Technical Analysis is to trading what Astrology is to Planetary Science. Whenever people attempt to "read" the charts are doing nothing more other than engaging in gambling superstition. Humans are highly irregular entities and this is especially true when bubble omens are signaling lurk around.

Anyone can be a smart-ass about market crashes — such as the one of 2008. Still, any "signs" it won't make any sense since the same principles cannot be applied nor the predict the next crisis. I have seen enough voodoo-memes over the last 5 years to confirm this. I am pretty sure you have as well.

Many have tried to use the same doom patterns and failed. If it was that predictable after all everyone would be making money and the Dollar Vigilante's wouldn't be busting our balls since 2012 for the "inevitable coming crush". Sure, at some point a crash will come because markets move in circles. But hey, "I told you to buy and you didn't listen". And you will fall for it. Every. Single. Time.

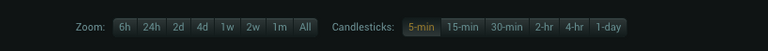

Most people seem to fail to grasp the grand perspective of the markets due to a single reason. Time. For those who have tried to view trading charts you will notice small buttons underneath that indicated a different view depending on the time scale vs zoom.

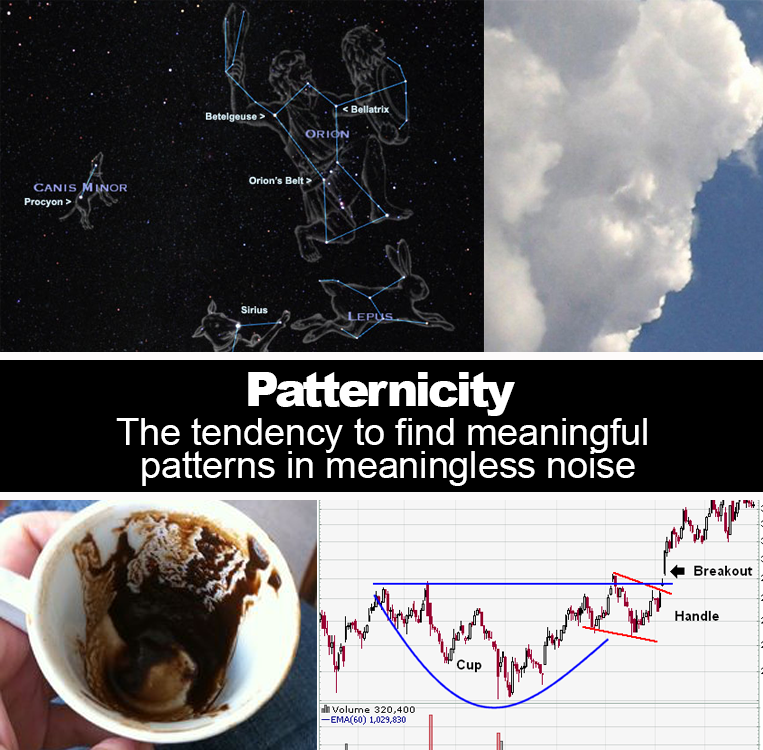

Based on the button combinations between these two groups you can pretty much choose different combinations to "see things". Really, you can adjust the view to see whatever you want. Similarly, a fortune teller makes shapes out in coffee stains, religious people start seeing Jesus on toasts and astrology folk start seeing shapes of animals based on the arbitrary position they are placed.

You can click on the 2day button and 30minute interval and see a cup and handle. You can click on 1 week and 15 min and see something entirely different. What you choose to see is what you want to believe. Patternicity rules so many parts of our lives. Humans have been proven unable to rationalize them properly due to our highly unstable emotional state. Just 1000 years ago we drew lines and saw omens in the skies. Today we do the same on the screen and see similar delusions. Today they s

You can try debating an astrologist for hours that the vast distances of stars and planets in relation to their galaxies. It will be of no use. They will simply refuse to accept that chaotic gravitational patterns have nothing to do with our affairs on this planet. It will be futile because humans like to believe in control and order. Much like in trading or fortune telling they will make a prediction because any other way everything seems futile. So for them it works like this; If the prediction comes out then: "fuck yeah, I am the second coming of Nostradamus". If it doesn't: "Something else went wrong but the "mechanism" still works and I shall try again".

