Celebrating the end of our 2017 tax return nightmare

I’m happy to say that my partner and I just completed and filed our personal tax returns for 2017, just in front of the Oct 15 deadline. April 15th is the regular deadline in the US for calendar year filers, but you can get an extension for 6 months, and we really needed it this year due to the drastic changes made to the US tax code very late in 2017!

Note: As a way of celebrating the successful completion of the forms, we'll be upvoting the scariest and most interesting tax horror stories people leave as comments on this post.

New Tax Rules, New Headaches

These 2017 tax changes are formally known as the “Tax Cuts and Jobs Act” or TCJA for short, but are also referred to as the Trump Tax Plan although the plan was most written by corporate lobbyists rather than by Trump himself. There were moderate changes for most everyone in America, but the primary direct beneficiaries were companies, since the corporate tax rate was significantly lowered.

So for most Americans, I don’t think the new rules caused many headaches, but if you owned over 10% of a foreign company like we do, your tax computation got super complicated due to a new tax that our humorous overlords (or maybe their mischevious vassals) decided to call the “GILTI” (pronounced “guilty”) tax and another related tax generally referred to as a "Toll Charge". Despite the threatening names, the tax rates aren't that bad, but the computation of these new taxes can be enormously complicated, especially because, even as of this date, there aren’t clear guidelines for many of the implications of the new taxes.

Ambiguous new tax rules: tax accountants to the rescue...

All of this meant that for the first time we decided to hire an outside accounting firm to help us do our taxes and I can say with certainty it was the right decision. I’m sure I would have been tripped up on several subtle points associated with the new rules: to get these rules right, you really need someone who is full-time focused on tax accounting.

Even with an outside accounting firm helping out, we still had an enormous burden to compute our taxes properly, just processing the accounting books themselves to hand off the final data to the accountants (this wasn’t something that it was feasible to outsource to the accountants as the data is in a proprietary database and consists of millions of financial transactions spread across multiple database tables, plus their's crypto-specific issues to account for).

Steem accounting problems: computers to the rescue...

To process all the transactions from our service, we first reviewed the automated crypto-accounting system that I posted about earlier and then spent a few more man-months making further improvements to it, including speeding up the calculations by about a factor of 10, as it was starting take quite a few hours to run a report with all the transactions we have to handle.

We also had to make updates to the software based on changes to the way the most recent Steem wallet generates info about blockchain operations (e.g. reward operations, etc). As I think I mentioned in my previous post about our automated accounting system, Steem generates a lot of different forms of income (author rewards, curation rewards, power downs, SBD interest, SBD->Steem conversions, SBD/Steem trades, to name a few), and while that is good per se, it also increases tax complexity. Our accounting system was invaluable in tracking all those income streams.

Another thing we did was improve automated matching of transactions in our crypto wallets versus deposits and withdrawals from exchanges, because exchanges often don’t give you transaction hashes for your deposits and withdrawals that you can match against. Once we get a chance to analyze that data, I suspect we’ll be contacting some more exchanges for failed payments, if past history is any indicator.

The final product of our labor

So how complicated were our personal taxes this year? Around 80 pages each (that’s not counting worksheets, that’s just actual forms being sent to the IRS). Note these are not corporate taxes (those have always been complicated), this is personal taxes! If you are wondering how it can be so many pages, consider that in one case where we sent ~$150 to a foreign company we own to pay for some legal expenses, we had to file a 2 page form to declare it. Trees are probably screaming somewhere (yes, we electronically filed, but we also needed paper copies for other purposes)…

Lesson learned

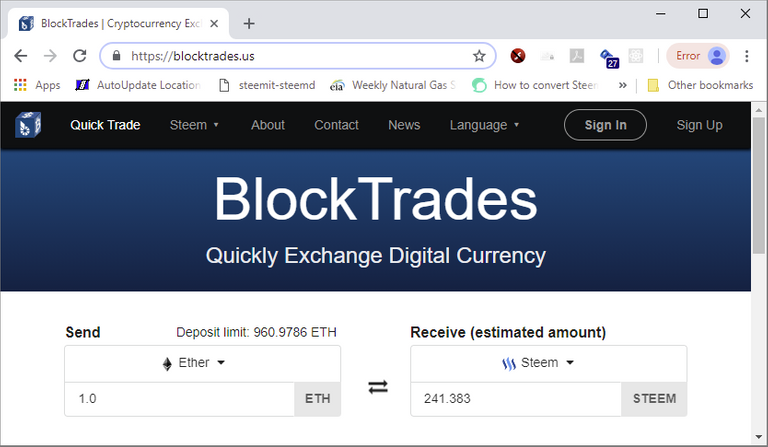

The clear lesson the US government seems to be teaching via the tax code is that it doesn't want US citizens owning 10% or more of a foreign company (the rules are quite different for companies owning foreign subsidiaries, at least in terms of the effective tax rates). If my partner and I had each owned under 10% of BlockTrades, none of these taxes would apply. I had been planning to do an IPO for BlockTrades for a couple of years now (in retrospect, I'm glad I waited), but going thru this latest tax nightmare has convinced me that it's time to diversify our holdings, so we're going to start actively moving towards an IPO within the next year.

Share your Tax Horror Story

Now despite the time spent on this year’s taxes, I’m not sure this was the biggest “tax horror” I ever experienced, because there weren’t many moments of actual terror (there was a brief moment when I made an error in a spreadsheet and some numbers looked pretty ugly). So I guess the biggest scare I got was much earlier in my career when I got a letter from the IRS telling me I owed them $30K (which wasn’t too far from my total yearly salary at that time). Fortunately, that turned out to be I had added one too many zeros to a number on the form, so I just filed an amended tax return (one of the easier things to do in the US tax system as it turns out) and all was right in the world again.

If you made it thru this long post on our tax problems, then I'm guessing it's possible you probably have one or more of your own tax horror stories to tell. Share them below in the comments and I’ll upvote the best ones to combat the pain and suffering you went through.

EDIT: Shout-out to our accountant here on Steemit

I didn't want to mention him previously without his express permission, but we met our accountant (@cryptotax) here on Steemit. After some back-and-forth here, I became convinced he was our best choice to help us through the new tax regulations. If you're in the market for a crypto-savvy accountant, especially one who knows the ends-and-outs of Steem, I highly recommend him! Very competent and pleasant to work with as well.

Hey, @blocktrades.

Worst tax story happened roughly 13 years ago, so I might be a little hazy on the details. Here goes:

In February, 2005, we moved into a new home. Our taxes for 2004 were filed sometime after that, with our new address. In September of 2005, we ended up with a notice from the IRS that we owed back taxes on another year (1999, 2000—something like that). They'd conducted an audit of this previous year and decided they wanted to see proof of our donations, since the amount exceeded what they figured was normal.

