Is BitConnect about to fail? Why are the numbers falling?

I have long been a critic of BitConnect. I have a six part series going into depth of the scam.

https://steemit.com/fraud/@cryptick/is-bitconnect-a-ponzi-scheme-post-1

https://steemit.com/bitconnect/@cryptick/bitconnect-scam-inside-the-bitconnect-trading-bot-post-2

https://steemit.com/bitconnect/@cryptick/when-will-the-bitconnect-scam-implode-post-3

https://steemit.com/bitconnect/@cryptick/bitconnect-scam-how-many-people-are-involved-post-4

https://steemit.com/bitconnect/@cryptick/bitconnect-scam-inside-the-facebook-profile-of-a-scammer-part-5

https://steemit.com/money/@cryptick/bitconnect-the-billion-dollar-pump-and-dump-part-6

That said I have been watching the number of people who are listed at the scam and posting in the comments on post 4. This paid off as @msstraney pointed out growth slowed and I noticed the numbers fell!

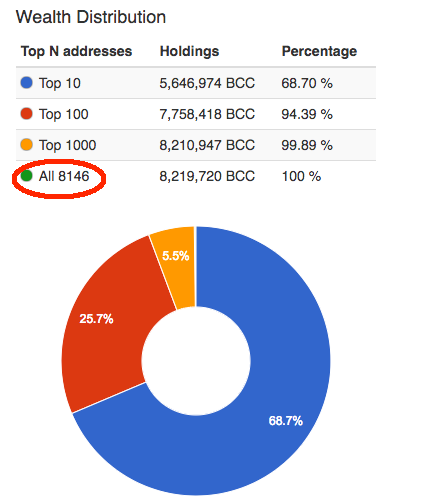

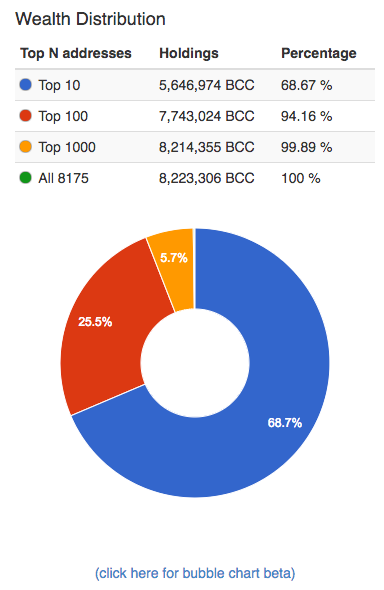

It seems to have slowed down and reversed. After hitting a high of 9,018? The numbers seem to have fallen to a recent 8,146.

https://chainz.cryptoid.info/bcc/#!rich

I believe this is the number of active wallets on the BitConnect block chain. It is updated about every six hours. If people are leaving, wallet balances would fall to zero and no longer be counted. That said, you can actually inspect many of the wallets, individual balances and all transactions on the block chain explorer. If you can make heads or tails of all the transactions you will be doing better than me!

In full disclosure, I don't trust any of the numbers from BitConnect. The cool block explorer I have used, has features in Beta and has various warnings everywhere. My guesstimate also gave this scam a few more months, but those are purely guesses. That all said. I thought it was an interesting data point. This could be the beginning of the end of BitConnect. I was also hoping to get some others thoughts and inputs on what this might mean.

For full data be sure to visit comments on post 4.

https://steemit.com/bitconnect/@cryptick/bitconnect-scam-how-many-people-are-involved-post-4

All Ponzi schemes eventually fail.

Do you think this is the end? Share your thoughts below!

They are having "Maintenance" pages today which make some people nervous.

the end coming. the end of fucking bitconnect

I keep expecting it to collapse..but it keeps going up! #9 on coinmarketcap? Crazy

it called major hyip. And really few supply available in trade.

