Our current financial system relies on regulation and trust parties that enforce its rule. A great example is the recent try by several companies to issue an Bitcoin ETF.

The SEC rejected the proposal of many issuer starting with the

Why limits were required in the past

The U. S. Securities and Exchange Commission (SEC) has a three-part mission: Protect investors. Maintain fair, orderly, and efficient markets. Facilitate capital formation.

As a result the SEC is a gate keeper and simply decides who and which products are allowed to operate in this case in the US and on wall street. This is required because without any rules there would be chaos and especially no recourse in case of scams.

With these rules the SEC and US government gets to put rules in place and have a gate keeper that enformces these rules. Additional there is the legal system that will deal with parties that do not follow them. This creates order, rules and protection which ultimatley creates trust in market actors. For instance anyone buying an ETF can just trust that what this product claims to do actually is enforced, because it is approved by the trusted party and if rules are not followed, consequences would be enforced.

A whole country at work

This is critical: In order for all of this to work a whole country, in this case the United States needs to be in place. Consequently this creates somewhat of a monopoly. The SEC is the King of all financial products backed by the power of the state.

The cost

Because of this monopoly and hurdles to get approved, creating financial products is risky and expensive. Of course if you manage to get approved, there is likely a big profit opportunity, which in turn has to be paid by consumers.

These cost come down to

Direct Fees: The organisations offering these products need to recoup their expensenses, risks and make a profit. Consumers have to pay for this

Indirect Fees in the from of taxes: The state also requires large resources to function and we can look at GDP vs taxes. In the US this is about 24% of GDP. If you are employed, have property and generally a bit richer this part for you tends to be much closer to 50%. For instance the top federal tax rate in the US is 40%, add state taxes, property and sales taxes and your exposable income is reduced easily by 1/2.

An expensive financial system: About 20% of GDP is required just to make our financial system work.

Limited products and innovation. This is not something we can put in numbers, but logically there are a lot less products than the market would accept. This I believe is the biggest cost of all and the reason why there has not been much innovation in the financial sector in the last few decades.

Central Planning: Along with single authorities like the FED and the SEC comes the central planning aspect, that if either the FED or the SEC are wrong and do not perform the correct actions, there is no punishment to them until the entire system collapses, leading to likely bad decisions overall. Are these authorities really incentivised to act in the best interest of the public, in this case the USA? I think likely not. Preserving power and generating benefits from this power is likely more important.

All of this cost to create one thing: Trust. Without it we can operate and function.

Example: Winklevoss ETF

The winklevoss twins started working on their ETF in 2013. They created the product, built an exchange, a price index and tried to comply to the rules of the SEC

Since then they have gone thru several iterations and rejections by the SEC. Now it is 2018 and they have little but failure and expenses to show for it. Furthermore the public still does not have the benefit of the product that has been built.

There is cost, failure and no benefit. Until the SEC changes their mind and approves the product.

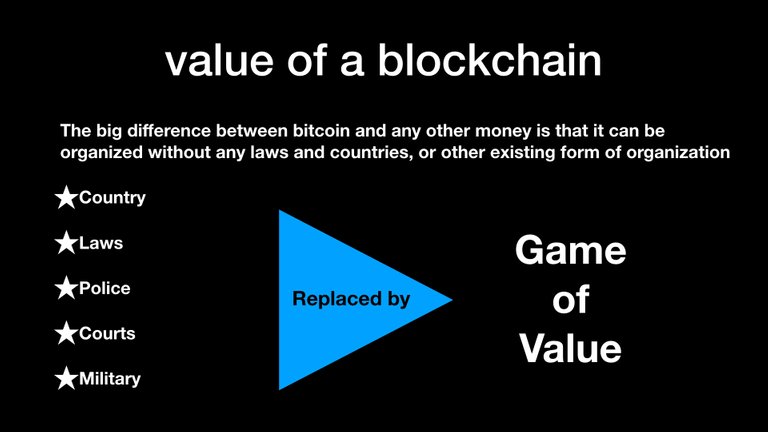

The solution of bitcoin: A game of value

Bitcoin functions fundamentally differently. It does not live within a state. Instead all of the governance that is required for it to run is done by its internal governance, which is essentially a game of value. Game in the game theoretical sense as mathematical functioning system. This is why some say bitcoin is backed by math. I think it would be better to say that is it run by mathematics and economics: Game of value.

