Its amazing how Ethereum is filled with so much history and information. I’m a bit surprised by the bread and scope of the community and history for a Cryptocurrency that was only formed in 2015. So this is my third post on Ethereum in regards to what it is. Part of today’s post is about Ethereum’s fork. And why it happened and the aftermath of the fork.

As a reminder, most of my research is googled from various websites, such as Coindesk.com, Blockgeeks.com, digitaltrends.com. And what I’ve done is share key highlights about what I found and provide some perspective or interpretation of the matter.

Last week’s Summary:

• Ethereum’s goal is to develop decentralized data and apps.

• Ethereum’s desire is to develop decentralized autonomous organizations (DAO) to help foster Ethereum apps and dialogue about ways to that communities can move towards better transparencies and proprietary control over information.

• There are many apps that are employing Ethereum in that context.

• Ethereum is not like Bitcoin. Bitcoin is focused on peer-to-peer transactions where Ethereum is more about computational operations and data collection.

• Ethereum users employ the Ethereum Virtual Machine to help develop Ethereum apps.

• A core attribute of Ethereum is SMART CONTRACTS.

Question: What is Ethereum’s fork?

This weeks Summary:

The DAO hack that changed everything…almost everything - The following is from Blockgeeks.com.

I feel like a lot of these controversial issues happened about 2 years ago and I'm now stumbling over it...but it was a big news at the time. And it seems relevant to share what I learned, given that someone in one of the articles I read stated that Ethereum's fork was a pivotal moment, that ranked up there with the creation of Bitcoin...."wow"....so hence I'm sharing a little of history here.

• In the summer of 2016 a startup working on one particular DAO project, aptly named ‘The DAO’ got hacked.

• The DAO was a project by a team behind another startup called Slock.it. They wanted to build a humanless venture capital firm (crazy right…humanless VC firm…who would have thought that was possible…but with SMART CONTRACTS you can) that would allow investors to make decisions through smart contracts. The DAO was funded through a token sale and ended up raising around $150 million.

• Shortly after the funds were raised, The DAO was hacked by an unknown attacker who stole Ether worth around $50 million dollars at the time. While the attack was made possible by a technical flaw in The DAO software, not the Ethereum platform itself, the developers and founders of Ethereum were forced to deal with the debacle. There was no easy answer.

An Ethereum fork in the road

• “After much debate, the Ethereum community voted and decided to retrieve the stolen funds by executing hard fork or a change in code. The hard fork moved the stolen funds to a new smart contract designed to let the original owners withdraw their tokens. But this is where things get difficult. The implications of this decision are controversial and the topic of intense debate.”

• “Here’s why. Ethereum is based on blockchain technology where all transactions are meant to be irreversible and unchangeable….(isn’t that why we like Cryto….CODE IS LAW) By executing a hard fork and rewriting the rules by which the blockchain executes, Ethereum set a dangerous precedent that goes against the very essence of blockchain principle. If the blockchain is changed every time a large enough amount of money is involved in the transaction/hack, or enough people get negatively impacted and screwed, the blockchain will lose its main value proposition – secure, anonymous, tamper proof & unchangeable.”

• “While another less aggressive soft fork solution was put forth, the Ethereum community and its founders were in a difficult situation. If they didn’t retrieve the stolen investor money, confidence in Ethereum could be lost. On the other hand, recovering investor money required actions that went against the core ideals of decentralization and set a dangerous precedent.”

Post aftermath – Ethereum splits and creates Ethereum Classic (ETC) vs. Ethereum (ETH).

• “In the end, the majority of the Ethereum community voted to perform a hard fork, and retrieve The DAO investors money. But not everyone agreed with this course of action. This resulted in a split where two parallel independent blockchains now exist.

o For those members who strongly disagree with any changes to the blockchain even when hacking occurs there is Ethereum classic (ETC)

o For the majority who agreed to rewrite a small part of the blockchain and return the stolen money to their owners, there is Ethereum (ETH)

• Both blockchains have the same features and are identical in every way up to a certain block where the hard-fork was implemented. From the block where the hard fork or change in code was executed onwards, the two blockchains act individually.

• The founder and the rest of the community migrated over to the new, ETH chain after the DAO hack. The faction that disagreed decided to stay on with the old chain, which they’ve since titled “Ethereum Classic,” or ETC.

• The fork idea was to make the attacker’s Ethereum chain worthless and abandoned while the rest of the community moved to the new chain (this makes sense to me). The perk of this approach was that victims of the hack would have the equivalent amount of ETH returned as they had originally put into the DAO.

• So when we talk about Ethereum now, in media, its about the new Ethereum and not Ethereum Classic.

• How Material is this to us investors? Probably not so much but it does highlight that Ethereum is subject to potential future hacks. As a reminder the hack was on a specific DAO group and not on the Ethereum platform, so I think that’s not an issue.

• The founder of ETH (Vitalik Buterin confirmed that he will work 100% on ETH and won't support ETC, even if the price of ETC overtakes the price of ETH.

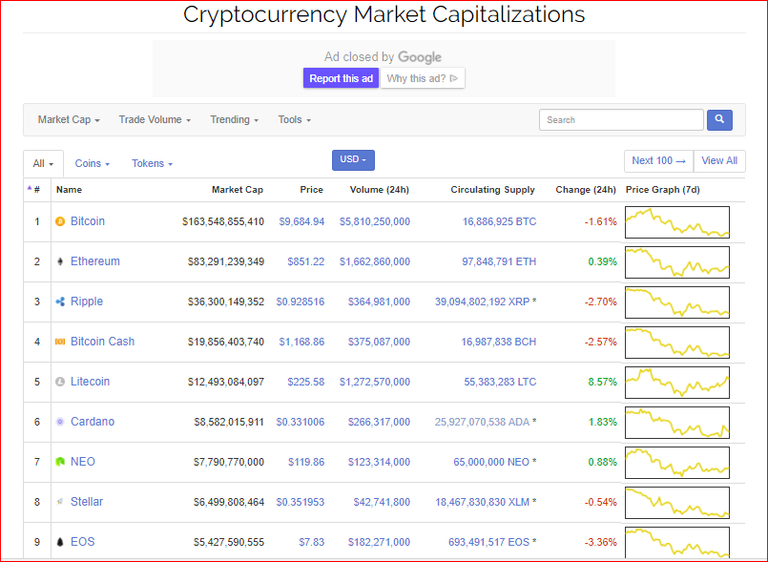

• When the fork occurred, ETC had a market cap of $1.5B but ETH had a Market cap of $24B. Needless to say, the two have diverged. There are lots of potential reasons for that divergence but to simplify, all of the heavy hitters of Ethereum left ETC and joined ETH.

• ALL NEW UPDATES to ETH does not Transfer over to ETC. So there are issues with furthering investing in ETC.

Key Takeaways:

• Not much to say here other than a history lesson of not putting all your eggs in one basket. I don’t know if the original DAO got they total value back ($150M) but it does suggest that, if a hack were to occur the community does have some recourse.

• Don’t invest in ETC….Duh!

• Back when the fork happened in summer of 2016, ETC was the 5th largest Cryptocurrency with Market cap of $1.5B. ETH had a Market Cap of $24B.

• Now in Feb 2018, ETC has a market cap of $3.5B (2x growth) and is the 14th largest but Ethereum (ETH has a market cap of $83B (3x growth) and is the second largest.

• It pays to go with the founders and the heavy hitters. If you believe in Ethereum in terms of the business case of SMART CONTRACTS and potential adoption by larger firms (MSFT, JP Morgan etc), they will go with the more mainstream offering...hence ETH and NOT ETC.

• Ethereum looks like it might be going through another potential “super hard fork” in the form of EtherZero (ETZ). Not sure if this is going be successful. Who knows, but as I see it, don’t get too distracted.

• ETC rise isn’t bad 2x but ETH was 3x. So recommend adding a little here and there.

I think the key point is that the hardcore developers are mostly on ETH and ETC is less. So if you buy ETC, know that the other buyers are SPECULATORS and not ETH developers...where the truth growth is....

• Ethereum looks like its going through several periods of hacks: software company, Parity Technologies just saw 513,777 ETH (or $421 million) rendered inaccessible last year, and just months before the same company saw 150,000 ETH (or $123 million) loss due to a code error (whatever that means). Last year a faulty Ethereum address saw Kraken exchange and wallet provider MyEtherWallet lose hundreds of thousands customer accounts. Looks like there are issues. So again, don’t put all your money in ETH….just not smart if you do….For me, I think its my 2nd or 3 largest holding in my Wallet.

• Lastly, Man…Ethereum is complicated and ever changing.

Follow Me @epan35

Reply (with a good comment) and Upvote and I'll return the favor! I need Feedback!

Great post,

In time ETC and ETH will be very different but I don’t think there’s a good and a bad version

About the DAO hack I remember reading they were able to recover the majority of the stolen money, but not everything.

So in the end, the hacker did end up getting some millions out of this crime.

About the fork, I think it is clear the dominant ethereum will be the one with Vitalik, as simple as that.

I think Investors must be wary of investing ETC and ETH to avoid losing their investments.

Coins mentioned in post: