It's long been known that inflation is a function of the money supply. Or more precisely, a function of the velocity of money (how fast money circulates in an economy), and the quantity of money aka the money supply.

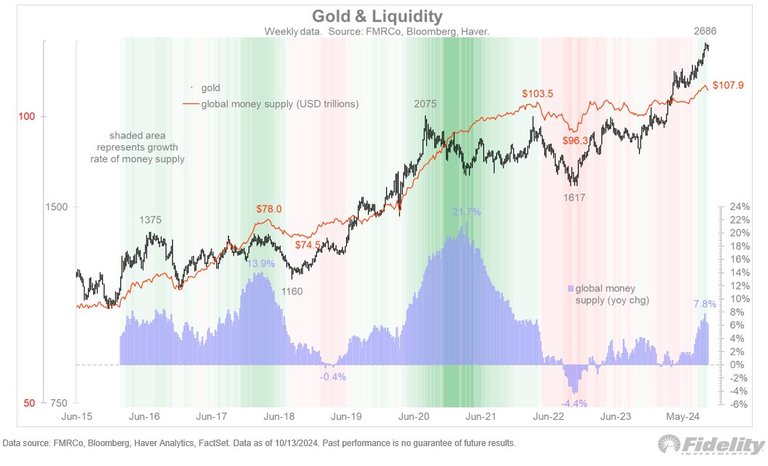

And the price of gold tends to track the money supply. See the following graph:

The price of gold declined during the pandemic even though the money supply increased, because the velocity of money collapsed (people were locked down and couldn't spend the way they normally did).

At the moment however, global money supply is increasing despite western central banks efforts at Quantitative Tightening - they are being offset by massing stimulus from China as it tries to avoid recession. And the velocity of money is quite strong because unemployment is quite low in the US, UK, and other places.

It's a recipe for inflation to take off again, which is why the price of gold is rising.

So why isn't bitcoin also rising? Well bitcoin may have just 21 million coins, but the supply of crypto is vast. At the moment the total supply of crypto is expanding faster than the global fiat money supply, which is why bitcoin is going sideways and the price of some altcoins is actually falling.

In order for the crypto space to be a hedge against inflation the way gold is, the number of coins needs to shrink. Some coins need to die and be delisted. Other coins need to shrink their supply, perhaps by burning them. Unfortunately, the trend is in the opposite direction with new coins being launched every day.