This is very very significant. Bitcoin has invented a new form of organisation that does not require the state to function. As such it removes all the cost described above and replaces it with something that is more efficient (there is still cost) but also allows for new things to built that were not possible before.

Open to all

Additionally of functioning outside of the state and in a new way, bitcoin is also open and in competition to everything. In fact bitcoin now provides an alternative financial system that even the existing system such as wall street has to compete with. But bitcoin competes with itself as well. Anyone can create an alternative version of it, which is happening with the creation of all the other cryptocurrencies. Imagine the Internet and how innovative it would be if every app would need the permission of ATT to be launched. The internet has created powerful companies like facebook and amazon, because nobody had to ask for permission. Bitcoin does this to the financial system. It goes around the SEC just like the internet went around the phone companies.

The mistake of the ETFs

An ETF is bringing bitcoin into the existing financial system. I think an ETF will create a way of allowing parties on wall street to participate in bitcoin. However it does not really create anything new of value. Anyone can buy bitcoin already with a bank account, no ETF required.

I believe the problem of an ETF is that it inherits all the cost of the existing financial system.

The new functionality that bitcoin provides must be leveraged to built new financial tools and products. Asking for permission is the wrong approach. It misses all of bitcoins potential.

Instead it is up to entrepreneurs to built a new product that does not rely on laws and the approval of the state or its law enforcement to function. We need to build a crypto product that creates new solutions that are more powerful and work independent of the SEC or any other countries institution. It must leverage the core innovation of bitcoin: independent governance.

Bitcoin is hard

Doing anything in the blockchain space is hard, because we have no idea what potential of the technical really is. Could anyone predict how social media would change the world when the internet was invented in the 90is? But if you figure it out real value and rewards will reaped.

We are just getting started.

Summary

In summary I think a bitcoin ETF is almost pervers. We need instead systems that leverage the organisation form that was created with blockchains and cryptocurrencies to create new solutions that could not be done before. This is why I look for such system to invest in. Steem was one of the examples that attracted me because it creates a new way of doing social media, without need of companies and states and external laws.

These systems must provide value. That is the most important thing. We will know if bitcoin is successful by watching its market cap grow. If it is surpassed we know it is failing and competition took over. Yet if bitcoin becomes big, everyone needs to use it or be left out of its value. Organisations that want to profit will find a way to do so.

Wall street is driven by profits. Owning bitcoins has made many people rich. This is the biggest attraction. An ETF may spur short term demand but in the end does not add to value for bitcoin. We need to make bitcoin or any other cryptocurrency better, create value to organically grows its market cap. Then people will join because they have to (to make profit).

Don’t worry about the ETF or institutions ability to buy in. Lets focus more on how bitcoin can create actual utility. If you want to build something, study the functionality and leverage it for real solutions. Like facebook, google and amazon did. They used the internet and changed how their business fundamentally works.

We need financial products that leverage the new organisational capabilities bitcoin provides.

What do you think?

Is the ETF really that important? What do you think will it be approved and what will be the implication.

What du you think about this article and how bitcoin does create value?

Bakkt, the biggest and baddest, is coming before christmas, and the media has us talking about failed ETFs?

BTC has completed a Full Elliott Wave Cycle, and has just put in the first wave of a higher third. It just does not get any better than this. Smooth sailing to 52K. Take some profit above 90k.

We will probably first go down to 4800 dollar per bitcoin before the next bullrun.