Bitconnect is unlike any traditional HYIP/Ponzi scheme because they can literally mint more money to pay off the early investors and thus far have managed to extend the scope of the scam and form an exceptionally broad base of the pyramid. The key points are 95+% of the daily trading volume of BCC are conducted in their own internal exchange, therefore they are able to tightly control the price of the "Asset" and that if you backtest their alleged profit generation of trading volatility on the BTC/BCC pair, even if every execution was perfect (statistically impossible) they wouldn't be able to reach the targets necessary to pay out at the stated rates.

Hi there, I have been doing research on bccpay.co, the debit card Bitconnect claim to have for spending crypto.

Their website asks people to deposit BTC before they send out the cards in December. This is of course alarming but what is even worse is that Mastercard have absolutely nothing to do with Bitconnect. In fact Mastercard have told me they have no relation to ANY bitcoin debit card product. BCC Pay literally doesn't exist as a product.

To me this points to an exit for the Bitconnect owners sometime in December. Once they get a couple weeks of deposits for the debit cards, they will either have to produce the cards or run with the coins before people catch on.

Considering they have no card network deal, the exit is their only option.

My guess? 25th December. Merry Christmas to all Bitconnect investors.

I have not done extensive research on the BCC card but I know prepaid Visa and MasterCards, backed with Fiat before they are issued are quite common. To me it looks like Bitconnect is doing that. You would convert from BCC to cash and then load the cash on a PrePaid card. This would make very little risk for Visa or Mastercard, and those type of prepaid credit cards are available from most major retailers for a few minor fees. That said, I do suspect BitConnect someway is using this to hold onto peoples money longer. Mastercard and Visa avoid bitcoin because it could be a long term competitor, but a few other legitimate companies have ways for you to easily spend your crypto. (with Visa/MC cards)

Also if the wallets are emptying what makes you think they aren't just putting that money into the system? 😂😂 I know I just took $100 of my own BCC and put it into Bitconnect.

I've seen move and more people sign up. Who's running away? 😂😂

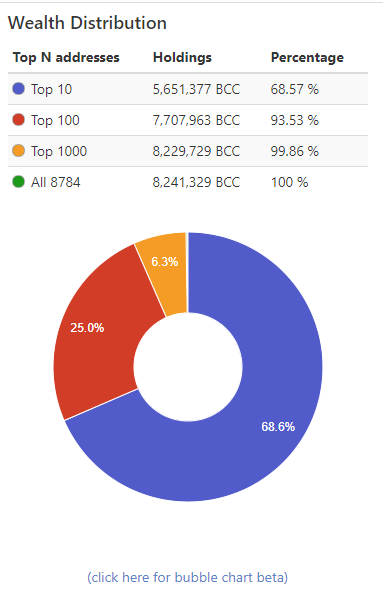

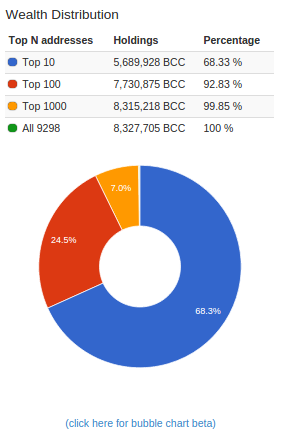

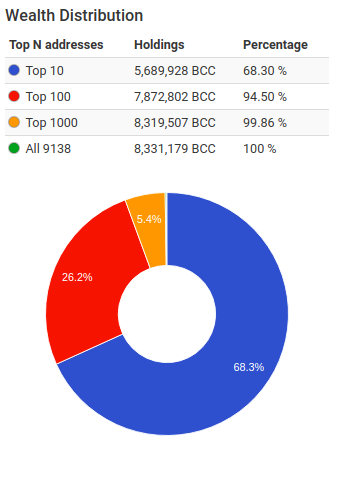

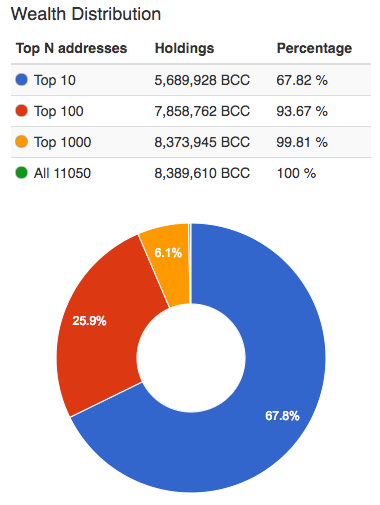

Key Points: The top cohort's balance hasn't changed, which is unusual and indicates 100% of POS rewards from staking were spent. ALL BCC flowed into the second cohort (addresses 11-100). The 3rd and 4th cohort saw huge declines, with the 4th declining by almost two thirds of its total BCC.

Love the Chart! I did similar math trying to figure it out; but nothing that looked so pretty!

I don't believe any of the top addresses are real people. They are placeholder addresses for the company. In the rich list there are 156 addresses with 2,000 BCC (exactly) ending at number richest address # 272. Now i am not sure what exactly those addresses are (money temporarily stored by the system) (a booking thing) but suffice it to say is is an unusual pattern representative of a non-normal process. One can look at when they addresses were created and what price BCC was at -at the time- and how much of an investment would have been required based on past BCC price to represent one of the even dollar amounts but I still haven't found that data to be useful. In my opinion, all of the "real" people are in the last two Cohorts.

Even the amount of holdings is screwy. See if you invest $100 when BCC was at $10 you would have 10 coins and now BCC is at $200 your investment went to 0.5 BCC. They can "renew" your loan, and have to give 0.5BCC in your account. Where the other 9.5BCC went, well those are the questions that become complicated. BCC uses deflation to drive up the BCC token price. It is sort of like Venezuelan inflation in reverse. Suddenly, all these numbers are really meaningless.

"...when BCC was at $10 you would have 10 coins and now BCC is at $200 your investment went to 0.5 BCC. " The triangular nature of the price relationship between BTC, BCC, and USD makes it hard to follow, and in all probability deliberately so. You correctly point out that as long as the BCC price rises, fewer BCC tokens will be due to the "lender" upon maturity of the "investment".

"BCC uses deflation" Its very sustainability depends on it. Conversely, imagine that the BCC price fell from $200 to $100 . In that case Bitconnect would need to pay out twice as many tokens as it was lent @ $200 upon maturity. let alone if the price fell to $10 (20x the tokens to pay) , however i think our suspected perpetrators would be long gone by then.

The daily loan percentage payout would hypothetically be subject to similar deflationary effects, but daily rates are completely unverifiable and arbitrary. Bitconnect could simply set the payout percent to 0% and claim the "trade bot" activities became unprofitable. This slight of hand is not possible with the return of capital at maturity in which the full USD capital amount is to be repaid . If there is a BCC crash we might start to see those top two cohorts drain more quickly. However, the relative effect of this would depend on "loan" volume, which like almost everything else about BCC is undisclosed.

It reminds me a lot of Wizsec's investigative report on the Mt Gox theft. Stolen coins were initially mostly in one very large wallet, then distributed to many small wallets. Finally the coins were reconsolidated into a large wallet at a foreign exchange. The main difference is that BCC controls 95% of the market through its onsite exchange. I'm starting to think that a lot of the addresses in cohort 3 and 4 were fictitious as well , and that Bitconnect.co is using Gox like tactics to populate addresses for shill trading to manipulate the BCC price. It would be in Bitconnect's interest to legitimize exchange data with BCC blockchain transactions. Exchange trades should have a BTC counter part that could theoretically be vouched to, however this might be very difficult, like finding a needle in a haystack.

Also, I find it extremely suspicious how correlated BCC price and BTC price are. No other coin is so correlated to BTC. If anything I'd expect there to be a somewhat of an inverse correlation as BCC purports to be a vehicle to trade out of BTC in order to make fiat USD loans. We might expect a flight to a fiat based instrument during a BTC price crash for instance. The charts look nearly identical. It's almost as if someone is literally copying trades from a BTC exchange and pasting those exact trades into the BCC exchange:

Hi @cryptick, you are being celebrated here: https://steemit.com/steemit/@anniversary/20171017t052920711z-celebration-post

8,175 people the next morning. Updated as an easy place to keep track of the data...

