As the oldest crypto currency, Bitcoin is the flagship of crypto world. Bitcoin still accounts for 41.7% of the total value of the crypto currency market. Therefore, the price of Bitcoin is dominant on cryptos. Crypto currency prices are moving together under the leadership of Bitcoin. The price of Bitcoin does not determine the price of other crypto currencies, but it is clear that there is a high correlation between the price of Bitcoin and other crypto currencies.

We are interested in the price development of Bitcoin and try to understand the price dynamics.

The main question in my mind is: how much Bitcoin's "real" value is?

I can't really rely on technical analysis methods that try to predict prices through the acceleration of demand for a financial asset. Of course, I do not argue that these methods are completely invalid, but I can see that they are quite fragile.

There are basically two types of investors: investors who try to catch the trends and those who seek to buy financial assets when they are respectively cheap.

Investors who try to catch a positive or negative trend and make money from it are not interested in the "real" value of the asset they invest in. Regardless of the price level, they try to make money by moving according to the trend. Their motto is: "Trend is your friend".

So, for example, they hope to profit buying Bitcoin when the price is 15.000 USD. If they manage to get out at the right time, they can accomplish their goals or they can do great damage. The traders who are betting on trends take intensive advantage of technical analysis methods.

The second ecole try to buy a financial asset when it is cheap and hold it for a long time and sell when it is valued assuming that it is more than "real" value. I'm one of those investors.

The most popular fundamental analysis methods for determining the "real" value of a company are the price-earning ratio and the market value book value rate. The price-earning ratio refers to how much percent of the company's invested capital is earned in a year. Market value book value ratio compares the book value of the company assets calculated using the accounting methods with the market value of the company. When you invest in a company, you can understand more or less what you are actually investing in through these ratios.

It is not possible to use such methods for crypto coins.

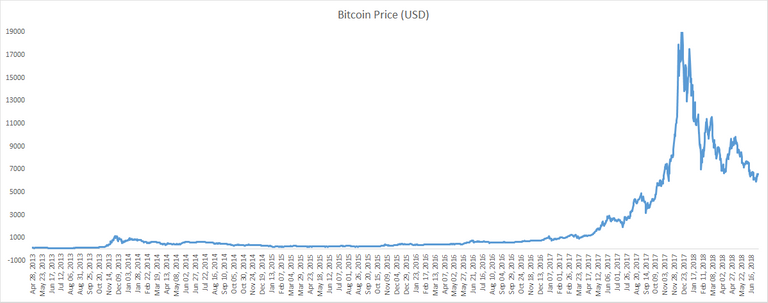

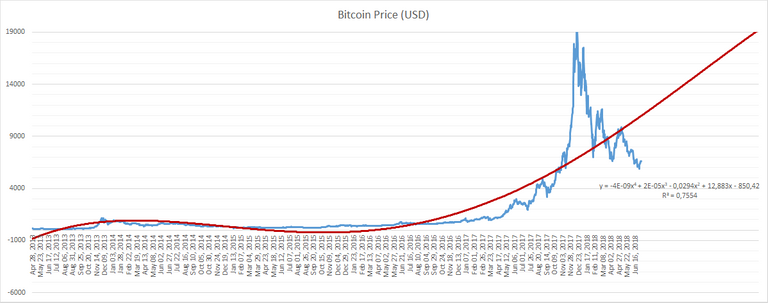

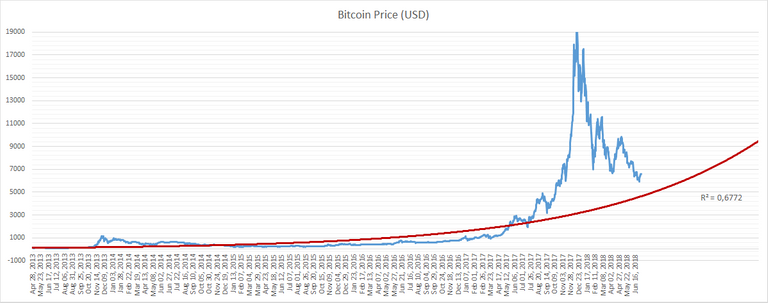

In this context, looking on historical prices seems to be the most logical solution. If people assume that the value of an asset is at a certain level for a long period of time, we have to rely on that value. The oldest price data I could find on bitcoin belongs to April 2013. Since then, the daily development of bitcoin price is shown in the chart below.

