Introduction

I've heard a lot about the Steem platform, so I decided to try posting on it for this one topic. I'm looking for a place where I can control my own content without it being at risk of deletion, and where there is generally a higher comment quality available than those seen at reddit. We'll see how it goes.

Ethereum provided a wakeup callToday, I thought it would be a good idea to review my earlier outlook on the future of Bitcoin and Ethereum, which was initially posted at http://forums.prohashing.com/viewtopic.php?f=11&t=782. In general, I believe that the predictions made earlier, despite being delayed by the Ethereum fork, will continue to play out. The major difference from my earlier predictions is that I had only considered an "official" fork supported by the Core, and didn't include the possibility of a fork initiated without prior consensus. I'm now pretty sure that Bitcoin will have a hostile, non-Core fork, but so much time has passed that I don't think it has a high probability of success because, as I'll show, the outcome will be determined by the media, which is controlled by theymos. Even if the fork beats the odds, the outlook in the short term is grim regardless.

What has been preventing Bitcoin from forking seems to be that many people believe that miners control coins' destiny. As I pointed out at http://forums.prohashing.com/viewtopic.php?f=11&t=717, markets always pop up for both chains after a fork of a widely traded coin, because exchanges can make more profit that way. It's one of the reasons I've reiterated that the idea of creating a "2MB" fork has little chance of success. A temporary blocksize increase just increases the number of forks that are traded, causing confusion and confrontation.

Furthermore, we know that hashrate follows price, not the other way around. Many people continue to rail against the Bitcoin Core developers and expect miners to revolt without providing them an alternative fork first where they can earn profit.

We saw the causality between hashrate and price in action with Ethereum Classic (ETC), which had almost no hashrate immediately after the fork. Then, investor Barry Silbert led the charge in pushing up its price through his articles and Twitter posts. People like me started mining it - not because I have any belief whatsoever that ETC will surpass ETH, but simply because there were buy orders that I could sell into. ETC mining was so profitable that I turned on a house full of miners, on one of the hottest summer days with temperatures around 85 degrees. We mine ETC and have our payouts auto-sold into ETH. Most of the ETC miners, like us, don't care about ETC; they just want to get rid of the coins so that they could make more profit. If you still have trouble believing that miners care only about money, consider that over 95% of the payout coins we issue at our pool occur in coins other than the coin that was mined.

Despite so much hashrate being pointed towards ETC, the polls before the ETH fork indicated widespread support among users when weighted by holdings. It was pointless to ask ETH miners before the fork what their opinions were, because I've pointed out before that exchanges, not miners, have the power to decide these things. ETH will continue to be the canonical chain, and and ETC will remain a sideshow, but that doesn't mean that miners won't exploit ETC for profit while it lasts.

A Bitcoin fork is certain

With BTC, we also know that a similar poll of users indicated that a 50% plurality supported the BIP101 blocksize plan when it was announced back in September. Because developers Mike Hearn and Gavin Andresen were unwilling to force a fork, the 50% of users never had the chance to voice their opinions with their money on the markets. While more recent polling is not available, it is reasonable to suggest that the plurality would have turned into a majority as some supporters of other the blocksize expansion plans in that poll came onboard. There clearly exists a significant proportion of users who would bid up the price of a large blocksize BTC fork today if one were released.

At the same time, it seems that the ETH fork has caused many users to finally wake up and recognize that Bitcoin will remain stagnant and inferior unless they take matters into their own hands. For now, they are still mired in discussion at /r/btcfork. At some point, someone is finally going to end the debate and publish a fork client to put the choice to users. A precedent has been set that trading volume will be enormous, so exchanges would likely race to offer it for trading. If the fork has even a small chance of success, there will always be traders who buy it up the minute it is listed and try to convince others to do so, as happened with ETC.

