What in fact are Macro Indicators?

These are the reports released by the central banks and that reflects periodics results of the economy.

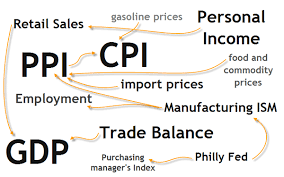

Which are:

- Interests Rates

- Trade Balance

- CPI (Consumer Price Index)

- Public Debt to GDP Ratio

- Unemployment Rate

- Non Farm Payrolls

- PPI (Producer Price Index)

- IPI (Industrial Production Index)

- Retail Sales

- RMPI (Raw Materials Price Index)

- PPP (Purchasing Power Parity)

- IRP (Interests Rates Parity)

- International Fisher Effect

- OPEC

If I missed something, let me know. Thanks!! (For sure I did, but thoses are the main used, feedbacks are nice anyway).

Their resumes:

- Interests Rates - Ok, so, I talked a lot in other post about how it impacts into the economy, the economical models and cycles. Link below:

https://peakd.com/macroeconomics/@dstampede/macroeconomics

- Trade Balance - I'll already link to other post about that (I mean, you must be very curious to get until here).

https://peakd.com/macroeconomics/@dstampede/how-the-currency-exchange-rate-works

- CPI - Measures the buying power through the average price of goods and services. So, it notes inflation and real wage.

Public Debt to GDP Ratio - It compares how much production is variating (jobs, consumption...) to how much public debt is also changing, showing the future sustainability, and helping to measure expectations, credit risks...

Unemployment Rate - This is tautological, but also important to considerate when looking to macro fiscal policies, it's needed to have jobs estabilized before central banks

can contract the economy to deflate for ex, so it won't hurt the population, it's a very delicated matter.Non Farm Payrolls - Indicates the variaton of jobs in secondary and tertiary sectors.

Producer Price Index - Shows variatons on operational costs, it'll be reflected on sales prices.

Industrial Production Index - Monthly changing on secondary sector. Results in measures of jobs generation, average revenues and rentability of industries.

Retail Sales - How the tertiary sector is going, it tends to go along with consumers spending patterns.

Raw Material Price Index - Tracks the average price of commodities, external demand, also as operational cost of others sectors.

Purchasing Power Parity - Compares revenues with real wage, considerating international parameters of price using USD as base, it shows diferences on countries inflations. It corrects the GDP to show real economical expendure capacity.

Interests Rates Parity / International Fisher Effect - Theory that the diference in interests rates of two countries is equals to the diference in long and short term exchange rates tax, impacting the following variation.

Search for it if you want, for me, after testing it, the varition of interests rates of countries is around 5% to 15% at most, in comparision to an actual bigger difference in currency exchange ratio, so I concluded that inflation is a more important determinant, but this parity is also considerable...

- OPEC (Organization of Petroleum Exporting Countries) - Mostly Middle East countries, they determine the nivel of price on oil barrel, production, reserves, so it impacts directly on global operational costs, prices, inflation...

Those indicators are very used in forex (cambial) market.

About that, I'll only tell the main liquid fiats, which are:

USD; Euro; Iene; Pound Sterling; Canadian Dollar; Australian Dollar; New Zealand Dollar; Swiss Franc.

Also about Iene been used as a global reserve of value on uncertain times due to laws that prevents too much volatility on market (circuit breaks were inspired on them after 1987 black monday happened), also lower multiples of stocks valuations.

Sometimes the market precifies before the event, so there is an result's expectation already, and the market can behave through the difference on what was waited.

I recommend for you to search about market behavior theories, like the Dow theory and the Wyckoff method, it would took sometime to write about it.

I was thinking about make another post about technical analysis, but its very subjective, many factors involved, I don't want to have any influence on mistakens decisions of others... So, on tradingview platform, you can search for those many technical indicators listed there and google it if you are so interested, needing know how about candle reading, price action, figures patterns, tape reading.

Besides that, people uses it for short term operations, where many of them really get rekt with over leveraging, so be careful, they use strategies with risk manegering (similar to poker), also risk reward ratio, sizing, success percentage of a setup in backtest. So, as this turns much like into a casino, I do prefer consistents strategies with low risk and long term focus. Or maybe some liquidity pools that lends money to the market make use of leverage with a collateral, and then receiving some nice dividends that helps to compound on long term.

Continues with the posts, soon everything will be all right !PIZZA 🙃

Thanks bro!!

Im hyped for this.

Take this free !PIZZA

Congratulations @dstampede! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 50 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

PIZZA Holders sent $PIZZA tips in this post's comments:

(1/7) @dstampede tipped @italoobrito (x1)

Please vote for pizza.witness!