Bitcoin was a high-gaining currency in 2016 and 2017. All the hype in December 2017 has brought even more attention to it and cryptocurrencies in general, as many people tried to jump on the bandwagon and catch a ride to the top.

But when that happened, those who had bought earlier started to sell to make some gains themselves, and Bitcoin went through another bubble/cycle where the value dropped/tanked again, as it has in the past. Some people think they got cheated, some people think it's a scam, but they don't understand how buying and selling creates bubbles in trading markets to change the value of something. Many thought they were buying into a "sure thing" that was going "to the moon" as some like to say.

And when Bitcoin was going up in USD value, so too did all the other cyrptocurrencies go up in USD value. When Bitcoin went down relative to the USD, most cryptos went down relative to the USD too.

With this recent wave of interest in Bitcoin, a study was conducted to assess how the value of Bitcoin is connected and affects other cryptocurrencies and mainstream traditional assets. The result were published in Economics Letters earlier this February, 2018.

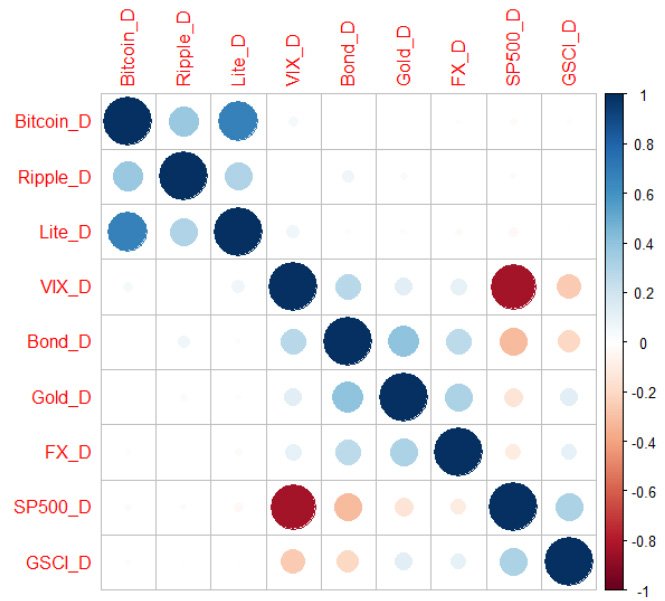

Three cryptocurrencies were looked at: Bitcoin, Litecoin and Ripple. Gold, bonds, stocks, the S&P 500 and Forex are some of the traditional assets that were compared and correlated with Bitcoin's rise and fall in value.

The study found that Bitcoin affects Ripple and Litecoin significantly, with a spillover of 28.37% and 42.3% respectively. The highest spillover influence to a traditional asset was from Bitcoin to Forex at 15.25%. This would make sense to be the traditional asset class most affected, since Forex is about trading in currencies, which Bitcoin is. But the influence is stronger from Bitcoin to affect Forex, than the reverse of Forex affecting Bitcoin, with only a 4.18% spillover.

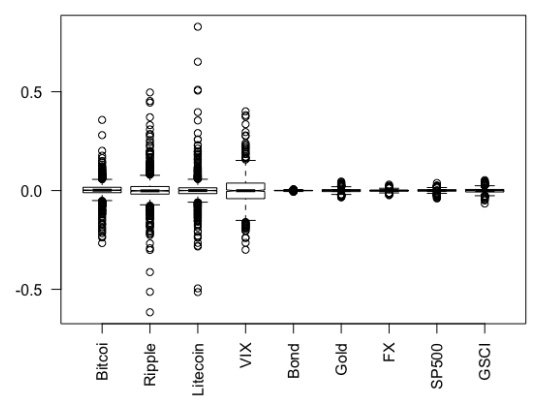

In terms of volatility, cryptocurrencies are more volatile than traditional assets, as many of us in dealing in cryptos already know from experience.

It seems Ripple and Litecoin have limited influence on Bitcoin, demonstrating that Bitcoin is the king of the cryptocurrency market at this time. When Bitcoin goes up in value, the other cyrptos like Ripple and Litecoin follow suit.

Cryptocurrencies are shown to be highly interconnected to each other, but are still isolated and disconnected from traditional assets. For now, this means that a devaluation of Bitcoin is unlikely to have much of a negative effect on the price of gold or the stock market, for instance.

