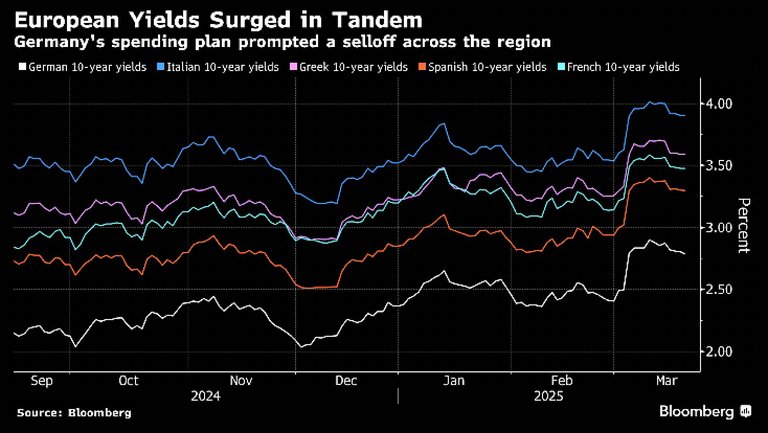

This is despite the European Central Bank cutting rates at the start of March for the sixth time in nine months to 2.5%.

So why are European government bond yields rising?

What seems to have spooked the markets is Germany's plans to increase borrowing to finance infrastructure and defence spending.

Germany's debt is only 62% of GDP (compared to 125% of GDP in the United States), so the Germans can afford increased borrowing. But the markets seem to be worried that the spending will cause inflation, which the Germans will export to the other eurozone members. This in turn will mean the ECB might have to raise interest rates again.

The other thing worrying markets is that other countries will feel the need to follow Germany's lead and borrow for defence too. So the markets are pre-emptively raising borrowing costs across the board.

Finally the markets are worrying about the inflationary effects of tariffs.

This is putting serious pressure on Italy, Greece and France. Unlike Germany, they have huge debts. Italy's debt to GDP ratio is 135%, Greece's debt to GDP ratio is 155% and France debt to GDP ratio is 111%. Interest payments are a huge part of their budgets, and they can't afford the higher interest rates.

All these countries will have to manage their fiscal positions carefully if they are to head off another currency crisis. Ideally they should try to grow their way out of their problems, but is that possible in the new world of tariffs and retaliatory tariffs? The other option is to cut govt spending to reduce their borrowing requirements.