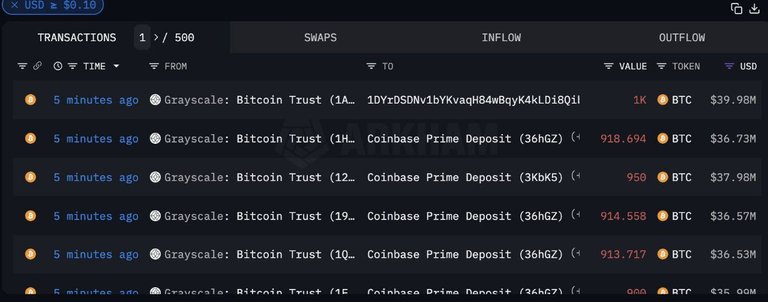

In the last few hours, Grayscale have sent another 19,000 bitcoins (worth $760,000,000) to Coinbase. Here's the evidence of the transactions:

It looks like investors in the Grayscale Bitcoin Trust are withdrawing their money, and Grayscale are selling coins to meet redemptions.

Why are people withdrawing their money from Grayscale?

Well, as of Jan 2024, they raised their fees to 1.5%. The following week their competitors started a fee war, which resulted in fees on average of 0.3%. And then the coup de grace, the SEC approved ETFs.

Grayscale investors decided to pull their money out and put it into a low fee bitcoin ETF. But if everyone redeems at the same time, the price tanks. It's tanked over 20% in two weeks. Costing the redeemers way more than they would have paid in fees.

The bitcoin market isn't liquid enough to cope with large sales. I'm not sure the Wall Street types who invested in Grayscale realise that.

Congratulations @teatree! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 8000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: