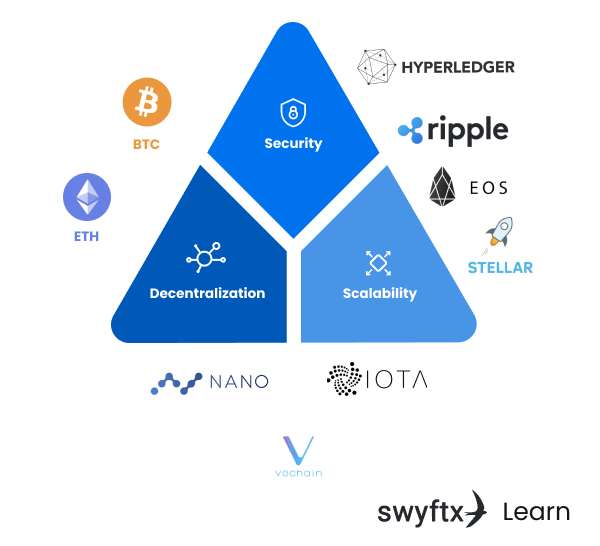

Remember the "blockchain trilemma"? The apparently unsolvable conundrum of "security" - "decentralization" and "scalability"? We've seen and continue to see much hand-wringing over this topic which is also a good backdrop against which to "sell" a new blockchain.

Because Bitcoin and Ethereum are widely credited to having solved for security and decentralization at the expense of scalability, many modern blockchains and almost all DAGs come to the market claiming to have solved for scalability. The reason none of them has overtaken either bitcoin or ethereum is that it soon becomes apparent that they did so at the exepense of decentralization (blockchains) or security (DAGs) ... or both (scams) ...

I was watching the 2018 MIT class taught by no other than Gary Gensler, today's Chairman of the SEC (and currently waging something approaching legal war against the crypto industry), who back then was a Senior lecturer at the MIT.

Early in the very first class he compares the Depositary Trust and Clearing Corporation (DTCC, the central securities depositary in the US) and its 30 000 transactions per second, and VISA's 20 000 - 70 000 transactions per second with the measly 7 tx/s of Bitcoin

And it was at this moment that it dawned on me: the "scalability trilemma" can't be solved ... because it's the wrong problem to try to solve with a blockchain. As a matter of fact, it's an obsolete problem, which either has already been solved (in a certain sense) or worse, shouldn't be solved at all!.

Our centralizing mind setting

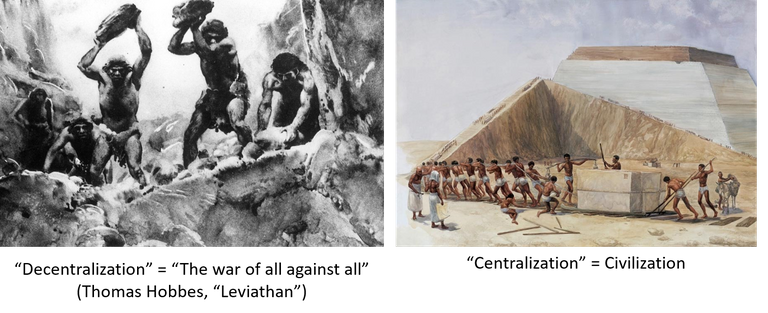

Indeed, this scalability problem is the product of our minds not being able to fully embrace the decentralized way of thinking, and it serves to illustrate how important, how integral and essential centralization is to our societies. At this point, I would like to invite you to read (or re-read) one of my older posts, Understanding blockchain's social impact

In it I remind readers that what the blockchain enthusiasts praise today and hold as one of the greatest qualities of such a technology, "decentralization", was present for centuries in the thoughts of philosophers and seen mostly not as solution but rather as a serious problem. For Thomas Hobbes, what we currently celebrate as "decentralized" or "self sovereign" was the "state of nature", a state of "war of all against all". Against such unappealing situation, Hobbes advocated an authoritarian, centralizing State, synonymous with progress and civilization.

Thomas Hobbes, Leviathan, Chapter XIII

It is simply stating the obvious that we reached the current level of civilization thanks to centralization. And so we are rightfully indebted to it, to the point where we cannot really conceive, at least not without considerable effort, of a decentralized arrangement.

DTCC, VISA and ... what?

See, although I've long sensed it wasn't fair to compare Bitcoin with VISA, the insidious fallacy of the "scalability" topic only became clear to me now, in the year of the Lord 2023, watching Gary Gensler talk about ... the DTCC - the epitome of a centralizing body. And although VISA is not quite the monopoly the DTCC is, it's still part of a VERY priviledged duopoly with Mastercard.

They bloody need 100 000 tx/s, because ALL the transactions HAVE to pass through them! That is the very definition of centralization, and precisely the principle blockchains have been co-opted to fight (or at least mitigate).

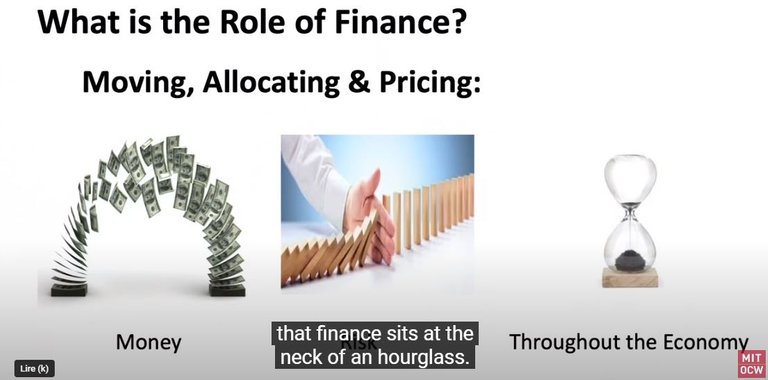

Coming back to Gary Gensler 2018 class at MIT - these financial intermediaries, DTCC, VISA and others, they "sit at the neck of an hourglass, and it's why they collect so much economic rents from society"

"Economic rents" are the evil to be fought against in every economist's book, be them of the "Karl Marx" hue or "Frederik Hayek" / "Ludwig von Mises" hue or any nuance in between.

Saying that Bitcoin, or Ethereum or any other blockchain for that matter, need to be able to scale to tens of thousands of tx/s is akin to saying "The king is dead, long live the king!".

It is akin to saying "We claim to be fighting for justice and equity, but what we really fight for is to replace the existing powerful elites ... with us! What we really are after, is collecting the rents they are collecting now!"

It's basically acknowledging that we are at best able to see a centralizer replaced by another centralizer, but are fully unable to picture a different, decentralized, more just and more equitable system!

I know at this point the "cognitive disonnance" will strike, and all the bitcoin maxis (especially them), crypto bros and blockchain enthusiasts will intensely loathe me for putting them in front of an inconvenient truth. But while preaching "decentralization", what they truly want, is to replace the current "central power" with a new one, a different one which they imagine better (mostly because they would be part of it).

Centralization is strong with us

In a previous article dedicated to Ethereum I was observing that, for all its talk of "decentralization", the Ethereum blockchain itself was in fact an "über centralizer". And it does so from its mission statement: "The World's computer". Why would the world have only one computer (the Ethereum blockchain)? Why is that a good goal to aim for? Thanks to its programmability, the underlying narrative of Ethereum is that everything could, ultimately, be connected to it.

Is there anyone who seriously thinks about this and deems it a desirable outcome? What would that do of the people who are "ETH-rich"? What would that outcome make of the people who were left not holding any ETH?

But Ethereum is only the most famous illustration of our limitations: because we survived all these millenia thanks to "generally well-done centralization", we cannot seriously envision any "end game" other than dominated by "the blockchain / cryptocurrency to rule them all"

The cryptoverse is the solution

I argue that Bitcoin doesn't need more than 7 tx/s. Neither does Ethereum or any other blockchain. Heck, we should be wary of any blockchain that achieves scalability on the scale of VISA or the DTCC!. Because then, it would have the power of the "dark side" (for those prefering a "Star Wars" analogy), the power of "the one ring to rule them all"(for those who prefer a "Lord of the Rings" analogy). The temptation to replace the monopoly of yesterday would be too great to resist.

A single cryptocurrency might be technically able to replace the current centralized fiat system (if it manages its scalability) but would not be any better (and might actually end up even worse) than the current centralized and, for many, corrupt system in place.

What needs to be stressed is that the true rift is not between "fiat currency" and "cryptocurrencies", but between "a single currency" and "multiple, competing currencies"

It follows that the solution to this conundrum is ... multiple currencies - what I use to call "the cryptoverse". What a truly multipolar world might be able to sustain, most realistically, is a healthy mix between "government-sponsored" fiat and "community-backed" crypto

If we are serious about addressing the shortcomings and propensity of centralizers to abuse power, it follows that the best we can hope for is a wealth of not-able-to-scale blockchains, none of which acquires the network power which today's tech-platforms such as Facebook or Google enjoy.

And the measure of success is that, by that time, both VISA and the DTCC, regardless of the capability and throughput of their systems, would not have to process more than 7 tx/s.

Thus the "scalability" issue would be forever put to rest and forgotten as a "problem" best left unsolved.

That was a fantastic post - I applaud you and agree with almost everything in it :)

I was recently called a "Crypto Boomer" by a younger friend who's achieved far more than me in the crypto game and also lost a lot more...

It's due to him not knowing WHY Crypto and Blockchains were created in the first place and your post REALLY emphasizes that point: Decentralization

Transparency, Sound Money and other factors of course... but Decentralization... 😘

Thank you for this well thought out, well written piece!

