After the 666 point drop on the 33rd day of the year on Friday, which I said likely was a signal that things were going into play, the Dow Jones Industrial Average (DJIA) lost as much as 1,597 points by mid-afternoon on Monday.

The Dow ended up closing down 1,175 points, or 4.6% which was the largest single-day decline for the blue-chip index on a points basis in history.

But, the Dow, like most things, has been inflated higher due to historic Federal Reserve money printing since 2008, so a 1,000+ point drop now with the Dow near 25,000 is nothing like it was even in 2009 when it was under 9,000.

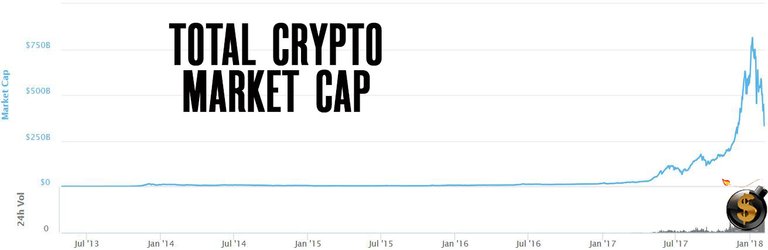

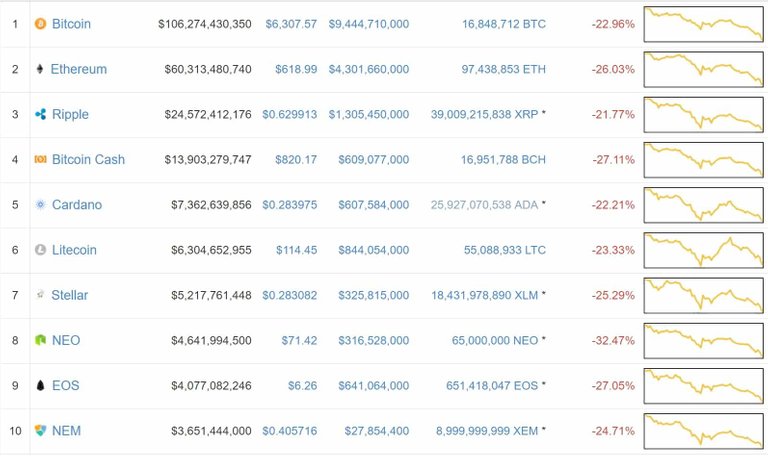

Meanwhile, the cryptocurrencies continued to get routed and have not fallen below $300 billion in market cap after being above $800 billion just one month ago.

Bitcoin is now below $6,500, Ethereum is close to $600 and every other cryptocurrency in the top 50 in market cap was massively in the red again today.

I’ve been saying for the last two months to be taking profits. This is why. I also said on Friday that it still isn’t time to buy. I’ll be updating subscribers (subscribe HERE) first when I think we are close to the bottom.

This afternoon I joined Kerry Lutz on the Financial Survival Network to discuss where things are at in the cryptocurrency space and where things may go from here.

You can see it here:

As you may have heard, Anarchapulco & Cryptopulco, from February 15-18th is completely sold out at 1,500. But we will be livestreaming the entire conference. You can find out more HERE.

The Dollar Vigilante Investment Summit still has spaces available, however, and will be held on February 19th. So, even if you couldn’t get tickets to Anarchapulco you could still come down and watch the livestream by the pool, enjoy the evening festivities and then attend the TDV Summit where cryptocurrencies will definitely be a hot topic of conversation!

I wonder how many people panic-sold into one the $6k support zone, yesterday?

Great read! So you’re saying crypto is about to explode and start seeing green again?!

Let us hope so bahahaha!

People shouldnt get too happy, there is still a long way to go for the crypto and stock market to corrrect their selves and us star seing more profits. This is the time to buy no doubt abot that but but is also time to look at your portfolio and and see what needs to stay and needs to go. I think the best bet now is buy buy buy winners and set up an exit point to profit from it and see the next face in btc

cool logo man

Not sure if serious...

Hi Jeff, how's it going Miles?

I have bought over a $100k over this correction and adding more with further drops.

This is the opportunity of a life time to get real money into the game!

Not the end. Just a healthy correction. Don't be a weak hand. The whales want to shake you out of the market and buy your crypto cheap...

The price in 'dollars' can do whatever it wants. I don't care because I just keep mining it using the BitClub Network that I joined under Jeff. http://bitclub.network/dibble1

I have a theory...

Now don't get me wrong I believe bitcoin will succeed

But there was some heavy coin hopping going on to inflate all these prices...

bitcoin moved into ethereum, ethereum spawned ethereum classic, ethereum then pumped up a bit,

Then Monero shot up

For a while nothing, until end of december Dash started to go up

At the PEAK of Dash's price Ripple started to go up as Dash was going down

Then at the peak of Ripples price Ethereum started its run as Ripple made its way down...

check out the pattern for yourself on coinmarketcap, the charts prove what I am saying...one day Ill make a more detailed post with pictures and dates and everything

That’s a really interesting theory! I’m looking forward to hearing more about it

The banks are running scared. They will attempt to sabotage any threat to their criminal existence.

Simply a short correction in equities that was long overdue. Last correction was in Nov 2016. Every day since has been green, some breathing room was due. The short VIX funds being wiped out was fascinating, however.

Cryptos is another story entirely. Weak, uninformed hands being squeezed and they are performing beautifully for their long-term compatriots. For now, cash remains king but a buying opportunity seems to be emerging on the horizon this spring.

Bouncing back now. I don't think this is the big one. There was no catastrophic fundamental news other than worry about interest rate rises. This is likely a small correction, but when interest rates do rise, that's when things will go to the wall.

I think this might be different than last time, people know this is the big one and big investors were pulling money out of banks way before the general public was aware of the damage last recession. I think that they might try to get ahead of the deflationary event and take profits before official numbers go to print.

I think that even if there is a recovery numbers in a lot of key cities show that real estate has already been faltering, U6 has been terrible and tells us way more than U3 does. The flight to safety is just beginning, get ready people.

Yes you could be right, although the flight to gold (the ultimate safety) is a bit muted so far. Having said that it's risen steadily since 2016. Silver is looking very lacklustre at the moment though. It's got some work to do to catch up.

TFW you see one of your memes being shared about.

Well done sir!

I am going to use that one a lot if you do not mind, since it is one of my favorite ones out there by a large margin.

Today I bought a bitcoin

33 happened 3 Times not just once.... it was the 33rd day of year when markets fell 666 points but also

The 1179 point drop was 33rd largest % drop ever and the market had been up exactly 33% since trump took office when it dropped

dead cat bounce today?

Great interview with my 2 favorite financial gurus.

Excellent read.

I believe we have a couple more weeks of the red and horror before a green light comes trough. I am holding most of my coins and will just wait for crypto to come back as it does after every big crash. :)

There is no doubt in my mind that big corporations, banks and investment companies trying their best to submit sanctions and regulations into cryptocurrency, they are afraid more and more people will invest in it because of its potential and they end up lossing business. The congress been talking about regulating the crypto market more and more now since BTC hit $5k mark and above so they are looking not to shut down but for an entry point for themselves to get a piece of rhe action, thats what big entities worry about. Now us as investors need to educate oirselves and look for a solution on how to protect our market but ALSO! How to open it to bigger money while keeping it dezentralize, getting wall st stock market and other big investors into crypto will bring billions if not trillions of dollars into the market and make it mor profitable for all, the point here is how to get them in and keep their laws and rules out. In my opinion anyway

Like I predicted it would yesterday today the market started to recover, probably get it all back by the end of the week.

I think it is but we will know more tomorrow and next Monday.

I already bought and looks like too soon. Well, I am a noob and learning as I go.

Hopefully you have some cash left to buy lower.

Yes I do :-)

Smart. There is a chance we could have hit the bottom but hard to say.

Why is everything crashing?

Patriots lost

The banks are scared and they're taking it out on crypto once this liquidity squeeze ends crypto will bounce back. I'm not so sure about bonds or stocks though as they have only been kept afloat by 0% interest.

If the fed raises rates its coming down if they dont its coming down, its just a matter of time, some guy on tv today said in 5 years well see this market go higher... I kinda laughed I said if no way Ill be waiting 5 years for the next crash 3 at the most but i think its coming before 2020,.I really do hope its a dollar crisis too. @dollarvigilante could you check out my post on regime change I feel really good about it. Also Great post! really love watching this unfold

your thinking is great....you will running create this type posting....i waiting for your next post..

I don't know how to react. This makes me happy and unhappy at the same time.

The funny thing is, if everything went to 0 things would be a lot more equal.

black friday time! ;)

Great post, wish I could be there! Followed, upvoted, resteemed and shared to almost 7000 people on Twitter, show me some love with some upvotes please people? Much love back to you!

I did not even recover from the 08 market crash. Wait I did not even recover from any crash. I should have done better.

@dollarvigilante This is suddenly getting frightened. It seems cryptocurrencies are taking an unfortunately deep plummage and I cannot but hope for a quick recovery in the coming days.

Still glad cryptocurrencies have not gone below the $300b capitalization benchmark. We hope for a comeback sooner.

Well since everything is up today and not by some huge amount but more as a stable increase I say no. Just a correction and fear.

It is a tale of woes everywhere, both crypto market and stock market.. Not the best of times for investors. Thanks @dollarvigilante

They're not crashing, they're correcting; it was only a matter of time. While some cash in their chips, others are looking bullish.

Titles like these make people wary and spreads scaremongering.

Interesting read, thanks for sharing.

I think, it's important to sever the emotional connection between the invested money and yourself. Otherwise it will be incredibly stressful every time, you see big red numbers like now.

Every time you buy something at the stock market, buy cryptos or take part in an ICO, you should consider your money gone. Sometimes, everything works out and you can cash out with great profits – but it is as likely to lose your whole investment. If you get angry about losing money, then you are everything but a good investor.

Stay calm and don't panic.

My thoughts is that the capital markets were to conplacent about potential risks in the system. This also lead to the avalanche of capital coming into ICOs and crypto assets last year. It was a matter of time for people to realize the amount of inflated assets worldwide and as we have seen in the cyrpto space, velocity is very high when the heard wants to move. Although the economy seems to be stable, it is built on lots of leverage and uncertainty around the world.

Woke up today (I work nights ) Feb. 06 to see it aaall green. When went to bed market cap was 280bn. It bounced back with 80bn. so far...

well I thing this guy explain it much better

The players a gaming the game

The sell off was to obfuscate press on the memo release, the sec meeting on cryptos is in progress and as of this second, we're heading back up. When you read this, we just might be going back down...it's a turbulent ride.

the 666 lol they like to joke the f*kcers

Stocks and bonds sellout, where will they park their money after selling? Into cryptocurrency. Nobody no govt can take away the value. But in bank accounts, thru so called legal means, they will.

Thank you Jeff for the information. Today I bought some Steemit. I believe is a good opportunity by some crypto. It will all depends of your personal perception.

According to the firm Autonomous Next, the number of hedge funds investing in digital assets like Bitcoin has grown rapidly to more than 100. Since the launch of Bitcoin Futures on the Chicago Mercantile Exchange in December 2017, it shouldn’t be a surprise to anyone why the price of Bitcoin is down 50% from the high.

bitcoin.PNG

Only Retail Investors chase price and buy high and sell low, while the Professionals buy low and sell high. The Hedge Funds have purposely sold Bitcoin futures to get in a better price.

At the moment, there is a war taking place between the buyers (Hedge Funds) and the sellers (Retail Investors) called capitulation. That line in the sand was at $9000. Capitulation is when investors give up any previous gains, by selling, in an effort to get out of the market. Capitulations are outcomes that result from the maximum psychological and financial pain that can be endured by a group before throwing in the towel. The Retail Investors are throwing in the towel after seeing a more than 50% correction in the Bitcoin price to the buyers, the Hedge Funds. With 100s of millions of dollars to invest, we are witnessing an accumulation phase by the Hedge Funds between $6000 and $9000.

The Hedge Funds are loading up and buying from the Retail Investors. But to fill all their buy orders, as the sell orders dry up, price must go down to the next stack of sell orders. We are approaching what I believe will be the bottom of bitcoin at $6000. My first target is $12,000 and my second target is $17,000 over the next 3 - 9 months.

The easy money has been made over the last 12-18 months. With the big boys in the game now, the rules have changes. The question is, are you ready to play to win with a new play book?

This post is my personal opinion. I’m not a financial advisor. Do your own research before making investment decisions. By reading this post, you acknowledge and accept full responsibility of any gains or losses.

Very nice write-up. I absolutely appreciate this steemit blog. Thanks!

The writing is on the wall - I've got my popcorn ready!😜This could only be good for crypto...

Am I the only one who questions the use of these numbers as signals.. also this post has 999 veiws hmmm. Do they think people so ignorant to not question that or is it a diversion ploy.