The study concludes that cryptocurrencies are an emerging asset class for investors, but due to the demonstrated volatility they are "difficult to hedge against". That means you can easily lose a large part of your investment because of how volatile the crypto market is. Be careful how you invest in any asset, but be more careful with crypto.

Do you invest in crypto?

Do you invest in traditional assets?

Which do you prefer?

Have your say, speak your mind.

Thank you for reading. Peace.

Nice post! The fact that cryptos are uncorrelated with other assets makes them a very good addition to any savvy investors portfolio as you can increase the expected return.

Indeed :)

i started with crypto. my portfolio is all crypto.

would you say that investing in other (non crypto) assets will decrease my expected return? and why?

I’ve been wondering what an overall economic downturn would do to the crypto space. My guess is it would be impacted along with traditional assets. Bitcoin may be a crypto safe haven but it’s surely not a traditional safe haven. I much prefer the volitility of crypto, because proper portfolio management with prudent asset allocation will result in faster profit taking cycles. I first invested in precious metals in 2011 (should have been in crypto) and it’s taken forever to get a trend to change. I love the speed of the crypto market, but need to be better educated on how to protect (store) my investment. This isn’t much of a problem in traditional investments. Overall, I’m pumped to be in crypto and can’t wait to see how it progresses over the next couple years!

Yup, not as safe but better potential earnings ;) The safety of precious metals is like a snail waiting for it to go higher lol... I'm in the same boat... didn't trust in immaterial invented currencies at first...

I've tried both. I prefer crypto because I see it as more promising. It being decentralized helps it over all traditional markets. There's manipulation in either case but with crypto at least there is less control and regulation. I trust crypto because it is raw, because it can become anything. Also, just the sheer usability of it. Many are upset about slow BTC transaction times. At least you don't need a custodian. The network isn't closed on Sundays. Once we scale up, we're not going to even need BitPay and Coinbase Market or whatever. We're just going to have multi-wallets for our daily spending and all merchants will accept most tokens. Pricing can be done in averaged prices. 50 day average, for example. I've played with stocks and made a little in that as well. This is better. This is exciting. This is new. I'm for what we're doing here. The old guard can have what they want. That's the old way-- unchanging.

You make a good point :) More potential to make gains ;) Thanks for the feedback, especially sine you add your experience from traditional markets.

Thanks for sharing i will done upvote I always see your post. And follow you

I'm excited to see where this thing goes. Thanks for the big ole upvote @krnel!

I'm not investing in Shuan. But I am investing knowledge. Financial power is not enough. My aim here is to make a profit and invest. Thanks to the knowledgeable people like you, I have the knowledge. Thank you.

According to my thoughts, Ripple and Steemm are suitable for me.

Investing in quality knowledge is much more meaningful, I agree. I have done that for many years now :) It pays long into the future, priceless :)

Woww I am so glad that we agree. I also thank you very much for your comment. Yes, with the right moves, we have beautiful winnings :)

I did invest in traditional assets because they have physical existence and well-known market as compared to Crypto. I'm planning to invest in Crypto after getting encouragements from so many posts on expected huge rise in bitcoin and 50k expectations till December but on the other side, it's volatile, there could be a sudden downfall as happened in January when it was as down as 6k USD. I'm really confused whether it's the right time to invest in BTC?

What would you suggest?

I also did physical investments as well, and ignored BTC for too long... I think BTC is high to buy into it (relative to the lower 300-600 range when I could have earlier, so it's too high for me comparatively)... but maybe it will go higher... maybe I'm wrong. I won't tell anyone to invest in BTC or anything. Make that decision on your own ;) It's up to you ti decide if you think it will go up and be worth it, or not... The risk is yours to take.

Exactly, that's the main thing. While one is anticipating its rise, another speculate for its fall and it's all so confusing.

Thanks for reply and best of luck for your investments.

Throw $20 a month into BTC. What could it hurt? Then when you find yourself with a pile ($300 or so) maybe start spreading out that BTC into some of the other projects you deem worthy. Or just hustle on STEEM and try and do gigs / bounties and earn crypto by the blood, sweat & tears method. Just don't sit out entirely.

Oh yes this could be the way. Instead of investing 5k$ altogether, why not to start from a little.

Thanks for the advice bro.

That study does make sense. It doesn't take long to figure out that Bitcoin is the big influence on altcoins in dollar terms.

STEEM's drifted up and down between a range of ~10,000 satoshis to ~50,000 satoshis since November of 2016. The only reason it's above four bucks right now is because of Bitcoin's huge leap.