Cheers 🍻,

Thank you!

Good morning Sorin,

2.a) "winner takes all" and the tendency for products to evolve into single solutions. (will decentralisation help an economy evolve into product diversity on the demand's side as on the offer's side?)

2.b) you seem to write a truth about the "Bitcoin maxis" by pointing out the centralised character of their objectives (and their presence in it), but is this really the case? They are quite opposed to centralised power, aren't they?

Wishing you an excellent day!

Wim

Hello Wim, thank you for your comments

I think economy and society are usefully thought of as being "layered" - just like the 7-layers of the OSI model for networks. You can decentralise at one layer (say, infrastructure), but you must be wary not to end up centralising at a different (upper or lower) layer. Bitcoin for instance decentralised mining but economies of scale led to 90% the miners running the same machines with the same ASIC (so centralised the lower, hardware layer)

I call "Bitcoin maxis" people who imagine more and more economic transactions (up to all of them) being facilitated by Bitcoin as MoE. They usually call any other crypto (including, and perhaps especially ETH) "a shitcoin" and believe they are all "scams". When you confront them, they usually adapt the definition of "scam" so as to mean "anything which is not exactly BTC".

There are several problems with the vision of such "Bitcoin maxis" (as I call them), but the scalability of the Bitcoin blockchain is the last of them (because they are quick to point to the Lightning network).

The accusation I level at them is that they are in truth opposed to the current, existing centralised power because they are outside of it. But if their vision came true and BTC were to become "the new money protocol", that would automatically create a new, very steep and rigid hierarchy of wealth, means and power, a hierarchy where they, the Bitcoin maxis, would be on top. And it is the lack of competition (from the "shitcoins") which would be instrumental in such an outcome.

A great day to you too!

Finally, I got stopped by an article that forever ended the dilemma and trilemma of scalability, at least for me, I can say the problem of scalability is over once and for all. Thanks a lot, Sorin, for me you are truly a celebrated author; with the kind of articulation, you literally earned a fan.

I really like the concept of the Hobbesian concept of the State of Nature and it is even true in this decentralized world. Indeed we are motivated by our appetites and passions, and in the absence of centralized institutions, we would be at war with each other. Every man is an enemy to every man. This is so true.

Might is always right. And in the crypto ecosystem that might has taken the nomenclature of stake power, the more power you have the more twisting power you accumulate to your whims and fancies. So the actors are the same but with different packaging, with the only slight difference being that they are relatively more number of units, but then again they form their consortium and cartel.

I really wonder when Bitcoin was relatively a newborn baby the narrative was deflation or deflationary inflation. And now the narrative which is being sold is that inflation is actually good. As an individual, I personally like to find multiple options to weigh upon my judgment and requirement. Therefore multilateral world is the answer and cryptoverse is the solution. Thanks a lot, it's a million dollar article for me.

Thanks @milaan.

About inflationary vs deflationary - there is a dichotomy between a "good Store of Value (SoV)" and a "good Medium of Exchange (MoE)". Money must have both characteristics (besides being also unit of account, but that one is an easy one). Intuitively, there is value in scarcity - the scarcer a thing, the better SoV it is. A deflationary currency such as Bitcoin is an excellent SoV;

What many people don't realise is that the better a currency is at being SoV, the worst it becomes at being MoE!

This has been expressed most famously as "Gresham's law": "Bad money drives out good money". A good SoV is "good money" - in the sense that it keeps its value ... but precisely because of that, it is being driven out of circulation (MoE) by "bad money" - money that is inflationary and thus an inferior SoV.

So there is a right balance to be striken. As I've argued in a previous article, "Bitcoin is too good to be money" ("money" being understood here as MoE). By contrast, inflationary currencies such as Hive are not as good as SoV, but are better MoE. This is a "match made in heaven between Bitcoin and the "cryptoverse"

I think you're very correct, Sorin. There is most certainly an aspect of evolutionary potential in decentralizion.

In other words, Hobbes was dead wrong: A war of all against all is the natural state of nature, yes, and that state is the ideal state. And that state can NEVER be terminated, except with the absolute termination of life and growth.

As long as we live, we must fight, and anyone who forgets that, be it the king on top who is content with his riches, or the lowliest peasant, who simply accepts the oppressive status quo, will simply fade into oblivion. It's only a matter of time.

Evolution never stops, and that fundamental natural force is the same force that keeps decentralization more than just relevant: It is necessary. We need competition, because the only alternative is first stagnation, and then extinction.

However you take his words, I would never say that "Hobbes was dead wrong" - he lived and wrote almost 400 years ago, for God's sake! 😄 He was likely right in 1651, also because, among other things, blockchain had not been invented yet! 😄

As you point out too, in "Understanding blockchain's social impact" I argue that it's more useful to talk not about "the state" of society, but rather to integrate the time dimension and see society as a dynamic flow - like riding a bicycle. For some periods the centralising "Power", i.e. Hobbeses Leviathan pushes harder, and during other historical periods the "state of nature" has the upper hand.

We are at a delicate juncture in history. Since the late 60-ies (probably the "free-est" period in the history of human society) the "Power" has continuously increased its grip and took away more and more freedoms.

Decentralization has become more and more necessary indeed, as has competition between hierarchies of power.

The rewards earned on this comment will go directly to the people ( theb0red1 ) sharing the post on LeoThreads,LikeTu,dBuzz.https://leofinance.io/threads/@theb0red1/re-leothreads-fbd9u1ts

~~~ embed:1644428180382531586 twitter metadata:MzIwMTk4MDU3fHxodHRwczovL3R3aXR0ZXIuY29tLzMyMDE5ODA1Ny9zdGF0dXMvMTY0NDQyODE4MDM4MjUzMTU4Nnw= ~~~

The rewards earned on this comment will go directly to the people( @yecier, @kriszrokk, @kalibudz23 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

A Banker will always put out the perfect argument that banking software is the best solution for banking requirements and that will always be true. It's just the practical banking itself that's causing all kinds of problems around the globe and we're trying to get rid of our sole dependency on it.

Banking for example could not help the people in cobalt mines or the modern slaves in Central Asia so far, because they don't even have an ID and their countries want them to play a closed game of monopoly instant of being valued participants in the world of free exchange of services and goods. It's the fringe corners of the old system that is keeping people on their knees, deforesting the Peruvian Amazonas to mine for gold, giving banks the ability to use multiple rulesets for multiple classes of people and do all of that in the shadows of closed monetary transfers. I argue #NoThanks to that, we need at least an honest and transparent base layer and Bitcoin is very suitable for that, it's even our best bet so far by all available evidence.

Of course, my examples are handpicked as well and give enough room for counter argumentation. Let me finish this comment with a thought that always hits me after reading the word "Cryptoverse". We're very bad at telling the story so far. It should be the "global neutral financial systems" we're talking about and we need a bunch of them. A combination of old-school finance and cryptocurrency technology should be pursued, which means most of the crypto should not be regulated at all, if sufficiently distributed and decentralized.

Indeed, I thank Bitcoin daily for what it did, for what it made possible. The importance of having a "currency without government" cannot be overestimated.

I totally agree that what we see in this space are mostly technical people, rather nerdy, not very good at telling the story. And I also agree that most crypto should not be regulated.

Let's start with the icing on the cake which prevails in the "cognitive dissonance" part of your article. The trifecta / trilemma which sucks all financial topics (economics overall) into a vortex of discussions without meaningful outcomes is the wrong approach. Your detailed analysis showcases that extremely well.

I believe the future is all about multichains and a healthy mix of multiple currencies as you stated -- whether we call that "the cryptoverse" or give it some other marketing / branding spin is second nature.

Great article. To the point!

Thank you!

Mes connaissances en finances sont limitées cependant c'est exactement ce que j'ai compris en lisant au coeur de la monnaie et l'étude sur des périodes "stables" de notre histoire, où pour certaines civilisations il y avait la monnaie officielle et une monnaie complémentaire non thésaurisable qui assurait l'équilibre et favoriser les échanges quoi qu'il arrive (en gros c'est ce que j'avais compris et avait trouvé très cohérent). J'espère que j'ai bien compris lol

Si tu as le temps, je te recommande le cours de Gary Gensler (les links sont dans l'article). Tu peux regarder avec sous-titres générés automatiquement (c'est comme ça que je le regarde)

Je viens de terminer la vidéo passionnant et très pédagogique merci pour cette découverte ! Je me suis abonnée a la chaine youtube pour continuer a apprendre ;)

Bonne décision, c'est bien expliqué je trouve et avoir le chef de la SEC comme prof, que demander de mieux! 😀

Ok merci je vais regarder ;)

BitcoinSV ($BSV), the original bitcoin protocol solves it. Most of the hash currently is controlled by three big players but it’s an open field. Scalable to millions of tps.

Another one that seems to have solved the trilemma is Radiant ($RXD) which is also an ASIIC resistant chain. It’s pretty new and not much is built on it yet but it’s got the same scaling potential as BSV.

It’s clear that the only secure and trustable kind of chain is a POW UTXO model.

Funny! Thanks for commenting but if you read the article, I argue that we should rather avoid "scalable" blockchains. They are by nature "centralising " - precisely what Bitcoin wanted to combat or at least mitigate

This is a fantastic post, I have to thank Brian for pointing this out by reposting.

Thank you !

Great post :)

Thanks!

Congratulations @sorin.cristescu! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 81000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out our last posts:

Support the HiveBuzz project. Vote for our proposal!