities that react the least to this type of event might be some of the same ones that wil be around the longest.

Something to keep an eye out for.

I definitely noticed that as well. The highest quality names in my crypto portfolio are down the least or even up vs BTC. Mid-level names are down 10% vs BTC. The junkiest low-priced crap that I was fortunate enough to jettison last week is down 20-30% vs BTC in the last day or two.

My last BTC transaction took 5 days. No more BTC for me unless you ant to send me some. LOL!

▶️BitMEX ◀️

This was a freebie given to me by Elliottwave International issued on 4th Jan. Not looking a bad forecast at all as you view it now.

This great and typical January downward price action. Remember the last time there was a drastic dip and we hit high 10s and low 11s and I hoped for $8.5k and people thought that was scary and too indicative of a bear market? That is the indicator of fear and panic at certain times of poor perspective, and that was just a few weeks ago. Now we can call for $8k and smile about it, hopeful for an opportunity instead of being fearful.

I tell everyone and everywhere that this dip is good! Unusual or stupid it seems, but if you think about it, you will know, that it is true! This is a great opportunity for new people get involved with crypto, and for those who have experience a nice time to buy more.

All in all. HODL!

Hi Cryptovestor,

I definitely think Elliott Wave is worth gaining a rudimentary understanding of and even more so, the Fibonacci retracements. Let me explain.

In 2000, I first became interested in trading stocks and shares - the dot.com boom and bust. At first I couldn't help but make money each day, but then as a newbie, I was taken to the cleaners, when the bubble burst. It was an ugly and painful process that taught me a valuable lesson.

From there, over a period of 12 years, I moved into trading just six FX pairs and occasionally gold and crude oil. My trades were all derived from technical analysis (charts).

I used many different indicators on candlestick charts, as well as Fibonacci retracements and extensions and Elliott Wave counts. I viewed monthly, weekly, daily, 4 hourly, hourly, 30 min, 15 min, 5 min and even 1 min charts for each of the six currency pairs I traded.

Buying and selling pressures change according to which time frame you view. A strong selling situation on an hourly chart maybe running into an even stronger support level on the 4 hourly and daily chart. You just needed to be aware of the fractal nature of buying and selling pressures to determine the dominant ones at play in the moment of taking positions.

Remaining calm and detached is necessary quality of a trader. Streaks of winning might convince you that you have cracked this market thing and that you are invincible. That is a poor mindset for your trading account. So too is holding off a trade when your signals say “go”, but your last 5 Losers tell you to sit this one out. You need a strategy and a low enough account exposure per trade so as neither to worry you, nor bankrupt you. I set a limit of 1.5-2.0% maximum fund loss per trade.

Decide your entry point and your stop loss level, so you can set your trade size in two parts. Set your first and second targets. If the first target is banked, move your stop loss to your entry level, so it cannot lose and let it run to the second target, or stop out with neither a loss or gain on the second half.

My view is we are going to be correcting the entire move up of the 2017 rise. That is where you need to place your Fibonacci retracements - the starting low to the high.

Still not a fan of EW or Fib, but I know a lot of people use them with great success so I try not to criticize too much. I still think there are more losers than winners among those who try, but there are very clearly some people who consistently win so I can't talk it down definitely because I never know who those winners are beforehand.

Delayed, so free report from Elliott Wave Interactive.

The amateur can sometimes see a clear 5 wave pattern as on last year’s Bitcoin price action. It can just alert you to the idea a change of direction is close.

https://ewminteractive.com/bitcoin-bloodbath-ten-days-making

You are correct in terms of fundamental analysis, however, you are missing one key factor that differentiates this market from traditional stock/forex markets as you mentioned in your experience. There is ample exuberance in this market as proven time and time again. Just as you think it is about to end, a bullish run hits your right where you least expect it (I got burned when the market "crashed" from 11k-9k as I, just like you was expecting the same thing). Be careful my friend, this isn't your typical market.

Thanks, but I am no longer a trader. Too many hours sitting watching screens, eating badly caused me some health issues. I buy and hold, occasionally skimming gains these days. All my money in cryptos now is profit, no original capital.

Great to hear. Congratulations!

Hey cryptovestor, thanks for the video. You are one of the main sources for me to stay cool during this dip, well actually be sensible and excited about this. I "invested" for the first time mid December, so right during that massive influx. Needless to say I am a total newbie. I just put in some more into BTC as well as ETH since prices went below 10k. Just to clarify: I'm 24 years old and had a bit of gambling money on the side, that I can afford to lose.

I just entered all of my trades into CoinTracking (oh god, what a tedious process). In EUR my total unrealized/realized gains and losses are 12.75% down. In BTC however, it shows a solid 18.95% positive change. If I understood you right, BTC should be the benchmark in order to judge my own investments.. I own 16 coins, rather diversified. I do not attempt to daytrade. I really try to do my own research and avoid FOMO where I can. Could you tell me if I'm on the right track here? Keep up with the good stuff, you're the voice of reason here. ;) Cheers.

Great video.

I really hope it tanks more. I love to collect a little bit of every coin and i was holding of waiting for something like this. I really hope ETH drops even more so i can get some and round the numbers in my wallet. Keep in mind im actually investing pocket change and not something that might ruin my life. Hearing about people selling their houses/cars and buying any cripto hoping to get rich makes me feel sick.

Also i see a lot of people going mad during this drop. My portfolio dropped like 3-4 times and i feel fine because its STILL BETTER that it was in December last year!