Bitcoin's still the Big 'B", at least for now.

Indeed, it's still the big king of the hill, for now ;) hehe

For now. ;)

I own some precious metal, some crypto and we try to hold cash in USD.

Being on the lower end of the income scale, all of these holdings are relatively small.

But I like the prospect that crypto has simply because it is another disruptive technology.

Remember some of the "experts" predicted that the internet would have about as much impact on the economy as fax machines.

I look for coins that have some use in the real world, and that are still cheap, hoping that those few hundred coins purchased at $0.04 can multiply in value in the future.

Oh yeah, at some point the crypto market will have an effect on traditional markets, and vice versa hehe.

The fact that Bitcoin is not that dependent on traditional markets is great in my opinion. That's what allows it to create value and freedom. But I'd also like to see more and more cryptocurrencies starting to live a life of their own (like Steem) and starting to decouple from Bitcoin. Currently Bitcoin is the main gate between fiat and crypto and this means a lot of the cryptospere is directly dependant on it. The more ways to trade between fiat in altcoins directly, the less important Bitcoin will be.

I think Bitcoin served a great purpose but there are numerous coins nowadays which are superior and who deserve to take the torch from it as the market leader. But to do so, they need to stop being dependent on it which means a lot of exchanges having to deal with a lot of regulation.

Eventually, but it takes time for ppl to get off the bandwagon and support something better quality than the popular quantity ;)

Well, I think we are certainly headed in that direction. It feels like it was yesterday when Bitcoin held the majority of the total cryptocurrency marketcap while it's now hanging around 1/3. I'd love to see it below 10% (because of overall growth of course).

The game will start getting quite interesting when individual coins start moving around on their own. How long that will take, I don't know... right now we're just at the stage where everything-- as perceived by the broader public-- is either "Bitcoin" or "like Bitcoin." Most alt coins seem to have zero identity of their own outside the limited realm of cryptocurrency enthusiasts.

Steem is sort of interesting because of the whole social platform and the increasing number of initiatives to create an underlying economic base here: @steembay, @ steemgigs and so on. With the basis for an actual ecosystem economy being slowly laid, I have to wonder if Steem will be one of the first alt coins to "break loose," so to speak.

I used to hold some conventional assets for investments, nut it has been many moons; we liquidated pretty much everything to buy a house and land outright with cash.

I will be doing similar in a few years to build a eco-sustainable house... somewhere... hehe.

Both the things can be beneficial.

Investing in traditional assets could take time to give you profit, it's not like that you today and the value goes double the next time.you'll have to wait some time to get benefit from traditional assets.

But if we talk about Crypto market or you can say crypto coins,

You can be the richest man on this planet in just one day, or there is also a possibility of you becoming the Poor people of this planet.

If you can afford to take chances, My answer is to invest in Crypto,

but if you afraid of taking chances, then go for traditional assets :) Thanks.

Indeed :) Thanks for the input.

Your welcome.: )

If you are and oldie you'll never invest in Crypto , Because of the Some bad news about bitcoin etc and will invest in traditional assets like buying shop,property or doing some business,

But if Young blood like me, i'll definitely invest in crypto, because I've seen the fastest growth of this technology.

Hehe, good luck :) I've done both.

Best of luck :)

People looking to replicate the success of the first Bitcoin investors are investigating ‘alt-coins’ including Ethereum, Litecoin and Ripple in the hope they can be bought cheaply now and sold for a much higher price at a later date.

Yup, the hope is invest early and wish for big gains later on ;)

Bitcoin is on the line, and so is the long one, the most valuable crypto money to invest in. Bitcoin's most captivating feature is that it is not unfair to say that it promises huge profits. However, due to high variability, it can also cause huge damages.So my preference is litecoin..Litecoin has been one of the most stable crypto parallels ever. We can even address "safe harbor". @krnel

Good luck in your investment with Litecoin ;)

thanks for shearing sir, I prefer crypto because I see it as more promising. It being decentralized helps it over all traditional markets. There's manipulation in either case but with crypto at least there is less control and regulation. upvote and resteemed

I have not, and I only just read the first few sentences. It seems like a "SBD" for Bitcoin to make a stable price? Can you explain it more accurately? Thanks.

I have to look at this. I didn't think that many USDTs were made. A lot but not a sizable percentage of crypto market cap. Something like 2 billion or so I think....