A few days ago, Poloniex released a vague non-statement on how they will handle the August 1st situation.

The key part:

At this time, we cannot commit to supporting any specific blockchain that may emerge if there is a blockchain split. Even if two viable blockchains emerge, we may or may not support both and will make such a decision only after we are satisfied that we can safely support either blockchain in an enterprise environment.

Why the loan rates are surging

This was fairly predictable.

- Many users cash out of poloniex to have their Bitcoin in wallets where they control the private keys to ensure they obtain any forked coins. These users include holders, traders, lenders, and borrowers.

- Remaining traders that cashed out some of their balances continue borrowing to trade amounts they are used to from the semi-depleted loan book.

- Increased demand for borrowing with decreased supply for loaning equates to huge spike in loan rates.

The loan book at Poloniex usually has over 10k BTC offered for loans. As of an hour ago it was under 700.

I've been loaning BTC on poloniex for over 2 months now and in general the loan rates fluctuate between .04%/day to .2%/day. Occasionally they jump to higher rates, but that has been very rare, and most of the time the daily rates are under .1%/day.

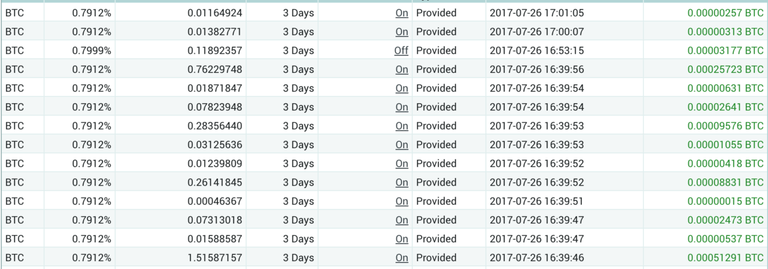

Today I managed to loan out just over 3 BTC at .7912%/day:

If these loans stay out for the full 3 day duration, I will make .06 BTC. If I managed to loan out 100 BTC at this rate for this time, I would make 2 BTC!

The Catches

Withdrawal Limits at Poloniex

I have $25k/day withdrawals on Poloniex. Meaning, since there are only 4 safe days left to withdraw money, I can only withdraw $100k from Poloniex before August 1st. Getting tier 3 verification took me over a month, so convincing support to upgrade me to tier 4 and increase my limits further before August 1st is extremely unlikely. This means I have to prioritize withdrawing coins first ahead of loaning them for profits.

Poloniex Transactions Possibly Disabled

I'm not sure exactly what is going on here, but there are complaints on twitter of Poloniex disabling transactions and people losing money due to stop orders. I can't verify this as I'm staring at the ETH/BTC order book and not only is it not empty, but there are buys and sells happening as I type.

However, a friend on Telegram informed me that a friend of his has 2 orders in limbo: he placed a limit order, it didn't go through, and the coins aren't in his exchange wallet. There are no pending orders, no open orders, and not in his account.

If Poloniex does decide to support any forked coins, having the coins loaned out on August 1st means you cannot claim the forked coin.

Suppose I have 10 BTC in my account, 5 in my balance and 5 loaned out. When the forked coin is created, if Poloniex decides to give users the coins, I would only receive 5 because when the snapshot was taken, I only had 5 in my exchange wallet, the other 5 were on loan.

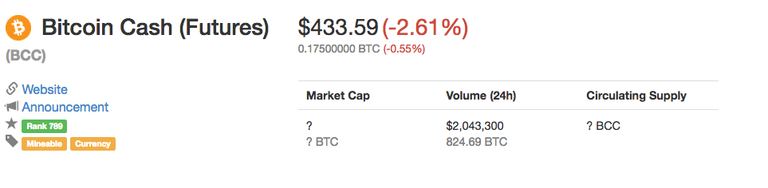

The promised fork, Bitcoin Cash, has futures currently trading at upwards of $400:

I don't really trust this price: it is only available on ViaBTC and I think it is heavily manipulated by Jihan Wu and Roger Ver. I suspect the actual price of BCC post August 1 will be well under $100.

Regardless of what the price actually is at that point, by loaning coins out, I cannot receive BCC for those BTC.

This means there is a trade off between potential loan profits and potential forked coin profits.