In the book Flash Boys it is described how Investment firms — yes those billion dollar companies — tried for a while to employ the best minds on the planet that came from backgrounds of Engineering, Math and Statistics. They wanted to do so because they too are victims of patternicity. As it turned out, a monkey picking random stocks still triumphed over the average Harvard-educated trader. TL;DR of the book: A simple bot written by an average programmer employed in geographical proximity from WallStreet (due to internet connection times) can beat any human, any time of the day. As it is explained from the book; this is part of the reason the market crash was so violent. Technical Analysis was reserved for the superstitious fools.

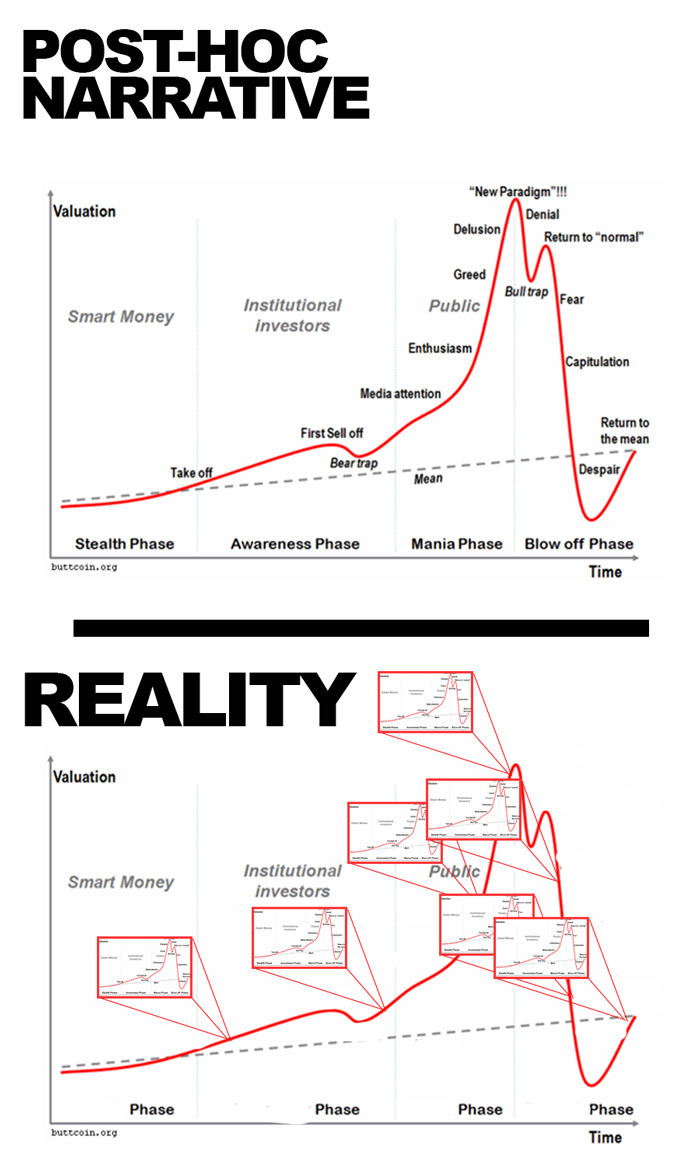

Perhaps the most obvious example of this situation are the predictions we are getting lately about a crypto bubble. There is a rather infamous chart that people debate over it. Thing is, the chart is meaningless because those events take place all the time whether they span across a time span of 1 hour or 10 years. We can make out fractals in just about anything if we pay close enough attention.

Next time someone tries to debate you BEFORE a bubble happens, showing you the "signs" and the "lines" and all that voodoo trading stuff gamblers are obsessing with, show them this. I am really curious what their response will be.

Markets are fractal. Looking at different timeframes provides context.

If you just look at a random timeframe without any other context and follow some random technical indicator then you probably won't make money over a series of trades.

If however you look at multiple timeframes, look for what are bullish signs and see them in all the timeframes and then pull the trigger with a pre defined stop and profit target then you'll probably make money over a series of trades.

Given you compliment it with some order book tape reading and the psychological quirks of the participants that make that market.

Most is bullshit, but there's a reason some people have been profitable for decades using technical analysis and it's not just luck.

Everything is fractal but still we can't predict the picture. You can have enough context about anything by observing a snapshot from the past. Still, too vague.

the context is dependent on trillions of factors. You cannot possibly draw any correlations —especially when 5 whales from chine literally can draw lines on the screen.

I doubt it because most traders follow the same strategy and yet they fail. This is not actually "high knowledge" I can train my 10 year old nephew how to trade based on those principles in a day.

that gets it even more complicated.

it is luck my friend. Much like in horse racing and sports gambling the law of averages on a standard distribution will favor some people, always. Same thing applies to lottery.

The thing is, TA is not about predicting the future. It's saying something like, 60% of the time I'll make 5% and 40% of the time I'll lose 5%.

It's not predicting any one trade, it's making slightly more money than you lose over a series of trades.

Not a crystal ball, just an educated guess within a framework that has a potential positive expectancy.

Do you think that all markets are random all of the time? Up, down or sideways each with a 33% chance of occuring?

Very good observations. The stock market truly is like a sports book. The reason teh sports betting line moves after the initial line is posted is because bettors use their knowledge to determine which of the posted lines offers the best chance of a win. Same thing with trading stocks. There are actually ways to "effectively" measure sentiment. And sentiment is the main factor that determines price. The goal is to pick out the setups that offer you the best odds of a win. Sometimes the sentiment gets skeeewed so heavily to one side that the casino is actually "daring" you to take the other side of the trade...that's how good the odds of victory can swing to your favor. the number one rule of trading of course is to stay off of the $5 blackjack tables as that is "likely" where kyriacos (and the rest of the crowd who knock the benefits of sound technical analysis) will be found. ALWAYS go to the $25 minimum table when playing blackjack. At least there your chances are "decent" that everyone at the table won't be just "wingin it." :-)

Will it help you be a better farmer at all if I have told you that this year we are going to have hail 5% of the time and wind 60% of the time if I didn't tell you when?

which still can't beat a monkey making random choices or someone hodling.

Again, too generic. if anything. semi-educated guess which is worse than completely ignorance ..see monkey.

Absolutely. Except ofcourse when our deal whales start moving things around as they like, creating mirages and all.

The market isn't random because it's based purely on human psychology, which isn't random. The market moves on "hive emotion" among other factors like "whale manipulation" (part of psychology), and likely millions of other variables (few of which aren't related to psychology, such as climate variables), but psychology is the inevitable prime influencer thanks to the fact that we humans can't escape our own consciousnesses and we humans make the markets.

Because it's not random, there ARE patterns. Because it's not random, money CAN be made through careful observation of said patterns.

There are ways to measure this through statistical analysis, which confirm that the markets indeed are NOT RANDOM (to something like 99.9999% certainty, given the breadth of the random samples across the markets through time) -- at least, not at scales that are relevant to our lifetimes (minutes, hours, days, weeks, months, years, decades, centuries).

Oh yes. Human psychology is pretty random. You can confirm that pretty easily by just examining human relationships. There are so many constituents in places with so many people taking place that the inter-relationships and effects become chaotic.

If someone else is drawing the patterns — which is the case in the crypto world where 5 companies in China control 90% of the market then "patterns" are pointless. They work much like hunting traps and unless you are not them, you are going to be the victim. I have seen any making a killing for a while and then losing pretty badly.

It is much like the casino. Eventually the vast majority of traders will exit with a loss.

Pretty random and random are vastly different things.

Also, patterns have seemed to work more often on bitcoin than any other "market vehicle" that I've ever personally traded. The whales seem to want them to work, which is smart -- it's ideal to have the market participants pushing price when you want them to and using the hype that's already there to rocket light-years past traditional targets.

Hyperbolic moves are what the big boys want, because that means lots of dumb money coming in at multiple X levels, giving them enough bidders to sell their big positions for 5~10 X profits.

Agreed. But it's mostly because this game requires a godly amount of patience and persistence, both of which 95% of people don't and never will have. People are good at rationalizing, that's about it.

The point of technical analysis is to give you an indication of when. And over a large sample size, yes, probability becomes relevant.

Did you even read the article you posted? The monkeys were more profitable because they picked smaller, high risk companies. That doesn't mean their picks were necessarily better overall.

I consider "better" what makes more money. And they won.

