The Scholz coalition (SPD-Greens-FDP) collapsed last week, when Olaf Scholz fired his Finance minister, Christian Lindner of the FDP. The issue was the debt-brake. Scholz wanted to declare a state of fiscal emergency, similar to the one declared during the pandemic, to allow the government to bypass the rules of the debt brake. Lindner refused. General elections for a new government will be held in Feb 2025, and the debt brake will be a big election issue.

The German debt brake, also known as the Balanced Budget Amendment, was written into Germany's constitution in 2009, in the wake of the Great Financial Crash. It restricts the German government's structural deficit to no more of 0.35% of GDP. If the German govt wants to spend more, they must grow the economy first.

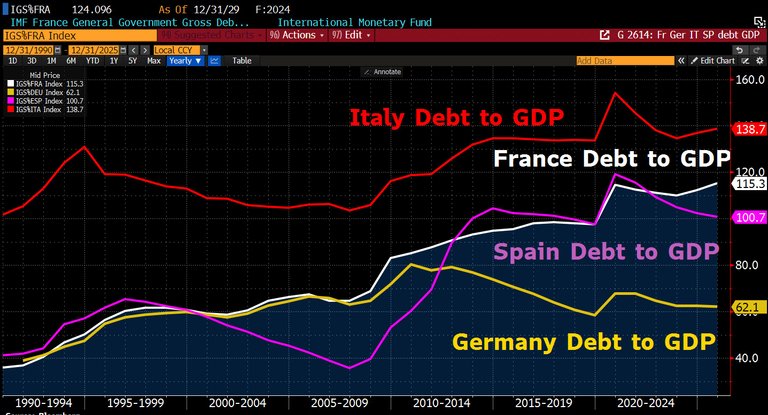

It's been pretty successful in it's aims. Despite an aging population, Germany's debt is only 62.1% of GDP, compared to 80% of GDP in 2009:

Obviously the SPD want it lifted. The Free Democrats (FDP) want to keep it. What about the Christian Democrats (CDU) who are likely to win the election? Well, Friedrich Merz, their leader has said “Of course it can be reformed. The question is why and for what purpose.” So he's giving himself wiggle room in case Germany's deindustrialisation becomes a crisis.

I personally think they should keep the debt brake and free up money for infrastructure spending by cutting welfare spending.

The debt brake is the reason German 10-year yields are only 2.336%, compared to 3.54% for Italy, 4.44% for the USA and 4.47% for the UK.

Germans don't spend a lot of tax money on debt interest. If they increase borrowing, the increased interest payments might crowd out other spending.