As I've typed this blog out over the last hour, the loan rates dropped back to .05%/day lol

This could be for a few reasons: maybe some auto-renew loans came back at lower rates and lowered the market because the bots that are lending out for people followed suit. Maybe the demand for borrowing BTC dropped because of the possible transaction freeze. Maybe the supply for BTC loans went up because people deposited to take advantage of .8%/day loan rates. It could be a combination of the three, or something I haven't thought about.

But I suspect as we move closer to August 1st, the loan rates will shoot up over 1%/day. I will have a tough decision to make: do I loan coins out and receive profits on them, or do I claim my BCC? And if I claim my BCC, do I keep them or do I just sell them right away?

Decisions decisions....¯_(ツ)_/¯

Regardless of what I decide, this will be interesting to watch play out: drama at Poloniex, drama with forked coins, market manipulation, loan sharks....real life is more interesting than fiction could ever be.

My name is Ryan Daut and I'd love to have you as a follower. Click here to go to my page, then click  in the upper right corner if you would like to see my blogs and articles regularly.

in the upper right corner if you would like to see my blogs and articles regularly.

I am a professional gambler, and my interests include poker, fantasy sports, football, basketball, MMA, health and fitness, rock climbing, mathematics, astrophysics, cryptocurrency, and computer gaming.

Good post. Uvoted.

However, I would say that lending on Poloniex during this fiasco is extremely risky. Given there will be thinner liquidity and extreme volatility, there's no guarantee you will get your capital back.

If the trader that borrows your funds gets rekt, you won't get 100% of your lent funds back!

That's a common thought, but as of January they had never defaulted on a loan before (I assume they still haven't, but I read a post from Poloniex saying that back in January). This is because they have an auto liquidate option in place to pay back people who are loaning out coins immediately.

Of course, that doesn't mean that a loan would not be repayed in the future if a black swan type event occurred (such as the flash crash with Ethereum last month on Coinbase). But given Coinbase paid out for that flash crash, maybe Poloniex would as well, so even if it happened it isn't 100% loaners lose money because it is on Poloniex's system if they did not liquidate properly.

I don't have a significant amount of my net worth loaned out, and still believe it is highly +EV to do so, so I'm comfortable with trusting that the past is more likely to predict the future than for something that never happened to occur.

Man, I hope you're right. But the Poloniex TOS say otherwise: https://steemit.com/cryptocurrency/@techwizardry/poloniex-margin-traders-lenders-should-be-very-very-carefull-going-into-august-1st

Yes, there is a slight risk as always. But it requires a lot to go wrong:

I'm closing out all my loans by the 29th. I don't expect there to be any problems, but hey, black swan events happen and as Taleb says, they shape history.

"liquidation attempt to somehow fail (this seems very rare)"

Under normal conditions I would agree with you, but Poloniex recently issued a statement on the hard fork, which said they they may or may not support bcc in the future. Which means that a lot of traders will be withdrawing their bankrolls from Poloniex to get bcc after the fork.

Imho, this is very dangerous for margin traders and lenders as there is less buy orders on the orderbooks of the major alts.

That's really going to hurt margin trading at Poloniex. My question is why are people still borrowing BTC to margin trade. Cutting it fine!

My theory was that they borrow because they wanted to cash most of their own coins out before August 1st, so to continue trading they needed to borrow more coins.

Borrowing to margin trade is actually a really good idea now that I think about it more. BTC will probably continue to decline until August 1st. So if you borrow BTC, convert it to USD...then wait for it to decline, buy back into BTC and return it...that's a nice chunk of change.

Regarding the spike in loan rates - when the news came out that btc-e had hacked mtgox, there was a spike in monero - and I think all the bot traders followed, which led to sudden demand for loans.

Interesting. I guess I need to hurry up and get back into bitcoin and get it out of GDAX before they lock it up.

Get your BTC off coinbase and into a wallet where you control the keys ASAP. They have already confirmed they will NOT be granting BCC to users who hold BTC.

Yeah I know....I got rid of my BTC just before this recent collapse. Just trying to time getting back into BTC and getting BTC off the exchange. Feels like we are going to go lower still, possibly 10-20% more?...so it's tricky.

Great post it´s allways good to know about this things! Im following you ! Resteeming this to my followers. Hope it helps a little.

I have voted for you can you vote my comment please .. Thank you dear in advance .

Thank you for the information, your post is very useful, I @manuelgr like your post.

I would say to stay your hand and not loan BTC until the Aug 1 dust settles. Go for the double coin bonanza and see where the new fork runs. My latest article on Analysis of Steem's Economy