That's like saying someone is a "better" poker player because their 2-7 hand beat someone's pocket aces. It's about probabilities.

But, surely, doing Technical Analysis is a good way of predicting if the Technical-Analysis-using traders will be buying or selling? 8-)

hahhaha! :D

Aha! We've found it!

So I'm guessing your still hella bullish?

I am not a trader. I am an investor.

yes, but investors can be still hold sentiments on the markets that could be considered mid term bullish tho right??

but if you're invested then it could be interpreted as bullishness i guess

more like superstition.

Exactly. Trading is like 1x2 soccer gambling afther the initial phase. All these predictors are no different than tarot and zodiac editors. I will just remember the saying: Buy when there's blood on the streets. And currenly there is so much "blood" in crypto this is insane. Bear traps everywhere.

yeap. using simple common sense does the trick.

eSteem commenting gone wrong. I wrote much more

We hear the bitcoin noise louder then normal people. We aren't even close to a bubble. The Dot Com bubble was 3 Trillion Dollars. We are not close. No one knows what alts coins are, no one even knows that bitcoin is a cryptocurrency or what a cryptocurrency is. They know bitcoin as some weird internet money people buy drugs and prostitutes with. At least this is true in the United States where I am at. It may be different in other parts of the world

Doesn't mean it can't be a bubble though. If there are only 10 buyers for something...and 9 out of the 10 are already "happy" with their purschase...do you "honestly" think the one guy left to buy can drive price exponentially higher? Well, yes...if he is interested in selling to himself I guess. From a funnymental standpoint...bitcoin has years of work to do before it gains universal acceptance. The guy who thinks it's internet money...why not just explain the "truth" to him. >>> Oh yeah, bitcoin is awesome! Not only do you have to jump through hoops with your local bank to transfer funds into one of the exchanges in order to buy bitcoin. But then after you buy and it shoots up $500 per coin at 4AM in the morning and you want to take your profit...you have to be willing to pay a data miner in China an extra $200 above the actual price in order to make sure that your sell order is one of the 7 of 20000 sell orders that actually gets executed. But wait...it gets even better! During fast market waves of selling you have exactly "zero" chance of getting out. Now tell me this doesn't sound like more fun than holding dollars? :-)

Technical Analysis is not nothing but the sign that are visible today and according to them how the market will react in the future. No one can be certain that I am healthy today , so will be tomorrow or so on. Only predictions can be made. Even the charts may change after few seconds so our opinions will also change. No one can stick with them. We have to change our views from time to time. I will like to invite you to have a look at my india tour blog post and explore the beauty of our beautiful country India.

@kyriacos, thanks for your post! I used to hate turbulence on an airplane until I realized the sudden uplifts were evidence that the wings had air under them. A correction so to speak. So, no more fear. When it get's bumpy, I take a nap. And, in this case, I stop looking at my accounts. It will turn around.

well put @karencarrens . I will use your example in the future.

Thank you @kyriacos.

Easy for you to say now. But the fact remains that bitcoin holders have not yet experienced a true wave of fear in calendar year 2017. The fact is that in most markets, anything that rallies for 1000% generally experiences at least 1 50% correction soon afterwards. the ONLY 50% correction in Bitcoin was right after Mt Gox. You WILL see one. And even using the $3000 bitcoin high, that means bitcoin will see at least $1500 sometime this year. If you can sleep though bitcoin $1500 then check your pulse. If bitcoin continues to drop to say sub $1000 and you STILL feel nothing. Well then it might be time for a complete physical check up. Personally I love fear/panic becuz it generates great buy opportunites. If bitcoin does actually trade sub $1500 we shall see what the locals are thinking via the daily spews. I bet most won't be as "cavalier" as you are. Especially the ones who paid $2500+.

@joejustjoe, you're right. In full disclosure, I can't relate. I'm new to this and really only see the upside to crypto because I just discovered the hopelessness of the fiat. Forgive me if I came across as cavalier, I can promise you, I'm not. I'm hopeful.

There ya go. The first step is to admit that you don't actually know what it feels like until you actually feel it. And one sure way to find out is to just ask someone who actually did experience it. I've already seen many people who have sworn off EVER buying ethereum again after their stops were taken out during that meltdown that took it to .10..or .13..whatever that low was. "If" you happened to be trading through an exchange that didn't compensate you for that loss, trust me...it's a very difficult emotion to recover from. Especially when you see the price right back up there at $350 the next day. Etherium now showing its true intentions though...as is bitcoin.