Almost all the addresses have funds again. Looks like they've bumped some funds from out of the top 100 to the little wallets. We might expect that this circulation is necessary for fictitious price pumping with matching blockchain records.

Also, is there a legitimate reason to use wallets like this? For nearly 70% of all smaller wallets to have balances blink in and out of existence over a day or two is hard to believe. The only reason for and method of liquidation would be to trade to BTC (I.E. BCC crashes while BTC soars, but they are very correlated). Why would 70% of the small cohort liquidate, and the others not move in the same direction in that case. Is this "group" supposedly just really smart/dumb?

So I spent a bunch of time on both the BCC and the bitcoin blockchain. While I wanted to write up an article explaining it all; I have not been totally able to figure it out; and quite honestly, spent time and effort on more worthy pursuits. But when I think is going on is massive moving of funds to confuse people. Imagine the following Scenario. We want to create a scam, yet hide what we are doing. (You have to try to think like an enemey...) Well They could create 5 (picking this number out of the air) fake accounts for every one real account. You could pay out small amounts of the money from a fake account to a fake account every day based on the interest rate. (This would make the fake accounts look more real.) You could also sweep all these fake interest payments back into any other sort of account. You could do this so that anyone who tried to look at all of your transactions gets really confused (it is working) and anyone who wants to "verify their transaction" can still do so. I think this is what they are in fact doing. It is a lot like a bitcoin washer or Etherium washer. i think they do this on both the BTC and BCC blockchains. While there is a cost (transaction fees) keeping everyone in the dark helps them perpetrate this fraud. I was getting so I was starting to figure out which transaction was which, but then I gave up moved on.

On the BTC chain wallets that blinked into and out of existence were either. A) just there to confuse people or b) daily interest payments. In the Bitcoin blockchain I believe they send out daily interest payments to a bitcoin address every day. (reguardless of wether people "sell" BCC.) then if they people "sell" BCC they show you the bitcoin address and allow you to take out the money. If you "reinvest" they send that money back into the pool. That said everyone does not go to the website every day, so these payments can site there for a period of time and then several can be swept up at once -as they are sold or reinvested. I was exploring the blockchain, inspecting time stamps and using You tube videos and transaction confirmation codes to verify real world withdrawls. There was a logic and I think I was following a fair amount of it. However, I still got a lot of questions I did not have good answers for. Another reason for a 70% of small cohort to liquidate could be ending of the loans. What cohort you are in is dependent on how many coins you have. How many coins you have is dependent on 1) how much you invested and 2) when you invested. People who invest early have a lot more and people who invested more money have a lot more. Small investers (~$100 USD) at the time of the starting would get thier money back at the end of 300 days. While the blockchain shows transactions from 12/26/2016 I see an uptick in transaction around 1-26. This could represent the first big influx of real small ($100) investors. With BCC at $0.25 they would have gotten 400BCC each. Now 300 days later this $100 would be about 0.5 BCC. (or the 100 compounded into 2,000 would be 10) and the number of BCC that should be ascribed to the account would be about 97% less.