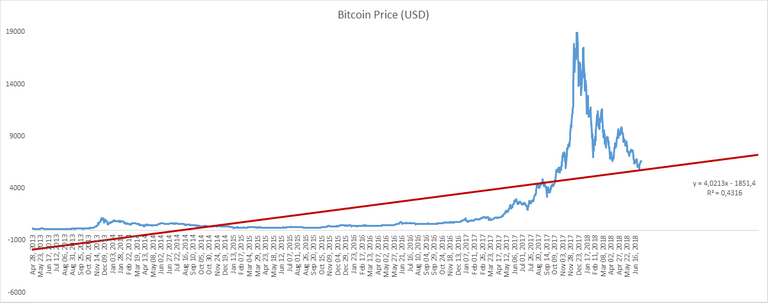

Looking at this chart, we want to estimate the future bitcoin price. For this reason, we want to establish a model that will best explain this data. After setting up such a model, we can estimate the price by extending the relevant trend line to the future. First, we try to place a linear trend line.

It is obvious that the graph does not explain our data set very well. The fact that the R square value represents the description of the data set is 0.4316 confirms the weakness of the model. It is interesting to note that the trend line starts from the minus, but I do not apply a correction because such a correction will reduce the predictive power of the model. According to the model, the price of bitcoin should be 5.765 dollars and expected to occur 7.233 dollars after a year.

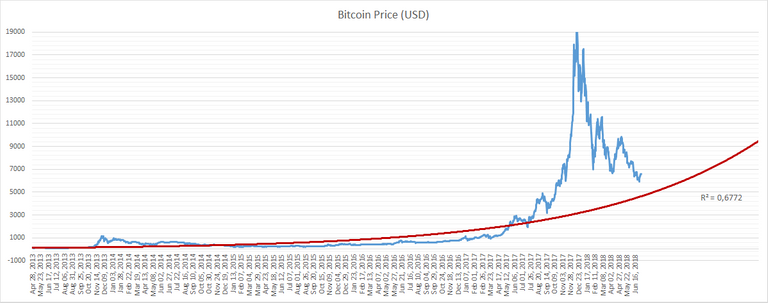

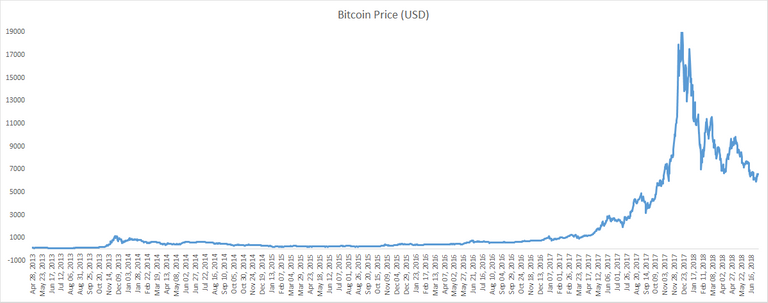

The actual price values shown in blue show us that prices have developed exponentially. So we draw a new graph with an exponential equation.

We see that the new graph we draw better explains the data. The R-square value, which shows the success of the model, has reached 0.6772. According to the model, the price of bitcoin today should be around 4600 USD, 1 year later, we can expect the price of Bitcoin to rise above 9400 USD.

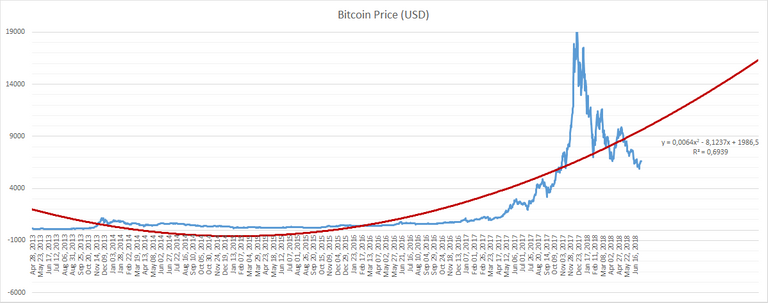

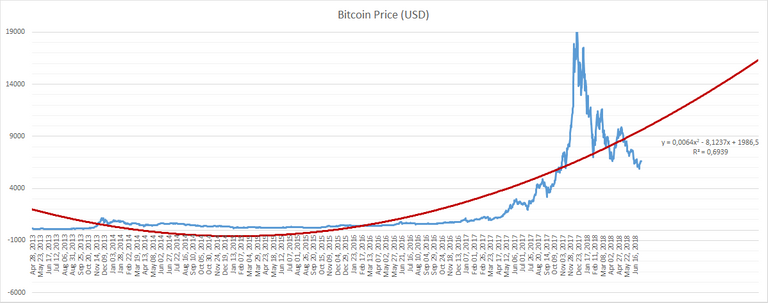

We see that our chart does not explain the last 1 year data very well. We use a second-order polynomial equation to better explain the last year's data.

We see that the graph reveals the last period data a little better. The R square value has risen to 0.6939. According to this model bitcoin's expected price today is 9.558 USD. A year later, we can expect the price to be 16.294 USD.

