Table of Contents:

00:00 - Introduction

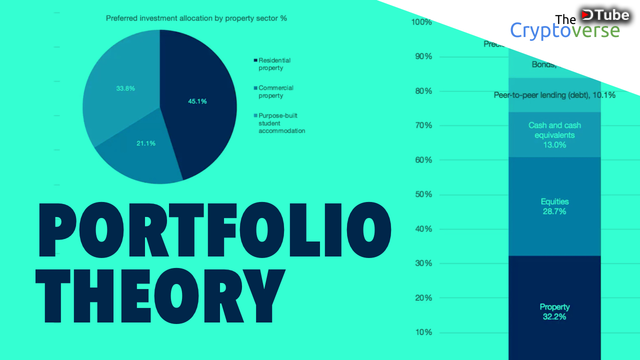

00:38 - A Glimpse Into The Mind Of The Average I

08:02 - INCORRECT MEMOS ON EXCHANGES ARE A THING

11:06 - Market Technical Analysis

On today’s episode of The Cryptoverse I would like to take a look into the mind of a traditional investor and how they split up their portfolio, we’ll talk about a new feature that makes sure you don’t accidentally lose your EOS when you send deposits to exchanges and we’ll do some technical analysis on the top cryptos and look a very interested synchronicity between the current major cycle and the date the Bitcoin ETF decision comes in.

●▬ Discount Links For My Courses ▬▬▬▬▬●

The Secrets Of The Bitcoin Triangle course: https://www.udemy.com/secrets-of-the-bitcoin-triangle-course/?couponCode=CRYPTOVERSEYT

The Digital Money Revolution course: https://www.udemy.com/how-to-confidently-join-the-bitcoin-revolution/?couponCode=CRYPTOVERSEYT

●▬ Social Networks ▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

Steemit: https://steemit.com/@marketingmonk

Twitter: https://twitter.com/ChrisConeyInt

Facebook: https://www.facebook.com/Cryptoversity/

Telegram: https://t.me/TheCryptoverse

Email: http://eepurl.com/dlPc9P

Reddit: https://www.reddit.com/r/TheCryptoverse/

Minds: https://www.minds.com/marketingmonk

Gab: https://gab.ai/chrisconey

●▬ Support The Show ▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

Buy online courses: https://www.cryptoversity.com/courses/

Become a patron: https://www.cryptoversity.com/enroll/

Buy Bitcoin: https://www.coinbase.com/join/56e9586dba1a7901da0004d4

Buy a hardware wallet: https://www.ledgerwallet.com/r/d1da

Trade crypto: https://www.binance.com/?ref=10890655

●▬ Donate Crypto ▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

Bitcoin: 3Fo7Uri2R4MLBbZZ3Ja1ryiXnto8BfqFL1

Bitcoin Cash: qqjjyt543y0untmq6w5em6h82u60kcaqpywxm7x75w

Ethereum: 0x0de0E11E0812982652AB68F903643b0cddD4C0a8

Dash: XbrDZbmqUvUUYsPnj8eSLTLqccXe6QvGoz

DigiByte: DBGFU3KLBiLHa6ZfeorxzfeYaA76Joa36B

LiteCoin: LKLvp8owSjqbNRo3iT2fwgzCF6XBZVC4ig

NEO: AYpGCzgWsZvR6f3fvfDKKkbcCKU1KFU8kd

EOS: chrisjsconey

●▬ Sources ▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

Research report:

https://s3-eu-west-1.amazonaws.com/propertypartner-blog/wp-content/uploads/2018/08/16140732/Property-Partner-UK-Residential-Property-Market-Trends-June-2018.pdf

INCORRECT MEMOS ON EXCHANGES ARE A THING OF THE PAST WITH EOS

https://eosauthority.com/blog/incorrect_memos_on_exchanges_with_EOS

VeChain news:

https://www.nasdaq.com/article/vechain-announces-blockchain-vaccine-tracing-solution-for-china-cm1008622

▶️ DTube

▶️ IPFS

95% of net worth in crypto, not counting Steem.

Here's a bit more steem as an upvote :D

My allocation to cryptocurrencies fluctuates between 10-15% every month. However, this is mainly due to the valuations increasing since I started in 2016 when it was only 3-5%. Luckily, I remained cautious on January and took profits to bring the allocation down. Since, I have gotten more comfortable having up to 20% allocated to cryptocurrencies so I have been redeploying fiat. Interestingly, my other 80% looks somewhat similar to the chart you mention although I am underallocated in stock right now because I am concerned on current valuations.

You sound like an excellent investor.

I actually looked into property partners a few weeks ago, they actually can't recieve investors from the united states. "Unfortunately, we can’t currently accept investors based in the USA." https://www.propertypartner.co/blog/investing-from-outside-the-uk/

Thanks for the show! Keep it up! If you are still interested in having someone find news articles for you to talk about, I might be interested.

Thanks for that link, very valuable to others in the USA

I am happy with my crypto portfolio. Got POS coins and getting them staked. happy days

A sound strategy :)

My Crypto Portfolio is primarily bitcoin at 80% then followed by litecoin, EOS, ether, and Digbyte. I would like to own a business, but I would struggle with the time needed to manage it! Perhaps in the future.🤑 Thanks for the info!

Such wisdom around here. I'm delighted

haha I'm heavily on the p2p lending tip did a massive reallocation when btc hit 20k now I'm slowly moving back into crypto as fast as I can ;) at these prices all available cash most get thrown at the market.

You mentioned funding circle but personally I like Zopa as they're set to become a bank soon which looks awesome.

Nice link at the end explains why vechain is booming :D

Another smart viewer. Much love