Reading through posts and news articles, I find it somewhat peculiar that most of us in the space tend to compare the perceived cryptocurrency bubble to the dot com bubble. There's certainly no doubt about the presence of excessive speculation. These two so-called bubbles are related to the world-wide web after all, tapping into the global collective. There's a great difference between these old world and new world organisations, but nevertheless, I think we can learn from those that survived the dot com bubble.

Looking back, the dot com bubble came about in a time when traditional companies were as closed and as rigid as they can be. These aren't open, decentralised organisations at all - which simply means that any outcome is largely in the work of its limited set of owners. Open communities like the ones found in Bitcoin, Ethereum, and Steem are made up of large, active communities that contribute to the betterment of their platforms on a daily basis.

On hindsight, capital markets back then also weren't all that fluid and connected to its true global potential at all. Speculating and investing just weren't very convenient activities. Today, anyone can pretty much buy and sell any of these tokens or cryptocurrencies in simple peer-to-peer fashion, spreading support, co-ownership, and mindshare. Over time, there will be less chances for any concentrated groups of people acting as a point-of-failure, especially when it comes to market under-performance.

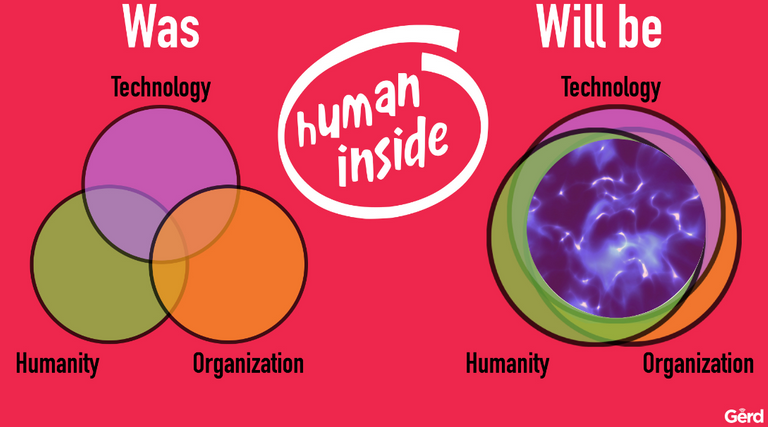

As technologically-charged as it sounds, dot com companies during that ~1995-2001 bubble had very little to do with any intersections between technology, humanity, and organisation. Naturally, companies that survived the dot com bubble all exhibited similar characteristics of being some kind of platform, such as eBay and Amazon. So now, think about what happens when anyone can become co-owners in similar platforms that survived and thrived through the dot com bubble?

Choose cryptocurrencies that have:-

- A massively growing decentralised community.

- Been in the game for more than a year.

- Core use cases.

- Diversifies itself into diversity.

- Eco-friendly architecture.

- Flash-fast transactions.

- Gamifications elements.

- Holocratic structure.

- Independence from big money interest.

- Jobs and gigs.

- @kevinwong as a user.

- Low-friction microtransactions.

- Memes and meet-ups.

- Newbie help channels.

- Original content.

- People from all walks of life.

- Quests and missions.

- Return-on-Community.

- Self-regulation as a common activity.

- Tinfoil tendencies.

- Underground music enthusiasts.

- Vocal and outspoken individuals.

- Whiners and winery operators.

- X-rated stuff just for the X of it.

- Youtubers!

- Zero transaction fees.

:P keep those Upvotes going! Markets are never the same. If we make so many Bubble, Steem will be the Soap Solution that keeps getting better. We have a bubble which ain't gonna pop anytime soon!

epic meme :D

Another thing to note is that the dot com bubble was fueled by speculation that originated from people who really didn't understand anything about the internet. Most crypto investors are quite savvy... which helps lend some credibility to growth in the market.

I got my first early warning of incoming dumb speculators, yesterday - an artist friend of mine whose eyes have glazed over every time I've mentioned crypto in the past was talking about buying coin, really excited, telling everyone they should do the same, big money to be made etc.

Yours is a long list and I get the humour, but yes focus on fundamentals not on froth.

Hmm hanging out in telegrams and slacks, I'm not so sure sometimes.. but yeah perhaps way better than 20 years ago. No idea who were the people pumping into the dot com bubble. Baby boomers? At least in my experience here, there wasn't much of a buzz at all. Major adoption only really occured after that.

We have a winner guys!