Interesting article, very well put together!

It was a bubble from the very beginning !

Markets where ticking 1billion mcap increase per day, everyone was making money from trading and had that euphoric feeling , actually everyone is doing money in a bullish market, now most of them are feeding the whales/bears!

I think we are going to January price range, and still we have to wait and see how king BTC will go at August !

You are always feeding the whale as long as you don't sell.

It really depends on your style ! You can get feed from a whale or you can be feed to a whale , after 4,5 years on this madness my meat is to "stiff" for them ! I bet yours too ! ;)

Wait, you're not going to tell me the top secret crypto to buy that no one else knows about? ;)

I have been telling you to buy X since 2012. You didn't listen. Now the Zionists are crashing humanity. If only you have listened. :D

what do you know about

Technical Analysis?for one i know its a meme that gullible gamblers have invented in order to excuse their addiction.

That's pretty funny. However, I know people who make money using it. Unfortunately, there are more and more unbelievable analyzes that arise on the principle of "whoever gives more"

I know people who smell horse urine and make money on the ponies. So?

Actually, technical analysis is just a tool to tell you what others in a position are thinking. Right now the behavior of most cryptos tells me to wait until things settle down before establishing a long position. There's some fear out there so why not wait until it shows signs of dissipating?

I find out that the best way is to go exact opposite than crowd. Usually.

that works. the classic sell high by low. now the perspective on 'high" and "low" is also subject of pattern.

I'm buying every day a bit now, regardless of price. Sheeple are selling and later on when I'll have more SP and I'm gonna reward myself with upvote they'll start complaining and pointing fingers.

yeap. I think most people don't understand what investment is.

Ahhh c'mon now. I stamp the word gauranteed on every single one of my market Ty Ming spews. Do you know of anyone else who does that? If you do then please let me know as I will Shirley follow. :-)

Car salesman logic

"Logic" will get you kilt when trading ANY market. (Copyright: Joe....JUST Joe 7/11/17)

Also, for the record since you mentioned stock picking monkeys. I strongly believed Jim Cramer's Mad Monkey could do a better job of picking stocks than Jim himself does. :-)

it can!

spot on :-) - my master thesis was more or less about a reinforcement learning agent trading in the market, and doing my research I haven't come across one single technique capable of beating the market. But people will always love 'Technical Analysis' :-)

like a friend told me once in here "Apes gonna Ape"

easier said than done. Again, matter of perspective.

Reminds me of the barkers selling sports picks. "this one is a lock". If astrology or stat analysis worked there would be no market left. The uncertainty is the game. Steem on

indeed.

I should go look up the post but someone yesterday "predicted" this.

It said,

Of course, I upvoted it. ;-)

:)

Great we gotta stay strong !

BUBBLE BUBBLE :(

ahhh takes me back, the neurons I burned on this game....

Awesome.... with this I can see where we are going from here ;)

great posting mate . i like it and resteemed.

https://steemit.com/crypto/@biddle/mysterium-could-be-last-chance-before-spike

Finally someone with a little bit of common sense. Every time I am trying to "technically analyse" I find it nothing but disappointing. Cryptocurrency market is ruled by the big whales and their trading bots. They make billions of profit every week. Look at the charts, it is not possible that independent group of people can take such synchronised actions. Even if sometimes analysis can help with trading. In this case is rather useless.

I don't really believe in the efficacy of technical analysis either, but I've talked to enough successful traders that use it. If enough people believe TA achieves results, then TA achieves results. Even if the underlying graph shouldn't predict what will happen, because people believe it does and invest based on it then it does. It is a self-fulfilling prophecy.

That't like saying that astrology works (aka the relative placement of planets across our system) because some people believe they work.

LOL no it's not. The market moves based off of people buying and selling. If enough major buyers/sellers make decisions based off of TA then the market will move because of them. People believing in astrology doesn't change gravity. How do you not understand this?

That does not mean that looking at a graph will tell you if the market should move up or down. But if 10 million in buy orders come in on Ethereum cause people see a teacup and decided to buy it then the market will move.