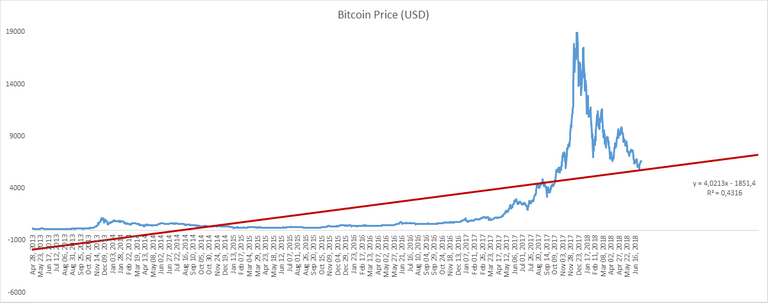

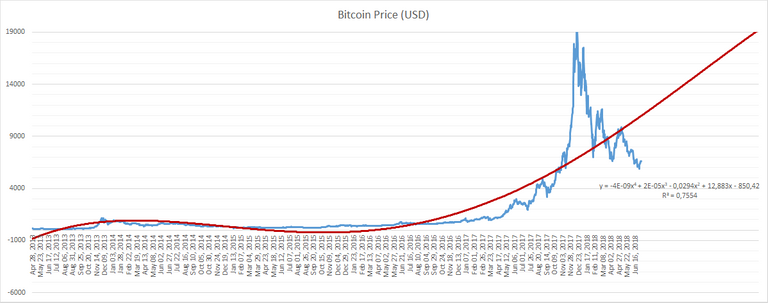

By increasing the degree of polynomial equation, it is possible to build models that explain data much better. For example, when we experiment with a polynomial equation of four degrees, we get much better results. The R square reaches 0.7554. The model shows that after 1 year the bitcoin price can reach USD 19,000 again.

According to the principle of "Ocram's Razor ", the more simple a model is, the more likely to be true, as the model is more adapted to the data as it becomes complex. This is called over-training in modelling terminology. In this context, I think the most reliable model is the linear model shown in the first graph.

CONCLUSION

According to my analysis, I have achieved the following results.

- The price level of Bitcoin reached at the beginning of 2018 was a financial bubble.

- I think Bitcoin will be a permanent financial asset and its price will increase in the future. There is no need to panic in price declines.

- I think that best models to estimate the price of Bitcoin are the first model with linear equation and second models with exponencial equation.

- I suppose the Bitcoin price will be higher than the price shown in the first equation and lower than the price shown in the second equation.

- When we take average prices of the first two models, we conclude that Bitcoin's current expected actual price is USD 5.182 and the expected price of the next year is USD 8316.

- In the next 1-year period, prices are likely to be out of the forecast, but in the long run, prices are likely to follow the trend shown in the first two equations.

The opinions I mentioned in this article are not investment advice, but the personal assessments of an author who is not an investment expert.

Thanks for reading.

Image Sources: https://pixabay.com/ and https://giphy.com/

Uzun Vadeli Bir Perspektifle Bitcoin Fiyat Analizi

Kripto paraların en eskisi olan Bitcoin kripto dünyasının amiral gemisi durumunda. Bitcoin halen kripto para piyasasının toplam değerinin %41.7'sini oluşturuyor. Dolayısıyla Bitcoin fiyatı kripto para dünyası üzerinde çok etkili oluyor. Kripto para fiyatları Bitcoin'in öncülüğünde birlikte hareket ediyor. Bitcoin'in fiyatı diğer kripto para fiyatlarını elbette tümüyle belirlemiyor ancak Bitcoin fiyatı ile diğer kripto para fiyatları arasında yüksek bir korelasyon olduğu açıkça görülüyor.

Kripto para işine yatırım yapmış kişiler olarak Bitcoin ve diğer kripto paraların fiyat gelişimini merak ediyoruz ve fiyat dinamiklerini anlamaya çalışıyoruz.

Aklımdaki temel soru şu: Bitcoin'in "gerçek" değeri ne kadar?

Bir finansal varlığa yönelik talebin ivmesi üzerinden fiyatları tahmin etmeye çalışan teknik analiz yöntemlerine bu bağlamda pek güvenemiyorum. Bu yöntemlerin tümüyle geçersiz olduğunu elbette savunmuyorum ancak bunların oldukça kırılgan yapıda olduğunu görebiliyorum.

Temelde iki tür yatırımcı var: Trende oynayan yatırımcılar ve ilgili finansal varlığı ucuzken alıp yükseldiğinde satmaya çalışanlar.

Artı ya da eksi yöndeki trendie oynayıp bundan para kazanmaya çalışan yatırımcılar yatırım yaptıkları varlığın "gerçek" değeri ile ilgilenmiyorlar. Fiyat seviyesinden bağımsız olarak trend arkadaşındır mottosuna göre hareket ederek para kazanmaya çalışıyorlar. Böyle olunca örneğin 15.000 USD olmuş Bitcoin'i o fiyattan alıp kar etmeyi umabiliyorlar. Doğru zamanda çıkmayı başarırlarsa hedeflerini gerçekleştiriyorlar ya da büyük zararlar edebiliyorlar. Trende oynayan yatırımcılar teknik analiz yöntemlerinden yoğun olarak yararlanıyorlar.

Bir finansal varlığı ucuzken alıp uzunca bir süre elinde tutmayı ve değerlendiğinde satmayı düşünen ikinci ekol ise o varlığın bir "gerçek" değeri olduğunu varsayıyor. Ben de bu yatırımcılardan biriyim.

Bir şirketin "gerçek" değerini belirlemeye yönelik en popüler temel analiz yöntemleri fiyat kazanç oranı ve piyasa değeri defter değeri oranı. Fiyat kazanç oranı şirketin yatırılan sermayenin yüzde kaçı kadar kazanç sağladığını ifade ediyor. Piyasa değeri defter değeri oranı ise şirket varlıklarının muhasebe yöntemleri ile hesaplanan defter değerini şirketin piyasa değeriyle karşılaştırıyor. Bir şirkete yatırım yaptığınızda bu oranlar aracılığıyla aslında neye yatırım yaptığınızı az çok anlayabiliyorsunuz.

Kripto paralar açısından böylesi bir yöntem kullanmak mümkün olmuyor. Görece yeni kripto paralar için ilgili kripto parayı piyasaya sürenlerin kim olduğu, nasıl bir ekibe sahip oldukları, hangi problemi çözmeye aday oldukları gibi soruların yanıtları aranabilir, bitcoin ise oldukça yerleşik bir kripto para, dinamikleri biliniyor.

Bu çerçevede dönüp fiyatlara geçmiş fiyatlara bakmak en mantıklı çözüm olarak görünüyor. Uzun bir dönem boyunca insanlar bir varlığın değerinin belirli bir seviyede olduğunu varsaydıysa o değere güvenmemiz gerekiyor. Bitcoin ile ilgili bulabildiğim en eski günlük veri Nisan 2013'e ait. O dönemden bugüne Bitcoin fiyatının günlük gelişimi aşağıdaki grafikte yer alıyor.

Bu grafiğe bakarak gelecekteki Bitcoin fiyatını tahmin etmek istiyoruz. Bunun için bu verileri en iyi açıklayacak modeli kurmak istiyoruz. Böylesi bir model kurduktan sonra ilgili trend çizgisini geleceğe uzatarak fiyat tahmini yapabiliriz. Önce doğrusal bir trend çizgisi oturtmaya çalışıyoruz.

Doğrusal trende göre Bitcoin'ün güncel fiyatının "gerçek" değerinin bir parça altında olduğunu görüyoruz. Ancak modelin veri setimizi iyi açıklamadığı grafik üzerinden açıkça görülüyor. Modelin veri setini açıklama gücünü gösteren r kare değerinin 0,4316 olması da modelin zayıflığını teyit ediyor. Trend çizgisinin eksiden başlaması dikkatinizi çekmiştir, bunun üzerinde bir düzeltme uygulamıyorum, çünkü böylesi bir düzeltme modelin tahmin gücünü azaltacaktır. Modele göre Bitcoin'in bugün olması gereken fiyatı 5.765 dolar ve 1 yıl sonra gerçekleşmesi beklenen değeri 7.233 dolar.

Mavi ile gösterilen gerçekleşmiş fiyat değerleri bize fiyatların üstel olarak geliştiğini gösteriyor. Dolayısıyla üstel bir denklem içeren yeni bir grafik çiziyoruz.

Çizdiğimiz yeni grafiğin verileri daha iyi açıkladığını görüyoruz. Modelin başarısını gösteren r kare değeri 0,6772'ye ulaşmış durumda. Modele göre Bitcoin'in bugün olması gereken fiyatı 4.600 USD dolayında, 1 yıl sonra ise Bitcoin fiyatının 9000 USD'ın üzerine çıkmasını bekleyebiliriz. Grafiğimizin son 1 yıllık veriyi çok iyi açıklamadığını görüyoruz.

İkinci dereceden bir polinom denklem kullanarak son yılın verileri daha iyi açıklamaya çalışıyoruz.

Grafiğin son dönem verilerini biraz daha iyi açııkladığını görüyoruz. R kare değeri de 0,6939'a yükselmiş durumda. Bu modele göre Bitcoin'in bugünkü beklenen fiyatı 9.558 USD. Bir yıl sonra ise fiyatın 16.294 USD olmasını bekleyebiliriz.

Polinom denklemin derecesini artırarak verileri çok daha iyi açıklayan modeller kurmak mümkün. Örneğin 4 dereceden bir polinom denklemle deneme yaptığımızda çok daha iyi sonuçlara ulaşıyoruz. Modelin açıklama gücünü gösteren r kare değeri 0,7554'e ulaşıyor. Model 1 yıl sonra Bitcoin fiyatının yeniden 19.000 USD'ye ulaşabileceğini gösteriyor.

"Ocram'ın Usturası" ilkesi gereği bir model ne kadar basitse o kadar güvenilir oluyor, model karmaşıklaştıkça gerçekleşen veriye göre kendisini daha fazla uyarladığından yanılma olasılığı artıyor. Bu bağlamda en güvenilir modelin ilk grafikte gösterilen doğrusal model olduğunu düşünüyorum.

SONUÇ

Yaptığım alternatifli analizlere göre aşağıdaki sonuçlara ulaştım.

- 2018 yılının başında ulaşılan Bitcoin fiyat seviyesi bir finansal balondu.

- Bitcoin'in kalıcı bir finansal varlık olacağını ve gelecekte fiyatının artacağını düşünüyorum. Fiyat düşüşlerinde paniğe kapılmaya gerek yok.

- Bitcoin fiyatını en iyi tahmin eden modellerin birinci ve ikinci grafikte gösterilen modeller olduğunu düşünüyorum.

- Bitcoin fiyatının birinci denklemde gösterilen fiyatlardan yüksek ve ikinci grafikte gösterilen fiyatlardan düşük bir seviyede gelişeceğini düşünüyorum.

- İlk iki model sonucu oluşan fiyatların ortalamasını aldığımızda Bitcoin'in bugünkü beklenen fiyatının 5.182 USD ve 1 yıl sonraki beklenen fiyatının 8316 USD olduğu sonucuna ulaşıyoruz.

- Gelecek 1 yıllık dönemde fiyatların burada öngörülerin çok dışında gerçekleşme olasılığı da bulunuyor ancak uzun vadede fiyatların ilk iki denklemde gösterilen trendleri izlemesi kuvvetle muhtemeldir.

Bu yazıda belirttiğim görüşler yatırım tavsiyesi değildir, yatırım uzmanı olmayan bir yazarın yaptığı kişisel değerlendirmelerdir.

Okuduğunuz için teşekkür ederim.

Bitcoin is really unpredictable due to its being so volatile. Some whales do pump and dump for them to maximize their gain and due to many reasons. But currently, crypto have bad reputation this is mainly because of some ICO that ends in a scam, some due to several incidents of hacking that lose millions of dollars and these give negative effect to the cryptoworld.

hacking causes of lost of faith on crypto , missing billion of dollars from market in the last 5month , recently 7000 btc stolen from BINANCE THROUGH SYSCOIN that makes worry all of us .

hey hi

its "cryptocurrency update"

stay tuned for cryptocurrency market update

follow and upvote and comment on my blog

https://steemit.com/@dinkar

wow what a great idea sir ji

Hi, I gave you an upvote on your post! Please give me a follow and I will give you a follow in return and possible future votes!

Hi, I gave you an upvote on your post! Please give me a follow and I will give you a follow in return and possible future votes!

Yeah, It's True...

Exchanges are getting hacked that creates Negativity In The Market

@bnbtravels123 I dont agree completely.. Exchange hacking and Blockchain hacking are two different aspect.. till now most of the cases has been occured at eco system end point and not in core of the system.. & I Believe this will lead to more decentalization and the end of the day! like dEX are coming with more force into picture

Hi, I gave you an upvote on your post! Please give me a follow and I will give you a follow in return and possible future votes!

Sorry Dear! Prove your worth with best conent for follow !

Upvote the post

https://steemit.com/technology/@umair72023/how-to-implement-client-side-validation-in-asp-net-mvc

Somehow, I don't agree with Hacking stuff which you have mentioned, you have to keep yourself safe. In traditional ways you get looted with arms and ammunition, here you get hacked by technology.

and this is why i hate most masternode coins.

not only do they make bank in the beginning, but, if they dont run away with all the monies, and are somewhat legit, the small bagholder like myself ( i only earn $15k AUD a year, and after rent bills / food, have about $15/w to live off. so to invest in a pos coin that has masternodes, and then give 50-80% of my stake reward away... makes it hard.

Upvote the post

https://steemit.com/technology/@umair72023/how-to-implement-client-side-validation-in-asp-net-mvc

hey hi

its "cryptocurrency update"

stay tuned for cryptocurrency market update

follow and upvote and comment on my blog

https://steemit.com/@dinkar

Nyc.

I think because of ico btc went outer and that's why...btc does not take position uptrend like yearly.......

yes @elizahfhaye very well said..I am new on steemit I indroduce myself please check it out https://steemit.com/introduceyourself/@aditya61/introducing-myself

totally agree with you.

