Tariffs are paid by the importer. So when Trump put tariffs of 25% on imports from Mexico and Canada, that results in the American business that is importing produce from Mexico and Canada, paying 25% of the value of the goods to the US govt as tax.

Having incurred that extra expense, the question for the American business is whether to absorb the cost in the form of thinner margins, or whether to pass the cost to the consumer.

The Trump administration is betting that businesses absorb the costs. Some economists warn that if a business already has thin margins, absorbing the cost will put them out of business.

Trump put tariffs on steel and aluminium in his first term, as well as 25% tariffs on Chinese goods (which Biden kept in place).

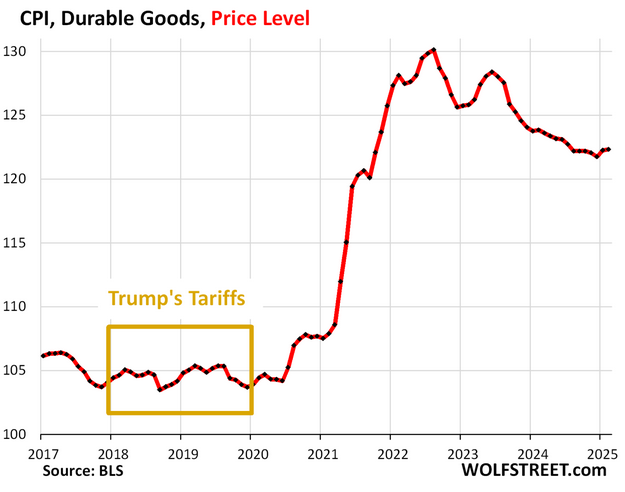

As you can see from the graph above, Trump's tariffs from his first term didn't cause inflation. But that might be because China simply re-routed it's goods through countries which didn't have tariffs from the USA. Vietnam suddenly went from not exporting much to the Americans, to being the third largest exporter to the US after China and Mexico.

This time round, Trump has not only increased tariffs on China further, he's put 25% tariffs on Canada and Mexico. And says he intends putting tariffs on the rest of the world on 2nd April.

If all the USA's imports carry tariffs, prices are bound to rise as importers with thin margins will not be able to shop around the world for alternative suppliers. And as the cost of imported goods rise, domestic suppliers will feel able to increase their prices too.

The only way prices go down is if the tariffs are accompanied by mass unemployment. The unemployed cut back on their spending, which then leads retailers to slash prices to shift their inventory.

Still, Trump might achieve his nirvana of tariffs and mass unemployment. Whether voters will thank him for it is another question.

So, tariffs on everyone at the same time = inflation, but tariffs on just a few countries makes no difference because trade diverts to non-tariff countries?

Yes. But bear in mind that the exchange rate also plays a part. If the dollar weakens, that also fuels inflation.

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below