What would a successful fork look like? First, it would occur soon - instead of yet more discussion, someone will simply take the well-tested Bitcoin Unlimited or BIP101 and add a few lines of code to fork the chain at a specific block. Second, it won't modify the proof-of-work to a different algorithm - people who blame miners for the current problem should be looking at themselves, who are failing to provide an alternate option for miners to mine. Third, the fork will permanently resolve this problem - a temporary solution like a 2MB fork won't succeed in adversarial conditions because another fork with a larger size (perhaps created by the Core itself, to cause chaos) will come along and supplant it. Finally, it needs to resolve only this problem - the blocksize is the only issue in Bitcoin that has enough importance to be worth the risk, and adding other features like Segregated Witness can only turn away people who would otherwise support the fork.

Potential outcomes

Now that we know that a fork is definitely going to come, it's worth discussing what will happen as a result. I review three possible outcomes below. In all of these outcomes, market forces and the actions of people involved will have a far greater impact on the result than the actual code in the fork.

Outcome A: Surge and collapse

One potential outcome is similar to what is happening with Ethereum Classic - an initial surge as proponents try to create an impression that the fork is taking over, and when they see momentum stall, they sell out and let the fork bleed down to a very low value. The probability of this outcome occurring with the new Bitcoin fork is lower than that of the old ETC fork, because there was a distinct dynamic in ETC of criminals having a lot to gain from its acceptance. That's why we continue to see paid ads and spam encouraging people to buy ETC, because the hackers are slowly leeching out the buy orders from people who respond to these advertisements. With Bitcoin, criminals don't stand to gain tens of millions of dollars by pumping up one fork over the other.

In this outcome, as with the other, we would see exchanges offering both forks. Here, however, wallet providers would sit on the sidelines. Since many people use bitcoins through wallet providers, they probably wouldn't even know that a fork had occurred, limiting the success of the fork.

It's difficult to see this result ending up in any way other than Bitcoin's slow death. Assuming that the fork was a serious attempt, the outcome would have demonstrated that the Bitcoin community is completely unable to come to any agreement whatsoever about moving forward. It implies that Segregated Witness, the Lightning Network, and any other solutions are also dead, because they too require a hard fork - and those hard forks will be far more risky and even more contentious.

Remember, the default outcome for Bitcoin in the absence of at least one successful fork is death. The Bitcoin network is already close to unusuable, and is inferior to Ethereum in all ways except volatility. If a fork fails simply due to low community acceptance, a huge amount of time would have passed and it would all but certain that the next fork would also fail.

Outcome B: Immediate success

In this outcome, a fork is released and most members of the community quickly rally around it. Its price exceeds that of the old fork and a rapid changeover occurs. We would probably see a slow rise for a period of time, and then over the course of a few hours the forks will switch trading positions, with people holding on to the old fork losing 80% of their wealth.

This outcome, like outcome A, hinges on the actions of wallet providers. Coinbase, in particular, controls 10% of bitcoin and has stated that they support a Bitcoin fork. Coinbase's refusal to support Ethereum Classic while they still released ETC for people to sell, is one of the key reasons why ETC failed to gain traction. Coinbase's switching to the new fork may be sufficient to turn the tide. Other providers, like Blockchain.info, would also play a pivotal role by declaring to uninformed users that the "official" fork is the new client.

On the other hand, there are forces that make this outcome less likely than the other outcomes. Core developers, who have a lot of money at stake both in holdings and in their business models, would make public statements declaring that they will quit cryptocurrency rather than work on the new fork. Some people will trust them to follow through on their word, and see their contributions as irreplaceable. Furthermore, journalists often contact Core developers for comments on Bitcoin events without asking ordinary users as well, so the media narrative would be one-sided. theymos would use his control of the Bitcoin media to create an "insulated world" where people visiting his sites would be tricked into downloading the Core client, even if the majority of Bitcoin users have moved onto the new chain.

These users would present a challenge to reach. They would download the Core client, visit theymos's linked "Core" wallet providers, and buy Core bitcoins. A stream of confused users would continue to prop up the Core's influence. Even if theymos himself doesn't become involved in outright scams, his misinformation will allow fraudsters to sell people lower-valued Core bitcoins at the higher new fork price and significantly damage Bitcoin's image.