@elizahfhaye BTC is one of the most valueable currency ! what i feel tht it been manupulated vai Tether or other related currencies there was a research done as well one the same

Ref : https://www.newsbtc.com/2018/06/14/new-research-claims-bitcoin-price-manipulated-using-tether-2017/

as well you can find when ever BTC is recovering ppl who are holding BTC are dumping it .. seems they intentionally do not want to recover again .. So this should go for some more time and afer a certain level of regulation BTC should recover more stronger and more stable way

Upvote the post

https://steemit.com/technology/@umair72023/how-to-implement-client-side-validation-in-asp-net-mvc

Yes u r right

I don't think anyone really knows what is going to happen.

The future looks sooo bright! Thanks for the positive info!!

Bitcoin aslında az bir hareket etdiynde altcoinlerde 100 de 500 1000 kar ya da zarar etmek oluyor

hey hi

its "cryptocurrency update"

stay tuned for cryptocurrency market update

follow and upvote and comment on my blog

https://steemit.com/@dinkar

Upvote the post

https://steemit.com/technology/@umair72023/how-to-implement-client-side-validation-in-asp-net-mvc

Evet, alt coinler daha hızlı hareket ediyorlar

I pray the price of bitcoin goes, so as to bring in the other coin up.

Good idea, I am wondering how you did not take the inflation with its 4-year cycle of halvening into account at all.

Upvote the post

https://steemit.com/technology/@umair72023/how-to-implement-client-side-validation-in-asp-net-mvc

you are very good at your publications and worthy of being followed! congratulations friend you are exemplary!!!!

Great article, thanks for sharing and i look forward to your next article!

What do you think the price will be by the end of the year?

Bitcoin is really unpredictable due to its being so volatile. Some whales do pump and dump for them to maximize their gain and due to many reasons. But currently, crypto have bad reputation this is mainly because of some ICO that ends in a scam, some due to several incidents of hacking that lose millions of dollars and these give negative effect to the cryptoworld.

Upvote the post

https://steemit.com/technology/@umair72023/how-to-implement-client-side-validation-in-asp-net-mvc

All I do is HODL Bitcoin FIRM enough!

Hahahaha!

:)

Bitcoin story start from 5$ 2011.

https://steemit.com/million/@bidzpak/bitcoin-crash-my-usd1-16-million-story

Oh yeah!

@ronel Good one

so much info. imma have to bookmark this and go through it later. i not been sleeping properly lately, so my focus is a little low.

bit of luck whilst im scrolling the comments, there'll be a TTS in there ;)

excellent analysis. i agree with your analysis and it looks like we will be following the trends in the long run but in the short run we may see alot of fluctuations for next 3-4 months. overall trend looks bearish still.

Doing a prediction of the price of Bitcoin is one of the toughest Job of this universe! If any prediction comes true, that's just a fluke in fact! Technical analysis is more effective in the case of Fiat trading pairs (say Forex), unfortunately not that much effective in the case of Cryptos! It's because, this market is totally immature yet! There are a lot of kiddies, manipulators, hackers etc etc who are controlling the value of this market. Technical analysis will be much more effective when we will reach to a mature market where there will be no FUD! This technology is here to stay & gonna rule this world in a near or far future! Long term investors are gonna be the winners, short term investors are gonna be the looser!

I agree and I strongly believe if technical analysis is such a great way, most poeple wouldn’t share that information if it is indeed worth gold. Ie. why take the effort to post it on steemit, analysis is making money for you. Perhaps out of the good of someones heart, but I think these people are most likely in it to make money.

I think TA is fine, but there are porbably only very few who make consistent money with it.

I created a website to rank crypto looking at longterm properties using the Steemit blockchain to write benchmarks and share research with each other.

If anyone is interested just check my posts.

@muratkbesiroglu friend excellent post, as you say, are not financial advice, but for people who are entering the world of cryptocurrencies, it is something like a mouths open to the trend. I consider myself new in this type of subjects, and with your explanation clarify certain doubts that I had in relation to it. In my country unfortunately our national currency has totally declined by internal and external factors that, for the ordinary citizen, it is impossible to fight. For us, to count at the moment with any cryptocurrency, it is very advantageous, since when we change it, our finances, as it were, have a positive curve in relation to the purchasing power; that is, it is very viable to earn in cryptocurrencies, since with that we can give a certain battle to inflation, in a certain way. A fraternal greeting from Venezuela

I like your simple and clear writing. However, there is no value using curve fit that doesn't fit. What predictive value does that provide? If the correlation is low, then you must find a model that represents the data. Simply using a linear or exponential or polynomial curve is not a very useful exercise. Also, your conclusions do not follow from your analysis, since you make new points that have nothing to do with your analysis. I'm not trying to be harsh. I'm an engineer. If others read your post and start using Excel and it's linear curve fit to get an equation for Bitcoin price with it's obviously low correlation, then some may think they can actually predict it's value.

The more useful prediction is to watch the number of companies and governments (regulation) that are aggressively adopting blockchain technology, use the internet adoption curve as an analog and assume it will be similarly adopted but in a faster way. Technology speeds up over time including it's adoption. Like you, I'm a buy and hold and plan on making a lot of money from my crypto/blockchain investments. I also subscribe to top financial newsletters that provides the crypto positions with the best projects, best leadership and best on-ramp to adoption. The safest and most reliable way to invest in a highly volatile asset class like cryptocurrencies, is to buy small position sizes and forget about them. In 10 years those that did will have a meaningful change in their financial status.

Upvote the post

https://steemit.com/technology/@umair72023/how-to-implement-client-side-validation-in-asp-net-mvc

good advise, if you like to write benchmarks and check if you truly understand the crypto you invested in, check out my website https://cryptoowls.com you can write a benchmark about your favourite crypto amd check out how it scores. Feel free to join our telegram as well: https://t.me/joinchat/FrZCmw_Xqcj7i3sH65BU-g

Actually, I subscribe to quite a number of top financial newsletters. One is crypto focused and voted to the top position out all crypto focussed newsletter for its depth and itspicks. I am well positioned and do not talk specifically about my positions, because it's a costly service.

Teknik analize genelde pek güvenmediginizi söylemişsiniz. Buna tabiki saygı duyuyorum. Fakat ben kripto paralara yatırımın teknik analize bakilarak ve genelde günlük yada saatlik yapılması gerktiğini düşünüyorum. Çünkü TA bize yatırımcı eğilimleri hakkinda bilgiler vermekdedir. Ve kripto para dünyası için bu veri bizim olmazsa olmazımızdır. Bahsettiğiniz 2 ekolden 2. olan bist, dow jones gibi borsalara daha uygun diye düşünüyorum çünkü şirketlerin somut işleri üzerine tahmin de bulunuyoruz. Fakat kripto dünyada işler biraz daha soyut ilerliyor. Bu yüzden uzun vade tahminler genelde pek tutmuyor. Teknik analizleri biraz daha basitçe anlatmaya çalıştığım bir kac postum var. Blogumdan incelerseniz ve eksiklerimi yada yanlışlarımı belirterek kendimi geliştirmeme yardımcı olursanız çok sevinirim.

You say you don't usually trust technical analyze so much. Of course, I respect that. But I think the investment in the cryptocurrency needs technical analysis, because TA gives us information about investor tendencies. In my opinion, to invest cryptocurrency usually has to be done daily or hourly. You mentioned about 2 types of investor. Second type of investment is more appropriate for BIST, DOW JONES and so on. Because we are specucting on the concrete work of the companies in these exchanges. But in the crypto world, this progressing is more abstract. That's why long-term prediction is not usually true. I have a few posts about TA that I'm trying to explain more simply. I would appreciate it if you could review my blog and help me improve myself by stating my shortcomings or mistakes.

BTC risks falling below $6,341 (double bottom neckline - former resistance-turned-support, the lower end of the trading range) as indicated by the bearish setup on the hourly and 4-hour chart.

Acceptance below $6,341 would abort the bullish view put forward by the double bottom breakout, bull flag breakout and bullish falling channel breakout and would shift risk in favor of a drop below $6,000.

On the higher side, an aggressive move above the significant obstacle of $6,754 (23.6 percent Fibonacci resistance) would bolster the already bullish technical setup on the daily chart and open doors to $7,000.

Yea. BTC will definitely come back up. We just have to be patient and HODL for now

CET al hayatını yaşa.

https://www.coinex.com/account/signup?refer_code=c5sgt

Upvote the post

https://steemit.com/technology/@umair72023/how-to-implement-client-side-validation-in-asp-net-mvc

boss this is right time to buy crypto or not?? @banjo

My name is not Ashley. How would you know it is the first time you've talked to me. Maybe it isn't.

I think it is good analysis..but predicted always not happens.

Totally!

For sure

Hi murat, I created a way to rank crypto based on a longterm view using the steemit community, Basically by sharing research and writing benchmarks it becomes possible to grade the .

if you like to checkout my website: https://cryptoowls.com or join our telegram: https://t.me/joinchat/FrZCmw_Xqcj7i3sH65BU-g

Good and a detailed post

Can bitcoin reach its all time high in 2019? whats your opinion?

hey

@muratkbesiroglu plz suppot my @dilip77 profile

I do both, holding and working on a the daily-weekly trend. BTC coin and Cryptos are the future my friends.... now is the best time to learn and get prepared to be in the economy game in the future... those who dont invest on this will have harder times than grandpas doing electronic transfers. cheers to all!!

hello i read your blog you said in next year BITCOIN price is only bubble mins approx 8000 USD but my opinion is in next year BITCOIN price is 45000 USD

Other wise you explain is very well Thanks

Because we all know that it's not stable.

