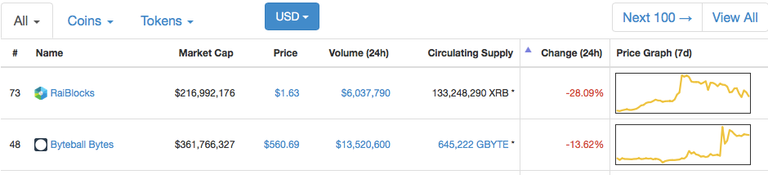

I'd never knew but coincidence had it that I had seen Byteball on CoinMarketCap to be the 2nd lowest today:

Byteball Bytes (GBYTE)

$554.61 USD (-13.07%)

0.02855150 BTC (-15.91%)

I heard it later in a video, his two favourite altcoins, Monero and Byteball. I know Monero but Byteball??

If you were worried about scaling and block sizes, then things that are built on distributed a cyclic graph instead of block chains are cool and, in my opinion, the best of those projects is byte ball. It sucks that the price is so terrible, but the technology's super cool - it's got smart contracts built in it's got an exchange built in where you can convert from buy, bought a Bitcoin back and forth with in order book through a chatbot. You can write your own chat, bots that do smart contracts and it has anonymity features and it doesn't use blocks and it doesn't use mining and it was fairly distributed with no pre mine. I think 1 % pre mine actually for a foundation or something it's just super cool tech and works really well and the value was like nothing. The price like died.

Richard Heart

Untraceable currency: Blackbytes

Cash-like privacy.

When you want complete privacy, pay in Blackbytes, a cash-like untraceable currency whose transactions are not visible on the public database, they are sent peer-to-peer instead.

Use built-in TOR switch straight from the wallet to increase your privacy even further.

Users help each other

Secure each other's transactions.

There is no central entity that stores and processes all the payments. Instead, transactions created by users are cryptographically linked to each other, and once you add your new transaction, other users start adding theirs on top of yours, and the number of other transactions that link to your transaction grows like snowball (that's why we call it Byteball).

I'm not sure at all about this feature, which might be the most important! I'd really like to know how it works but I'm lazy reading the whitepaper. But if what I read below is true and they are right I'd might invest just for fun. This seems like a little gem.

Immutable storage

Once stored in the Byteball database, the data can neither be revised nor removed.

Settlement finality

After certain criteria are met, a new transaction becomes final. It cannot be revised even by a powerful attacker. No guesswork about the right number of confirmations, no 51% attacks.

Multi signature

For security, you can require that your funds be spendable only when several signatures are provided, e.g. from your laptop and from your phone. For shared control of funds, signatures from different people may be required.

Almost every coin has this feature but I'd really like to see the UX to this one. What you need is a good wallet / app and you're good to go : ) Now finding an exchange where's it's easy to sell and buy for fiat...

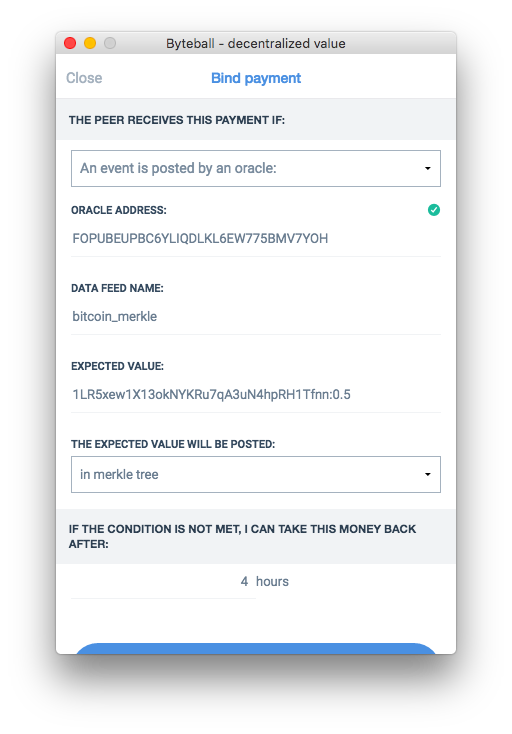

On-chain oracles

When dealing with untrusted counterparties, you can lock the funds on an address that is spendable either by you or by the counterparty, depending on the events registered to the database by trusted data providers — oracles.

Wow I really would like to see how this works because who is going to be the source and how is the natural language say from a website describing the event, being parsed? Imagine having a bet how are the oracles able to get the truth? I know there are bots which buy and sell stock just of reading Twitter and the news. Some do it below 20ms!

The external events are brought into Byteball by trusted third parties — oracles — who monitor specific events and import them into Byteball database as a data feed.

Once the events are there, you can set the terms of the contract and bind your payment to the other party’s performance:

Your money then becomes locked in a smart contract that the other party can’t spend before it performs the actions required by the contract. As soon as the required event is evidenced by the user-chosen oracle, the other party can unlock the funds. If this doesn’t happen within the specified time frame, you can take your money back.

Although the oracle is a trusted third party here, it is not a party to the deal. It needn’t be asked for permission, it needn’t know anything about your deal, you, or your peer, it just posts publicly available data and doesn’t care how this data is used. And since the data is publicly available, everybody can verify that the oracle’s data feed is true and accurate. If an oracle attempts to lie, it can lie only once.

If an oracle attempts to lie, it can lie only once.

Well so that could be an expensive joke but

it needn’t know anything about your deal, you, or your peer,

it could work...

Free distribution to BTC and Byte holders.

Mass adoption requires wide distribution, that's why 98% of all bytes and blackbytes are to be distributed for free.

Oh this is going to affect the price!

The first distribution round took place on Dec 25, 2016 when the network launched, over 70,000 BTC was linked, and 10% of the total supply of bytes and blackbytes was distributed. In the subsequent rounds, the total distributed supply reached 58.4%:

- For every 16 BTC you receive 0.1 GB (1 gigabyte = 1 billion bytes),

- For every 1 GB you receive additional 0.1 GB.

The first distribution round took place on Dec 25, 2016 when the network launched, over 70,000 BTC was linked, and 10% of the total supply of bytes and blackbytes was distributed. In the subsequent rounds, the total distributed supply reached 58.4%:

- 2nd round on Feb 11, 2017: 121,763 BTC linked, 1.8% distributed;

- 3rd round on Mar 12, 2017: 129,139 BTC linked, 2.0% distributed;

- 4th round on Apr 11, 2017: 145,441 BTC linked, 2.3% distributed;

- 5th round on May 10, 2017: 207,672 BTC linked, 2.9% distributed;

- 6th round on Jun 9, 2017: 453,621 BTC linked, 6.6% distributed;

- 7th round on Jul 9, 2017: 949,004 BTC linked, 11.0% distributed.

- 8th round on Aug 7, 2017: 1,395,899 BTC linked, 16.0% distributed.

- 9th round on Sep 6, 2017: 1,306,573 BTC linked, 5.7% distributed.

- 10th round on Nov 4, 2017: 1,093,155 BTC linked, 6.1% distributed.

Conclusion:

I'g going to wait and see when the cryptomarket crashes because of the Bitcoin futures failing. After that I'm probably going to buy that what went down most be it either DASH, BTC, EOS, BitShares which I trust and some smaller coins like LiteCoin (LTC) which was supposed to go up but I didn't pay attention to what Clif High was saying / and I didn't know much about Litecoin. So don't make the same mistake.

Also YOYOW hmmm but yeah the market is crazy right now!

If you have played with Byteball, let me know!

- sources:

i totally agree with you on that.

On what point?

He's a bot.

Can someone please break this down in simple English? I honestly can't

What part do you want to break down?

What's the major difference Byteball and other cryptocurrencies? Or is it not a cryptocurrency

Yes, good question: they don't have a blockchain! But are using acyclical graphs. No idea how it should work but you can read it here. If you want more detail try AskSteem and finding posts with

byteball AND netvote:>20 AND created:>2017-08-01for example.Okay,I'll do quite so. And thanks for lending an helping hand. Twas nice from you.