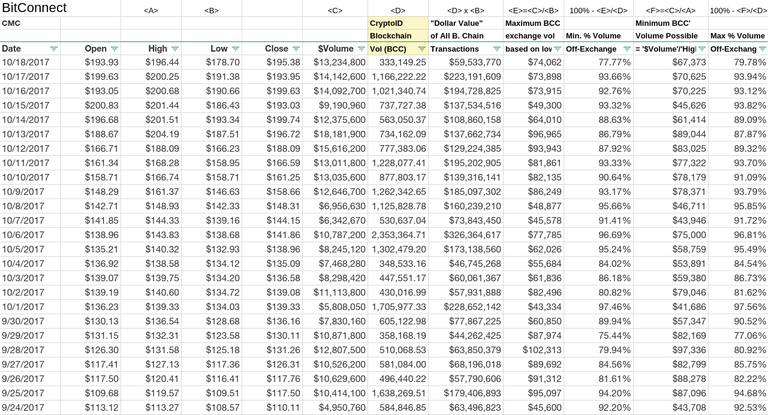

Also, I don't know if you've noticed this already, or if I'm missing something. I started comparing Coinmarketcap data (in $USD) to the block chain data on CryptoID (in BCC) by converting with an appropriate exchange rate. It looks like about 80% of daily volume is done off of any exchanges. Here is my preliminary analysis:

Also, I noted that the following days within the past year did not have enough block chain transaction volume for the minimum possible exchange transaction volume:

Google Sheet Link: http://bit.ly/2xSRblr CMC data: https://coinmarketcap.com/currencies/bitconnect/historical-data/ CryptoID data: https://chainz.cryptoid.info/bcc/#!overview

Am I missing something here?

I read somewhere on the internet that BitConnect "pressured" Coin Market cap into listing its own exchange. If you look at volume on Coin Market Cap by exchange.

you will see 94% of all the volume is on BCC. Lets talk about gorillas? Where does an 800 pound gorilla sit? Wherever he wants! Since, 94% of the volume is on the BCC exchange and Bitconnect directly and indirectly controls the BCC exchange it is not exactly a "free" market. BCC is that 800 pound gorilla. Since 94% of the volume is on that market, they can control the volume and prices. So that basically means they can send whatever data they want to coinmarketcap. https://coinmarketcap.com/currencies/bitconnect/#markets

I would also share I got a love hate relationship with coin market cap. I love the data they have it is very useful and all put together, I think it is one of the best sources of data around right now. If you know of a better one please share. That said, their data is not exactly clean, honest or filtered. Basically, a lot of data is crap. I detailed that here... https://steemit.com/ico/@cryptick/how-to-fake-a-top-100-alt-coin-chart

and also here...

https://steemit.com/bitconnect/@cryptick/bitconnect-scam-inside-the-bitconnect-trading-bot-post-2

In defense of coin market cap, it is not just data at one or two of the markets, it is also a massive amount of data at any (many), most? of the exchanges. You really have to look into it closely t see what it really says. I think coin market cap is probably just doing the best they can with what they get. Garbage in is garbage out. It is just many of the pump and dump coins and cons fake the data. They have bots artifically create whatever number and type of transactions they need to manufacture the volume of transactions they think would "look" good.

I mean just imagine for a minute Bitconnect is legitimate. And it only "sold" BCC tokens twice. One when a customer joined and then once when they left.

How many tokens would need to trade everyday?

See lets go with the 8,000 number of customers and assume they are all on a 6 month (180 day) investment plan and evenly spread out. 8,000 customers/180 days is 44 customers a day. If all of the customers had $1,400 each invested $61,000 of BCC would need to transact daily. If new customers joined at 8 am and old customers left at 11 am we would need two transaction. (If new customers bought directly from old customers we would only need one transaction.) That Means there would he $122,000 of BCC traded each day. Instead volume yesterday there is 15.4 million! This is flunking the smell test! All that volume is nonsense. If I told you I put 500 people in my car, you wouldn't believe me because any normal person knows a car holds about 6 and a clown car at the circus might hold 20! but there is no way it could hold 500. Well that is the kind of crazy numbers we are dealing with at the BCC volume. People who bought in to BCC aren't so good at basic math, so this is not a problem.

This is pretty interesting. Using the experimental wallet feature at CryptoID it appears that there are over 184,835 addresses it believes are associated to this wallet. I think the deposit pattern is consistent with it being used as a sinking fund to receive exchange transactions and drive up price. The sudden withdrawals are likely to prevent any wallets from getting too big/visible.