But to be honest, I have no idea if TA works or not in theory. I have never seen anyone analyze it historically or empirically. I imagine in a few years it will be possible for AI to look at the history of many graphs quickly and analyze whether or not it actually predicts prices better than randomness. Until then I'll remain agnostic on it.

you can never know this.

irrelevant. this is not what I said.

That does not prove that TA is correct. It demonstrates that belief in the TA is.

We can poll traders if they think people buying/selling because of a concrete reason, whether valid or not, will move the price of something and bet on it if you think it's impossible to know.

I like your blatant style!!! Very honest, accurate and truthful. Nice 👌😎👊

glad you enjoy it.

Post-hoc Narrative speaks a thousand words!

Thank you for sharing.

Follow me @Yehey

These crypto market predictor gurus give me the creeps.

Same bullshit as the rest of the stock market analysts who don't know what they are talking about either but have fancy jargon to cover that up.

What bothers me that in this day and age with almost perfect public record of previous "predictions" that these guys never get called on their bullshit...

You are dead on with the "patternicity" hadn't heard that one.

Give me coin flipping chimps anytime... much more entertaining

I think most of them are quick to claim a victory that was never theirs to claim. To prove this to yourself you only need to go back to what the bitcoin chartists were saying during the Memorial day weekend selloff. Pretty much ALL of them were picking "buy the pullback!" targets in the range of $1500 to $1800. The "actual" low for that selloff was $1880 on Sat eve of Memorial day weekend. I "know" this for a fact as you can paruse my list of spews and you will see a blog where I outlined volume characteristics on the actual bitcoin "live" ticker. I was only 'expecting" that low to create a short term bounce...therefore I called a short term buy which generated the biggest move higher for the weekend, +$250 per coin within 24 hours. It turned out to be "the" low before the move towards $3000. Something that even I wasn't expecting at all as my general calls on 'actual" bitcoin are made via sentiment readings on bitcoin tracker GBTC. ...which only trades during regular U.S. stoc exchange hours. The windup? Not a single one of those bitcoin chartists were "correct" in their $1500 to $1800 line in the sand to buy. Price never even got there. Yet go and see how many of them were claiming "victory!" about their great call to buy at $1500 to $1800 as bitcoin moved on to a new high. Pretty much all of them. :-)

?? See my comment above...

The whole point of market is uncertainity and no prediction can be accurate.

this is a great post

Very good analysis. I will follow you now. Oh wait... I already do. ;-) Keep up the good work.

We are accustomed to speak of the 12-year cycle of ups and downs in the economy. Although these predictions are more similar to a guessing on a coffee thick. Or on solar activity.

It seems to me that we humans — are weak creatures. And we need something, to rely on in order to not slide into fear and unbelief

The Bubble has popped ... ETH below $100.00 ?

I wrote a post about my own view on the whole bubble thing. My point is very simple, if each one of us do not make their part, we can ruin the party. If we get enough bad examples out on the street we'll sure piss off a bunch of regulators and traditional investors, and that will likely limit the whole of crypto and blockchain economy's growth.

TA is still valid for short term momentum based trading. The high volatility in crypto markets should itself remind people not to use TA charts to predict price ranges for anything greater than a hr in the future.

I freekin love your perspectives! You always got me lookin forward to your posts ha! @kyriacos

People being irrational has nothing to do with markets being unpredictable. If you put lots of irrational beings together and let them all be irrational together, you will likely be able to observe there is a certain regularity within this chaos, as if there was a law which makes irrational masses behave a certain way. And there is, it is a law of our nature, of the way we are wired. Technical analysis does not predict future behavior, it predicts probabilities of a certain event. Over 50 percent of all trades on speculative markets today are done by bots following certain algorithms. And this percentage is growing fast because they are massively more successful than humans. If there was any truth to this article that would not be possible. Put the worlds best AI in a casino and let it gamble it will be no more successful than humans. Thinking there is no higher order in our irrational behavior is very naive as any sociologist can confirm.

if that was true you would be able to make consistent predictions.

if I tell you that next year is going to have a 12% hail chance in any of the 365 days how much help do I provide to you to protect your crops? Is it statistically significant than any other vague assumption?

sociology is bullshit. not a science

Great article!

great post as always .. thanks

click here!This post received a 3.2% upvote from @randowhale thanks to @leejin-33! For more information,