Outcome C: Repeated forks and attacks

When previous Bitcoin clients were released, they were quickly subject to attacks from criminals who supported the status quo. It is reasonable to believe that a definite fork that does not require consensus would be subject to attacks even more massive than the previous attacks on the nodes that had not yet achieved the required consensus.

In this outcome, a fork is released, but criminals conduct the largest DDoS attacks in the history of the Internet, shutting down nodes and exchanges that offer trading in the fork. In addition to DDoS, replay attacks are used to steal money from the new fork. Some people may spend large amounts of money to fill up the blocks on the new fork and procure miners to mine those transactions, using up disk space for the new chain if they can get those blocks transmitted in time. Theymos would attempt to seize control of more domains and media outlets associated with the fork by registering them or buying out existing owners.

At the same time, some Core developers continue with their previous legal threats to deter people supporting the fork, or even file suits against them, tying them up in time-consuming and expensive litigation.

The end result in this case would be that the fork's blockchain stalls and its price collapses. Then, the fork creators would address the issue the caused the fork to fail. For example, if the fork failed because paid-off miners attacked the chain and the difficulty rose too high, then a minor adjustment to the difficulty algorithm might be made. Then another fork would be attempted by the same or a different group, and this would happen again and again, throwing the Bitcoin world into chaos until Bitcoin is eclipsed by Ethereum.

Factors determining the outcome

Astute readers will notice that, in this post and others, I repeatedly mention theymos as the key player responsible for the current Bitcoin deadlock. That's because the upcoming Bitcoin civil war will be determined by whoever can control the media narrative of what "Bitcoin" is. People listen to the media and use that information to move markets. It will be a battle between theymos and commercial wallet providers, and the winner will be whichever fork is considered as "Bitcoin" on the most websites and services. Exchanges will play little role because they will likely offer both coins, and miners will split hashrate between both forks at a ratio close to that of their prices.

The ETH fork was resolved very quickly because influential people in ETH quickly announced that they considered ETH to be Ethereum. Vitalik Buterin declared that he would never support Ethereum Classic, even if ETC grew to become more valuable than ETH. His statement stabilized markets and wallet providers followed his lead, leaving ETC as a slowly declining sideshow for hacker wars and speculation. ETC's decline will continue now that Coinbase and the "white hat" DAOs have announced that millions of previously locked up coins will be made available for people to sell out.

For BTC to fork successfully, someone will need to take a stand and back up his words with action. A huge bitcoin owner or wallet provider will need to place its business on the line and announce, like Buterin, that they will only support the new fork and will never return even if the fork falls significantly in value. There are only a few people who have the power to do that. Here's an incomplete list:

- Craig Wright could sign a message with his keys and say so, since he is known to support an unlimited blocksize. If a threat isn't enough, he could simply place an impenetrable sell wall of 1m bitcoins at $10 or $50 on his unfavored fork.

- Blockchain.info could change its entire website to work only with the new fork and ignore the old one.

- Coinbase could follow up on its founders' posts and announce they will never provide services related to the old fork, and like ETC, return the other fork's coins to users for sale.

- An ETF or trust could announce that its holdings will be valid only on the new fork.

Unfortunately, the odds of any business taking a stand are low, because businesses are incentivized to earn short-term profit, not long-term returns. They are also inclined to avoid legal risk. Yet, there is almost no risk and it requires little effort for an ordinary person to release a version of an existing Bitcoin client that simply allows larger blocks. That is why I believe it most likely that Bitcoin will move into a phase of "fork wars" (outcome C), where people will continually try to fork the Bitcoin network, and major businesses will decline to take a stand. The result will be that Bitcoin will remain deadlocked and that people will become exposed to Ethereum, see how much faster and less expensive it is, and its use will overtake that of Bitcoin.