The notice we actually received was like the third or fourth notice, since the previous ones had been sent to our old P O Box, but apparently not forwarded onto us. They were sent there despite the fact our new address was already in the system as early as mid-March. Apparently the change finally took place because this latest notice came to our new address.

Most of what we had claimed as donations went to the church we belong to in form of tithes and fast offerings. We couldn't just give them receipts or a print out—we had to do that, plus get the leader of the local church to sign an affidavit that we had actually made those donations.

Fortunately, the church keeps very good records, and so the bishop was able to sign the letter with absolute guarantee that we had paid that much to the church.

Not allowing the deduction caused us to owe a few thousand dollars in taxes, and since we had not replied the previous times they'd sent the notices, we also owed penalties and late fees. I think the total came in above $5,000.

Fortunately, a couple of months into this, I was able to get a hold of a local IRS agent and set up an appointment to see them. They were in a nondescript building (no signage whatsoever) with the drabbest decor I've ever seen (outside of an ICE office). He went over the proof and within a few minutes determined that we were good. All of the taxes, along with the penalties and fees they said we owed were rescinded. I think this was early 2006 when it was finally resolved.

All because the agent conducting the audit decided it wasn't possible for us to pay so much in donations based on my earnings. :)

That is both scary and sad. All that wasted effort and the tax agent responsible probably didn't miss a minute of sleep for all the trouble he caused you. It's lucky your church was so responsible in their record keeping!

I agree. It was very fortunate. Seems like the audit department was in Cleveland or some place like that, and they were only accessible by mail. So insulated they weren't going to even talk to me on the phone. As you said, probably never missed a wink, and probably never knew of the reversal, either.

That was an extremely generous upvote. Thank you for the chance to share the story. :)

@blocktrades,

I was once audited for an additional 6k owed in taxes. My tax agent said that was absurd and to wait it out with the IRS, 6 months later they said i owed 5k instead, 9 months later 4k, and finally by the end of the following year having sent in receipts that i had to xerox to them limited to 4 per page, which was roughly about 2000 pages in the end they reduced it to 1800 and took it out of the following year. what a painful nightmare dude.

Yep, that sounds pretty unpleasant.

My worst story is when two years after the fact, I got a notice that I was being audited by the IRS and I owed them like $2500. After panicking, I realized it was because THEY didn't count my student loan interest deduction. So I spoke to a human on the phone who was like ...yeah, you're right, don't worry, that was a stupid mistake on our part ...but I still had to go back and forth in the mail for months freaking out every time, even though the IRS guy right there on the phone the first time admitted it was an IRS mistake and I had done my taxes correctly.

Whee, beurocracy!

I know how painful it can be to get something corrected in the IRS's system. We had a similar experience on corporate taxes for SynaptiCAD, the first company we started. We opened up a second version of the company to switch from S corporation (passthrough tax entity) to a C corp (files taxes separately from its owners). That all went fine, but there was a brief period when both the old company and the new company were operational. On a tax filing for one company, we accidentally used the tax ID of the other company (I think this was for employment taxes we collected for the IRS, but it's been a while ago, so not sure). This was the only mistake on the form (we had the correct company name, etc), but I think it took many phone calls and almost a year to get it fully straightened out. Everything would seem good, then we'd get something else from them which made it clear it wasn't fixed everywhere. It's amazing how long it can take them to fix these kinds of minor errors.

Exactly that. The guy on the phone would say all fixed, then I'd get a letter saying otherwise, then I'd send in more forms, then I'd get another letter, then...

It seems all government works that way. The right hand doesn't know what the left hand is doing.

I have doing tax filing since year 2011 but this year it became horrible for me. I usually do tax return filing in July month after getting tax documents from my employer. As usual i did the same this year too. But in aug month I got a notice from tax dept with some transactions detail of Crypto purchase. Want to inform you that i did buy bitcoin and some other coins which i am still holding because now market is down. So basically there is no income from these transactions. Instead of tracking the income tax dept questioned me to explain why i didn't pay tax for Crypto transactions. I replied them mentioning the reason but they were not convinced and it was totally horrible experience for me. They asked me to visit their office along with all documents and evidences. I visited thier office with all the requisite documents and had a meeting and made them understand. But the problem is that they must understand if there is no income then why should I pay tax. From mid aug to early sep month was harrasment for me. From the time i received notice from tax dept and till the time i explained reason to them took almost 20 days of time and it was worst time for in tax filing till now since beginning. Though things are sorted now but i seriously hope next year i dont get something like this. This is my story @blocktrades

Posted using Partiko Android

That sounds worse than here: it sounds like they are actively persecuting you for just holding crypto.

Yes dear friend @blocktrades it was truly a torture. But after discussion of 2 hours I explained them about crypto and they agreed with my opinion. I was relaxed when they issued me no due letter. Have an amazing day.

Posted using Partiko Android

Dear @blocktrades thank you so much for full vote and considering my story worth it. It means a lot for me and I thank you from the bottom of my heart. Its a great motivation. Have a great weekend.

Posted using Partiko Android

Here is my personal story. I am happy that the outcome was favorable.

The final year I attended school, I made a tuition payment eligible for the American Opportunity Tax Credit (which was $2,500 tax reduction, a credit is much more powerful than a deduction). There is a maximum of 4 credits per taxpayer (previously 2 under the Hope credit rules prior to expansion to 4 years). You can take the hope credit for the first four academic years of tuition. Practically, this spans 5 tax years or more sometimes as academic years are based on credit hours (most taxpayers and even accountants don't know this but I've read the hope credit regulation front to back). My parents took the credit 3 times while I was a dependent, and skipped the 4th year, and I claimed the credit on my final year when I wasn't a dependent due to having a full time job to support myself.

I received a IRS notice indicating I owed $3,000 because I did not receive a 1098-T from the educational institution demonstrating that I paid eligible tuition expenses. They billed it in the fall of the previous year and reported it on the previous year Form 1098-T.

The irony here, is that educational institutions are permitted to issue Form 1098-T on an accrual basis when tuition is billed. However, the taxpayer entitlement to a credit is based on a cash basis. I can't think of a dumber rule to be honest (see sidebar at the bottom).

Long story short, the final year I made a tuition payment to claim my fourth AOTC credit (there is a maximum of four total), I received an IRS notice for $3,000 due.