Thanks for the high-quality information! Following you since early autumn and confirming that you bring a lot of value to cryptomoney holders!

My idea is that the money in cryptocurrency market is about to migrate from altcoins and Etherium back to Btcoin. Here is one idea of correlation between ETHBTC and BTXUSD charts. Also the corrective wave pattern is not clear for now.

In my opinion, BTC is going to strike back quickly. Here is one more point of view Here is one more point of view to support it from the time axis perspective.

Waiting for new videos! Thank you CI! Great job!

Thanks a lot for sharing about bitcoin...I gain knowledge about crypto...Thanks for sharing...

The sky is falling! The sky is falling! NOT!

Don't you think that lightning network will be a big disappointment when the people will realise that hubs are actually just banks all over again and that will shift attention away from bitcoin even more?

2 years is to few... there is no mainstream adoption yet of crypto... the buble will pop after your mom and grandma get crypto

I hope that this prediction comes to life. reviewing the history, btc always fell during dec to jan and I am looking forward to that to add more investments. I already missed it 3 years ago, I don't want to be left behind anymore..

pretty scary situation. There is around $150K billion out of the market. The news seems to push BTC down to even $6000K. I would consider buying BTC when price is around $6000.

Question. How can China ban bitcoin if they mine most of it?

They're banning mining: https://www.forbes.com/sites/sarahsu/2018/01/15/chinas-shutdown-of-bitcoin-miners-isnt-just-about-electricity/#11382fc6369b

The Lightning Network is here, the LN Wallet is also here, there are businesses that accept LN transactions already. Just a bit more of a push in that direction can drive the price action. It can take time, even a month or two, but we are on the right track to get there. 25K btc is very real, and I see this spring as a timeframe for this move.

Bet you wish you hadn't canceled that $17K sell order. I did sell at 17k, but took most of that money off the table. Still I've got cash on the sidelines and have made four small buys on the way down. I'll go all-in circa 9K.

While it does look like the alt coins have lost relative to BTC, BTC dominance is still under 35%. So while having rotated out of alts into BTC means slightly less pain now. A portfolio with significant alt diversification might yet prove advantageous.

BTC is already down 40% off it's high. While I agree with you that I expect support to show up no lower than 8k, with tremendous upside potential on the bounce, the possibility that the bubble is popping now looks more and more likely the lower it goes.

Hi Crypto Investor! Great post! Since you say that you have cash on the sidelines to invest if Bitcoin goes below $10K or $8K, it would be very helpful for us to know how many percent of your portfolio you currently have in cash, and at what price levels you would deploy that cash, and when you would be 'all in'.

I've been slowly building a long-term crypto portfolio over the past three months, and I have invested about 50% so far. So I'm looking forward to the price declining further so I can deploy the rest. But the eternal question is at what levels to do that. Hopefully this not the beginning of the bubble popping! :-)

It's a mere price correction from the around New year hype I think. I might have actually mentioned it already in one of the reply's on earlier post. We might see some stagnation now because of the fear, but soon we'll see green again :)

If you take market cap from last year and example BTC price last year around the same time, they look pretty much the same.

But I might give you a point here on BTC, because normally we saw drops like these scare people a bit and want to stay with something they're familiar with. That's ofc BTC for 99,5% of us.

So that I could buy it for that cheap price... Thanks, and I agree with the investor it should go even lower to 8.000 so that I can catch up with you folks.

So where can we get access to news like this so we don't have to wait for everything to crash before realizing something is wrong.

I told you so. The ship is sinking. Fibbonacci never lies.

I knew you would be the voice of reason in a sea of "freak out" today. I too hold cash to deploy, I too caught the last sale in Dec (was up all night having fun), I too will buy into $8k bitcoin woo hoo.

Seriously though, I don't really do this soley for financial gains, I do it because it makes sense to me, we disagree on there being a reason for the rise, but we agree on the value of the fall.

Now, China with the hard stance, while Wall St and Japan imbrace is interesting!

Really good response time to this price action, considering you had to make/upload the video aswell. Luckily for me i had the chance to buy cheap this time, because i took your advice to have a portion of my portfolio in cash. I always fall for the first dip though and buy in too high, because there comes a second harder dip after the first one most of the time.

Despite all that, today is the day BitConnect finally took a silent fall to its death, with a drop of more than 90%. It could'nt keep up with the other cryptocurrencies in the last months and therefore did'nt have an impact on the market as a whole anymore, but I'm still curious on what caused this dump and on your oppinion about it.

Al Czervick nails the crypto market!

Hey man do you mind doing a video on how the futures market might be affecting the price of bitcoin?

Hey man, you mentioned on your youtube that you are far more able to engage on steemit so I wanted to send you a message here (hope you see it). I just want to say that I think you give a smart, highly thoughtful and interesting take on the crypto markets and I feel that you really get it (i.e. the game we are all playing in this crazy crypto world). Please keep producing all the great content and don’t let the haters and trolls get you down. For every one of those dicksplashes there are ten guys like me that love your content, the (usually) silent majority.

Happy New Year and greetings from the UK.

Thanks for the kind words, I appreciate it - no worries, I will keep on producing!

Dear cryptovestor, do you recommend moving my funds from BINANCE to my ledger? And I don't want to sell my alts now everyhting is crashing all I want to do is buy more actually.. but I am a little worried about CHina cracking down on the exchanges.. Any advise? Thank you for all the great material. ALWAYS 100!

Do you think buying STEEM at these prices is a good idea?