If you are an investor, the outlook for Bitcoin is negative. In the unlikely event there is never a fork, other coins will continue to surpass it. If a fork succeeds, the total value of bitcoin will fall sharply during the changeover. If the multiple forks and attacks chaos scenario plays out, the networks will be grind to a halt, reminiscent of John Ringo's "Council Wars" series, where all the world's electricity is spent towards energy strikes between warring factions. No matter what happens, the price of bitcoin will fall. I still believe the total value of bitcoin will fall into the $200 range even in the best scenario, as previously predicted.

Conclusion

It seems that every time that I post, I keep looking for reasons to be optimistic about the future of Bitcoin, and I just can't find them. In the 4.5 months since I made the original post, there has been absolutely no progress on the blocksize issue, the Chinese miners reneged on their agreement to fork, and Segregated Witness is delayed even more than I predicted it would be. Nobody has stepped forward to offer a fork, and communities like /r/btcfork are mired in endless discussion when what needs to be included is simple.

Meanwhile, the Ethereum community chose legal legitimacy over an "anything goes" approach, which will attract the major corporations that are being turned away from Bitcoin due to its image. Ethereum is now so widely supported that it can, in just the past few weeks, be used to send value between people and exchanges interchangeably with bitcoin. Ethereum's transactions confirm 100 times more quickly at 1/100 the price. Ethereum's only major issue at present is its volatility, which is likely to decline as it gains adoption.

It is the media that will determine what Bitcoin is and how it moves forward, not exchanges, miners, or even users. With Ethereum, the media sided with Vitalik Buterin. With Bitcoin, theymos owns most of the media. Whichever side controls the most media in the end will most likely win the Bitcoin civil war. The only way that a fork will win that war is if businesses band together and seize or drown out theymos's media control.

I hope that Bitcoin users create a hard fork without miner consensus that eliminates the blocksize issue soon. But even if the fork succeeds, Bitcoin's odds of success are significantly overestimated by the prices in the current markets. Many people have not used Ethereum and they do not recognize how it has become a superior way to transfer value over the past two months, even disregarding its contractual features. The upcoming Bitcoin fork, which will happen one way or another, and which will be extremely ugly, is going to be a wakeup call to a lot of people, who are going to have to reexamine their beliefs that Bitcoin will remain the leading cryptocurrency.

This is really horrible utter nonsense. From Craig Wright, to claiming users support a fork from a totally inaccurate and unscientific poll. There is nothing of value in this piece. Sorry to be harsh but you should not write things that are false.

You are way out of line in your assertions.

Anybody can fork Bitcoin at anytime, just copy the code, and name it whatever. This is how most alt-coins have come into existence.

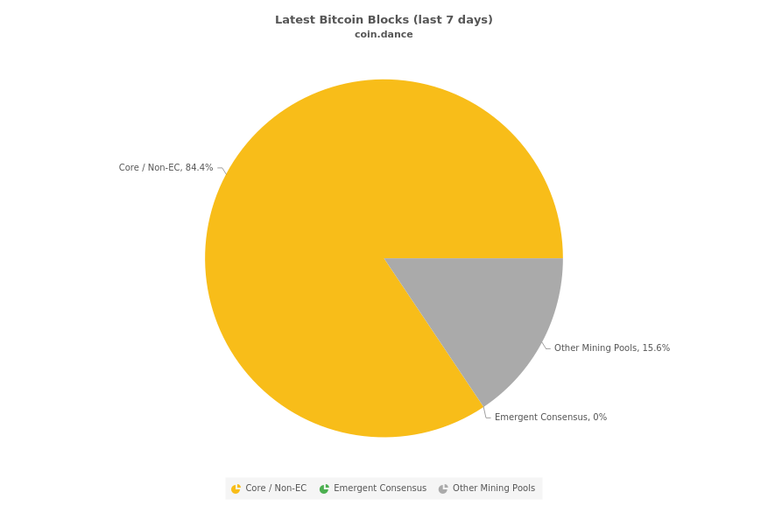

There is an indisputable consensus among Bitcoin miners in support of BTC Core and its road-map

Please see who is securing 96.5% of all the BTC blocks:

This is old news, it was decided in a miners' meeting held in Hong Kong last year. But some hard heads keep on spreading FUD ... ;)

Core's road-map points to deploying Segregated Witness first.

