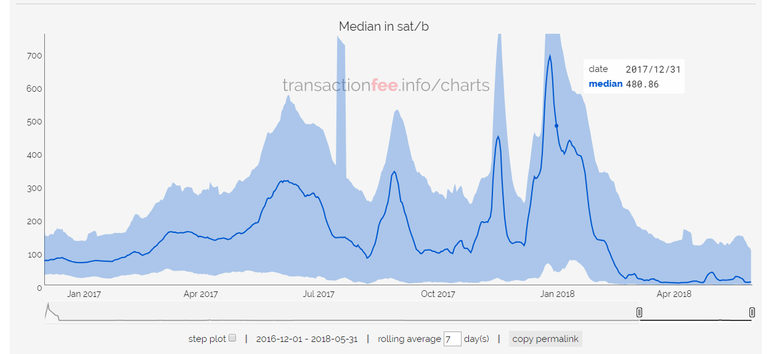

Exactly the fees are the smallest since 7 years right now.

This is a mix of Segwit + batched sends (many payments sent as 1 transaction) and also the dumps aka not that many people send here and there for now.

So currently its around 10 satoshis/byte aka 2,250 satoshi per tx average.

Markets

Binance totally crushes volume on BTC now. Rememeber they have STEEM and need to ID verification! Register now if you haven't!

Follow, Resteem and VOTE UP @kingscrown creator of http://fuk.io blog for 0day cryptocurrency news and tips! |

|

|---|

good to know thanks

Those transaction fees at the end of the year were insane!

That could have been a factor that caused the crash that followed to be so severe. All those new people that got into the market then were investing a few hundred dollars and if they moved it to another exchange to buy alts they were already losing 5-10% of their investment. Hopefully this will make the next climb up that much more stable.

Yep. It got way faster and cheaper!

It got to a point that I started to question how long bitcoin would dominate. Keeping in mind that Coinbase is the most popular source for people to start buying crypto, they offer etherium (which had extreamly low transanction fees in comparison).

I wonder how long the "no ID verification" will last, now that they will be active in Malta. Other European countries will put the pressure on them to change this.

Just like early Investors have been saying capping the blocksize to 1MB is the same as capping the growth. That's exactly what is happening, less people are using Legacy Bitcoin but increasingly using other Cryptos. Fees have dropped a lot b/c much less usage. Sub 200K trans a day.

Actually the number of users have remained stable -no growth but no major loss either(if you count batching) bitcoin has 2 MB blocks but the capping of the blocksize was made to make the LN more imporant to use and to let more nodes run. With more nodes running the latency would be high but it would be much harder to take down bitcoin. Look I want to see big blocks but not too big. 4 MB +LN is the one for me :)

Active addresses in ETH are soaring past Bitcoin.

Ok then? Nice to now. My point still stands

I am looking for growth in the protocol. Number of users, updates, use cases ECT. 99.99% of people have no interest in running a node unless they get paid to do it. Miners on the other hand have huge incentives to run full nodes and allow as many transactions as possible. I have no problem with 1 terra bite blocks to gain up to 7 million tps. Different coins for different folks. The Bitcoin today is not the one I signed up for in 2013. That's all I am saying.

I'll agree to disagree with you. Have a good day. 😀

That's fair. It's good for the have different coins with different ideas b/c it allows mass markets to decide who wins or loses and not a small group of extremist.

Yet bitcoincash still talks trash about how super high they are rolls eyes

Bitcoin Cash is sub penny fees and Bitcoin Core is 18 cents right now. BCH will introduce 1 terra bite blocks with 7 million transactions per sec. In the end the only thing will matter is usage. The coin that has most use will become best store of value too. Personally, I don't really care about which Bitcoin wins the war. I just wanna see mass Crypto adoption happen and the only way you'll get that is fast, almost free transactions with a great user experience. Neither Bitcoin could end up winning mass adoption but a third generation blockchain could. Ideally I would like to see at least a few very large Cryptos so they have competition with each other, insuring a great user experience.

The problem is 1 Tb is not a good decentralization path. The LN would beat thatin a mile but it taking a long time to use it. :(

I say it be done by 2019. But if usage did indeed only matter-A semi decentralized would be the top that might explain why ripple still ahead. I hope decentralization is what truly matter along with usage as a result of that

I think you also have to factor in the network effect which is far greater for Bitcoin than Bitcoin Cash

This space changes so fast with less than 2% global penetration of Crypto network effects and brand name can only last so far. I would agree with you if Bitcoin would have copied all the alt coins best traits like many thought would happen in 2013 but that has not happened.

It is amazing how Binance came on the scene and totally took control from the other exchanges. I use several different ones but Binance is my go to exchange for most trades.

The network is becoming more efficient. I'm happy the hype has died so the technology has had time to get better.

Great news! The BTC taxes in the start of the year were insane. Only problem is that the transactions are still slow compared to other cryptocurrencies.

Depends on the what way you use bitcoin. On chain wait min 10 min. Off chain aka LN less than 5 seconds though that not industry use ready yet

"10 satoshis/byte aka 2,250 satoshi per tx average" is a good deal! I hope to get more bitcoin.

.

It does if you want to withdrawal alot of crypto

Still quite expensive though :( supply and demand I guess.

How do you think we could further reduce costs of Bitcoin transactions?

Use the LN that the main scaling plan for bitcoin

Bitcoin Cash still has lower fees so I’m not impressed with these latest developments.

What about 'unrecoverable accounts'? They are counted as assets yet they are unrecoverable to everyone, not even the currency.

https://steemit.com/crypto/@stephenthorburn/crypto-bombshell-cryptocurrency-s-dirty-little-secret

Well that should say something about bitcoin

Also due to the crypto bear market. Most new players have already been shaken out and hodlers are holding!

Binance doesn't need ID verification as I know...