[In future Bitcoin will go more than 1 lac dollar or may be Come in less than 1$]Hi @muratkbesiroglu, I like your thought.! But, No One knows the #Bitcoin real value.

It's better to take a deep breath and see the bitcoin market recovery

I think bitcoin price being controlled by some whales, if we see patterns, 2 weeks back there was huge BTC move like 85000 or so and price goes from $5800 to $6400 and again 5 days back some moves push prices to $6700. But yes volume also affects the price, higher the volume , higher the price

But can Bitcoin reach 15k USD in 2010 ??@muratkbesiroglu you write very good blog.

absolutely right,. BTC will be definitely come back up.

Relatively, the price of bitcoin up to this moment is still low. One of the reasons why, is that, not all of the people know bitcoin, or how does it work. like for example, my grandfather doesn't know how to use bitcoin, not even my mother. When the time comes that all of my family members, or yours, or theirs, knew already the uses of cryptocurrency, what do you think would be the effect of it in the market? Yes! you got it.

Love your post

bitcoin price stay the one week mid $6350 to $6800.

everyone buy to less then $6000. but not possible.

Baii ji .. follow back krr do

keep it up boss

Nice information

https://www.okb.com/landingPage?channelId=1800037OKEx是全球领先的数字资产交易平台,支持法币交易、100余种创新数字资产币兑币交易、合约交易,为用户和行业提供安全、专业、透明的数字资产一站式服务

@ muratkbesiroglu Do you think Bitcoin reach All Time High in this year ?

should i invest in Bitcoin???

if i am in lose then my life will be waste for some next year.

But if i stay in profit then i will do something for myself in the future.

so what should i do???????

i think bitcoin comes in 4000$

No matter how much bitcoin price went down, it will definitely follow its previous path of touching ATH ..Its just a matter of time that tests every investors their patience and holding capacity ...There is always up and downs in every successful path so the downs are nearly ending soon as you can see any negative news from now not affecting the price that much..So from now any positive news like Fb joing crypto or like that will boost our crypto beyond our imagination..

our crypto experts are soo fool...bitcoin is not any statical problem so u cant judge it by graphs....lets take an example...bitcoins graph shows that it will increase in future tooo,,,,,,lets suppose if in 2019 , the intrest of bitcoin among people decreased,,,,will it grow again,,,,,answer is noo....now you will tell me that whales will increase its price...but my answer is that ,,,,whales dont care about its price,,,they only care about their profit....weather bitcoin is of $1 or $10000,,,it will not matter for them,,,they only know how to pump,,,,

thnaks

What about ripple de-centrelized?

What you think about this? Pls reply must

@muratkbesiroglu What do you think about the future of cryptocurrencies will goverments would accept it as an asset they have no way of regulating it so wouldnt that be a concern for them?

I think they will be forced to accept and regulate. Crypto creates real value. No way out

@muratkbesiroglu Im from India and from july 5 govt has just banned it! They are just not letting us to exchange the fiat currency to cryptos using banks. I strongly disagree with this step what do you think and can you suggest some ways to trade crypto even if the govt completely bans ?

@muratkbesiroglu do you think Bitcoin will hit it's highest price in end of the year 2018 ?

I don't know🤠

i have a Question for you .

can cryptocurrency is legal in india??

and how can i earn india currency by cryptocurrency ??.

please help me !!

its not legal in india

@cryptogem Bitcoin is not legal tender in India. If you can buy good and services with any mean that is called as legal tender. Fiat currency is legal currency. Now when we say bitcoin is legal, it stands neither true nor false. Bitcoin is neither legal nor illegal in India because India doesn't own it. Anything which is decentralized, government cannot interfere.

what is india currency my friend?? Did you mean Rupee..if it is then sit back and get relaxed.. Crypto is going nowhere. Its the future technology which is slowly growing. And if you need to exchange to rupee then WAZIRX exchange got i brilliant idea to get ride of it.. They are launching a P2P system for cryptoexchange method to fiat if govt bans crypto..For me Crypto is the future and you have already taken a step towards future

thank dear .

such a great infomation you giving me .

i need more helps about cryptocurrency

do your own research !

how??

bitcoin very risk

This is a very common electronic currency and has been around for a long time. Pretty good when using this coin!

bitcoini bu kadar uzun anlatman hoş

we all know that bitcoin always get reach 10,000$. so dont worry friends be positive every time.

tnx for upvote

hey hi

its "cryptocurrency update"

stay tuned for cryptocurrency market update

follow and upvote and comment on my blog

https://steemit.com/@dinkar