You can already buy bitcoin ETFs and bitcoin certificates on certain non-US exchanges. You can buy in size (millions), if you want. If you have an “international” brokerage account, or a private bank account, it is easy.

If you want to know the names and places to trade, your friend Google is nearby to help.

Yes this is true!

ETF is not really important for the decentralized digital curreny like bitcoin. It does not matter they approve or not.

Bitcoin has it's own value as long as people accept it.

Steem is a saver for the country like myanmar. This is a great opportunity for myanmar people.

Even though bitcoin itself is independent of a specific country, government or economy, the people who buy and sell bitcoin are not. The regulations and rules that are set forth by the SEC and the Fed are there to ensure civil and fair conduct between players, as well as quality products making it to market. I don’t think there is a way that bitcoin can operate completely outside of the current financial system until people stop using the current financial system. Jumping through the hoops to make something like an ETF acceptable to the Fed and SEC is a necessary evil given tne current state of affairs. Unfortunately government as been allowed to bloat and grow into an octopus with tenticles stretching to every aspect of daily life and in order to remain a citizen in good standing or be allowed to operate within the confines of the reach of the government , then you need to play by the rules. You made a good case for the benefits of such systems to ensure trust and fair dealing but the trade off is having a gate keeper as you stated. This is another great, thought provoking post @knircky!

Great points you make and thank you for the feedback!

Dear @knircky, the only think i know for sure is that Bitcoin can keep alive this crypto world, there could be super valuable ICOs but finally who is keeping the machine running is always our crypto gold...

Good analysis on ETF vs Futures market. I was telling people for months future markets will suppress the hell out of btc's growth. ETF is exact opposite

I know everyone has their own opinion but I really believe the SEC will approve the CBOE etf just because the CBOE has been apart of the markets for a long time and they would be considered a "legitimate" source verses the up-incoming people like the winkelvos twins of Gemeni. I know people have been calling a bottom in this bear market all year but I really believe that if the SEC approves the CBOE etf (again I highly think they will) that will send a nice spike up that day and slowly and steadily the next bull run will be here because once people can buy a bitcoin etf verses buying physical bitcoin and having to store it themselves the institutional money will come in. I can't wait

Great post and good explanation regarding Futures and ETFs. Just one thing, Futures you do not jst bet against the market, you can bet that prices go up or down....I found that a bit misleading. Indeed the majority seems to have bets against Bitcoin the months after though, but technically they could have also bet on price increases.

amazing

About 20% of GDP just to make your US financial system to work is bloody expensive.

Amazing post @knircky

Resteemed it already :)

Moment ago I came across your other post and I really liked it.

Just checked your profile just to realize that we seem to share a number of interests :)

In particular that we both share a similar passion towards cryptocurrencies and blockchain technology :)

Thx for that quite informative post. Keep up with creating interesting content.

I know it's hard at the beginning to build solid follower base. But just don't give up. Steemits needs solid content builders.

Cheers

Piotr

Do we need an ETF? No, not anymore with the other on-ramps to crypto that wallstreet is bringing. Could it help? Yes!

As far as education goes.. it's not absolutely necessary. This is because in the regular stock market people buy and sell purely - 1. For profit. 2. Based on market fundamentals and the specific financial reports the company they're investing in publishes.

When Microsoft, Cisco, Intel, Oracle, etc come up with a new esoteric technology that works in the background for computers, do any of the investors actually care? Do they understand it? No and no. From the richest guy to the average Joe, people in pretty much all markets only sometimes understand the value behind what a company does. There are dozens of large cap companies that never sell a consumer item ever and the investor might have never seen a physical location from that business, but the company has billions of inflated value just because people fomo into it. This situation is seen as normal and healthy by 90% of the people in the markets. If the stock market can get away with this then so too can crypto.

It's all about the money. If there is money to be made on speculative items then people will come in so long as there are businesses using tokens for almost anything. We just have to weed out dead coins with college dorm room teams because those are trash. Fill CMC with coins backed by registered businesses that have fancy offices and we're in business.