I don't think loan balances adequately explain the movement. Since, as you noted, there is a 300 day maturity period. I would expect that loans would mature on a rolling basis. The daily amount of loan liquidations in BCC is the the original loan BCC amount times the price ratio:

Eq 1: LoansPaidToday = VolumeLoansInBCC300DaysAgo X (Price300DaysAgo/PriceToday)

The percent change from a given days loan payouts should be close to:

Eq 2: LoansPaidToday / SUMxFrom1To300(VolumeLoansInBCCxDaysAgo)

Eq 2 should be less than 1% at around 0.34%( 1/300) , or even less given growing loan volume and increasing BCC price per the equations above.

The remainders not paid upon maturity {LoansPaidToday - VolumeLoansInBCC300DaysAgo} belong to Bitconnect, and could be collected in "sweeps" transactions to larger wallets. This could explain how the drawdown occurred, but does not explain the rapid repopulating of the wallets. Also, the change in addresses corresponds to movements in BCC/USD and BCC/BTC, which is consistent with a trading utilization(either fictional or real), but is inconsistent with fixed term debt instruments, whose operating characteristics are price agnostic.

I agree with your thinking here. When I first started to explore the BCC blockchain I was looking to do that. If the data in the BCC chain is honest. We should be able to see 1)the date every loan started. 2) approximate amount of every loan. 3) daily interest paid on every loan. From that we should also be able to check our figures with daily interest payments. (since these vary accross the loans day to day, -but should be consistent for the same day. (with the exception of you get more interest if you invest more). We would be able to know, when every loan was made. What interest is paid, if that interest is reinvested or paid out. We could conglomerate the data knowing every single customer and every single payment in and out. We could then predict the exact day it will blow up! I got frustrated and gave up before I got to that data. I think the data in the Bitcoin blockchain is a lot more "dependable." If you really want to bust this thing open I think we should look there. I think i could get to it, but it would take too much work. I don't have all the right tools, time effort. After I spent a couple of hours I started to notice things and then it started to make sense. Let me mention it here so you -and anyone else investigating knows to look for it. They purposefully complicate the data with false payments to confuse us. You have to find a few real payment, then go back and evaluate the other payments. By ID each one temporarily as real or fake and moving up and down the chain you can see the patterns. You can confirm what you are seeing Via BitConnect You tube Videos (This is the withdrawl transaction. This is this amount) and you can

then start to figure out other accounts. Generally, I saw about 5 fake transactions for every 1 real transaction. I believe every account has multiple addresses as well. (the account I was looking at had several "interest payments" but then they stopped for two weeks... appearing exactly two weeks previously. Anyway, good luck!

see this video too

the video may see probitconnect but at the end he reveals he agaisnt bitconnect,

Very interesting video. There are a lot of different ways to look at the funny math and accounting going on. At the end of the day, BCC is not a product with inherent value. The Bitconnect token does not feed people, clothe people, or provide a service. It is a zero sum game. (henceforth Ponzi scheme). Bitcoin facilitates internet commerce (IE is a new form of bank, a replacement for Visa). While one can argue over the value of those benefits, there is a benefit to society. With BitConnect those benefits are not so clear.

well said

Congratulations @cryptick! You have received a personal award!

Click on the badge to view your own Board of Honor on SteemitBoard.

For more information about this award, click here

Well Addresses are back up to 9,000. I guess the answer is no people are not fleeing. Still some odd and unusual activity.

I predict we will see the number of active addresses start to come down very soon if the BTC correction continues post-BTCgold fork. If this occurs, it will be consistent with these temporary addresses being sinking funds for bitconnect's bogus exchange activity. Also, I predict BCC will inexplicably rise in tandem with BTC as the Segwit2x hard fork approaches, and behave exactly like bitcoin after the fork (probably a fall in price), despite no free BTCg for holding BCC.

OK. Interesting predictions. We will see. I haven't been following the gold fork much.