Amazing food-for-thought. It's only natural that the current "bubble" is in fact a paradigm-shift in the way people come together and create value. Companies formed back in the days because physical proximity is the only way for interactions to happen in real-time.

But with the advent of high speed internet. We can be on different parts of the planet and still communicate as well as if we're side by side. And so,

it opens totally new (and better) way for people create value together.

I really believe in Steemit because it really is the best of all worlds. There are many things one can learn from the "old" cryptocurrency (pre-ethereum and graphene) and I recognize that Steem incorporates almost all of it.

It's why i jump ship to here. Steeming on the way to go!

Yes, the world is quite a different place today. Btw, jumped ship from where? Facebook?

X-rated stuff + zero transaction fees = moon

Just sayin'

Love the "Human inside" graphic :-)

Hey I remember your account :) there was a post about some organisational stuff.. and looks like you've not posted anything in a while! Thanks for dropping by :)

Hi there, yes, was focusing on setting up a cool integrated energy solutions company. Nice you remember me and what I was posting about. Couldn't believe months had already gone by and I REALLY want to get back into Steeming. Your post was a strong reminder of what I've been missing. Thanks!

Thank you for taking the time to write this very comprehensive article. I think there are some similarities between the dot com bubble and the current cryptocurrency boom. However, thedecentralization of the cryptocurrency market is what makes its future up to a very broad user base. You also pointed this out in your well written article.

This is refreshing to know that manipulation is more difficult to pull off because with previous investments such as the stock market, the markets could be manipulated by a select few. Can cryptos become manipulated too? By all means.... but the ability to do so is much more challenging which is to the advantage of individuals invested in that crypto market.

Great article! Keep up the good work!@kevinwong

Upvoted!

Cryptos can definitely be manipulated, in a ton of ways. One of the most obvious ways pointed out is pre-mining. The developers pre-mine the currency, giving themselves some large amount of tokens at the genesis block. What this does it allows them to hold for a while, and let the market cap rise. Since a lot of speculators make decisions based on market caps, the pre-mined coins which are temporarily off the market, but included in the market cap, make a huge difference. Then, they can slowly sell off their holdings, and make their money.

Another big way is the "Pump-and-Dump" strategy. Find a small cypto, with a rather small trade volume, and quickly buy a lot of it. The small trade volume means that this unexpected purchase will increase the price a lot. This, in turn, will increase the market cap, and also show a rising price chart. Other speculators will latch onto this as a sign that the crypto went "viral" or whatever, and buy into it also. Then, the original pumper sells his holding much slower, and the higher volume from the new speculators masks this, and he makes out with a bunch of money.

Pretty much anything that affects market caps, quickly changes the price, or otherwise advertises the crypto can be seen, in part, as manipulation. This includes hard-forks, which can be a powerful way to manipulate a crypto if the miners aren't sufficiently decentralized. Sometimes, even if they are decentralized, with every miner game-theoretically teaming up to pump and dump together.

That said, manipulation isn't the end all. A crypto can still be a good speculation even with manipulation. Any person holding the crypto can "latch on" to the manipulation and ride the waves along with the manipulator too. And probably every crypto has experienced manipulation, to some extent, so good luck avoiding manipulation itself.

At the end of the day, manipulation isn't so much a bad thing, just something to recognize. Before buying into something, look at it for the signs. Ask why the market cap is what it is. Why did the price increase when it did? How long has it been since it last rallied? Is it likely someone will want to manipulate it in the future? These questions, and more, are wha you should be asking yourself before coming to any decisions.

Nice, I love this response! There are definitely plenty of creative ways to do this, especially with large stakes at hand. Just gotta rely on good platform fundamentals and sufficient, broad distribution over time..

If the product is good.. I think hodlers stand great chances of getting through any market manipulation :) Well the market is still very small and no doubt there's manipulation going on, but this should lessen over time and distribution goes on and networks grow larger!

I totally agree! The expectations are higher now when it comes to high performance and reliability of specific cryptocurrencies.

I believe that the overall outcome of this market will be a positive one and I look forward to the journey ahead!@kevinwong

I dont think there is any bubble anywhere. Just invest with ur head and what you can afford to lose. It is better to be part of this at any level then losing out completely.

Yeah I think the shift is gonna so huge, we can't really wrap our minds around what's to come actually..

perfect

It's a good list, but honestly i think your list is too long!

There is so much scamming and pumping on nonsense going on in this space, cause people want to get rich trading.

Of the hundreds of coin's and tokens that exist out there right now, only a handful are going to exist in any substantial way 5 years from now, let alone a decade.

Hey, Sorry for spamming.

But we need to vote for steem and we are very close, Please vote for Steem on BTCC ASAP.

Wow thanks, looks like we're closing in on the action!

Surely. I would have made post about it, but my post wouldn't have farther reach hence comments on the active user. Hope you won't mind. This could be huge for us.

Hahah I was just writing a list from A to Z. As a believer of irresistible offers as the way to go, I think nothing can beat free and fast. You know where that is ;)

I love the bullet points @kevinwong, so many good ones man :) I got down to 'jobs & gigs' and then there was a glitch on my screen and then I saw 'Low-friction micro transactions'. There must be 'something' about that bullet in-between that I couldn't see what it was ;)

It must be the steem ai who put it there! lol

That pesky Steem ai again LOL.

Excellent post... there is no need to fear about cryptocurrency bubble as long as they are on steemit and followed you @kevinwong. :)

Hey, Sorry for spamming.

But we need to vote for steem and we are very close, Please vote for Steem on BTCC ASAP.

Already did... anyway thanks for the reminder. Hey all steemians it's time to be heard.. Vote for Steem at Twitter!

Disclaimer: I am just a bot trying to be helpful.

It's free-to-play anyway, so to each their risk appetite :)

Busted out laughing at that one.

Yeah LoL, @kevinwong can you provide list of all your crypto investments?? :)

RLC, TAAS, STORJ, SIA, LISK, ARAGON, E4ROW, ETH, ETC, Swarm City, WeTrust, Matchpool, Agoras, Hush, Steem, DigiByte, BTS, Burst, Factom, Monero, Peerplays, Edgeless.

Thanks for sharing! Are you a trader? or Long term holder? And witch among those tokens pays good dividend or interest if you are a holder?

K, X, and Z are the hardest alphabets to start a sentence with...

My favorite is monero, they just need hardware wallet adaptation.

Did you watch that monero guy talking in consensus 2017? I like him lol.

Briefly, he was on stage with a ripple guy and another guy. They just seem like they have the best privacy token without the integration part yet, which is why I think they are a value pick and a long term hodl.

Glad i got some of them at half the price :)

here, if you can!Hi @kevinwong, I had question regarding the possible life span of crypto-currencies especially bitcoin and have not found an answer yet. As the ALL KNOWING and THE ONE can you shed light on some of the things I asked

Hey, Sorry for spamming.

But we need to vote for steem and we are very close, Please vote for Steem on BTCC ASAP.

I'm nowhere near NEO level lol, but I will check it out! Thanks for dropping by :)

Thanks, would be great to get your take on thing.

Great article.

Amazing list of tips!

Thank you lol!

Execelent article

thanks for sharing

Upvoted & followed

Hey, Sorry for spamming.

But we need to vote for steem and we are very close, Please vote for Steem on BTCC ASAP.

Thank you

there is great for us.. this is no spam

you are wecome

Voted just now

thank you for sharing

Upvoted and followed

Hope to have your suuport

Disclaimer: I am just a bot trying to be helpful.

Did someone say memes?

Hey, Sorry for spamming.

But we need to vote for steem and we are very close, Please vote for Steem on BTCC ASAP.

Disclaimer: I am just a bot trying to be helpful.

Yes.. i dont if i'm dumb but i happen to buy some of the meme coins, just because..

It worked for doge...

This made me feel better :-) good advice.

Hey, Sorry for spamming.

But we need to vote for steem and we are very close, Please vote for Steem on BTCC ASAP.

Disclaimer: I am just a bot trying to be helpful.

ok interesting...

Best advice i heard is invest only what you can afford to lose.

follow @secter

Very interesting information

I follow you, your post interesting @kevinwong

great....resteem and upvote for you.....

Thank you, this is a great post. Especially for the rookie like me :) Something tells me that you are the person I should learn from about cryptocurrencies @kevinwong :) Followed.

Thanks for the list. I definitely learned a lot the past few months from sudden dumps and putting too much trust. Most from the list reflects STEEM. I'm hoping for it to really rise as one of the giants but an equalizer one.

My waring sign for a bubble is only one. My mom starts talking about icos.(she doesn't even know where the computer power button is). Until then

H O D L

O

D

L

let's test some weak hands

Solid article. I was about to post a similair post. The future is in blockchain. Cryptos are the new popular kid now, but the market will find it's way just like it did with the Internet boom. This is quite an interesting website I found: https://www.coincheckup.com For a complete crypto analysis on every single tradable crypto out there.