Simply the best bitcoin TA I've ever seen in my life: https://steemit.com/bitcoin/@cryptosrocket/bitcoin-btc-update-imminent-breakout-bull-flag-confirmed-for-the-5th-time-in-a-row Serious guys, let's support it!

more products means less value on the whole.. etf is just bullshit and nothing important 4 the new economy

well. you point out most of it. certainly ETF can leverage bitcoin and subsequently the whole crypto market.

If the CBOE ETF does eventually get approved, it will mean a large demand for bitcoin...so it can be backed. However, that may not be until February or March of next year.

I dont think so, as no actual bitcoins would be bought, since it would be based on the futures price which also are settled in usd (not bitcoin)

The Winklevoss one was, and so were the 9 that we’re just denied, but the Solidex one that everyone is waiting for isn’t backed by futures, but by actual coins.

@knircky, nice post! In my view, the ETFs can damage the ecosystem of Bitcoin. ETFs will lead to centralization what will lead to price reduction of the cryptocurrency. We need more users, small players, not big ones. This is important for the success of the Bitcoin.

Posted using Partiko Android

This is what andreas is pointing to as well.

I am not worried about that part too much. But certainly it would create an easy way to confiscate bitcoins from the people.

Earlier for crypto money. Be prepared after the regulation.

Bitcoin is similar to financial freedom, but that is not the only way to hurt the world. In the United States, the Financial Crimes Enforcement Network (FinCEN), which is an agency of the United States Department of the Treasury, requires change that allow the trade of bitcoins by national currencies, comply with the regulations against money laundering. This involves registering the personal information of their clients in the same way that traditional financial institutions do. Organism like these are required to regulate it.

I am surprised big money like the winklevoss twins are still waiting for approval. I would probably pick up and move to friendlier location instead of trying to get approved in New York. I kind of like that crypto is an alternative to stock market, i kind of consider it more like currency trading

@knircky has set 5.000 STEEM bounty on this post!

Bounties are a new way you can earn rewards irrespective of you Steem Power. Go here to learn how bounties work.

Earn the bounty by commenting what you think the bounty creator wants to know from you.

Find more bounties here and become a bounty hunter.

Happy Rewards Hunting!

Congratulations to the following winner(s) of the bounty!

Find more bounties here and become a bounty hunter.@stwbll has earned 0.411 STEEM. 0.410 STEEM from the creator of the bounty and 0.000 STEEM from the community!

Find more bounties here and become a bounty hunter.@intellihandling has earned 0.007 STEEM. 0.000 STEEM from the creator of the bounty and 0.007 STEEM from the community!

Find more bounties here and become a bounty hunter.@solisrex has earned 4.295 STEEM. 4.102 STEEM from the creator of the bounty and 0.193 STEEM from the community!

Find more bounties here and become a bounty hunter.@swissclive has earned 0.016 STEEM. 0.000 STEEM from the creator of the bounty and 0.016 STEEM from the community!

Find more bounties here and become a bounty hunter.@mmunited has earned 0.019 STEEM. 0.000 STEEM from the creator of the bounty and 0.019 STEEM from the community!

I agree with you we don't need ETF's.

Yes it will bring more money into the crypto market, but what comes with that is severe paper market manipilation just as we have in the precious metal markets. These large financial institutions that want ETF's cannot be govern and although they are "REGULATED" they cannot be monitored. Then the regular Joe who is leveraging labor

for debt now needs to be a credited investor to invest in an ICO. What a scam. I hope it doesn't get approve. and yes it will reduce the dollar value of our investment and to me thats not a bad thing, because it teaches one to do indepth research before investing in a project. But for all who believe in this new asset class don't be fool because you want to get rich quick. who doesn't, but that was not the intention of the founder and founders. I have always been in buisness and i can tell you things are not well with the global economy.

It is inconvenient to carry gold or silver in your pocket or on a plane and then there is Civil forfeiture. But we don't have to worry about that with BITCOIN/Crypto all one needs is to memorized a few letters and numbers or with pen and paper record the Private Key and Public key and access to a computer to free yourself of financial misinformation and to keep more of what

You have made very good points. The whole point of the cryptospace is to exist as a peer-to-peer system outside of the regulatory framework of the financial system. With Wall Street money pouring in the crypto space would become vulnerable to control by the state to a much greater degree.

Posted using Partiko Android

Totally agree. Bitcoin doesn't need an ETF to create more value.

Moreover, a bitcoin ETF will probably spoil it by bringing people with deep pockets into a field they have no idea about, SEC controlling their private keys + a big portion of the market and potentially affecting how bitcoin works in the future. If they get as much money as people think could flow through an ETF, imagine how centralized the network could become. Think of Coinbase x1000.

Unfortunately it will happen sooner or later, hope by then people are more reluctant to learn about the technology before buying into it.

You got a 73.56% upvote from @postpromoter courtesy of @knircky!

Want to promote your posts too? Check out the Steem Bot Tracker websitevote for @yabapmatt for witness! for more info. If you would like to support the development of @postpromoter and the bot tracker please

You got a 73.11% upvote from @upme thanks to @knircky! Send at least 3 SBD or 3 STEEM to get upvote for next round. Delegate STEEM POWER and start earning 100% daily payouts ( no commission ).

Look my btc chart today post 🤗🤗🤗Wow superb information and hey dear @knircky today i am so happy because my old post bitcoin price prediction analysis was perfect and now hit 1 target / resistance 1.

Posted using Partiko Android

I love it Bitcoin and I appreciate your valuable content thanks for sharing this beautiful crypto

Technically you're right that we don't need an ETF, because Bitcoin will survive with or without one. However, I think an ETF approved by the SEC would elevate Bitcoin's image to a whole new level of legitimacy that would bring in a lot of newcomers to the crypto space.

In addition to that, it will open up the floodgates from institutional investment firms as they would be able to offer exposure to Bitcoin without their clients having to worry about safely storing their coins or managing private keys, etc. This would cause significant upward price action on Bitcoin itself from both of these factors.

Love lots @a-0-abul

Steem on!

Yea institutional investors will increase price. An ETF cannot hurt but it i thinks its importance is overstated.

Nice article gives one great insight into bitcoin.

The Security and Exchange Commission(SEC) is due decide whether to green light a new Bitcoin Exchange Traded Fund(ETF). The decision could provide the crypto-currency with a robust regulatory framework and provide investors with an easier access to Bitcoin assets.

-Here are implications

1 -Price Can Skyrocket

2 - Winner Takes Most

3-Currency Trading & Hedging Mechanisms

4-Sophisticated Trading Strategies

5-Other Exchanges, Countries and Digital Currencies to Follow

Bitcoin creates utility in a number of ways.

Like gold, Bitcoin is perfectly fungible (one Bitcoin is similar to another), it is divisible (you can pay someone a small fraction of Bitcoin, should you want to) and easily verifiable (via the Blockchain).

Interesting info. Thanks!

Hi @knircky I'm a bot, and wanted you to know that I've upvoted and re-steemed your post to help you with your promotion efforts! -exp

That's a very interesting article and we think Bitcoin is indeed creating value.

ETFs will skyrocket price, but what happens when we top? With ETFs it was clear that they could have shorted it once 20k, and win on the other side, that was when I sold, but now with ETFs, when they will eventually be approved (most likely Feb, to keep FUD and get further gains), what will you do? I'm thinking we may have some sort of high price stability, as I don't think institutions (like pension plan funds, etc.) will short trade just the boom. I'm also thinking of keeping it in alts until we get an altcoin bubble, and then sell to BTC, or cash out, and then. What are your game plays this time around, guys and girls?

