Is it possible to make money buying bitcoin on the first of the best performing months and then sell it at the end of the month?

Now that we are upon the final day of the month, we have yet another data point to look at as far as the monthly returns for bitcoin are concerned.

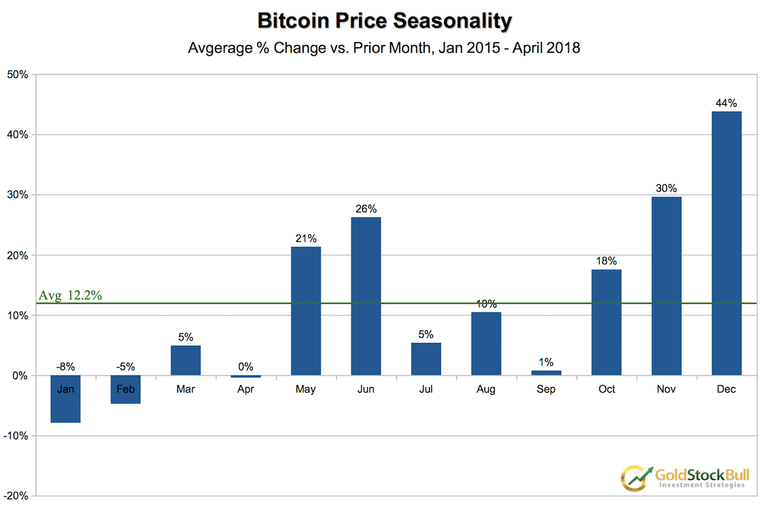

Traders everywhere are looking for an edge and there might be one when it comes to seasonality and bitcoin.

When I talk about seasonality I mean that bitcoin has some fairly consistent trends and patterns that tend to correlate with certain times of the year.

By now, we likely all know that bitcoin tends to do poorly in the first couple months of the year.

In fact, we got some major reminding of that this year.

Some years are worse than others of course, this year being one of those, but there is a definite trend of under performance in the first couple of months of the year, a quick glance at bitcoin charts will confirm this.

That is likely related to the Chinese New Year as well as Tax related selling in the US and abroad.

That being said, there are also certain months that do tend to out perform, at least in recent history and there may be some kind of an "edge" that can be obtained from that data.

For example, recent history and a quick look at the charts shows that May and June are often very good months for bitcoin and cryptocurrency. November and December have also traditionally been very good months as well.

If you do not believe me, pull up some charts of those months and take a look for yourself.

(Source: https://goldstockbull.com/articles/bitcoin-seasonality-chart/)

Today, I'd like to look at those 4 best performing months mentioned above and we'll look at their most recent trading history.

Let's take a look at the numbers:

If you bought bitcoin on November 1st and sold it on November 30th last year, you made roughly 47%.

Price on November 1st: $6,750

Price on November 30th: $9,900

Likewise, if you bought bitcoin on December 1st and sold it on December 31st, you made roughly 28%.

Price on December 1st: $10,900

Price on December 31st: $13,900

Fast forward to this year and we'll include the most recent month even though traditionally it has been a flat month for bitcoin.

If you bought bitcoin on April 1st and sold today, you made roughly 36%.

Price on April 1st: $6,800

Price on April 30th: $9,300

What will May bring?

We can't say for sure, but last year May was very good to bitcoin.

Last year if you bought on May 1st and sold it on May 31st, you made roughly 64%.

Price on May 1st: $1,400

Price on May 31st: $2,300

Will history repeat this year or did the April gains just get pulled forward from traditionally taking place in May and June?

Looking at these numbers one might be quick to think that there might be something to be said about only buying bitcoin on certain months and playing the seasonality game.

However, keep in mind that the vast majority of the gains in bitcoin each year come on roughly 10 days throughout the year.

If you happen to be out of bitcoin during some, or most, of those 10 days, it can be very tough to turn a profit on the year.

Knowing that, play the seasonality game at your own risk, though it may end up working out for you. :)

Stay informed my friends.

Follow me: @jrcornel

Today is the first, maybe we should test this strategy out, buy BTC today at $8,900.

i always feel like saying this to you boss,high greatness all over you...

Thanks you for sharing.@jrcornel It is interesting review the numeric data story. I am happy watching your opinion.

So you are saying it's the right time to buy bitcoin, and sell them after 1 or two months, or we can hold them to November 30th?

is that what you are trying to say?

That has been the recent trend of bitcoin price action yes. Though, keep in mind that it can do anything at any time. This is just for educational purposes, not trading advice.

oh yes, man!

I know don't you worry.

I look at more speculation and news than the season. If there is breaking news out about crypto, seasonality wouldn't be a factor to that. Great share @jrcornel

But I think there could be another price increase before may 14-16. The crypto summit held in New York. And possibly after that if there are partnerships or huge news due to the summit

Yes that is a great point. Which is why basing buy and sell decisions solely based on the time of the year probably isn't the best strategy. However, it might prove to be useful when taken in combination with other factors.

Agreed! ^^

So this youtuber, one of my favorites, has predicted the rise in crypto in May. Keep in mind, he created this video on March 25 of this year. His reasoning was due to historical data from 2017 consensus that caused the markets to rise drastically. This to me is a great example for a certain season to invest in cryptos, but then again it's involved around the biggest crypto summit in New York held annually. @jcornel

Let me know your thoughts when you get the chance of course!

That is very interesting and makes a lot of sense. We will be able to tell if he was right or not in a matter of weeks.

History tends to repeat itself...One needs to be smart enough to see the recurring trends.

but a constant reminder for everybody...

"Always invest what you are prepared to lose."

Yes, great reminder.

Agree with that. Always important to invest money you are okay if losing everything. It can be emotionally challenging seeing money gone that you couldn't afford to lose @xabi

Let's have Christmas come early this year and have a massive December pump in May :).

In general this pullback has been better than in the past. At least we are not experiencing another 2013 and having to wait years for a new ATH ,sorry if I jinxed it, that was a rough time. Only bright side is I had plenty of time to buy monthly and add to my stacks.

Good point. Though it may take a while, no guarantee those highs hit this year.

well, I can consider it :)

though I prefer to find technical analysis for entering and exiting positions...

Buy at April or May and sell at the end of the year.

That certainly looks like one strategy. Though keep in mind this data only goes back to 2015.

Have you been doing this @jcornel or is it something you're thinking about trying?

I do this somewhat, but it is more trading around a core position. I don't get completely out of my btc holdings. However, I did sell some in December on that big run up. Then I started adding again in March.

Nice Analysis, thank you for sharing!

I've never understood panic selling. my thinking is 'I m not losing my money no way no how!' so I am compelled to hold til it goes back up. maybe that's just me

This also demonstrates that it is very difficult to time the market so the best bet is to buy and hold (or HODL). There was some information shared by Thomas Lee from FundStrats that mentioned that the top 10 performing days for bitcoin have typically equated to most of the gains over the longer term. I feel sorry for those who actually try to short this.

Amazing perceptive on bitcoin!

Bitcoin is the famous currency in the world. Days by days increasing bitcoin popularity and price .

good inform

It's very interesting data analysis, i'm very surprised. Thanks!

It looks like you have great information. Thank you for sharing.

bitcoin now growth time

thats great for bitcoin....Bitcoin makes us all very profitable.i hope oneday every bank will accept bitcoin and others cryptocurrency as they understand the power of Bitcoin.

Past performance doesn't guarantee future results. At least it's what they say..

I think it still depend of lots of factors. Maybe it's better to just buy it when it's low because buying it at the peak is like suicide.

Interesting question if it will go the way you describe. How about buying May 1st and sell end of November or December

Well I just hope that history will repeat haha

Interesting data, but as the saying goes: past performance is not indicative of future results. It is a nice idea though, and it may prove to be successful. Only time will tell!

As I just go and buy some bitcoin today..... thanks!

Just bought some crypto. Let's see what will happen