This will bring about 75% more capacity with the current block size, and a myriad of other advantages that will accelerate further development without the need for hard forks. Yes, as you pointed out, hard forks are dangerous!

SegWit is already being tested and it will soon be ready to implement in real BTC blockchain. And YES, 96.5% of miners will support it. Coindance : https://coin.dance/blocks

As long as you grow, scaling will be a never-ending challenge

Bitcoin has been growing and maturing for 8 years already

Please be patient

Let me try to summarize:

My response is this, you seem to realize the significance of names when it comes to forking. If "Bitcoin" forks to prioritize "usable" (consumer frequency) TPS, it will also become a thing which doesn't even need miners anymore. And miners follow price, as you said. So who cares if they all leave? I'll tell you who, exactly the people that need their chain secured by POW with no risk of unexpected changes.

Bitcoin as a store of value won't be dethroned for at least 5 years. ETH still has to prove its PoS transition among other issues. You make some good points, but your predictions are probably very inacurate.

I came here to say this. I agree that Ethereum is far superior as a technology, but its inflation rate has not yet been decided which makes it an unreliable store of long term value. If the inflation rate can be locked, I think ETH overtaking BTC becomes a certainty.

But thanks for the post, @prohashing. I really enjoy reading these.

I agree with what you stated but we must remember, ETHER was never intended to be a financial commodity like BTC. It was meant simply to pay miners to miner/operate the dapps and contracts.

It is most certainly a speculative asset, but with good reward/risk ratio.

Bitcoiners far outnumber Ethereum fans. Of course the majority of interest will come from the Bitcoin side.

What is missing in the OP is what we read about in the last 24 hours:

"I am currently in the midst of crowdfunding my own smart contract network tailored to the needs of the music industry, called Tao. Tao is designed to execute Bitcoin transactions automatically in order to settle royalty payments."

"I had the opportunity to have a quick chat with Kim Dotcom and our goals are aligned. Tao and Kim's BitCache system stand to generate thousands of transactions per block, exceeding the tolerances calculated by SegWit. Lightning networks simply are not an applicable solution to our applications."

What I point out is these (or anything like these) are the killer applications for BTC-B(ig)B(blocks). These will generate value outside the BTC-S(mall)B(locks) branch and only in the BTC-BB

In this case, the BB branch can execute all txs the SB branch can and many more. Given the higher fee required to confirm on the SB branch, all transactions in the SB would confirm in the BB but not the reverse.

The fork coders could avoid and ignore the need to separate the txs in a branch from the tx in the other. This is matter for wallets.

Every tx would be validable in both branches, but once a tx is validated in the BB but not in the SB, the same bitcoin in the SB can not be used anymore in the BB.

If there is a demand for BTCs in the BB branch (to be used to pay for songs rights or downloads) the buyers will only have the BTC mined in the BB branch, and the BTC mined before the fork and not splitted. More pre-fork BTC are used in the BB-branch to pay for small transactions with small fees (outstripping the ability of the SB-branch to keep up and splitting, de facto, the coins in two different chains) more demand there will be and less BTC will be available to be dumped in the new chain from the old chain.

It don't matter if the SB-branch split the coins and dump them on the BB-chain, because the use case will anyway support a price different from zero and accepting the transactions in the other branch (valid in both of the branches) as valid will always give something to mine.

The problem is protecting the branch from a 51% attack and the initial change of difficulty, but there are pretty easy ways to do it with small changes to the PoW and rules to accept new blocks.

As the use increase, the price of the BB-BTC would continue to rise against the SM-BTC.

Holy moly. This puts a much different perspective on the cryptocurrency economy. Why doesn't this post have more up votes?

Congratulations @prohashing! You have received a personal award!

Click on the badge to view your Board of Honor.

Congratulations @prohashing! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!