Good article, i like the libertarian way of thinking about the topic. Although an ETF is a paradox move and works against everything bitcoin stands for it is still a necessary way to get institutional investor onboard. See it as an intermediary solution. I am totally convinced, the decentralized way is the right way and the movement is unstoppable. Due to technological progress and further adoption, vehicles such as ETFs will be simply outdated or rather not necessary anymore. For now, it could be the right thing for awareness.

You have recieved a free upvote from minnowpond, Send 0.1 -> 10 SBD with your post url as the memo to recieve an upvote from up to 100 accounts!

You are doing a great work pls keep it up and make us informed thank you bro....God bless you

Thank you! Will do.

I think Bitcoin has a government just like the US government, but it's far worse at making decisions.

In case some were misinformed about the fairy tales of Bitcoin's lack of governance... the bitcoin government which supposedly does not exist, met in New York and made an agreement: https://en.bitcoin.it/wiki/New_York_Agreement

Bitcoin's government is a corporate oligarch comprised of about 20 to 50 companies worldwide that ultimately make the decisions for Bitcoin's operation. The oligarchs don't always agree, yet this is Bitcoin's government.

I prefer Steem-like governance moreso where we vote on witnesses. While there may be some flaws with what we're going here too, it's more transparent as to how our government exists.

Interesting perspective on the decentralization of blockchains. I don't quite agree with your aspect on the bitcoin aspect, i think its a bit more complex than that.

Yes while it may be true that anybody can buy crypto with their own money there are daily and weekly limits on purchases, certain bank restrictions, the risks involved with buying and holding crypto as well as a very steep learning curve to get invested.

Large financial institutions already have massive amounts of capital that is parked in other financial instruments. By allowing them to participate in crypto markets through custodial ETF accounts they will be limiting their risk and reducing the learning curve. From my experience older people have a hard time grasping the concepts in crypto and they may not trust any of the new technology over tried and true methods.

These restrictions are only if at all available thru branking regulation. Thus increasing the value of bitcoin itself.

I think that the ETF is only important in the sense that it gets cryptocurrencies in front of a whole new range of people who can then start pumping money into the space and learning about blockchain technologies.

I didn't understand the potential of blockchain technology until I started putting money into crypto and writing on Steemit. Now I'm a full convert and want to do this full time.

So if an ETF brings more people into this space who can then become passionate cryptocurrency spokespeople, then that's perfect. We need more people in this space and we need to get the word out to the masses as to what the potential is here.

Yes this ETF will have some good effects including bringing in more people. They will also probably increase the price. All these are good things.

I absolutelly agree with you here @mazzle

This is one of the best blogs for those who are new in the crypto market and they don't know about the best trading exchange option.

I think ETFs are just a buy for adoption and time. The crypto market can and will probebly contiune evolve anyway. Crypto are able to bring alot more to the table than ETFs itself. I think crypto has the ability to take over the stocks and fund markets. But thats all about time and adotion.

Thank you for your post!

Your post was mentioned in the Steemit Hit Parade in the following category:Congratulations @knircky!

Look a that... There is more than 'moon' and 'lambos' around here...

Been a longo time since i found someone interesting to follow on steemit...

Wow! Amazing to hear that. Great points you make and thank you.

As far as I understood, an ETF would allow people (well, hedge funds) to trade in Bitcoin and other crypto without the need to actually hold them? Given the current state of ownership (private keys and a high possibility of fraud or accidental loss), it would be unwise to have a fund invest in a few millions of dollars only to have the security of a Ledger with no way of assuring only restricted and qualified access to the 'physical' tokens.

Also, if there was an influx of fund money, wouldn't it do a lot to stabilise the crypto economy? Not great for someone who wants to Lambo in a few months, but it is essential for long term stable growth and adoption.

Now, I may not have understood what the purpose and consequences of an ETF are, seeing as that is not my field of expertise!

i guess we will fomo build up to the 28th or so now

This was a pretty in-depth article. The world awaits what long term position on crypto currencies. #resteemed

Posted using Partiko iOS

Why on earth would Bitcoin need an ETF?