It took 10 months to clear up the notice. Being a tax accountant I drafted a long powerful response with support of my payment in the final year in which I had not received a 1098-T. I wrote an explanation of why Form 1098-T was elected as accrual basis by the university and I would not be able to produce a 1098-T on a cash basis for this reason. I cited not only Form 1098-T explanations but the regulations for the hope credit (later AOTC credit) and the regulations for the 1098-T requirements.

The IRS rejected my initial letter and re-affirmed I owed.

So I had to have my uncle that is a CPA get involved (and I didn't have this designation at the time only recently graduating). My uncle put my explanation on his letterhead and sent it in. Result: 4 months later they dropped the bill.

Side Bar

The IRS is in the process of changing Form 1098-T to avoid issues like this in the future by requiring universities to report tuition on a cash basis (when paid): https://tax.thomsonreuters.com/blog/onesource/what-a-new-irs-change-to-form-1098-t-means-for-colleges-and-students/

This story is just representative of the fact that the IRS itself just doesn't "get" all the implications of its own rules. And I'm also saddened but not surprised that your explanation had to be presented as coming from a "real" CPA in order to be believed.

Also thank you for the shoutout!

Mmmm..... The Final is coming and Taxes will be handled automatically by the Monsters. No more taxes if you don't have money.

This story is really a real horror tale about control, In my country (Uruguay - South America) people will have no more worries about taxes or maybe they will.

In here we are like a kind of laboratory to check in some experiments works, and after some time they will copycat the same model all over the world. Happened with abortion, weed and now with taxes and money.

Let me explain... now the government is making a mandatory law that is running step by step to make all the sheeps obedient to the system little by little.

The Mandatory Financial Inclusion that is in here is about banning all the Cash that exist and no physical currency will be allowed, no Uruguayan Pesos, no Dollars, nor Euros, nothing. Only debit and credit cards and anything else.

Total control by the Government and the Private Banks... to take care of all the sheep's money.

For example, the money you get, now everything will go throw the bank, no exceptions, you want to buy a car? or a house? or something beyond 4.999 Usd, well you have to justify from where the money cames if not you will be in a legal trouble.

Do you want to buy milk? you will have to do it by Credit Card or debit card from your lovely bank if not you will be starving. Anything you want to do will be in that way and it's mandatory

The good thing? we will not have to make any paperwork anymore to have a tax return or inform because you will not be able anymore to move any penny without a private bank permission, so they will do the work for you, controlling everything you all the time and owning your money to make loans and extend the slave circle.

So, after all, having a Nightmare is not so bad... the worst situation can be to don't even breath!

I know this sound like a cheap tale but is not. By the way, I'm working with the Entrepreneurs Chamber of the state to change this situation and make a Plebiscite so let's see if we can wake up asap!

At least guys, if you have a nightmare is cause you are alive and in here... we are almost dead!

That sounds pretty scary. Is barter allowed?

Hehehehe...seems to be the only way that the third world will be making business.

Thank You @blocktrades, I know this one may seem trivial but back in 1989 I mailed in my Taxes in a Regular Envelope at the time about one week before April 15th Deadline and the envelope was returned back to me for .03 Postage Due on April 17th. The Moral of this Tax Nightmare is that I Never ever Mailed my Tax Forms in after that without going to the post office to make sure I had proper postage because it Cost me $159.00 in Fees and Penalties due to Late Filing. That was me trying to be Thrifty and just save some time by not going to the Post Office and paying a little bit Extra for Certified Mail and Return Receipt...........Lesson Learned. Thank God for Electronic Filing now. Maybe IRS goes away in the Future..........

My partner has been a big believer in using certified mail for filing taxes for as long as I can remember (she's the pessimist in our relationship). It always annoyed me "wasting" even more money to pay the government (via the US Postal Service) to make sure they successfully delivered the money to themselves to avoid paying penalties. But I guess it wasn't wasted money as the same thing that happened to you could have easily happened to us. Agreed on the online filing, now if we could just vote online...

@blocktrades I am So Grateful for your Service that I have availed myself to many times since I started on STEEMIT. Your Kindness in Sharing with the Community is Second to None. By the Way YES YOU GET IT !!! The American Citizen has been so Abused most of their Lives by the Govt., with a little bit of LOVE and Consideration we can effect Change and hopefully it will be a Better World for all of us. I believe Crypto is going to Create a New Freedom and of Course I do Believe in Precious Metals Physical in your Possession. We are getting Closer to True Freedom and I hope to see it in the not to Distant Future.............Thank You again @blocktrades

@blocktrades at times taxing and its problem make sick, let me share an experience, actually it's not directly on me but indirectly it's really on me ,I'll just keep it brief and simple don't want to bore you with details .

5 years ago, I and my mum had a hell of an experience with our taxes, I just thank God for you guys overseas cus it seems your government and people are more mature and contented, but Here in Africa that's an apology , take it from me.

Since my mum is a bit advanced in age I run most of her errands like that of paying taxes, so I knew the weight of funds that usually lives us for taxes Monthly, mostly because of our small business.

In my country Nigeria, I don't mean to be disrespectful or unpatriotic but I'll say boldly that corruption knows no bounds .5 years ago a new tax verification system was introduced In my country, the TIN tax identification number, we're all eligible tax payers would enrolled and get an ID number during it's introduction my mum escorted by Me, went for the registration and she got the card, she was given an option to pay her taxes via banks or still continue paying directly at the IRS but since she was used to the system she still continue with it 2years ago the IRS called our notice that we were owing so much we became very surprised and thought it was a mistake and asked that they verified the names or we sue them but there rather told us we were actually owing ,then questions were asked ;how ,when ,why? In fact we had witnesses .

but after long verification we realized that my mum was scammed, she met with a fake officer who gave her a fake card and that all we were paying had no were it was going , all the same she enrolled again officially and we started paying the debts thank God few months ago we cleared our areas and we are now free, I just hope my country gets better.....

@blocktrades am telling thats was real horror .it's just always sad when we are faced with predicaments of that nature, but all the Same its well.

Did they ever catch the fake guys?

No my dear

I don't mean to be Unpatriotic but the rate of corruption in my country is very alarming , growing from strength to strength , but all the same I still wish the best for my country

thanks for the upvote , I really appreciate . And also @blocktrades

I also find the activity done with cryptocurrencies complicated when it comes to taxes given they are treated as property. This is unfortunate because it makes it more difficult for people to adopt them for everyday payments but I am sure we will get there one day to facilitate it. This is my first year on STEEM so my excel workbook already has hundreds of lines to determine my taxable income so it will be interesting.

Regarding my tax horror story, I recently moved from a foreign tax jurisdiction back to the United States. The first year I was literally half the time resident of both jurisdictions. Despite knowing my taxes, I hired an accountant which took 5 months to prepare. I submitted them with a hefty but manageable tax liability. However, the forms included receiving a big refund from one jurisdiction with a equal payment to the other. Unfortunately, everything went fine with the payment return but the jurisdiction that owed me money sent a letter months later asking for $80k in liability instead of the refund. The issue was they did not accept a prorated share of the deductions claimed due to my partial time in two countries. After a couple of letters, they finally applied them and processed a lower refund which made my payment higher. What was worst is that it took almost a year to get the refund! Imagine the Steem I could have bought with that!

That definitely sounds like a real nightmare!

The taxation rules for people who earn money across multiple tax jurisdictions have always been scary to me (e.g. how to successfully avoid paying taxes twice on the same earnings). I've paid taxes twice on some small foreign income I had from stocks, just because it was easier than figuring out and filing the associated tax forms for reducing my US tax payment by the foreign taxes paid.

My IRS nightmare started when I asked my girlfriend at the time, to drop some letters at the post office, and it spiraled down from there.

I got in her car about a couple weeks later, lowered the visor, and found my tax return and other letters. I wasn't too worried because even though it was past the filing deadline, I was due a refund, so I thought.

About 3 months later, I hadn't received my refund check, but I get a letter from the IRS requesting $2700. I just knew this was a mistake, so I call to see what's going on.

It turns out that I never received a 1099 for some gambling winnings I forgot about.

Some buddies and I were in Las Vegas and won a big jackpot, I was the only one that was single and had a paystub on me. So I guess I offered to give them my info for the winnings. We were all pretty wasted, so I didn't feel bad about forgetting about the tax complications.

We really had a great time and none of the guys told their wives, so I paid the $2700. Years later, we went to Vegas again, and told the guys what happened. I drank free all weekend!

Personally I don' think it's right that they charge on gambling winnings, but don't let you declare the losses too.

I heard you can declare the losses, if they don't exceed the wins, if you have evidence of the losses. So I started saving loosing lotto tickets every year, but we haven't won a jackpot since. Thank you for the very generous upvote, my first one ever. 🙏

Since you said I could do any "shady government story" instead I decided to write about the time I had to bribe multiple government officials to get my passport renewed 2 months ago!

The maze of bribery for passports here in Venezuela started in late 2017/early 2018 when the government announced that they didn't have the money to provide the paper for the passports(lol oil money has to go to their pockets how dare you suggest they use it to buy paper)

The bribes started as soon as the announcement happened, the website to process your passport requests was taken down so you have to go in person to make the request, there you will have to make your first bribe, the government people don't give a flying fuck about your issues and they won't help you arrange the paperwork, they will insist that something is wrong and that you have to try again.

Depending on the mood, the person will either tell you to fix it yourself or that he can help you for a fee, outright asking for a bribe for a process that he is already being paid for, others won't tell you that and you have to approach them with a bribe offer, I got "lucky" and the girl that took my papers told me that she could accelerate my process if I gave her 40$ which was like 5 minimum wages 2 months ago.

After dealing with her I had to wait 2 weeks to recieve the sticker, since there's no paper, instead of printing a new passport they take one of the pages and put a sticker that extends the passport life for 2 years.

When I went to pick it up, I was ready for trouble again, the girl was not there this time but the guy that took me in basically told me that he was going to held my sticker hostage until I paid him 20$, he was more aggressive but asked for way less money, which I found interesting.

60$ might not sound like a ton, but here it's good money to buy food for months, I had to go thru this and pay up because I'll be leaving soon and I had it relatively easy, I've heard stories of people asking 100$+ to process your request when it's actually supposed to be free and the sticker isn't even that good, it's just a copy of your passport card with a different expiration date... I'm glad I'm leaving soon...

Posted using Partiko Android

My Horror Tax Story

@blocktrades I can only imagine the nightmare you guys went through in the hands of the IRS. Anyways, I am happy that the nightmare is now over and you guys had a witty accountant @cryptotax who expertly arranged your books.

For me, my horrible tax experience occurred nearly two years ago when I needed to surety a friend who was in police custody. As a precondition for my friend's bail, the court had requested an employee who own a real estate and had consistently paid an income tax for at least four years.

Fortunately, I met the criteria and was glad that my friend would soon get his bail. However, when I went to the IRS office in my district in Nigeria to get a tax clearance certificate, I got the shock of my life. The officers there told me that my organization had not remitted any tax in my name in the past six months. I was dumbfounded, to say the least.

On the next day, I took my case to my company's HR. That was when we discovered that some fraudsters in the accounting department were siphoning some income taxes by not remitting them to the IRS. Immediately, the fraudsters were arrested and they were made to refund all the monies they had stolen. Afterwards, my income tax account was funded and I was able to secure my friend's bail.

That definitely qualifies as a scary story, glad it worked out ok in the end!

Thanks for considering my story and for the big upvotes. I am grateful.

Great stuff...I have two sides of the street....as a preparer and a filer...

This year is more nerve wracking than headache as I was shocked how many crypto trades I had done....90% coin to coin....I don't like having such a big number showing on my tax return as audit chances increase...and the net gain was enough to cause considerable pain writing checks for amounts I barely had in value due to coin market crash...

I also lose some sleep on the foreign account filing as it puts me in the league of some tax avoidance criminal with secret overseas accounts even though its a bunch of digital coins located who knows where for sure....

As a preparer....I've had the nightmares of not e filing client taxes only to find out later and have to eat penalties....or e filing a "return" instead of an extension before the numbers are even in the system....or suddenly have a client show up with some notice from a foreign bank I knew nothing about....and while its never pleasant to have a business client show up with an audit notice....its a lot more of a nightmare when IRS criminal investigators show up at my office concerning a client's irregularities....

No wonder I have gray hair and stomach issues!

Well....time to pop one more Zantac and go back to my tax program as I try and finish up a few more last minute client returns by one more final tax deadline...happy 2017 tax season end on October 15.

Sounds like we've shared many of the same fears.

I've actually never held crypto directly for myself, only via the company. When we first got into crypto, the regulations just weren't clear enough that I was certain how the US was going to handle it, so whenever someone paid me in crypto for work, I immediately converted it to cash. When we decided to start trading it, we opted to start up a company overseas and confine our crypto trading to that company as it didn't have all the ambiguous rules that the US was suffering from at that point in time.

It was a lot of work to setup an overseas company and at the time it was a big expense too, but I've never regretted it for a minute (despite the increased tax complexity that I didn't realize at the time I was setting myself up for).

But even with a foreign company, you can't escape the FBAR filings, and having to file those things gives me the same fears that it might trigger an audit. Oh, and the fear that I'll forget some minor foreign exchange I opened an account on and only did one or two small trades on and be hit with a huge penalty for some small amount of money. The FBAR filing rules are crazy, IMO.

Hang in there, the worst is almost over (well, as long as you don't have any audits afterwards)!

Right from the time of the British colony, the issue of tax payment/collection has always been horror, @blocktrades I must confess that this scandal still prevails. Your story just triggered my memory to an incident I can’t forget in a hurry, let me make it brief and simple. In 2005 when i lost my Dad, until his demise he was a loyal servant to the government of that time, investing both physically and intellectually as a civil servant, but yet still, he was greatly owed by the agency he worked for . Although death was so cruel to take him away just at the time he was to be paid his debt. As his next of kin ,it was in my place to get his entitlement. Through the help of his old colleagues, I was able to push the claiming process to 90% completion but during the last phase which the deduction of taxation was to be done, I was told that 60% of my late Fathers debt was to be deducted as tax leaving me with 40%. As a poor orphan I was left with no choice than to take what was given. Ever since then I promise myself not to forget and forgive our country IRS. @blocktrades its really hard that most humans tend to rejoice over other persons failure. Thanks for letting me share my story with you.

Interesting, so by delaying the payment, they were able to pay less in the end. They should have had to pay interest for their delay of the original payment.

Hello @blocktrades. After reading all of these horror stories about taxes and the IRS, I realize that my story falls somewhere in the middle. At the time that it occurred however, I was a basket case.

I have always used someone else to file my taxes and after 5 years with a CPA, I got audited. I was advised by two friends who had been audited not to go to the meeting with the IRS since I did not prepare the paperwork. I was told to let the professional handle it. Well, I have a cousin who worked for the IRS and she told me not to let anyone know more about my business than me. She told me “You’d better go to defend yourself.”

Well, I went against my better judgement and waited for 20 minutes for my CPA who pulled a No Show! I was left to answer questions about my tax forms by myself.

There is an old saying, “You can put all that I know about taxes in a thimble and still have room to sew.” After the auditor asked me the fifth question and I was still saying “I don’t know.”, I burst out crying. Not silent tears, but the boo boo hoo loud ugly cry.

The auditor was a man and he felt sorry for the little lady. He gave me a bill of $43,000.00 and told me that my accountant made a mistake in taking a deduction. The auditor also questioned whether or not I was able to run two different businesses. I was an educational consultant as well as a landlord for rental property.

To make a long story shorter, I ended up seeking out the help of my cousin who worked for IRS. She was able to help me get the tax bill cut in half so that I only owed $23,000. I still had to write out that check with money that was earmarked for something else that I desperately needed at that time.

It is a shame that the American tax system is so difficult and complex. Even the auditor made a mistake and if it had not been for another IRS professional, (my cousin) I would have had to pay $20,000 more.

I for one am in favor of a flat rate tax for every one. I would love to fill out one page and pay what I owe.

The worst tax story that I ever had happened a few years back when I opened a company to publish greeting cards. After the fifth year of my accountant doing the taxes, she told me that I would no longer be able to write off my expenses because my business was a hobby. I did not understand at the time that there was an IRS rule regarding business vs hobbies and I thought that she was making fun of what I was doing. So after I told her off for several minutes, she explained to me that under the IRS code, if you open a business and after years of not making a profit, it is considered a hobby and you are not allowed to write off expenses like you would under a real business. I had to laugh at myself, but later cried because of the amount of taxes that I had to pay because I no longer had the write-offs.

Ah yes, the infamous "hobby law". I'm very familiar with it and it was one of the more scary things about starting a new business: what if we failed and the tax office disallowed all our previous year deductions.

I definitely understand. It took me several years to pay off the amount.

Maybe I'm late to be here to share stories, but I really want to share the story that I've been feeling with my family so far.

The story happened 2 years ago, my mother was a wife left by a husband with 3 children. My mother struggled to support us her children (a great mother for me). A terrible experience with taxes happened when I met lies.

At that time a sister of mine experienced a tragic accident which caused her to be operated on and my mother had to be hospitalized, having suffered from the news of this accident. My mother has a heart attack.

Two days in the hospital, an IRS officer came to see my mother. He gave a piece of paper on land tax collection that had a large nominal maturity. I was surprised to see it, because our conditions were below the minimum economy. lifespan.The officer gives relief with installment efforts.I paid that day 250 $. After making a payment. I checked into the nearest office. However, here is the tragic event. That their party claims not to send members for billing and I do not have tax is so great. Indeed my heart is broken, on the one hand I have to pay for the hospital fees of my parents and younger siblings and in another I have been deceived by irresponsible people. And the money is my full money to pay for the hospital, so I have to sell it by selling our only house. So I have to stay in the corner of the shop until now Thank you @blocktrades for listening to my story.

Hello @blocktrades. This story happened around 2009-2013, when the officer from the tax office came to our shop, he said we had not paid the business and building tax for a long time. We were very shocked at that time, because the nominal listed was very large, as much as our profits for one year.

Then we asked the officer the solution. He said he could take care of it, but we had to pay through the officer. We pay the tax in installments through the officer for up to a year. The second year the officer did not come again, but another officer came from the tax office. He said that we had not paid taxes for a long time. If not immediately paid, the business license will be revoked.

We were also confused, and we said we had paid, we showed proof of installments. He said the proof of payment was all invalid. And we had to pay again ... meaning we were tricked by fake officers. That's my story. Thanks.

I've heard a couple of similar stories at this point. Seems like your taxers should make clear that taxes will never be collected by people showing up at your business and that any such person is a scammer if they express a willingness to directly collect the tax money rather than have you send it to a government address.

I was very moved to tell it. But, I will tell it. For me, a terrible tax experience for me happened almost four years ago when I had to make sure my husband got heart surgery at a hospital. I am an underprivileged citizen to collect my husband's surgery bills. As a prerequisite for my husband's guarantee, the court has asked an employee who has real estate and consistently pays income tax for at least four years. Fortunately, I met the criteria and was happy that my husband would immediately get the guarantee and could get out of the hospital for what he was suffering from. However, when I went to the IRS office where I lived to get a tax permit certificate, I got a shock in my life. The officers there told me that my organization had not sent any taxes on my behalf in the past four months. I was astonished, to say the least. The next day, I took my case to the HR of my company to work. It was then that we discovered that some fraudsters in the accounting department were corrupt about income taxes by not submitting them to the IRS. Immediately after that I reported the police by making a confession, the corrupt must be arrested and return all the money they stole so far. After that; I can secure my husband's guarantee and continue to change until now his condition has almost improved.

Thank you for listening to my story @blocktrades

My worst tax year was 2016/2017 as we had bought a house from the government at foreclosure for cash. After the purchase, we had several large cash deposits made into our account to cover the payment of workers via certified checks. That is when we found out that if you deposit more than 10k in cash in a single business day there are special forms to fill out. As we didn't know this in advance we made deposits over 10k 4 times in a single week to pay for new A/C wall units and to have them installed. This was a huge red flag to them and triggered an audit. The cash was simply taken out of one account and placed into a new account and that was little matter to them. We learned our lesson as we had to pay income on the deposited cash as it went into a business account from our personal account. Had we knew that we simply would have paid from our personal account to begin with but as it was an LLC and the units were for the office section of the house we thought we had proceeded correctly.

Worst part is we had no income for 2016/2017 as we were remodeling.

Live and learn.

Thank you @blocktrades this story began in 2013, this is the worst story I have ever received in life, I got a telephone notification from someone claiming to be an IRS member, that I was being audited by the IRS in the nearest future, because I owe them like $ 1000. After panicking hearing this news, because I have done my duty properly. I checked my transaction fees, in fact I paid correctly. But, because of the news. I was very shocked and continued to take it. After a few days, I was told again by telephone, THAT THEY WRONGED. People who want to be on the phone have almost the same name as me. But I still panicked, especially when my economy was in difficult times. I keep checking and being aware of that. Even though I have been called with news. That they are wrong people.

For some reason, that actually happens a lot here in the US lately (people being called and told they owe on their taxes), but here the calls are always by scammers trying to trick people into giving them money. The real tax authority here (IRS) always sends such notices by mail, they don't make phone calls.

Africa, Nigeria; here taxes has been in one word "horror ",let me seize this opportunity to share a short story on my experience with poor taxing system;

After I graduated from college, I had a work at the ministry and I was always severely and directly taxed where tax and other revenue would be deducted before my salary before it gets to me, they called it VAT value added tax, up till now I don't understand that stuff .All the eligible tax payers will be registered so as to ensure that there is no tax scandal but the most annoying would be that at times I'll get a double deduction from the and it's non refundable ......

I sufferd this way until a foreign company established a branch close to me home and it offered four times the salary I was receiving at the ministry so I resigned and left for the company amongst my duties was to pay the companies tax at the IRS , little did I know that the figure I was always given was an inflated figure .We continued in ignorance till a time were we had financial crisis and we could bearly pay our workers but the IRS insisted we paid or we'd be closed down .Our team of legal advisors tried explaining to them that we will pay it up later and that the cost also is very high and has been one of the factors of our fall we showed them our receipts that we were always faithful to our exorbitant tax. Everyone was surprised by their reaction as they said that the receipt was influenced and that the amount was inflated with 3 extra zerosWow interesting, @blocktrades, taxing has been one of the major factors of dispute between governments and it's citizens but let's not forget that it's still humans that causes all this scandals. I would have loved to say that developed countries would be an exception but I doubt that, as an African and my country not only being the most populated it also one of the developing countries in to the figure ,I needed no prophecy to tell me my job was in the line since I was the one who paid the bills but thanks to my reputation It the issue was verified scandal who usually gave me inflated bills paid dearly with their jobs and my company was compensated @blocktrades I mean, that was raw horror.

Ours over here is bit different unlike the US. In Nigeria, the only tax extension you get is a week and the local councils usually enforces it and last year was kinda funny, as they seized some of our properties and we only get to have them back when we settled our tax.

Well, I will wait to read those horror tax stories from the U.S

What kind of property do they seize?

Flat screen, sound system and some other electronics . They couldn't carry the refrigerator so they left it

My story starts like this, I made a btc sale, and the amount for which I had to deposit was greater, blocked the bank accounts, and I had to go with my father to talk to the manager of that bank in my city, I talk about something What happened 5 years ago, and make him understand that the origin of money was through online games, and that he did not commit crimes or money laundering, the face of the manager trying to understand that money could be made through games online, and that besides that I had to explain what bitcoin was, that new form of money, and he could not understand how money could be moving freely without regulations, besides explaining where his bitcoin value was, all relate the concepts of money with an alleged support in something tangible, he did not understand that the value of bitcoin is based on the difficulty to obtain another fragment or code, and that it is something that not everyone can invent his or her bitcoin, so as well as how the nodes work, I was just beginning to understand the use of exchanges, and I also had to explain that, I was nervous because I asked a lot, and spent more hours in his office, I really thought I would end up in prison, without money , but at the end and show everything, even teach him to use an exchange, and have an account, create a wallet, and make the transfer, to exchange it for local currency, the lord simply could not believe it, and after that I release the money from my account.

I guess this is one of the only benefits on living on a sort of lawless country.

Here in Venezuela the government doesn't really care about regular citizens doing their taxes, they only care about business owner's taxes, in theory everyone is supposed to do taxes but most of them don't except if they have a business because it could be expropriated.

Of course I would rather have scary tax stories than the scary stories I can tell you from living here lol.

Maybe I should have broadened it to "Scary Government Interaction" stories. If you have one of those, feel free to share it (assuming that itself won't get you in trouble with the government there).

I do have a plethora of stories of policemen trying to extort me and stories of how I had to bribe my way into getting my internet connection back after the government wouldn't repair it and how I had to bribe my way into getting my passport renewed :^)

Funny enough I read through this story, knowing fully well I am not taxable at the moment. But reading things like this is a seed to help in the future. Good luck on the IPO for BlockTrades. I look forward to seeing how I can join in participating.

Thanks, we're going to try to make it open to as many people as regulations will allow.

well, I don't really have any personal story cos I'm a civil servant here in Nigeria and my tax is been deducted directly from my monthly salary.

The only horror here in Nigeria is that if you know your way, you may never need to pay tax as a lot of our big men settle there way out using there connection.

Mum has tried to fight this menace for the past 2years since we registered with the tax Identification Commission of my Country. We are repeated always and the debtors list, even when the taxations and bills are being deducted even before her salary is paid. We have reported to the head offices, send Emails, make calls, meet everyone we can, it calms down for a month or two and then the debt-repetitions begin. Mum has since decided not to pay anymore since 2months ago, it’s surprising that they have done nothing yet, but we are still waiting for their actions, we are still waiting for their actions, we might sue them bought that is a very Expensive and Costly action here in my Country.@blocktrades, I celebrate your freedom from this Nightmare, although I have never been directly affected by such horrors and bottlenecks, But currently taxation is making life miserable for my mum.