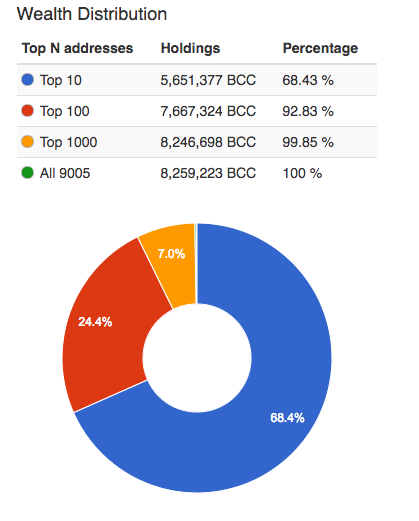

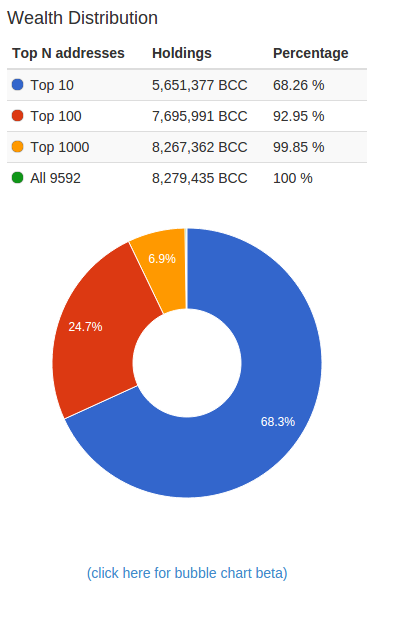

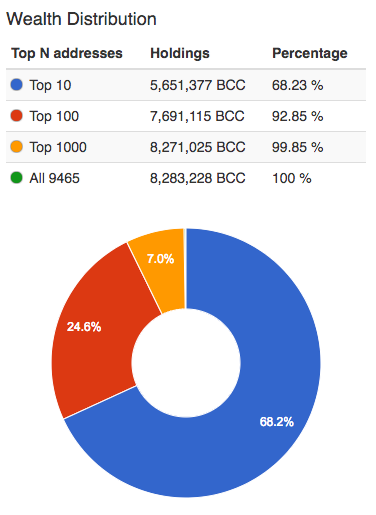

If I can read that small print right, it looks like the number of addresses rises and falls fairly regularly. You have 9592 above and I have 9465 now. That is 140 address that disappeared. Now I know we have to take these charts with a grain of salt. As I was reviewing these on other currencies I noticed several errors. (such as numbers above 100% (ie 137%) and places were the holdings of the top 1,000 exceeded that of all currencies). I just want us both to be careful that we don't put too much faith into these charts, the website has several experimental features. That said. I think our observations should still be valid. Normally, a flawed tool over time will still give a valid trend.

I completely agree regarding the reliability of the sources. The increase in addresses seems correlated to the pump phase. It appears that sharp decreases occur when the BCC/USD price gets too low, to recirculate coins so the pump cycle can start again. That's just my working theory. BTC price hasn't really moved that much more, having held at about $5,500 (better than I had expected).

This is from last night 10/25/17 @ 8 PM

This is from this morning minutes before this post:

So, it appears that the vanishing of addresses peaked out in between these two times. Note that bitcoin surged about 6% during the same period.

Following the recent price surge:

It's like blowing a balloon. You blow air into the balloon to inflate it, but you don't breathe that air back out from the balloon because you'd never make progress inflating it.

Likewise, with BCC when the wallets are building up, I think that's the result of BCC exchange pumping reflected in the blockchain. I also think the rapid address liquidations are off-exchange, and therefore don't redeflate the price balloon. The liquidations still give bitconnect enough coins (air) for the next pump (breath).

well it is still growing..

So I see it gets even more interesting. So what do you do when you have lost money? Kidnap multiple BitConnect employees and demand payment. I see this scam came from India as well. https://www.thequint.com/news/india/gujarat-bitcoin-case-shailesh-bhatt-named-accused-in-amreli-bjp-nalin-kotadiya-extortion-case