Good luck, I hope for the best for you, but unfortunately you can probably expect the worst.

It’s really sad that many humans are happy when others are afflicted by their actions. I really appreciate you for this opportunity to share what is happening in Nigeria with the world.

My family and other working friends, especially civil servants are frequently oppressed here in my country. Here is the thing, depending on the number in the labour market there is a cross estimation for the amount of tax to be paid depending on each civil servant’s level. But those at the top don’t pay, but in other to meet the net values we at the bottom of the food chain in turn are made to pay for their fees. This has been serious problem and currently a request for increase in the average workers minimum wage is ongoing, with strikes and demonstrations. This is as a result of human wickedness and greed.

@blocktrades , I have read your sad tale and I appreciate you are free, I wish one day a better Government that understands will come into place.

Thank you @blocktrades, I returned in 1990, at the age of 25. On that day I went to the post office to send the Regular Envelope Tax about one week before the due date, April 8 and the envelope was returned to me after a few days. The moral of this Bad Tax Dream is when an IRS employee came and told me; that I have never sent a Tax Form in the post date listed. I was very panicked and I was shocked, because I had heart disease. After a few days from the hospital, I went to the post office to make sure I had the right shipping costs and I had done it right. Until the post office apologized because the computer was damaged, the shipment was late. And want to compensate for mistakes made. But the lesson here is "From a few mistakes, it can cause fatal events to almost die".

Well honestly I was investigated once cos I earned too little... and as a freelance I was asked for the bills and all justifications when I'm a mess and usually don't keep proper record of things, :) then we have politicians stealing millions but they had to bother with a sigh struggling artist barely making ends meet LOL... at the moment I'm not even cashing out here, so it's just a token until I do so, and I've been a bit off the loop to handle paperwork, so I fear to do it.

hi @blocktrades, thank you for your explanation about the horror story of tax in your country (US).

Previously I also saya thank you for your services in cryptocurrencies transactions, you did it quickly, and we were very satisfied with the service you provided.

told the story about taxes is a bit horror, where all taxpayer companies have to deposit some money to the government, maybe the system and bureaucracy in your country more better than my country, but here I am still a little confused about cryptocurrency TAX which is currently in my country (Indonesia) is still not legal, the government has not agreed to this. Even if we see transactions here are greater than transactions Conventional Banks.

For your country, I don't know much about this tax rule, which I certainly believe, if the government has legalized this, then the government will require tax for these cryptocurrency companies. I hope this is a good thing, with government support, this will continue to grow throughout the world, and transactions in cryptocurrency become commonplace for the public.

Dutch regular Tax filing is easy to fill in as the tax office knows all your earnings and bankholdings upfront. The real HORROR here is that all your investments are taxed based on a 4% FICTIVE return while at teh same time the Central European Bank (similar as FED) thru buying bonds keeps the interest rates at zero!!!!

I've never actually used or seen the word fictive, so it's kind of cool to learn a new English word from a Dutch person! Is the tax on your investment gain or is it a tax on the net value of your holdings? If it's just a 4% tax on the gain, that sounds pretty good compared to the US!

If you have 100K holdings you pay : capital gain tax 30% * (100K *4%) = 1200 ; a threshold applies.

Ok, so if I understand you correctly, they are taxing you based on the assumption that you will have future capital gains regardless of whether you actually have them yet. If so, can you deduct the taxes paid already from later capital gains tax?

The actual gain or loss does not matter here. You are always charged with tax on the assumed 4%, the 4% itself is based on the historic return on a basket of investments and will change next years.

Looking forward to the 'annual' poker game in Krakow after Portugal last year 🤗Hey @blocktrades!

GREAT move having an account / accounting firm file your taxes. Doing so removes a 'red flag' from your return and reduces the likelihood of an audit. The peace of mind you receive when paying for a professional tax service is priceless; life's too short 🙂

I read the other day that the IRS has had their budget cut again, and thus the number of audits will be lower than last year.

Hope that helps 😊

We should definitely do the poker game again, I want another crack at taking down @nanzo-scoop! I've forgotten the rules again by now, but I'm sure it'll come back to me quickly :-)

Absolutely!

Good times brother, 🤗

Looking forward to it! 😀

I'm not American, but I moved to Panama to avoid all this 'first world' tax bullshit. As an American, you should consider moving to Puerto Rico.

I did vaguely consider it, but I'm pretty attached to my current location (Blacksburg, Virginia) and it would mean leaving family and friends behind.

Have you thought about investing the profits of your business into Opportunity Zones? (Incidentally, Puerto Rico is one but there are a bunch others.) There are some great tax benefits and crypto gains would be eligilble.

https://www.forbes.com/sites/stevenrosenthal/2018/08/20/opportunity-zones-may-help-investors-and-syndicators-more-than-distressed-communities/#2e67c68176f2

https://www.irs.gov/newsroom/opportunity-zones-frequently-asked-questions

I'll check it out, thanks!

I pay taxes and that is scary enough! Been paying since I was 13 and long after retiring I still pay them...

Wow, from age 13, that sounds pretty enterprising! What were you doing at 13 to earn enough to have to pay taxes?

I worked on a Ranch and IRS does not care the age as long as they had income they could tax.

Almost everyone at least every family currently has a motorbike, as a private vehicle. Almost every house is not only in the city, even in the village today, most of it, if not all of them say, have a motorbike. Well ... the consequence of having a motorbike can make style and require fuel for the motorbike, every year there is also an obligation to pay taxes. I am personally including motorbike users who are actually not too obedient to pay taxes, because almost every year I never pay fees, without being subject to fines. That means ... every year it must be late to pay taxes. Well, don't copy it. Hehehe Yes ... often the shadow of me paying motorcycle tax is something that is annoying and complicated. Why is that??? Yes ... we want to deposit money into the country but the procedures are complicated and long to queue, not to mention when there are rampant levies in the tax directorate. I was once deceived by extortion because I was lazy to queue so I had to pay for brokers. That is one of the reasons why almost every year it is rather unfortunate to spend time waiting in line to pay taxes. But ... such a shadow turned out to be a shadow of my past who had been in a long queue for almost half a day just to deposit money into the country. Because currently paying taxes turns out to be very easy. The story is like this, the deadline paid my motorbike tax actually on April 11th. And as is my custom every year, lazy or paying taxes. So when April 11 arrived, as usual I never worried to quickly pay taxes, because I lost with that feeling of laziness. Besides that, the school schedule that came home until half past three in the afternoon, increasingly became a justification for laziness to pay motorcycle tax. After passing for one month, I decided to become a good citizen, paying motorbike taxes.

RESTEEM Thanks for this @blocktrades

I was wondering why October because I know Singapore 15 Apr is same but no horror story from me because things are not that complicated.

I don't want to give the wrong impression: personal taxes aren't that complicated in the US for the average wage slave. They start to get complicated if you strike out on your own and try to do anything except work for a company for a fixed salary.

It's the same for Singapore. Most people are allowed not to submit if it's just salary which the employer has provided the information to tax authorities. Salaried people need to submit only when they change status like getting married or have a baby and tax relieve given are different as a result. Then the authorities just tax the new information and assumed same the year after.

That is much simpler than in the US. Even if you just earn a salary, you have to file your own tax forms and you have to do it every year.

I think it make sense for them to simplify the process and not need so much manual processes to go after the many small fishes but focus on the bigger ones. :-)

Yep, I agree. The US tax system wastes far too much human labor being calculated, it's terribly inefficient.

In South-Africa the tax deadline for e-filing is also the end of October!! I don't have a horror story for tax, but if you know South-Africa, you would know that almost all state departments are dis dysfunctional, with the one exception, the TAX department, they work 100%, I think that in itself is a horror story as there is no getting away!!

OMG I have a crazy tax horror story!!!! I don't have time to tell you the whole thing right now...

...but let's just say I also finished my taxes on the 15th...and I'm living off of a loan at the moment.

I seem to keep having random money mistakes happen to me and then I have to fix problems (like my taxes. there was a big mistake).

I actually came here to tell you guys that a @blocktrades transaction failed 3 hours ago, and I don't know what to do.

Because the money is still gone from my account and I'm out 500SBD which I've been working reallly hard to get.

Please help!!! Pretty please. I don't know why the SBDs are gone since the transaction failed.

Sent an email a few hours ago but haven't heard back. Thanks so much!

I'll finish the rest of my tax story later because it's nuts and truly the BIGGEST horror ever. Halloween worthy.

It's fixed now and your transaction has been processed. Sorry for the delay, our steem wallet went temporarily offline for a few minutes.

tax is the biggest asset of every country, it is possible that the current administration needs a lot of funds so that every year taxes are always raised, this is what makes entrepreneurs like you headaches, but if your income is still maximal it doesn't matter, what matters is your business is smooth just fine.

I enjoy your horror tax stories, maybe even in your country is increasingly detrimental to entrepreneurs. because your president Trump came from businessmen, and he also saved a lot of horror stories.

It may be counter-intuitive but just having a "business-minded" guy as president or a "business-minded" congress doesn't necessarily lead to a simpler tax code. In practice, most politicians in either of the two real political parties are actually very similar in their behavior, due to the way our political system is set up. It forces them to respond to pressure from rich people and corporations when passing laws.

And while you might think these rich people would be pressing for a simpler-to-compute tax system, it's actually the reverse. A simpler tax system would likely result in a fairer tax code: instead they lobby for a very complex one with many loopholes by which the rich can pay relatively small amount of taxes, but make it not apparent to the middle-class exactly what is going on.

Maybe my mind is a little different. Regarding the tax issue, there are many that are not suitable, so that many entrepreneurs run away from taxes by receiving high risks.

Thank you for your explanation

Congratulations @blocktrades more power happy trading..

Thx, you too.

My pleasure!😊

The story that happened 4 years ago, my father was a great father, a year after the divorce was left by a wife with 2 children. My father struggled to support us his children (father had brain cancer). A terrible experience with taxes happened when I met a lie. At that time, my sister had a tragic accident that caused her to die, and my father had to be hospitalized, because the cancer had recurred. Heard the news of this accident. Two days in the hospital, an IRS officer came to see my father. He gave a piece of paper to the collection of land taxes that had a large nominal maturity. I was surprised to see it, because our conditions were below the minimum economy. lifespan. My father's cancer surgery costs are very expensive and I have to pay a large tax. Officers provide assistance with installment efforts. I paid that day 450 $. After making payment. I checked into the nearest office. However, this is the tragic event. That their party claimed not to send members for billing and I did not have such a large tax. Actually my heart was destroyed, on the one hand I had to pay for the hospital fees my parents and my sister had to die and the other I was deceived by irresponsible people. And that money is my full money to pay for my father's operating expenses, so I have to sell everything I have without thinking, I have to be a homeless by selling our only home. So I have to stay under the bridge until now. Thank you @blocktrades for listening to my story.

The story that happened 4 years ago, my father was a great father, a year after the divorce was left by a wife with 2 children. My father struggled to support us his children (father had brain cancer). A terrible experience with taxes happened when I met a lie. At that time, my sister had a tragic accident that caused her to die, and my father had to be hospitalized, because the cancer had recurred. Heard the news of this accident. Two days in the hospital, an IRS officer came to see my father. He gave a piece of paper to the collection of land taxes that had a large nominal maturity. I was surprised to see it, because our conditions were below the minimum economy. lifespan. My father's cancer surgery costs are very expensive and I have to pay a large tax. Officers provide assistance with installment efforts. I paid that day 450 $. After making payment. I checked into the nearest office. However, this is the tragic event. That their party claimed not to send members for billing and I did not have such a large tax. Actually my heart was destroyed, on the one hand I had to pay for the hospital fees my parents and my sister had to die and the other I was deceived by irresponsible people. And that money is my full money to pay for my father's operating expenses, so I have to sell everything I have without thinking, I have to be a homeless by selling our only home. So I have to stay under the bridge until now. Thank you @blocktrades for listening to my story.

The story that happened 4 years ago, my father was a great father, a year after the divorce was left by a wife with 2 children. My father struggled to support us his children (father had brain cancer). A terrible experience with taxes happened when I met a lie. At that time, my sister had a tragic accident that caused her to die, and my father had to be hospitalized, because the cancer had recurred. Heard the news of this accident. Two days in the hospital, an IRS officer came to see my father. He gave a piece of paper to the collection of land taxes that had a large nominal maturity. I was surprised to see it, because our conditions were below the minimum economy. lifespan. My father's cancer surgery costs are very expensive and I have to pay a large tax. Officers provide assistance with installment efforts. I paid that day 450 $. After making payment. I checked into the nearest office. However, this is the tragic event. That their party claimed not to send members for billing and I did not have such a large tax. Actually my heart was destroyed, on the one hand I had to pay for the hospital fees my parents and my sister had to die and the other I was deceived by irresponsible people. And that money is my full money to pay for my father's operating expenses, so I have to sell everything I have without thinking, I have to be a homeless by selling our only home. So I have to stay under the bridge until now. Thank you @blocktrades for listening to my story.